journal entry answers and steps

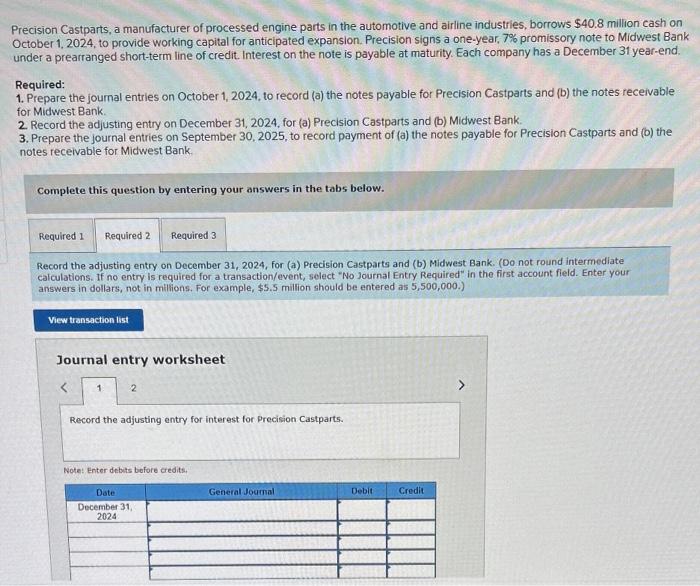

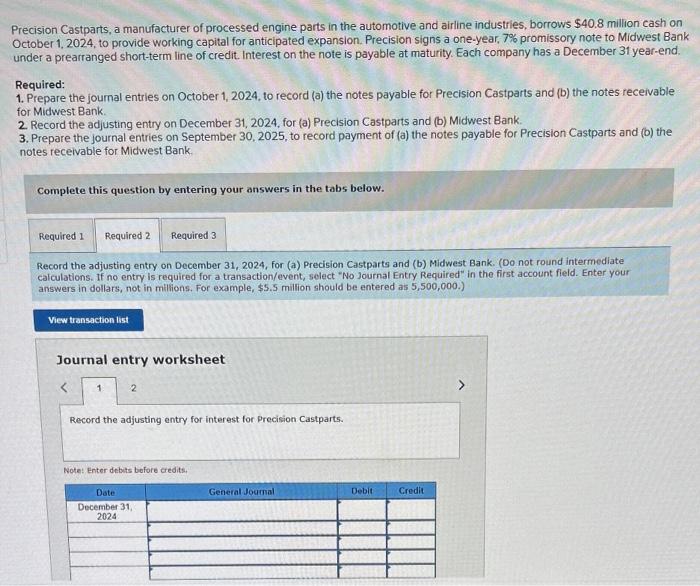

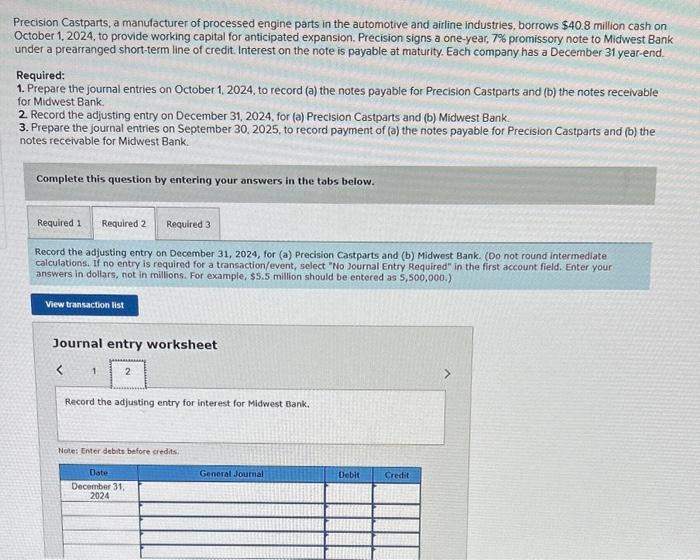

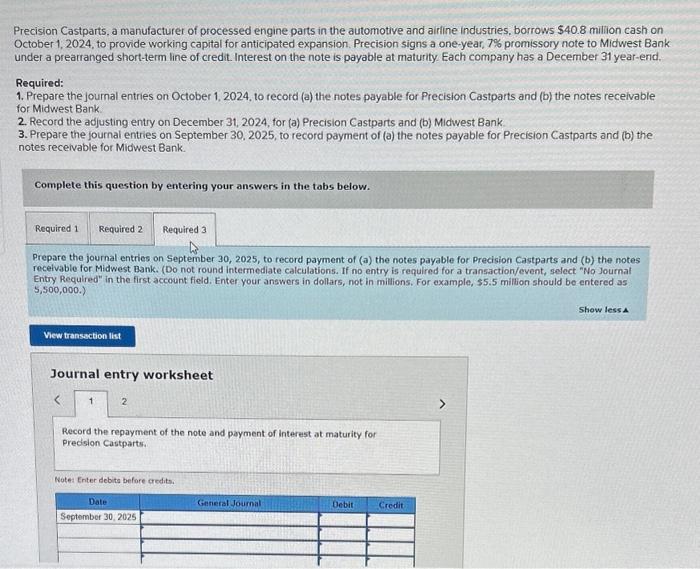

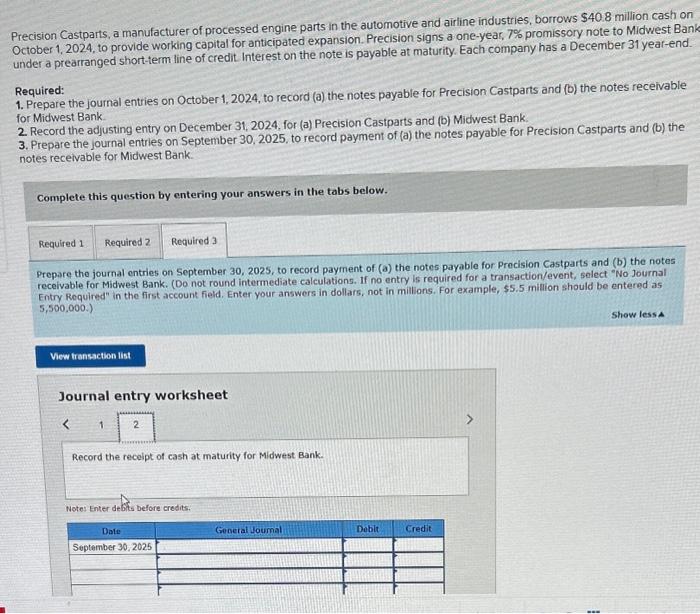

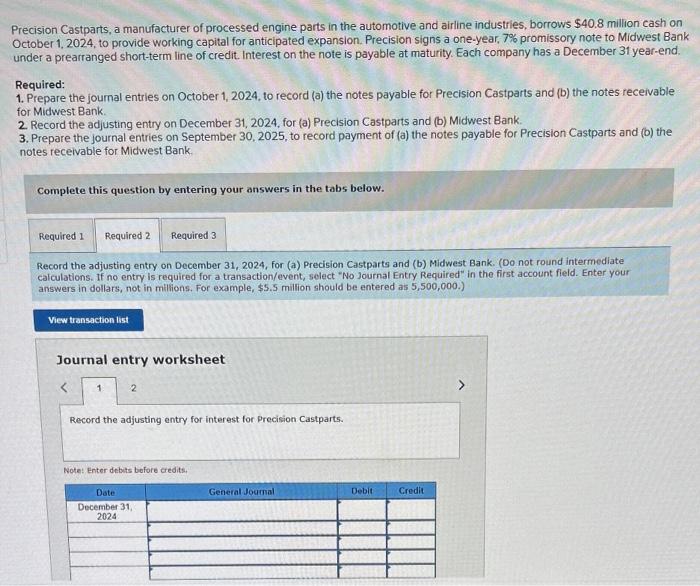

Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.8 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 7% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30,2025 , to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000. Journal entry worksheet Record the adjusting entry for interest for Precision Castparts. Note: Enter debits before credits. Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.8 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 7% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000. Journal entry worksheet Record the adjusting entry for interest for Midwest Bank. Note: Enter debits before credits: Precision Castparts, a manufacturet of processed engine parts in the automotive and airline industries, borrows $40.8 miliion cash on October 1,2024 , to provide working capital for anticipated expansion. Precision signs a one-year, 7% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes recelvable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30,2025 , to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes recelvable for Midwest Bank. (Do not round intermedlate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000. Journal entry worksheet Record the repayment of the note and payment of interest at maturity for predsion Castparts. Notes Eniter debita before credits, Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.8 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 7% promissory note to Midwest Bank under a prearranged short-term line of credit Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Prepare the joumal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. (Do not round intermediate calculations. If no entry is required for a transaction/event, salect " No journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Show lessi Journal entry worksheet Record the receipt of cash at maturity for Midwest Bank