Answered step by step

Verified Expert Solution

Question

1 Approved Answer

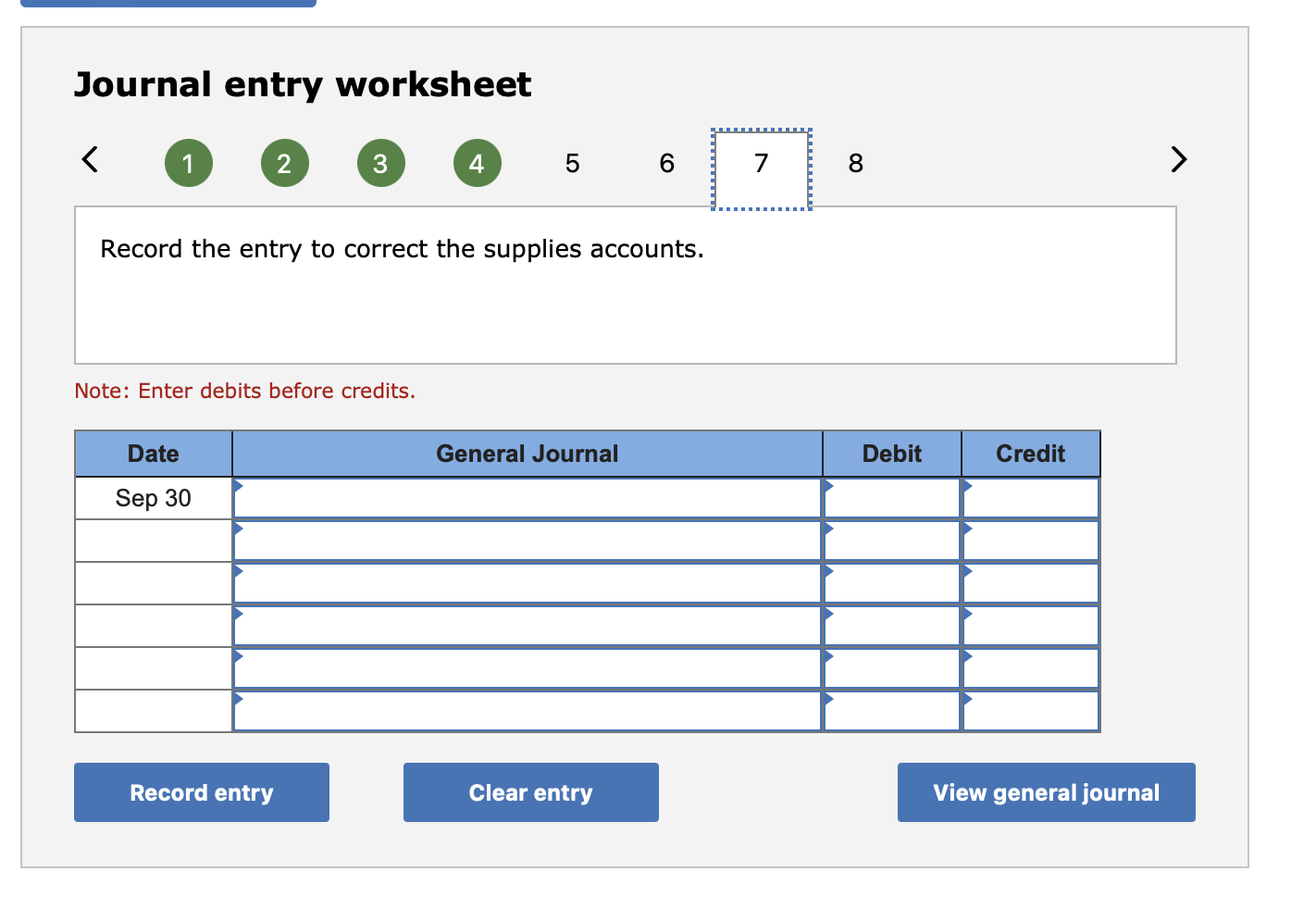

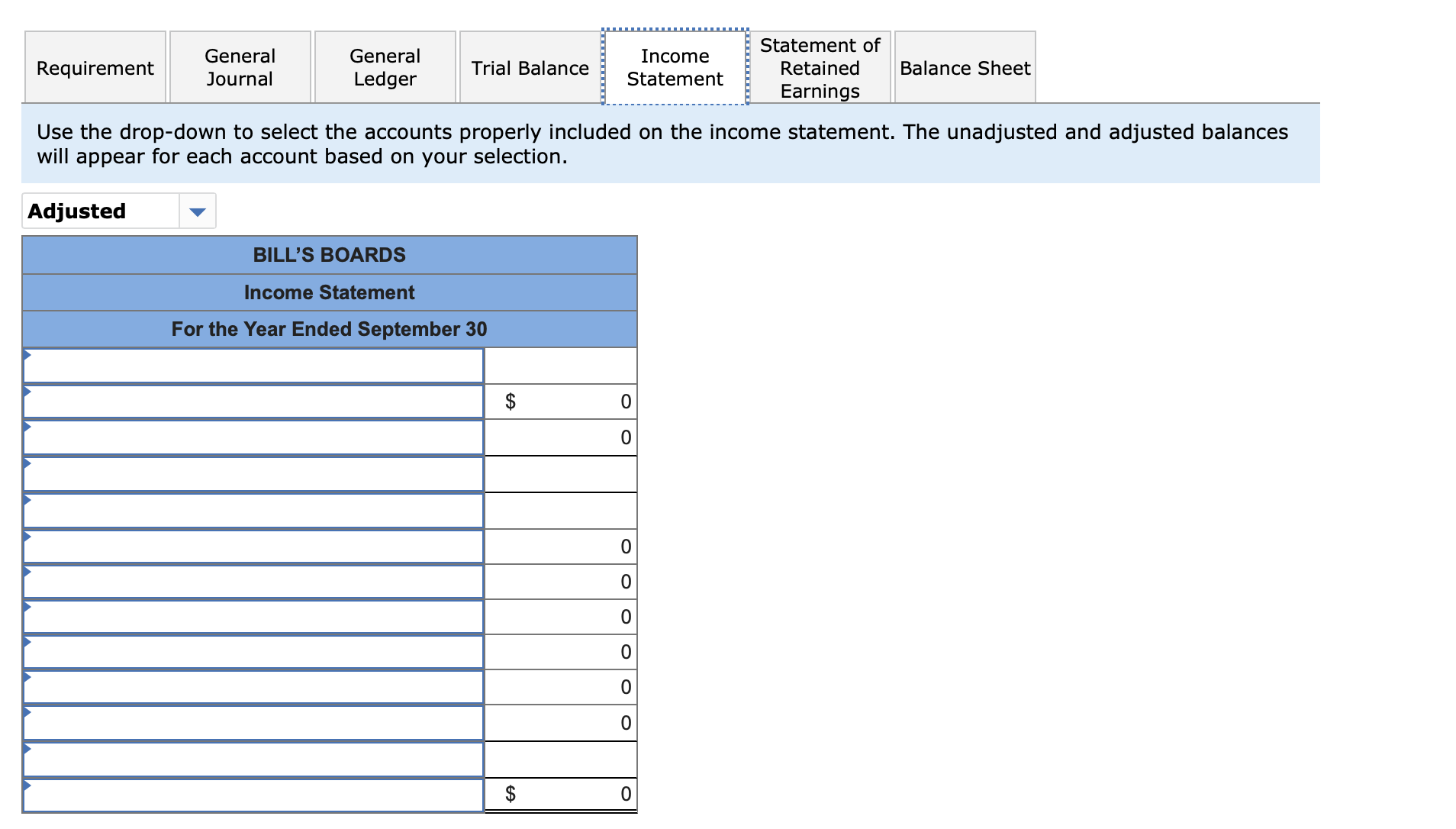

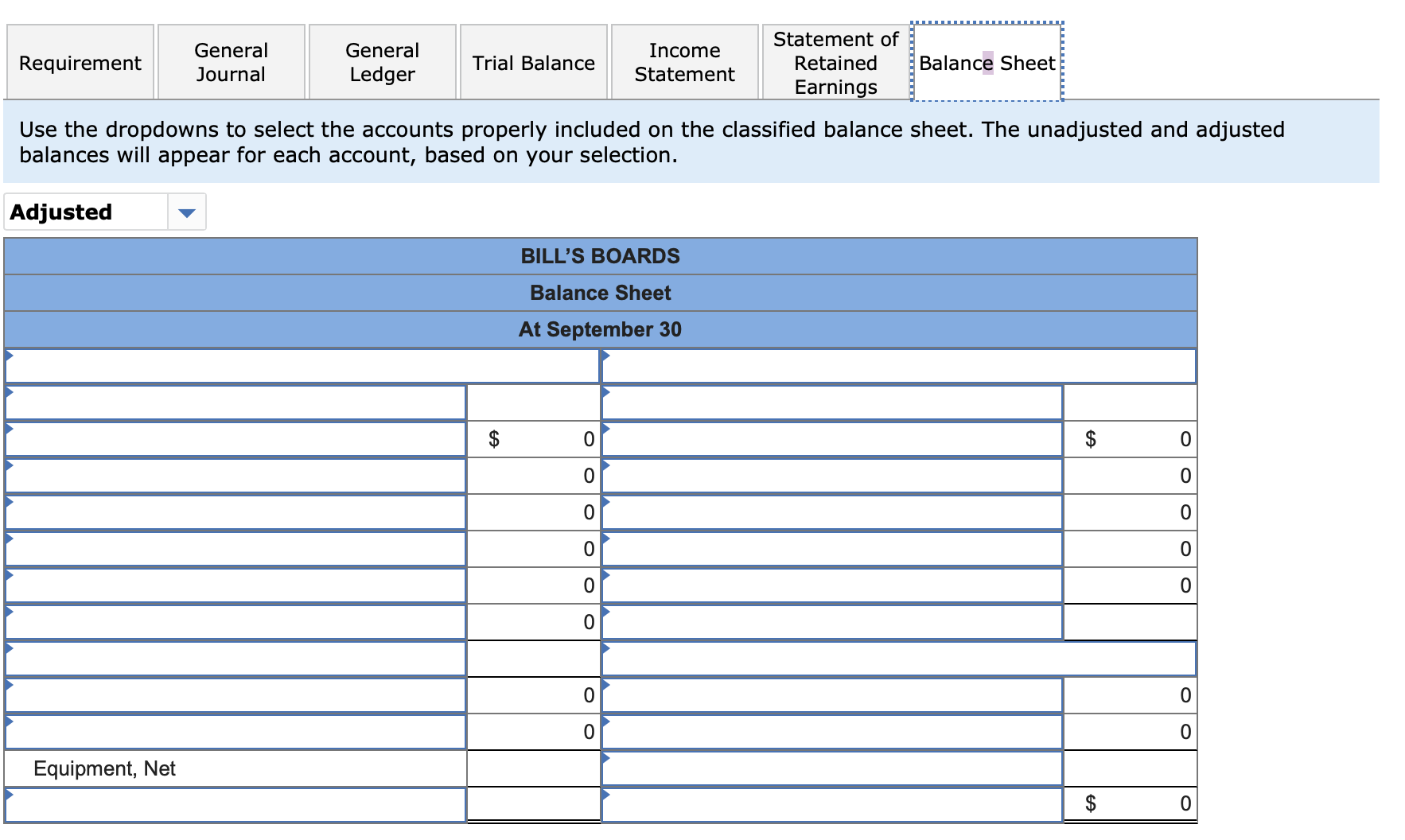

Journal entry worksheet (2) 3 5 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Use the drop-down to select the

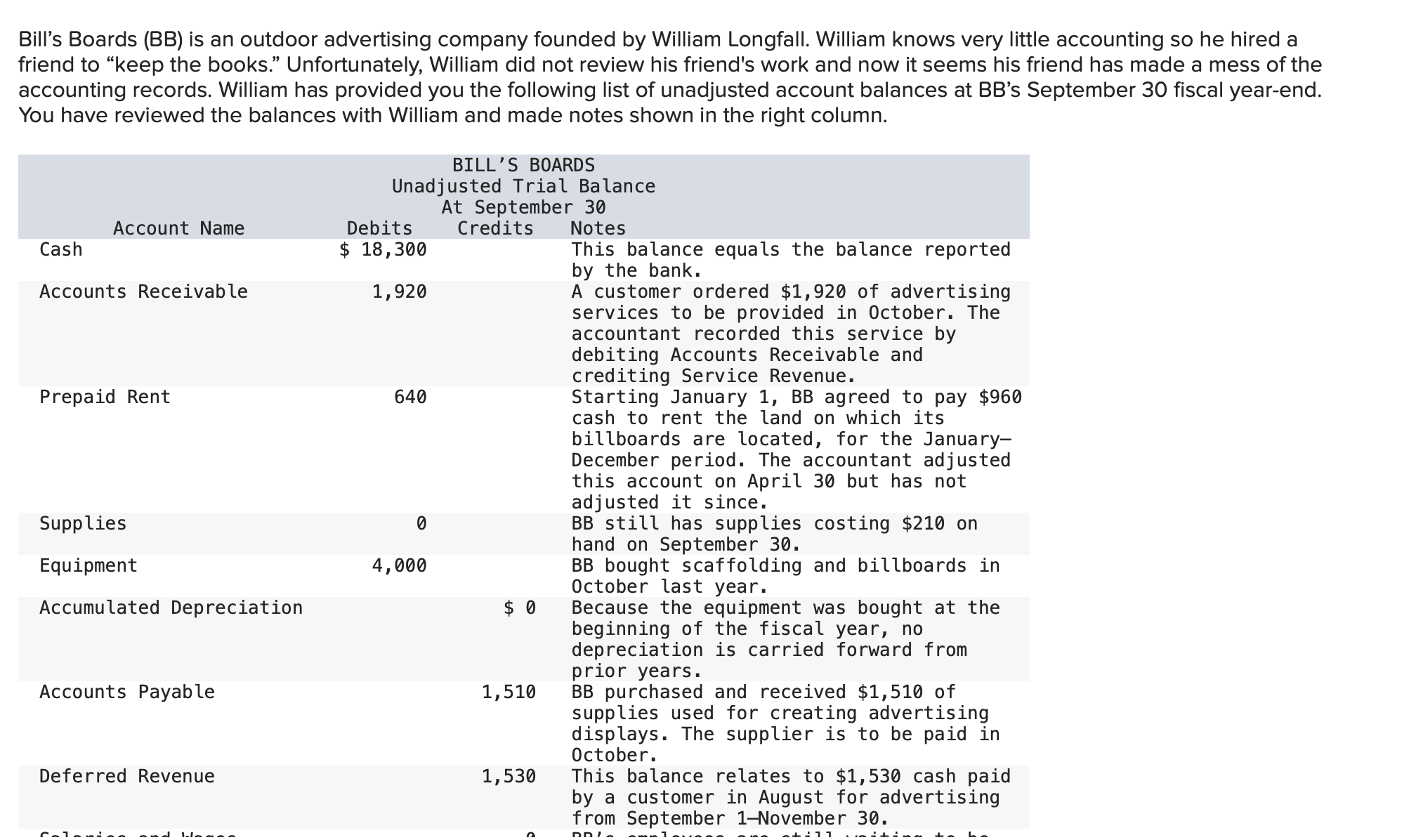

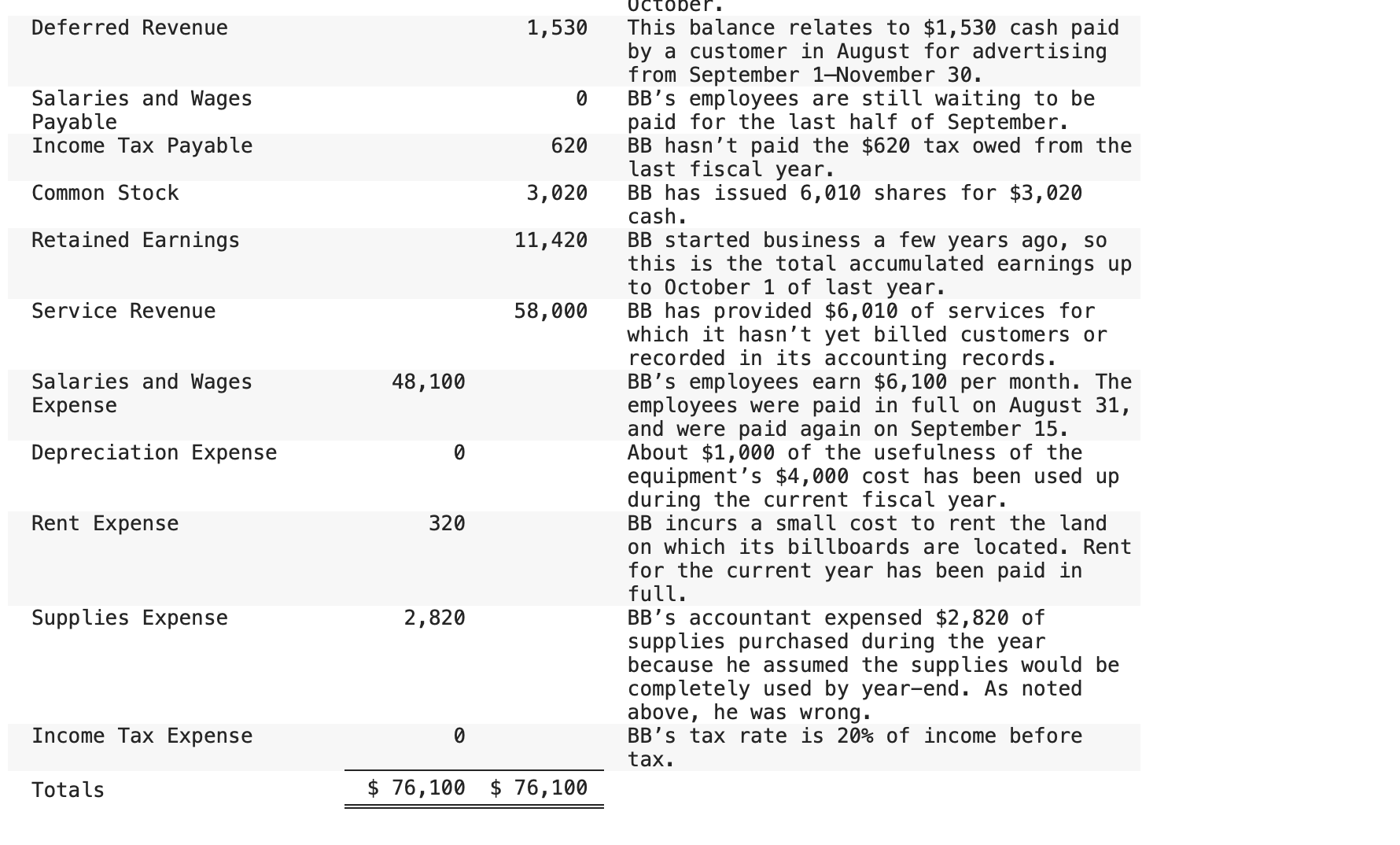

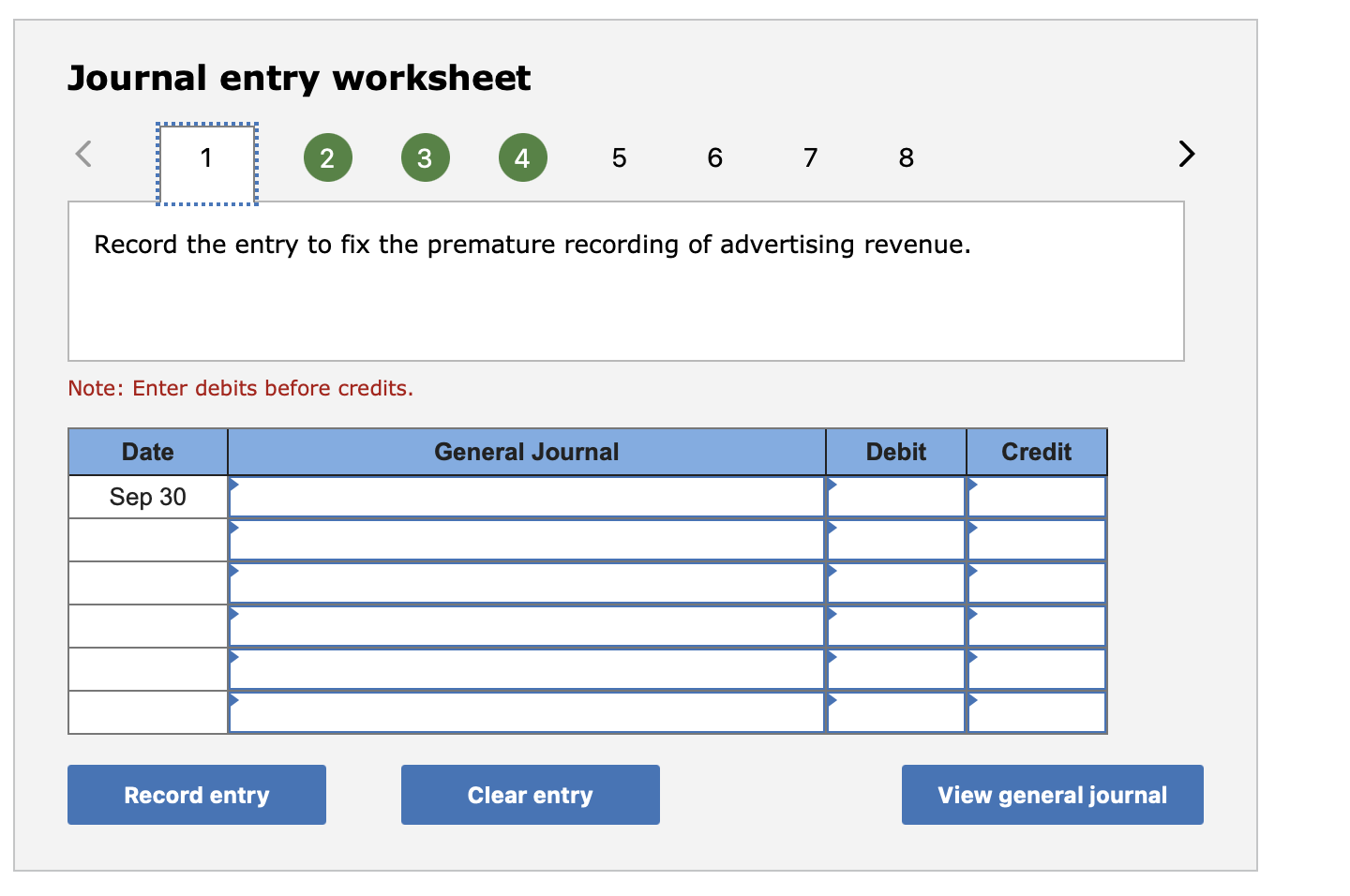

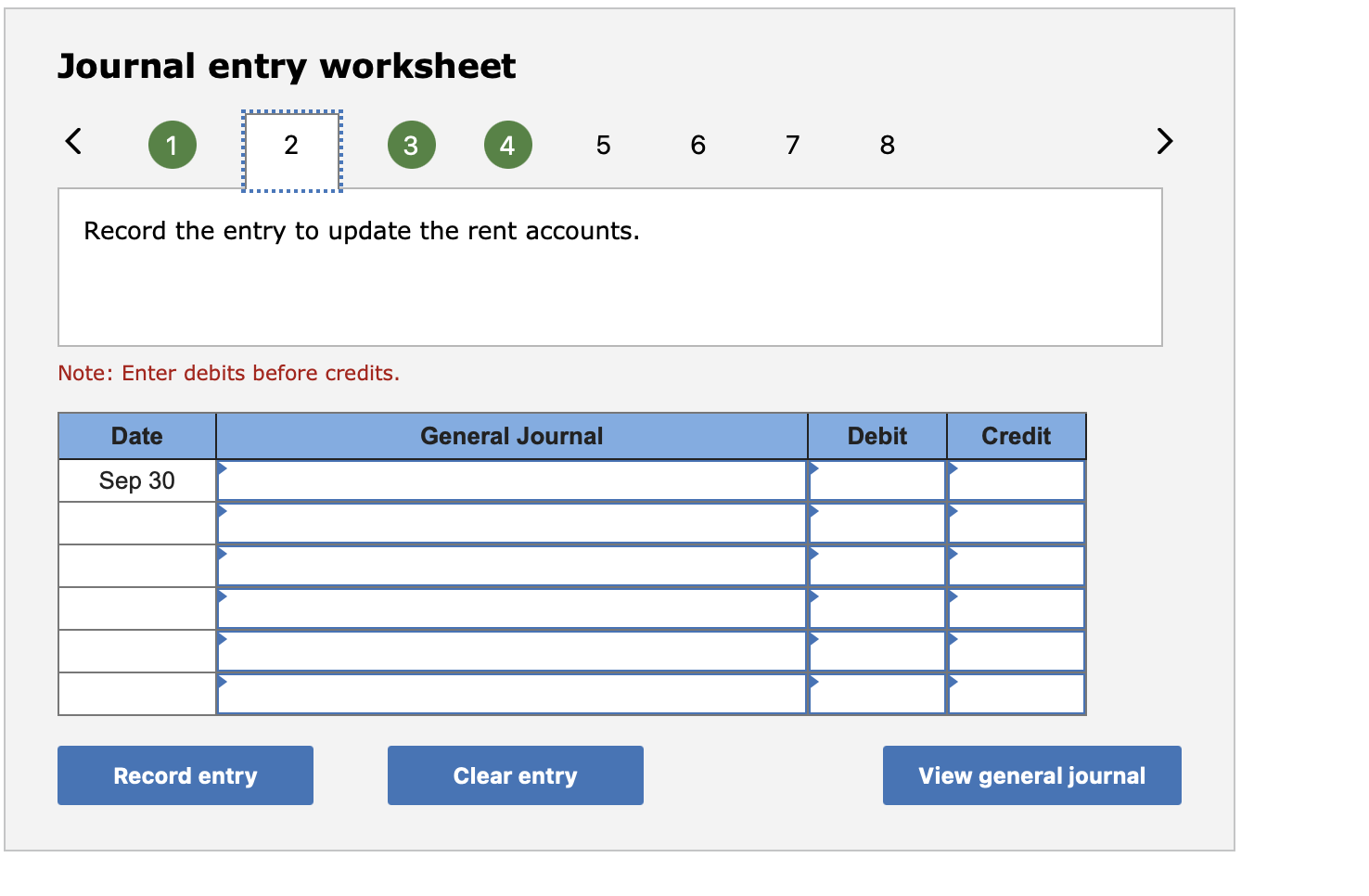

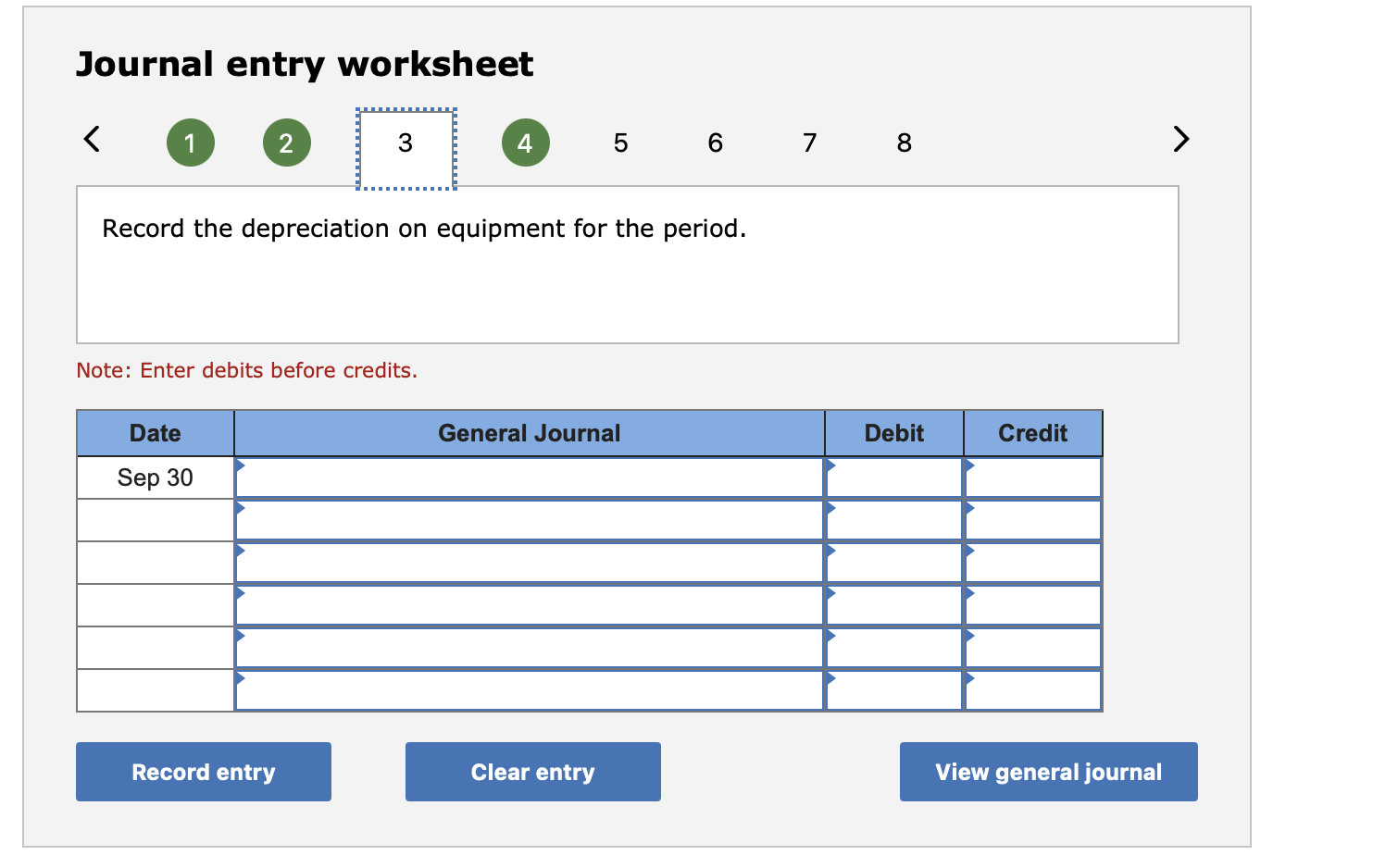

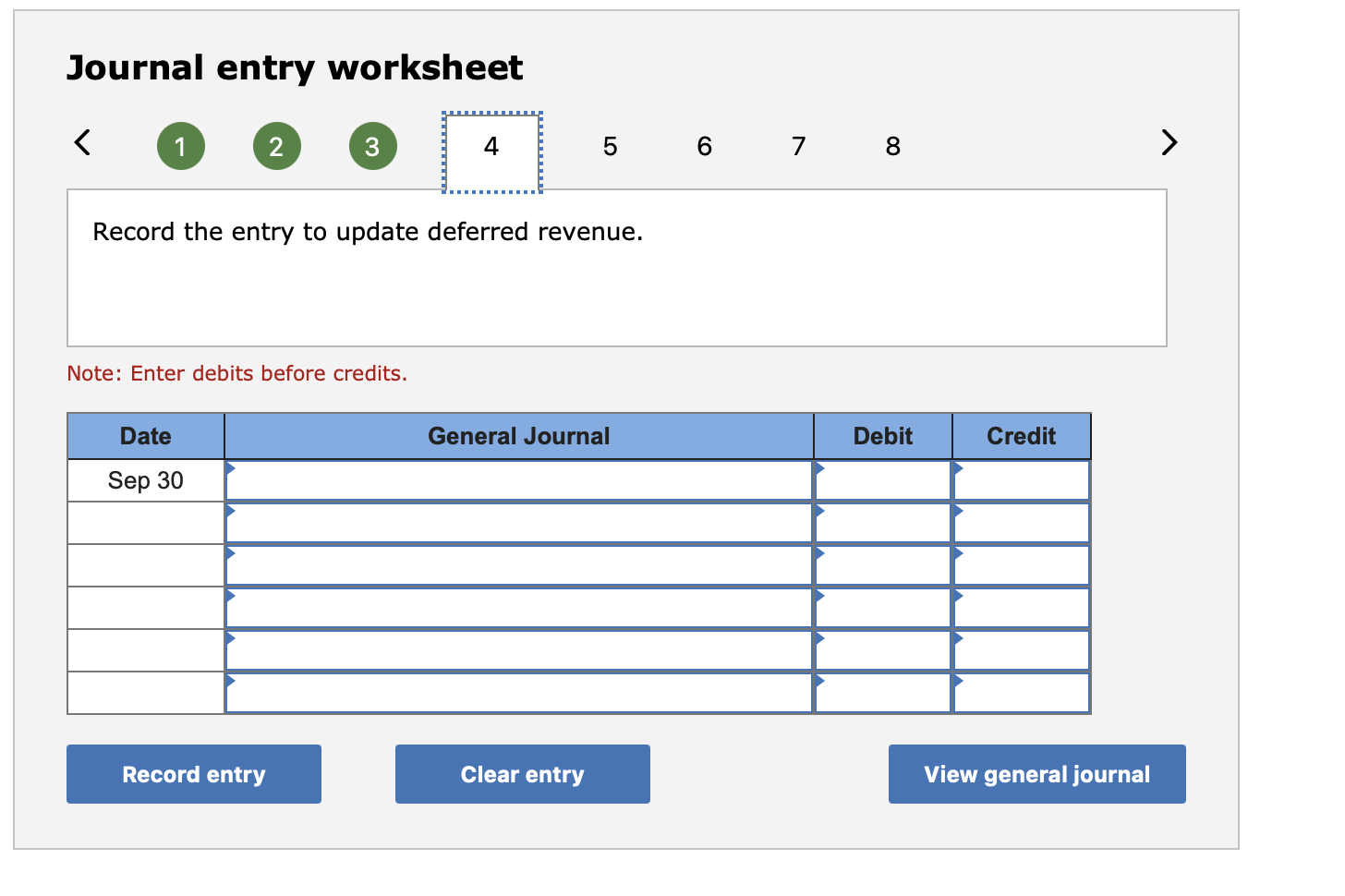

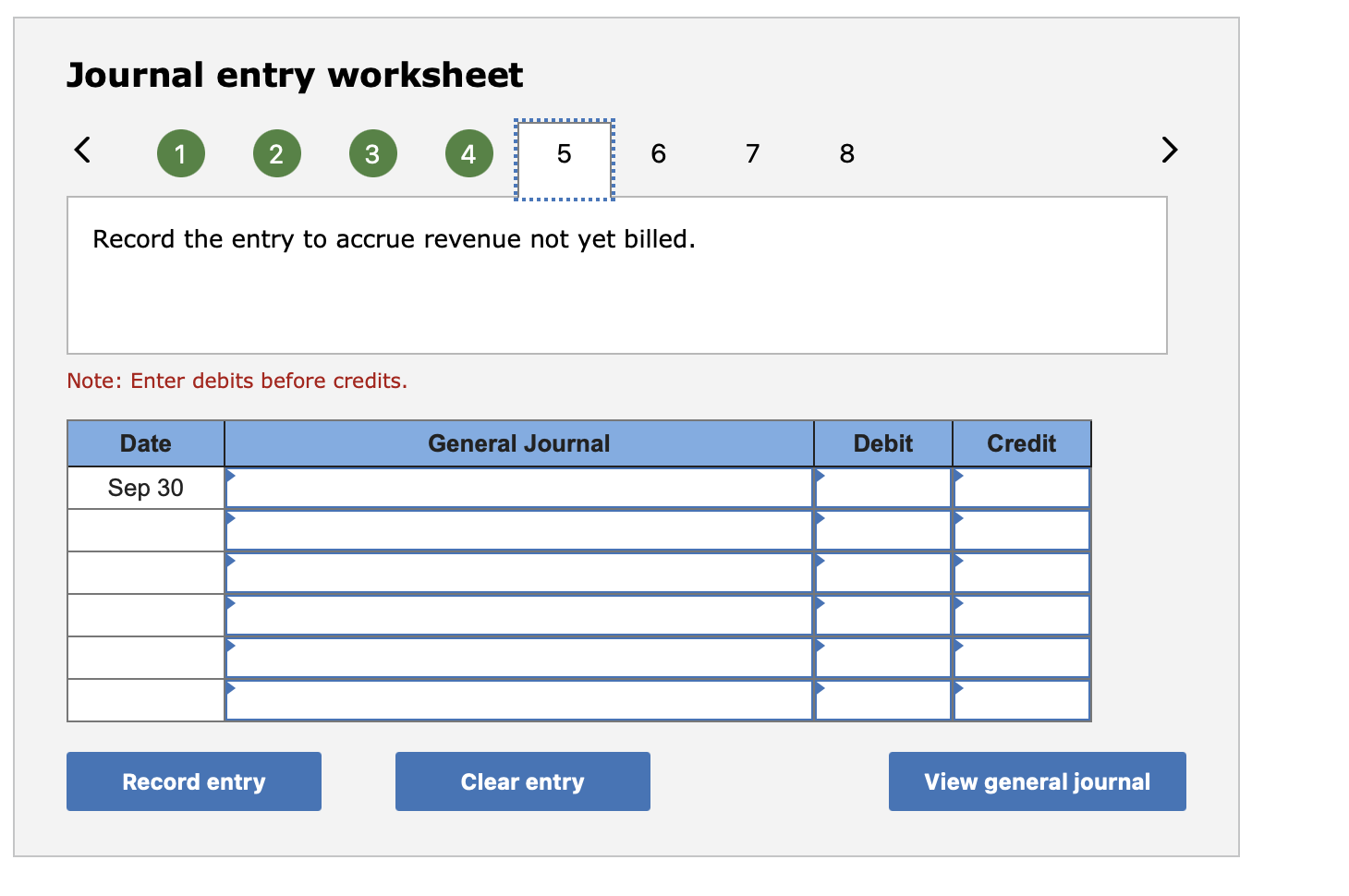

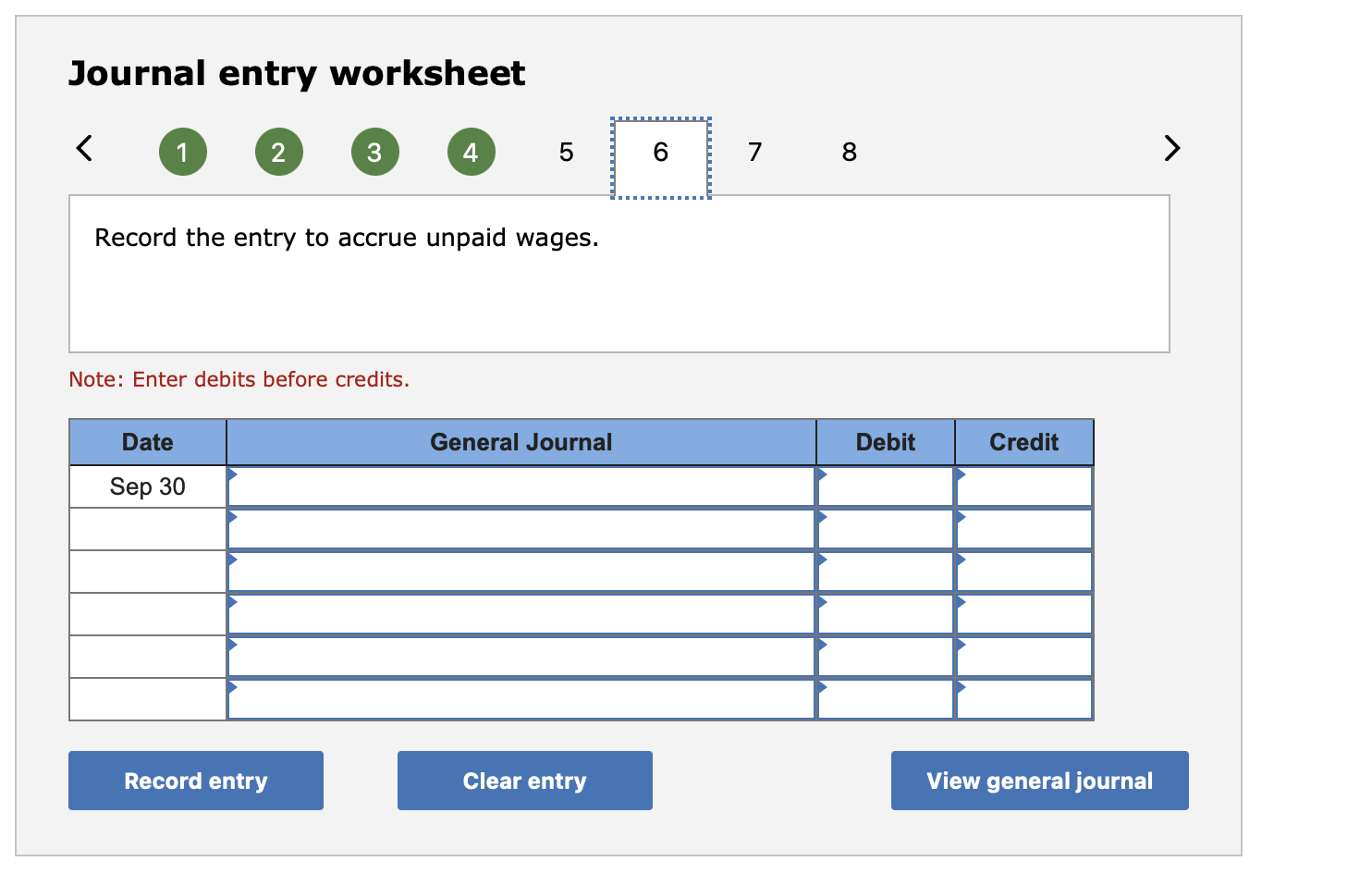

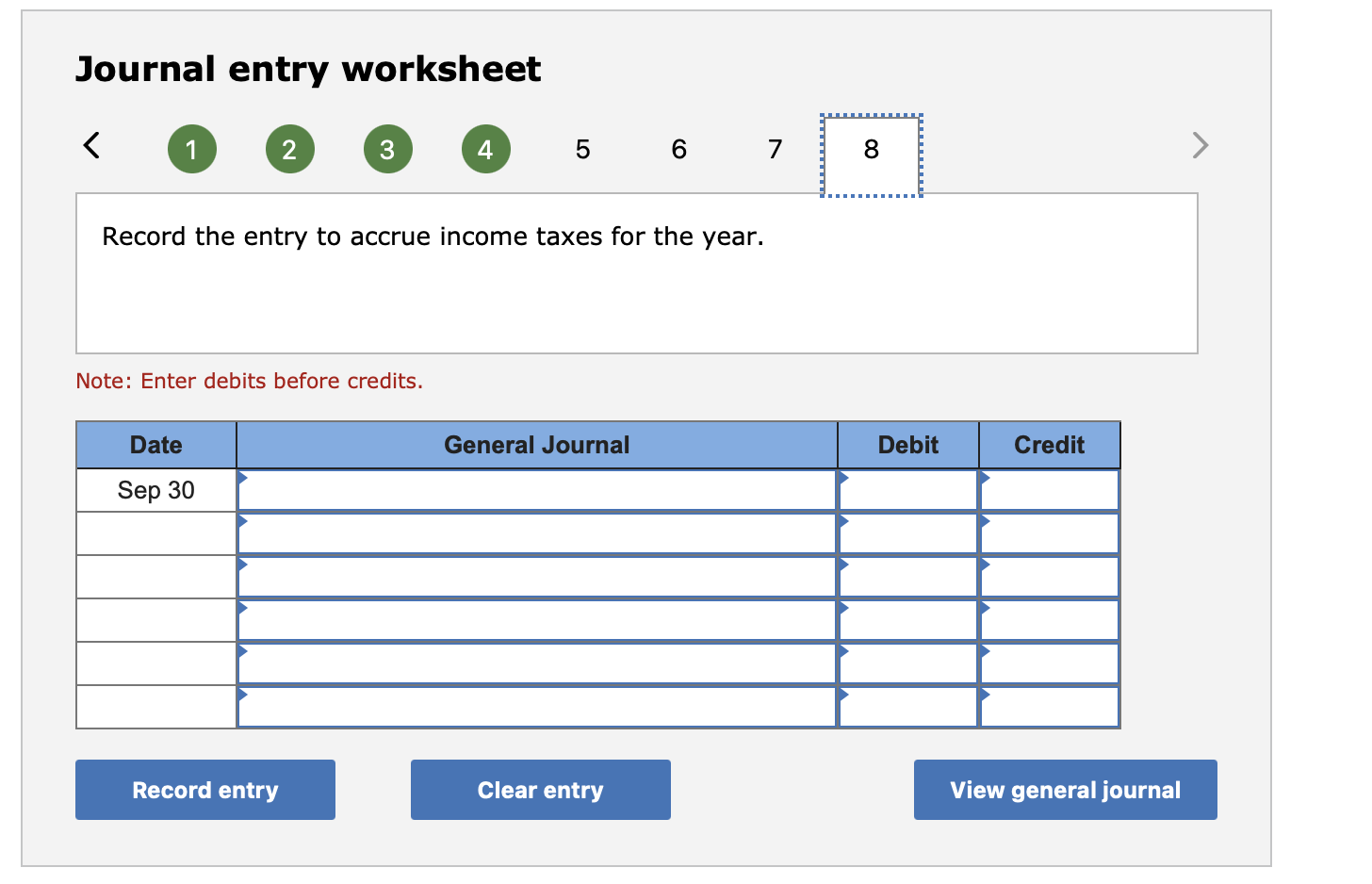

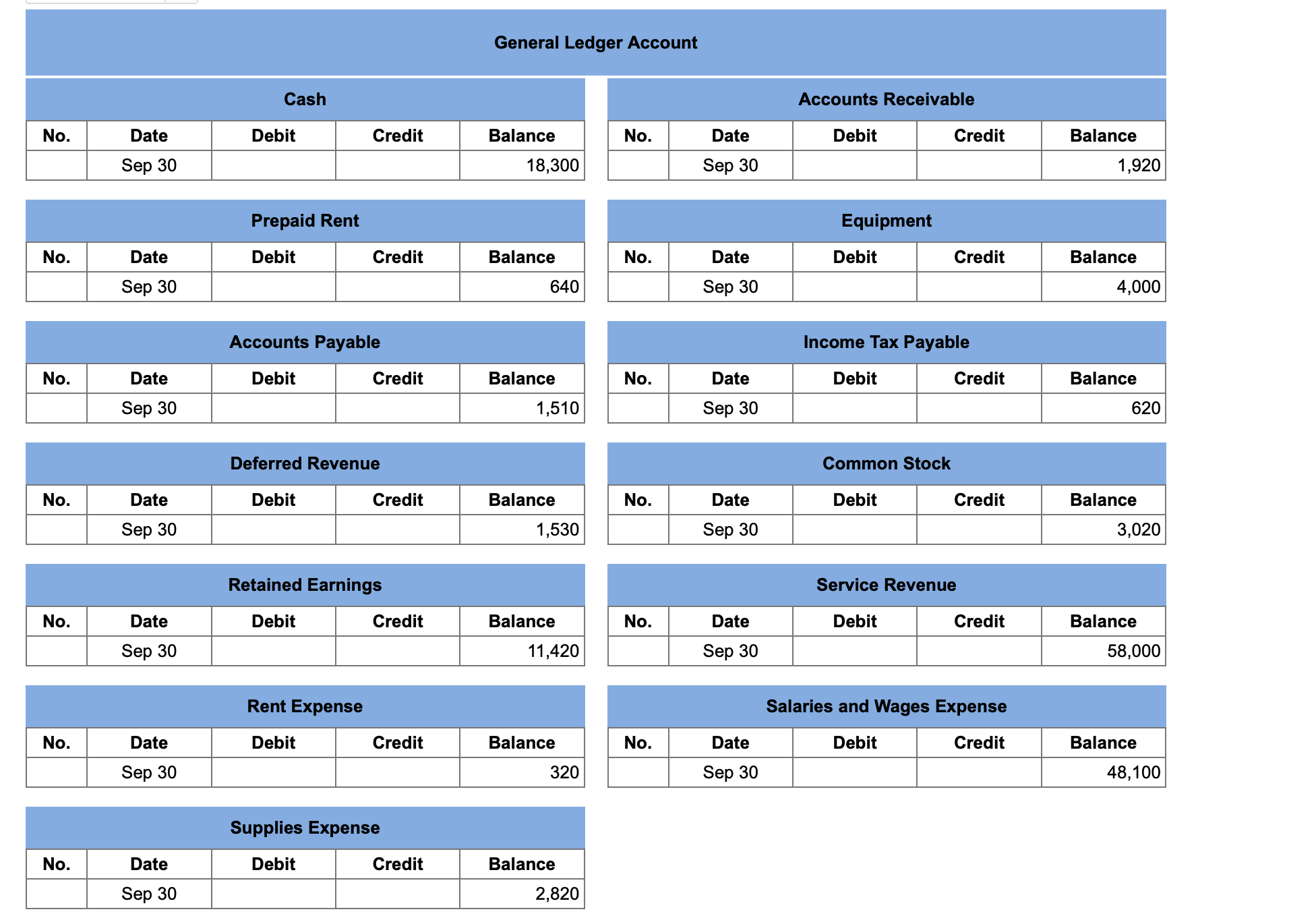

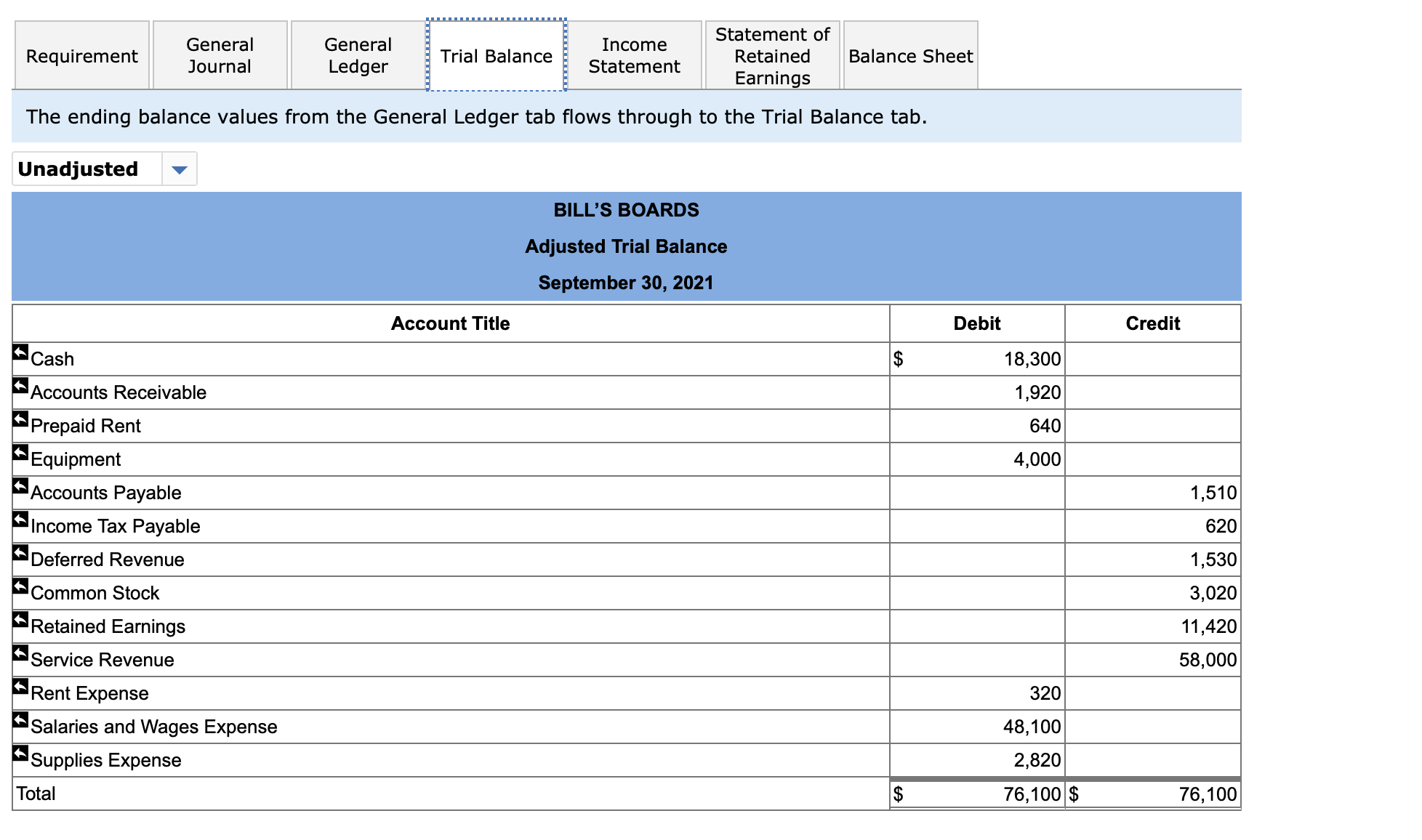

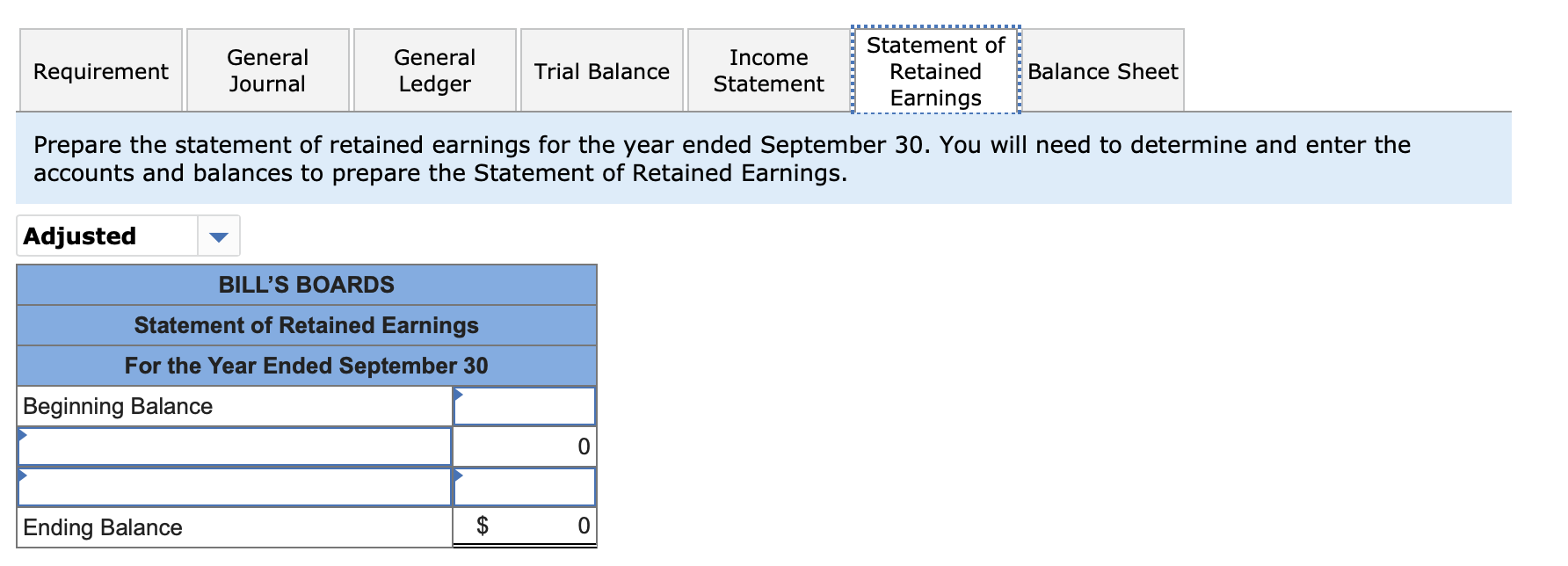

Journal entry worksheet (2) 3 5 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Use the drop-down to select the accounts properly included on the income statement. The unadjusted and adjusted balances will appear for each account based on your selection. Use the dropdowns to select the accounts properly included on the classified balance sheet. The unadjusted and adjusted balances will appear for each account, based on your selection. Journal entry worksheet (1) 3 Record the entry to accrue unpaid wages. Note: Enter debits before credits. Bill's Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting so he hired a friend to "keep the books." Unfortunately, William did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB's September 30 fiscal year-end. You have reviewed the balances with William and made notes shown in the right column. he ending balance values from the General Ledger tab flows through to the Trial Balance tab. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 18,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,920 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 4,000 \\ \hline \end{tabular} Accounts Payable Income Tax Payable \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,510 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 620 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,020 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 11,420 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 58,000 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \multicolumn{5}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 48,100 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|r|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,820 \\ \hline \end{tabular} Prepare the statement of retained earnings for the year ended September 30. You will need to determine and enter the accounts and balances to prepare the Statement of Retained Earnings. Journal entry worksheet 5 Record the entry to update the rent accounts. Note: Enter debits before credits. Journal entry worksheet 1234567 Record the entry to accrue income taxes for the year. Note: Enter debits before credits. Journal entry worksheet 56 Record the depreciation on equipment for the period. Note: Enter debits before credits. Journal entry worksheet (2) Record the entry to accrue revenue not yet billed. Note: Enter debits before credits. Journal entry worksheet Record the entry to update deferred revenue. Note: Enter debits before credits. Journal entry worksheet 678 Record the entry to fix the premature recording of advertising revenue. Note: Enter debits before credits

Journal entry worksheet (2) 3 5 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Use the drop-down to select the accounts properly included on the income statement. The unadjusted and adjusted balances will appear for each account based on your selection. Use the dropdowns to select the accounts properly included on the classified balance sheet. The unadjusted and adjusted balances will appear for each account, based on your selection. Journal entry worksheet (1) 3 Record the entry to accrue unpaid wages. Note: Enter debits before credits. Bill's Boards (BB) is an outdoor advertising company founded by William Longfall. William knows very little accounting so he hired a friend to "keep the books." Unfortunately, William did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at BB's September 30 fiscal year-end. You have reviewed the balances with William and made notes shown in the right column. he ending balance values from the General Ledger tab flows through to the Trial Balance tab. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 18,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,920 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 4,000 \\ \hline \end{tabular} Accounts Payable Income Tax Payable \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,510 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 620 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,020 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 11,420 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 58,000 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \multicolumn{5}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 48,100 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|r|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,820 \\ \hline \end{tabular} Prepare the statement of retained earnings for the year ended September 30. You will need to determine and enter the accounts and balances to prepare the Statement of Retained Earnings. Journal entry worksheet 5 Record the entry to update the rent accounts. Note: Enter debits before credits. Journal entry worksheet 1234567 Record the entry to accrue income taxes for the year. Note: Enter debits before credits. Journal entry worksheet 56 Record the depreciation on equipment for the period. Note: Enter debits before credits. Journal entry worksheet (2) Record the entry to accrue revenue not yet billed. Note: Enter debits before credits. Journal entry worksheet Record the entry to update deferred revenue. Note: Enter debits before credits. Journal entry worksheet 678 Record the entry to fix the premature recording of advertising revenue. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started