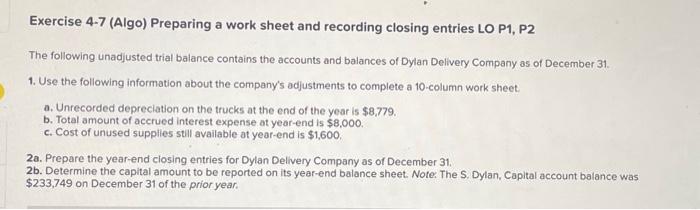

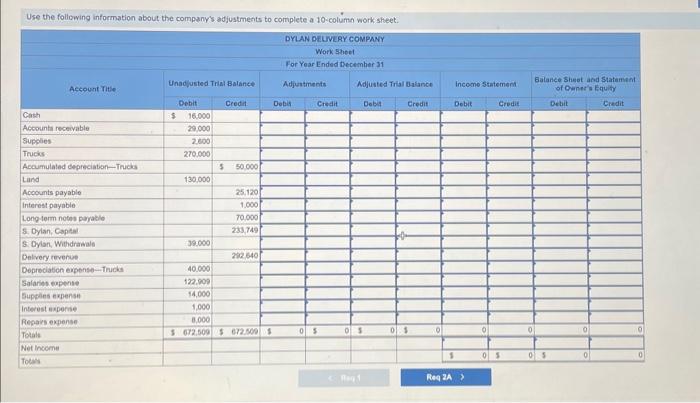

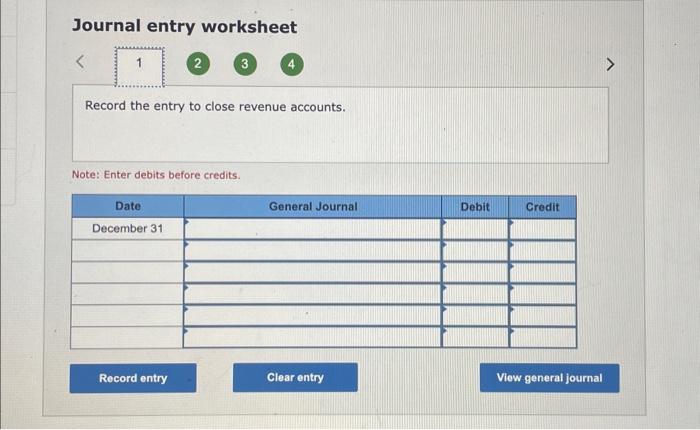

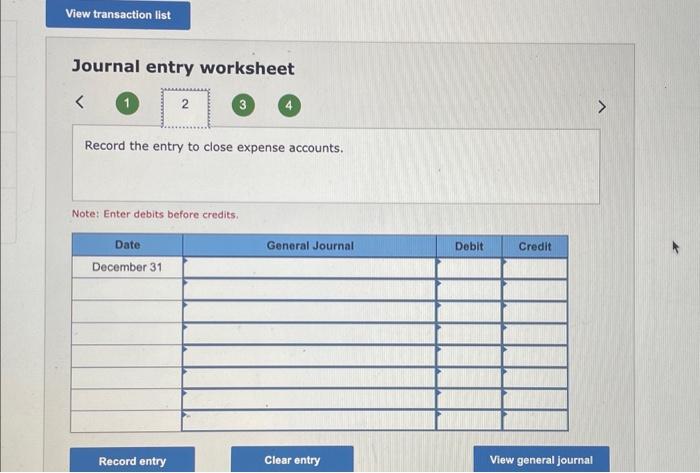

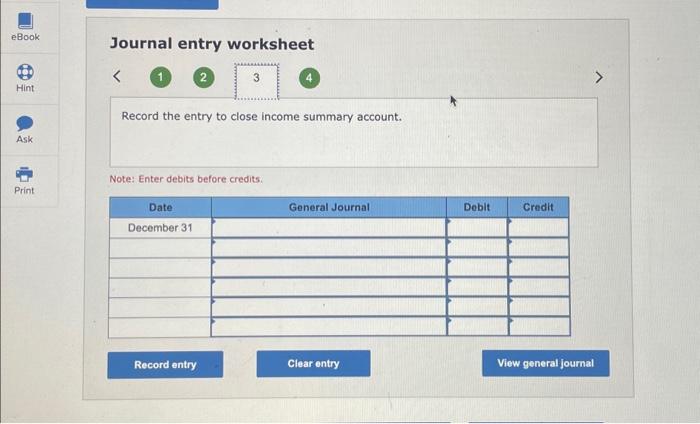

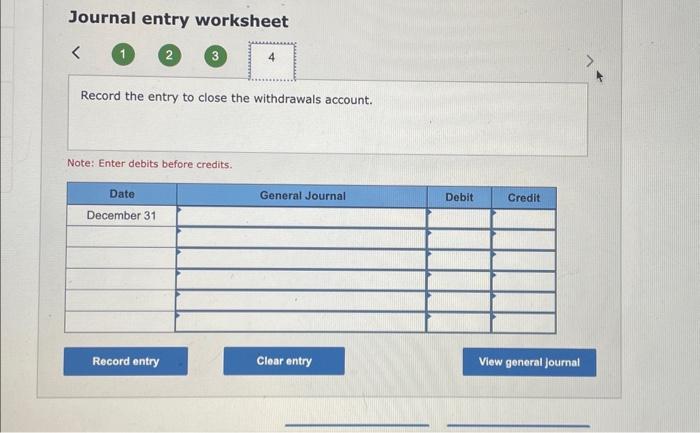

Journal entry worksheet 4 Record the entry to close revenue accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close income summary account. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the withdrawals account. Note: Enter debits before credits. Exercise 4-7 (Algo) Preparing a work sheet and recording closing entries LO P1, P2 The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about the company's adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $8,779. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $1,600. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note. The S. Dylan, Capital account balance was $233,749 on December 31 of the prior year. Use the following information about the companrs adjustments to complete a 10 -colume work sheet. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ DYLAN DELUVEYY COMPANY } \\ \hline \multicolumn{11}{|c|}{ Work stoet } \\ \hline \multicolumn{11}{|c|}{ For Year Ended December 31} \\ \hline \multirow[t]{2}{*}{ Acsount Title: } & \multicolumn{2}{|c|}{ Unad/usted Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Mdjusted Trial Balance } & \multicolumn{2}{|c|}{ incomo statement } & \multicolumn{2}{|c|}{EalanceSheotandStatemientofOinnersEquity} \\ \hline & Debit & Credit & Dobis & Credit & Dobat & Credit & Debit & Credit & Detbit & Credit \\ \hline Cash & is 16,000 & & & & & & & & & \\ \hline Accosunta receivable & 29,000 & & & & & & & & & \\ \hline Supplies & 2000 & & & & & & & & & \\ \hline Truds: & 270.000 & & & & & & & & & \\ \hline Accumulated depreciation-Truds & & 550,000 & & & & & & & & \\ \hline tand & 130,000 & & & & & & & & & \\ \hline Accoounts payable & & 25,120 & & & & & & & & \\ \hline Interest payable & & 1.000 & & & & & & & & \\ \hline Long term notes payabio & & 70,000 & & & & & & & & \\ \hline 5. Dylan, Capenal & & 233.749 & & & & & & & & \\ \hline 8. Dylon, Withdrawal. & 39.000 & & & & & & & & & \\ \hline Delivery revenue & & 2026402 & & & & & & & & \\ \hline Deprediation expense-Thucks & 40.000 & & & & & & & & & \\ \hline Salaries expense & 122.009 & & & & & & & & & \\ \hline Supples expensi & 14,000 & & & & & & & & & \\ \hline Interest exporse & 1,000 & & & & & & & & & \\ \hline Repais expense & 8.000 & & & & & & & & & \\ \hline Totale & 3672509 & 5 ens.sen & 3 & 0 & 3 & 3 & 0 & 0 & 0 & \\ \hline \multicolumn{11}{|l|}{ Notal } \\ \hline Toess & & & & & & & 1 & 5 & 5 & a \\ \hline \end{tabular} Journal entry worksheet Record the entry to close expense accounts. Note: Enter debits before credits