Answered step by step

Verified Expert Solution

Question

1 Approved Answer

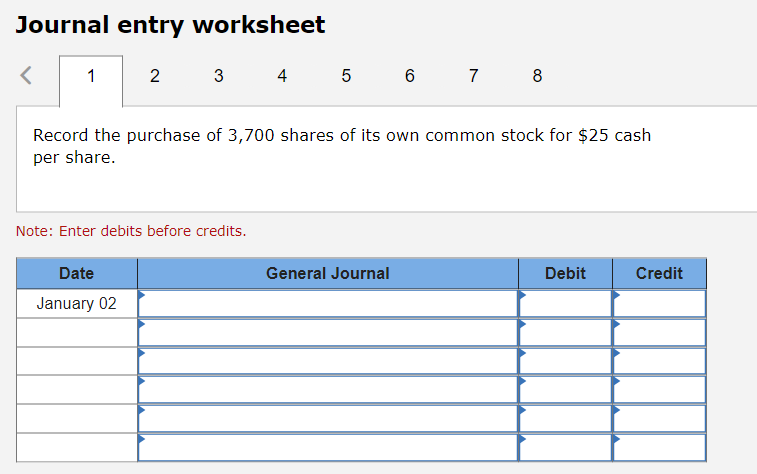

Journal entry worksheet 8 Record the purchase of 3,700 shares of its own common stock for ( $ 25 ) cash per share. Note: Enter

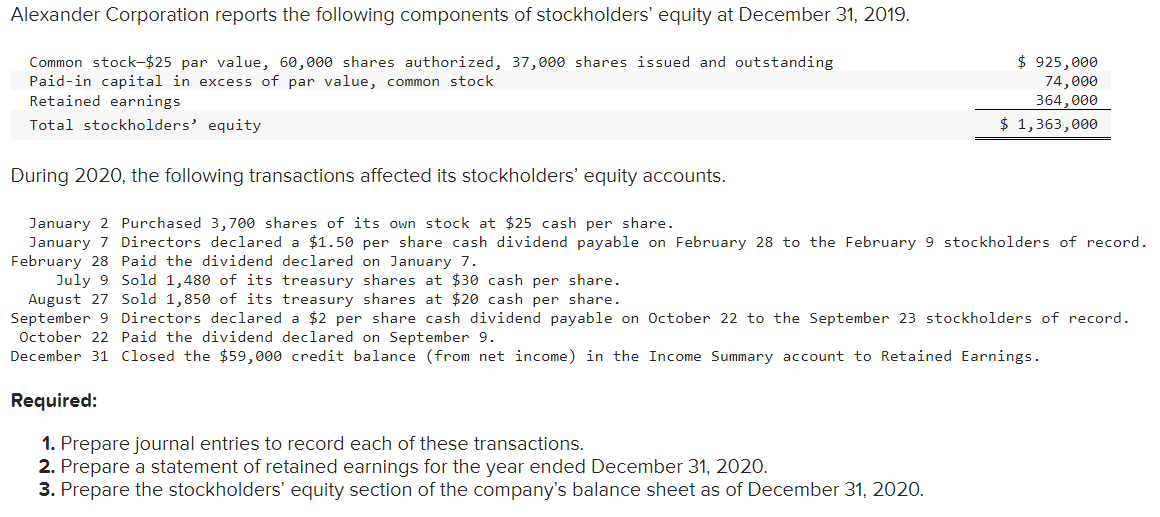

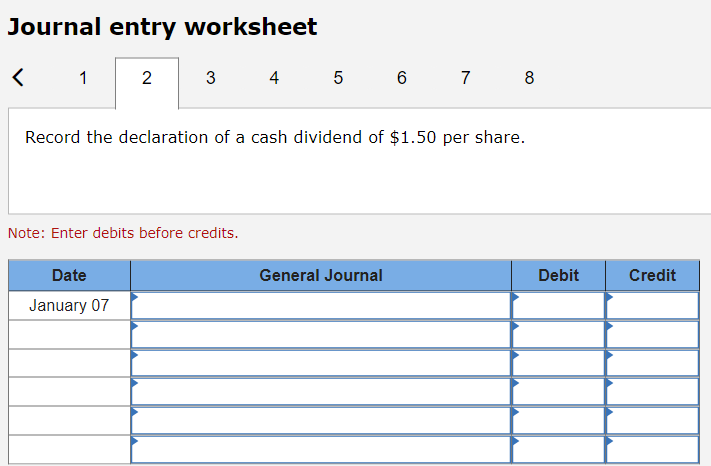

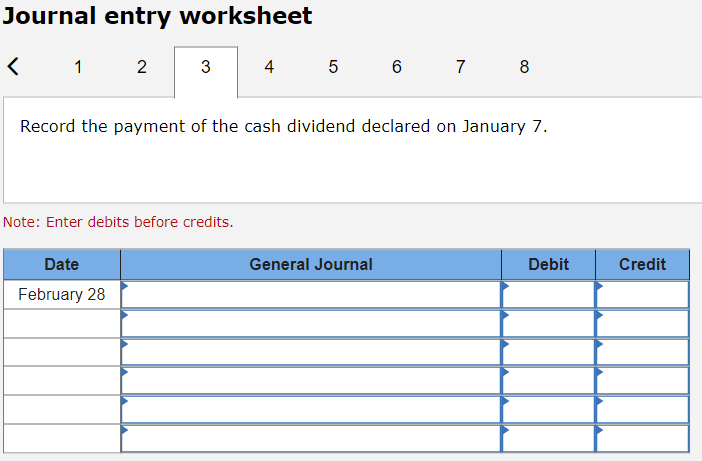

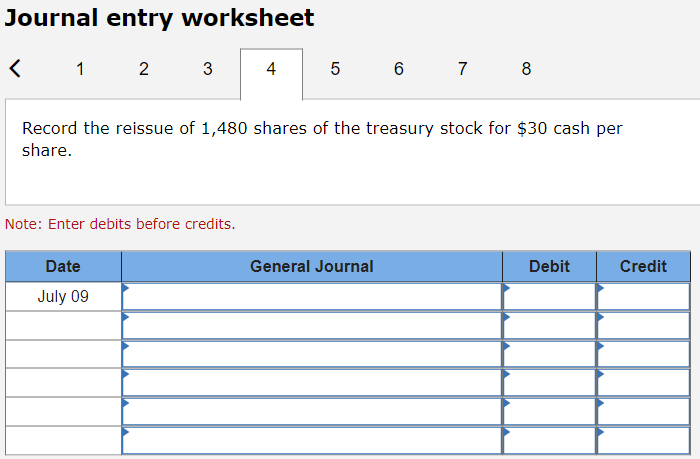

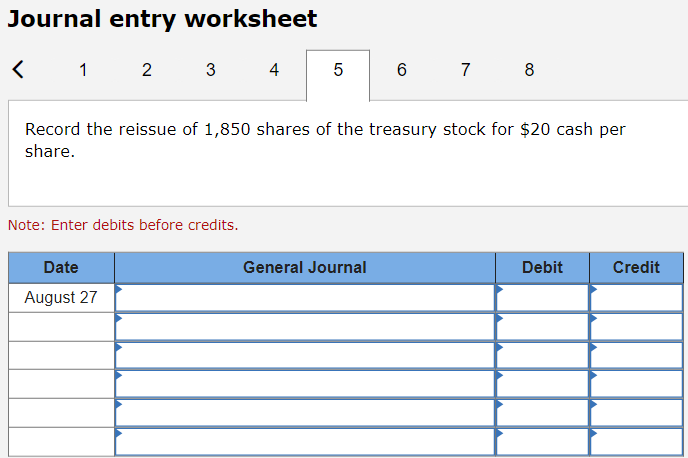

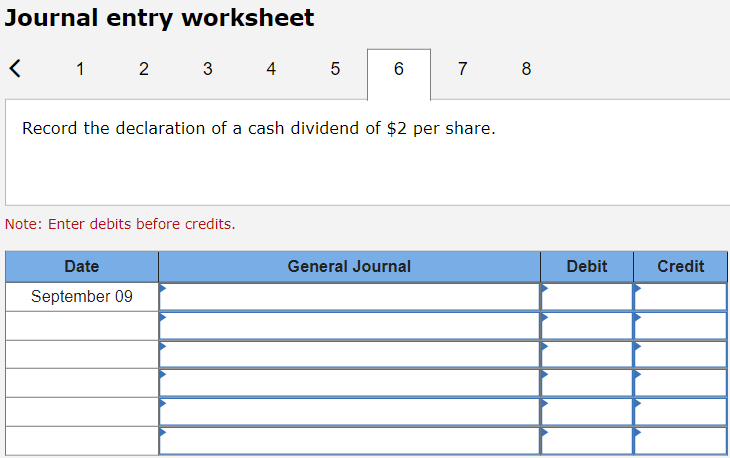

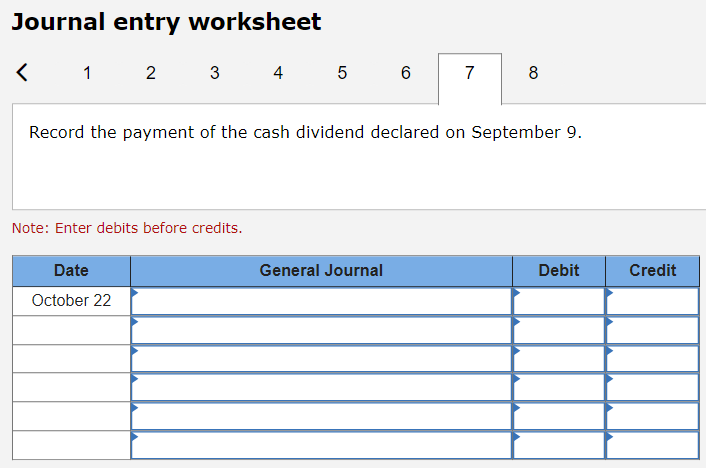

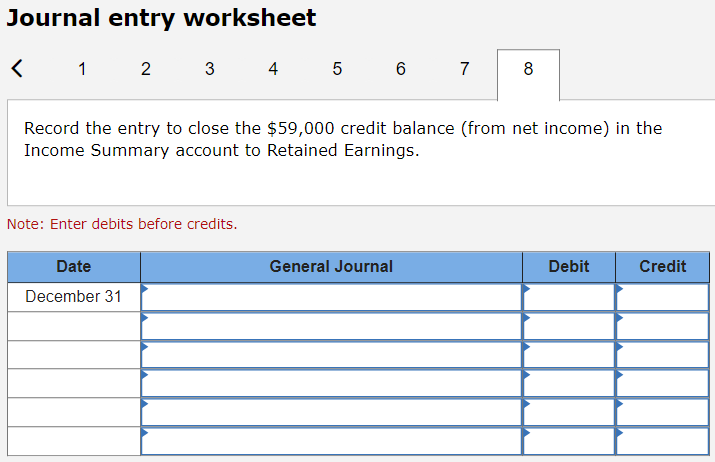

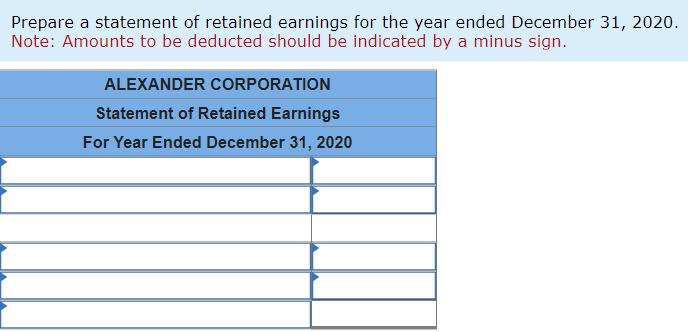

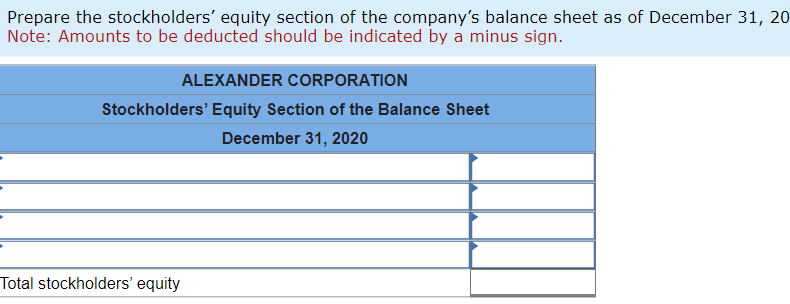

Journal entry worksheet 8 Record the purchase of 3,700 shares of its own common stock for \\( \\$ 25 \\) cash per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of \\( \\$ 1.50 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the reissue of 1,850 shares of the treasury stock for \\( \\$ 20 \\) cash per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of \\( \\$ 2 \\) per share. Note: Enter debits before credits. Journal entry worksheet 1 8 Record the payment of the cash dividend declared on September 9. Note: Enter debits before credits. Prepare a statement of retained earnings for the year ended December 31, 2020 . Note: Amounts to be deducted should be indicated by a minus sign. Prepare the stockholders' equity section of the company's balance sheet as of December 31,20 Note: Amounts to be deducted should be indicated by a minus sign. Journal entry worksheet Record the reissue of 1,480 shares of the treasury stock for \\( \\$ 30 \\) cash per share. Note: Enter debits before credits. Common stock- \\( \\$ 25 \\) par value, 60,000 shares authorized, 37,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity \\( \\begin{array}{r}\\$ 925,000 \\\\ 74,000 \\\\ 364,000 \\\\ \\hline \\$ 1,363,000 \\\\ \\hline\\end{array} \\) During 2020, the following transactions affected its stockholders' equity accounts. January 2 Purchased 3,700 shares of its own stock at \\( \\$ 25 \\) cash per share. January 7 Directors declared a \\( \\$ 1.50 \\) per share cash dividend payable on February 28 to the February 9 stockholders of record. February 28 Paid the dividend declared on January 7. July 9 Sold 1,480 of its treasury shares at \\( \\$ 30 \\) cash per share. August 27 Sold 1,850 of its treasury shares at \\( \\$ 20 \\) cash per share. September 9 Directors declared a \\( \\$ 2 \\) per share cash dividend payable on October 22 to the September 23 stockholders of record. October 22 Paid the dividend declared on September 9. December 31 Closed the \\( \\$ 59,000 \\) credit balance (from net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2020. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2020 . Journal entry worksheet 1 Record the payment of the cash dividend declared on January 7. Note: Enter debits before credits

Journal entry worksheet 8 Record the purchase of 3,700 shares of its own common stock for \\( \\$ 25 \\) cash per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of \\( \\$ 1.50 \\) per share. Note: Enter debits before credits. Journal entry worksheet Record the reissue of 1,850 shares of the treasury stock for \\( \\$ 20 \\) cash per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of \\( \\$ 2 \\) per share. Note: Enter debits before credits. Journal entry worksheet 1 8 Record the payment of the cash dividend declared on September 9. Note: Enter debits before credits. Prepare a statement of retained earnings for the year ended December 31, 2020 . Note: Amounts to be deducted should be indicated by a minus sign. Prepare the stockholders' equity section of the company's balance sheet as of December 31,20 Note: Amounts to be deducted should be indicated by a minus sign. Journal entry worksheet Record the reissue of 1,480 shares of the treasury stock for \\( \\$ 30 \\) cash per share. Note: Enter debits before credits. Common stock- \\( \\$ 25 \\) par value, 60,000 shares authorized, 37,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity \\( \\begin{array}{r}\\$ 925,000 \\\\ 74,000 \\\\ 364,000 \\\\ \\hline \\$ 1,363,000 \\\\ \\hline\\end{array} \\) During 2020, the following transactions affected its stockholders' equity accounts. January 2 Purchased 3,700 shares of its own stock at \\( \\$ 25 \\) cash per share. January 7 Directors declared a \\( \\$ 1.50 \\) per share cash dividend payable on February 28 to the February 9 stockholders of record. February 28 Paid the dividend declared on January 7. July 9 Sold 1,480 of its treasury shares at \\( \\$ 30 \\) cash per share. August 27 Sold 1,850 of its treasury shares at \\( \\$ 20 \\) cash per share. September 9 Directors declared a \\( \\$ 2 \\) per share cash dividend payable on October 22 to the September 23 stockholders of record. October 22 Paid the dividend declared on September 9. December 31 Closed the \\( \\$ 59,000 \\) credit balance (from net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2020. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2020 . Journal entry worksheet 1 Record the payment of the cash dividend declared on January 7. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started