Answered step by step

Verified Expert Solution

Question

1 Approved Answer

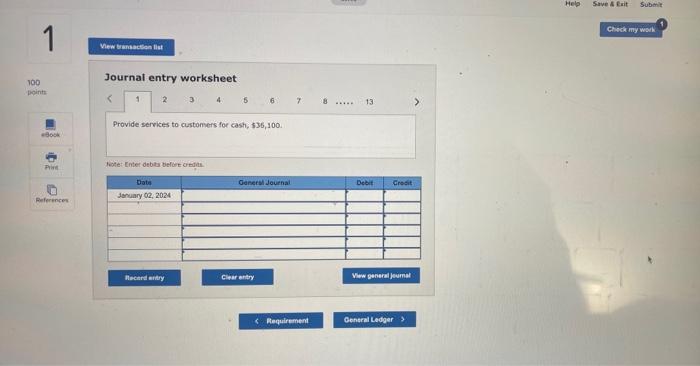

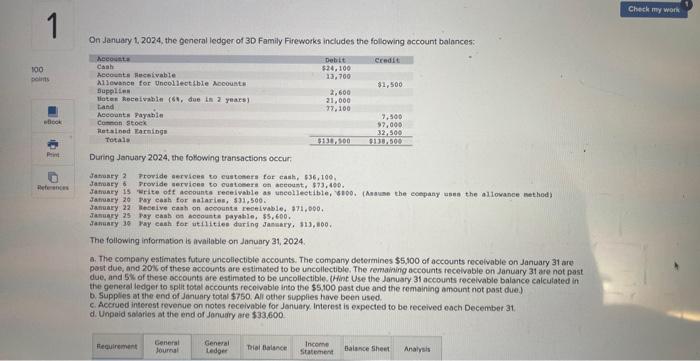

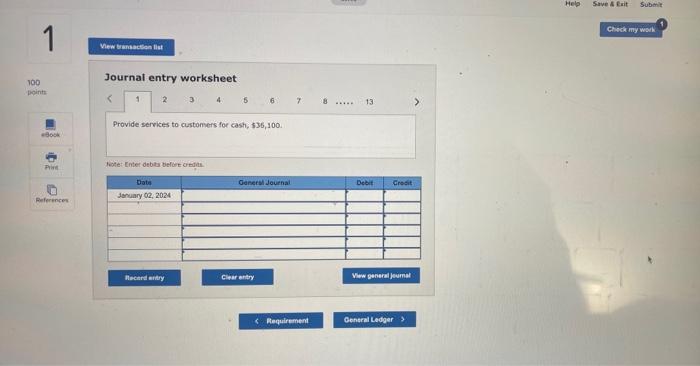

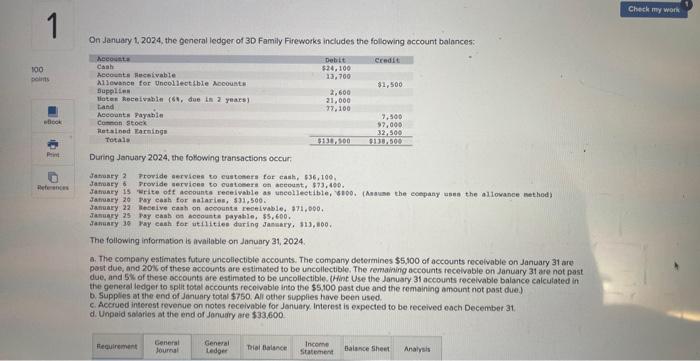

Journal entry worksheet On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024, the fokowing transactions

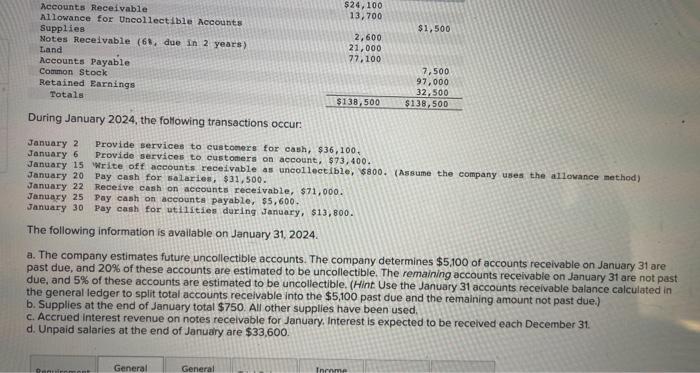

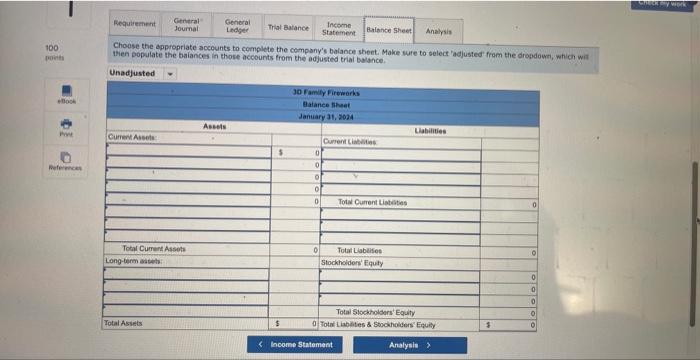

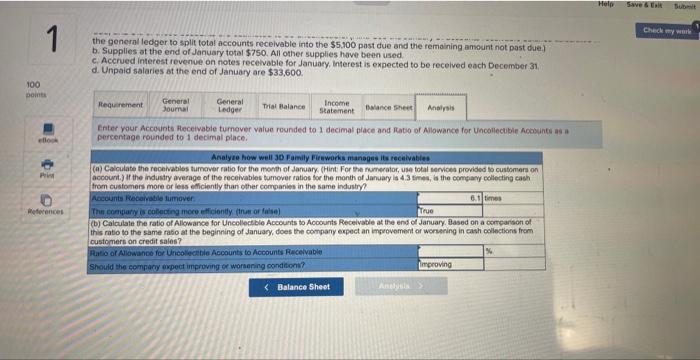

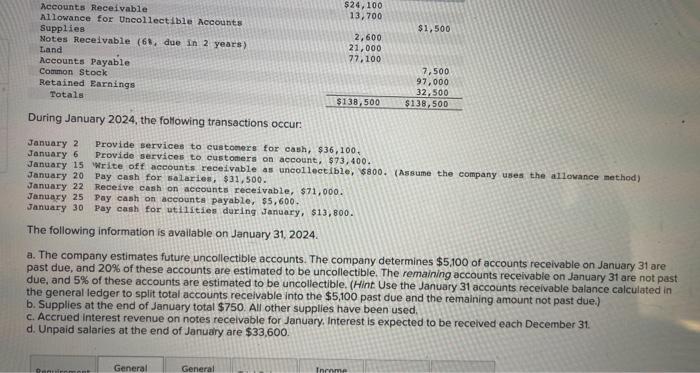

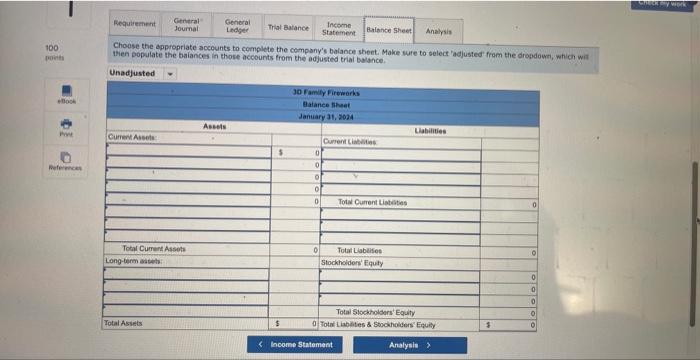

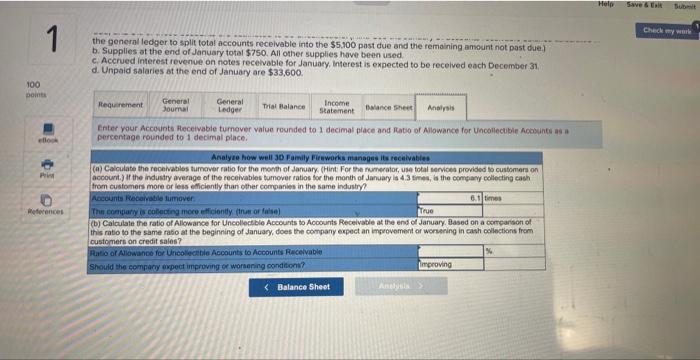

Journal entry worksheet On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024, the fokowing transactions occur. Jatracy 2 prowide aervicen to cuatenera for eanh, 536,100. Jathuny is write oft accounta receivable as uncellectible, sioo. (hasus the eeepany usen the allovance sethods Jatruary 20 tay canh tor natarles, $31,500. Janaary 22 deselive cash on accounta recelvable. 371,000, January 25 fay easb of accounta payable, 55,600. January 38 Fay cash for utilitiee during Jankary, 313, 100 , The following informaton is avaliable on January 31,2024 a. The company estimates future uncolectible accounts. The company determines $5,000 of accounts recolvable on January 31 are post due, and 20 s of these accounts are estimated to be uncollectible. The remaining accounts recelvable on lanuary 31 are not past due, and 5 k of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts recelvable balance calculated in the genexal ledger to split total accounts recoivable into the $5.100 nast dlue and the remaining amount not past due.) b. Supplies at the end of January total $750. All other sipplies have been used. c. Acerued interest revenue on notes receivable for Jantary, Interest is expected to be received each December 31. d. Unpaid solatios at the end of Januory are $33,600 During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $36,100. January 6 Provide services to customers on account, $73,400. January 15 Write off accounts receivable as uncolloctible, $800. (Assume the company uses the allowance method) January 20 Pay cash for salarles, $31,500. January 22 Regeive cash on accounts receivable, $71,000. January 25 Pay cash on accounts payable, $5,600. January 30 pay cash for utilities during January, $13,800. The following information is avallable on January 31,2024. a. The company estimates future uncollectible accounts. The company determines $5,100 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts recelvable balance calculated in the general ledger to split total accounts receivable into the $5,100 past due and the remaining amount not past due. b. Supplies at the end of January total $750. All other supplies have been used. c. Accrued interest revenue on notes receivable for January, Interest is expected to be received each December 31 . d. Unpaid salaries at the end of January are $33,600. Choose the oppropriate accounts to complete the company's balance sbent. Make wure to select 'adjusted from the dropdown, which wir then populate the baiances in thore accounts trom the adjusted trial bolence. the general ledger to split total accounts recelvable into the $5,100 post due and the remaining amount not past due. b. Supplies ot the end of January total $750. All other supplies have been used. c. Accrued interest revenve on notes receivable for January, Interest is expected to be recelved each Becember 31. d. Unpaid salaries at the end of January are $33,600. Enter your Accounts heceivabie turnover value rounded to 1 decimal place and latio of Alowance for Uncollecubie Acoylints as a percentage rounded to 1 decimal place. Analyce how well 30 Farnily Fienworks manages its receivables (a) Calculate the recenabless turnever fatio for the month of January (Hint. For the numerator, use total sevioes provided lo customons on account.) If the industry average of the receivables fumover tatios for the month of January is 4.3 tmen, is the compary collecting cabh from customers more or less eficiantly than other companies in the same industry

Journal entry worksheet On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024, the fokowing transactions occur. Jatracy 2 prowide aervicen to cuatenera for eanh, 536,100. Jathuny is write oft accounta receivable as uncellectible, sioo. (hasus the eeepany usen the allovance sethods Jatruary 20 tay canh tor natarles, $31,500. Janaary 22 deselive cash on accounta recelvable. 371,000, January 25 fay easb of accounta payable, 55,600. January 38 Fay cash for utilitiee during Jankary, 313, 100 , The following informaton is avaliable on January 31,2024 a. The company estimates future uncolectible accounts. The company determines $5,000 of accounts recolvable on January 31 are post due, and 20 s of these accounts are estimated to be uncollectible. The remaining accounts recelvable on lanuary 31 are not past due, and 5 k of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts recelvable balance calculated in the genexal ledger to split total accounts recoivable into the $5.100 nast dlue and the remaining amount not past due.) b. Supplies at the end of January total $750. All other sipplies have been used. c. Acerued interest revenue on notes receivable for Jantary, Interest is expected to be received each December 31. d. Unpaid solatios at the end of Januory are $33,600 During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $36,100. January 6 Provide services to customers on account, $73,400. January 15 Write off accounts receivable as uncolloctible, $800. (Assume the company uses the allowance method) January 20 Pay cash for salarles, $31,500. January 22 Regeive cash on accounts receivable, $71,000. January 25 Pay cash on accounts payable, $5,600. January 30 pay cash for utilities during January, $13,800. The following information is avallable on January 31,2024. a. The company estimates future uncollectible accounts. The company determines $5,100 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts recelvable balance calculated in the general ledger to split total accounts receivable into the $5,100 past due and the remaining amount not past due. b. Supplies at the end of January total $750. All other supplies have been used. c. Accrued interest revenue on notes receivable for January, Interest is expected to be received each December 31 . d. Unpaid salaries at the end of January are $33,600. Choose the oppropriate accounts to complete the company's balance sbent. Make wure to select 'adjusted from the dropdown, which wir then populate the baiances in thore accounts trom the adjusted trial bolence. the general ledger to split total accounts recelvable into the $5,100 post due and the remaining amount not past due. b. Supplies ot the end of January total $750. All other supplies have been used. c. Accrued interest revenve on notes receivable for January, Interest is expected to be recelved each Becember 31. d. Unpaid salaries at the end of January are $33,600. Enter your Accounts heceivabie turnover value rounded to 1 decimal place and latio of Alowance for Uncollecubie Acoylints as a percentage rounded to 1 decimal place. Analyce how well 30 Farnily Fienworks manages its receivables (a) Calculate the recenabless turnever fatio for the month of January (Hint. For the numerator, use total sevioes provided lo customons on account.) If the industry average of the receivables fumover tatios for the month of January is 4.3 tmen, is the compary collecting cabh from customers more or less eficiantly than other companies in the same industry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started