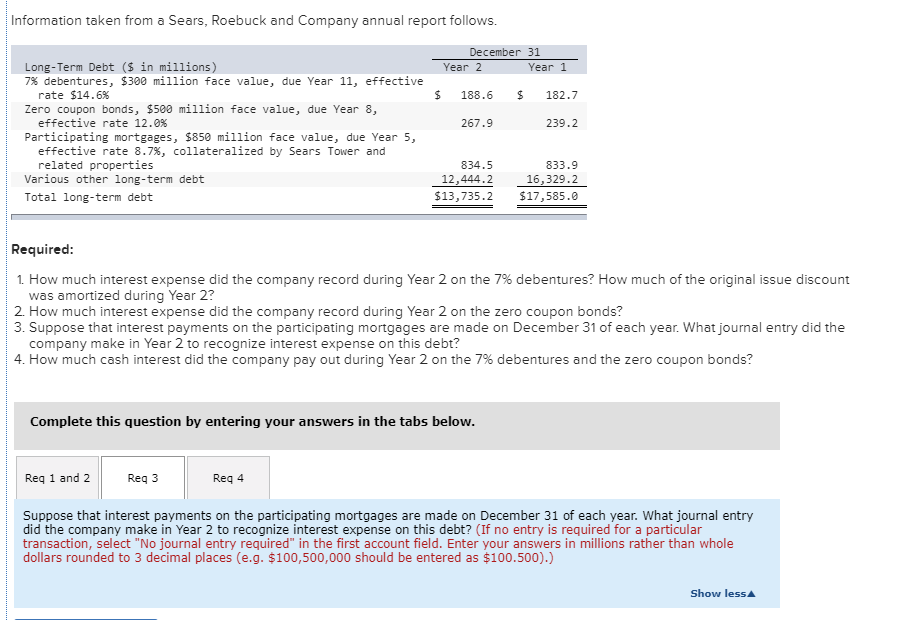

Question

Journal entry worksheet Prepare the entry for interest expense on mortgages. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Interest expense

Journal entry worksheet

Prepare the entry for interest expense on mortgages.

Note: Enter debits before credits.

|

1. How much interest expense did the company record during Year 2 on the 7% debentures? How much of the original issue discount was amortized during Year 2? Assume the interest for all the bonds are based on annual basis. (Enter your answers in whole dollars and not millions of dollars.) 2. How much interest expense did the company record during Year 2 on the zero coupon bonds? (Enter your answers in whole dollars and not millions of dollars.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started