Answered step by step

Verified Expert Solution

Question

1 Approved Answer

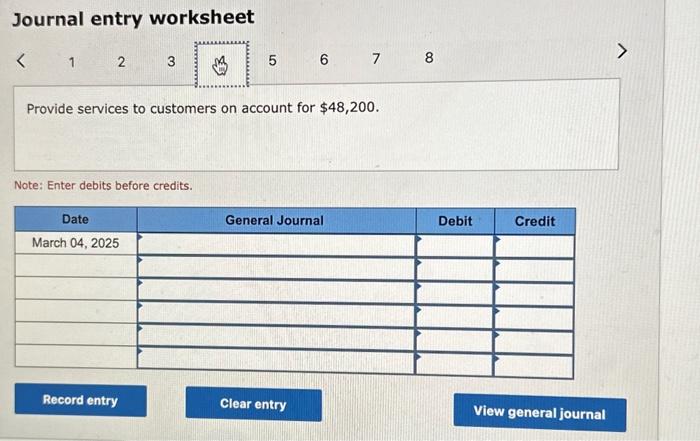

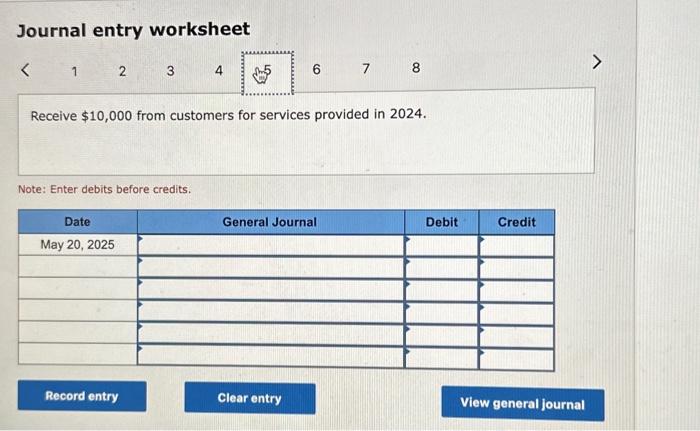

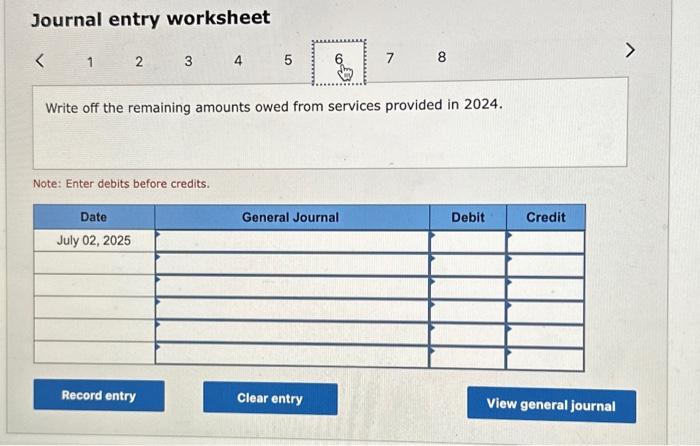

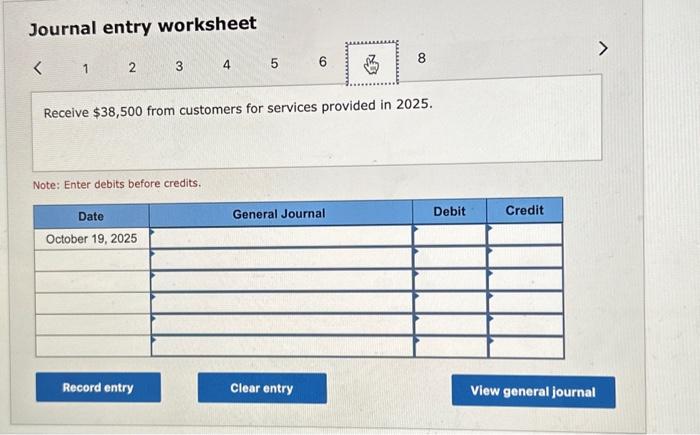

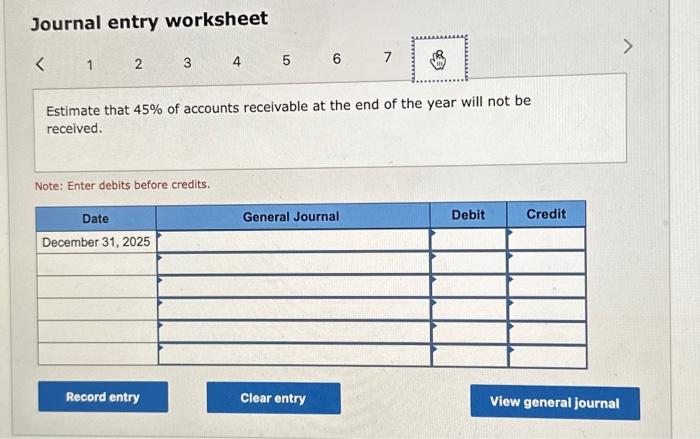

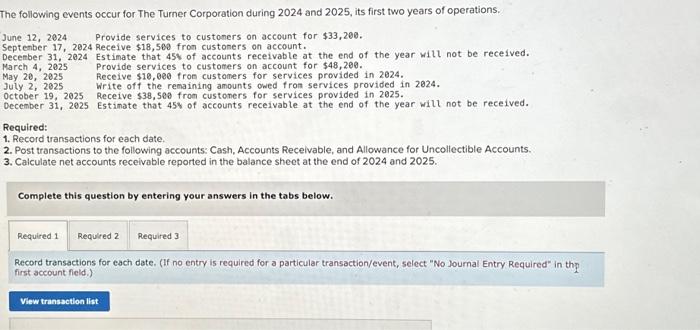

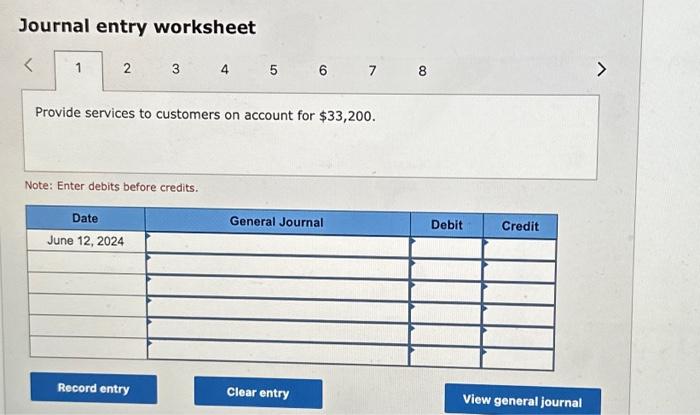

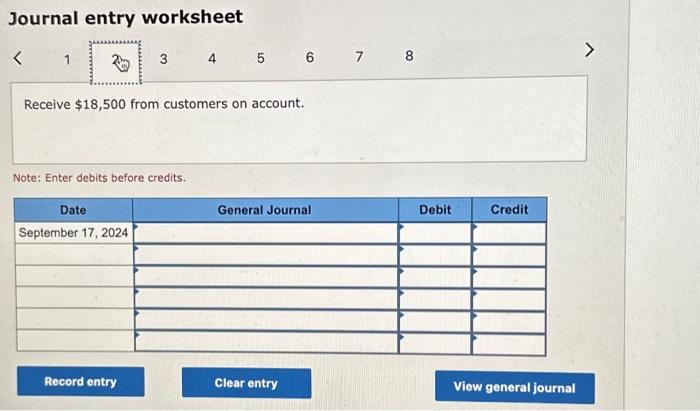

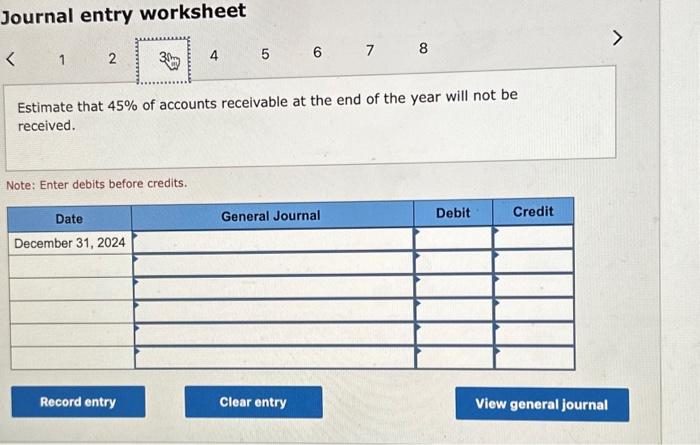

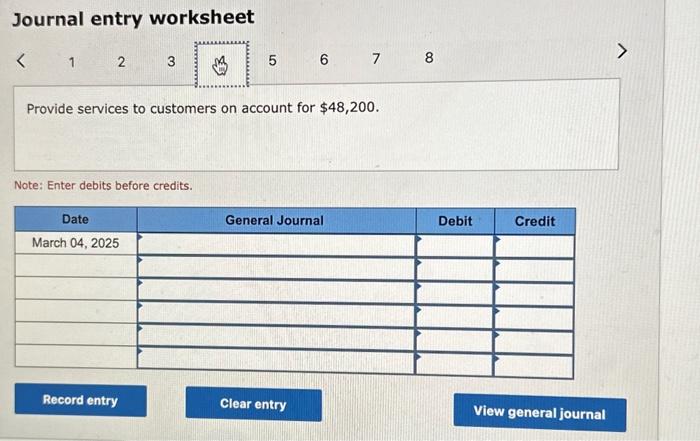

Journal entry worksheet Provide services to customers on account for $48,200. Note: Enter debits before credits. Journal entry worksheet 4 5 6 Receive $18,500 from

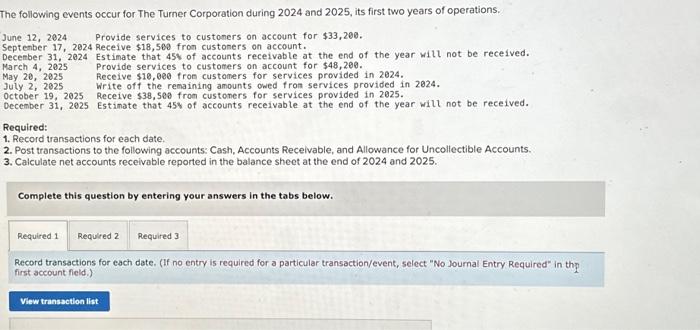

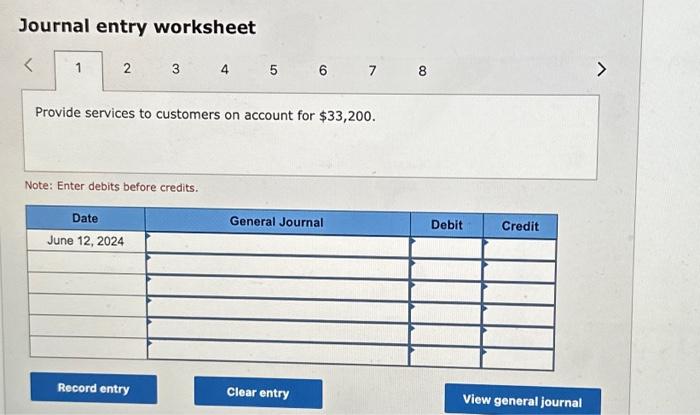

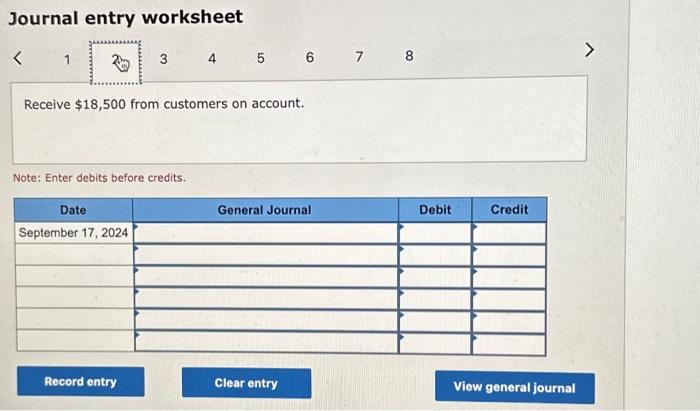

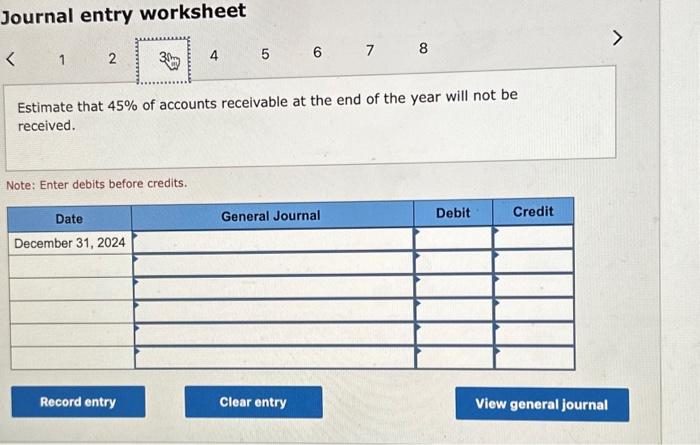

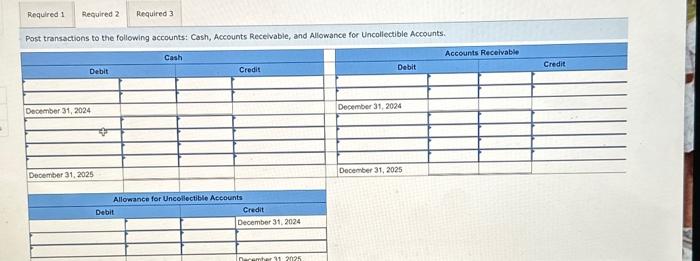

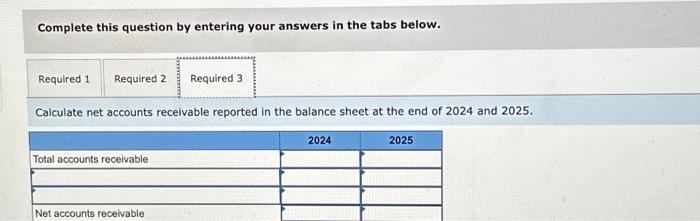

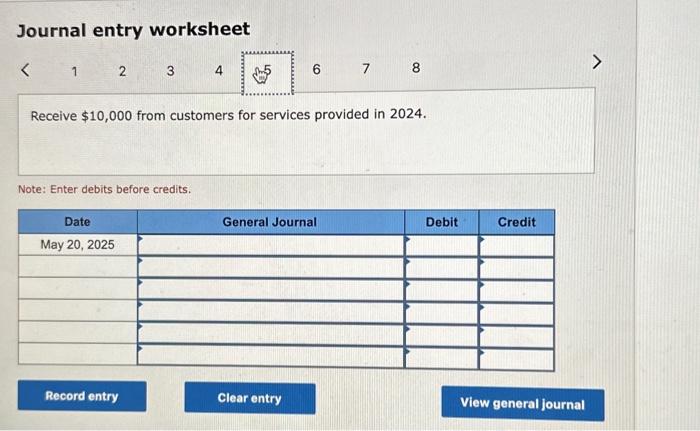

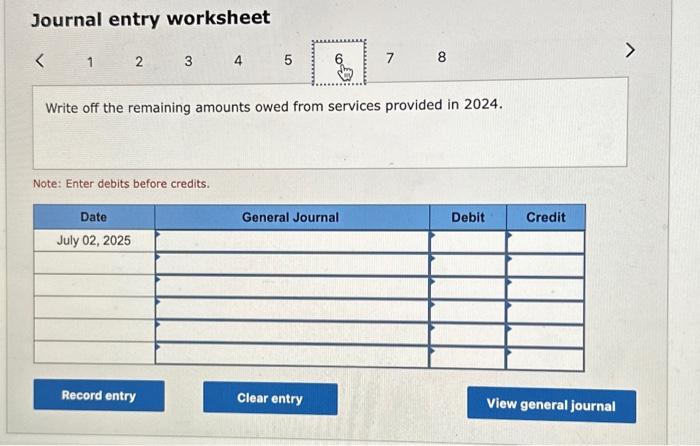

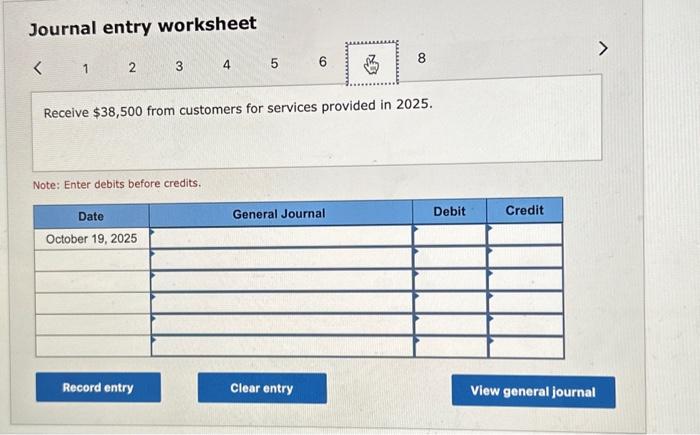

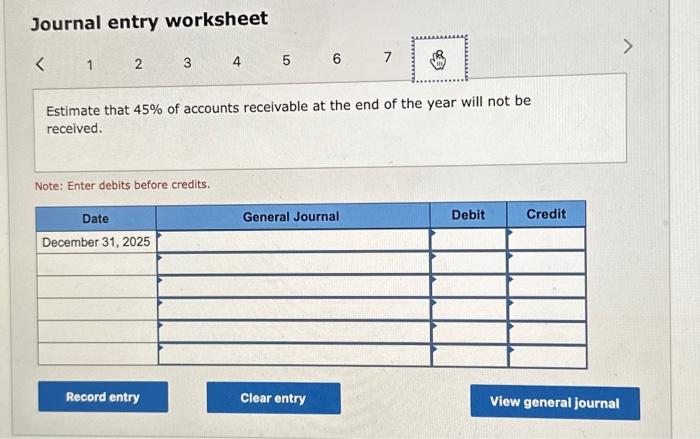

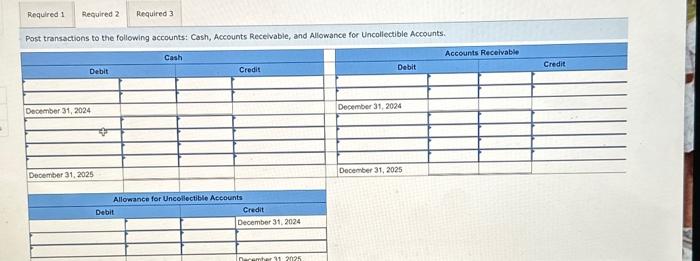

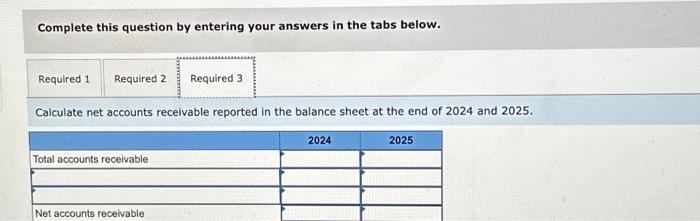

Journal entry worksheet Provide services to customers on account for $48,200. Note: Enter debits before credits. Journal entry worksheet 4 5 6 Receive $18,500 from customers on account. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025 . Journal entry worksheet Estimate that 45% of accounts receivable at the end of the year will not be received. Note: Enter debits before credits. Journal entry worksheet Receive $10,000 from customers for services provided in 2024. Note: Enter debits before credits. Journal entry worksheet Receive $38,500 from customers for services provided in 2025 . Note: Enter debits before credits. The following events occur for The Turner Corporation during 2024 and 2025, its first two years of operations. June 12,2024 Provide services to customers on account for $33,200. Septenber 17, 2024 Receive $18,580 fron custoners on account. Decenber 31, 2024 Estimate that 454 of accounts receivable at the end of the year will not be received. March 4, 2025 Provide services to customers on account for $48,200. May 20, 2025 Receive $10,000 fron customers for services provided in 2024. July 2 ; 2025 Write off the remaining amounts owed fron services provided in 2024. October 19,2025 Receive $38,5ea from custoners for services provided in 2025. december 31,2025 Estinate that 45% of accounts receivable at the end of the year will not be received. Required: 1. Record transactions for each date. 2. Post transactions to the following accounts: Cash, Accounts Recelvable, and Allowance for Uncollectible Accounts. 3. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025 . Complete this question by entering your answers in the tabs below. Record transactions for each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in thp first account field.) Journal entry worksheet Estimate that 45% of accounts receivable at the end of the year will not be received. Note: Enter debits before credits. \begin{tabular}{l|l|l} Required 1 Required 2 Required 3 & \end{tabular} Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncoliectible Accounts. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Accounts Recelvable } \\ \hline & & & \multicolumn{1}{|c|}{ Credit } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Allowance for Uncollectiblo Accounts \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Allowance for Uncollectiblo Accounts } \\ \hline Debit & & \multicolumn{2}{c|}{ Credit } \\ \hline & & & December 31, 2024 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Journal entry worksheet Write off the remaining amounts owed from services provided in 2024. Note: Enter debits before credits. Journal entry worksheet 67 Provide services to customers on account for $33,200. Note: Enter debits before credits

Journal entry worksheet Provide services to customers on account for $48,200. Note: Enter debits before credits. Journal entry worksheet 4 5 6 Receive $18,500 from customers on account. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025 . Journal entry worksheet Estimate that 45% of accounts receivable at the end of the year will not be received. Note: Enter debits before credits. Journal entry worksheet Receive $10,000 from customers for services provided in 2024. Note: Enter debits before credits. Journal entry worksheet Receive $38,500 from customers for services provided in 2025 . Note: Enter debits before credits. The following events occur for The Turner Corporation during 2024 and 2025, its first two years of operations. June 12,2024 Provide services to customers on account for $33,200. Septenber 17, 2024 Receive $18,580 fron custoners on account. Decenber 31, 2024 Estimate that 454 of accounts receivable at the end of the year will not be received. March 4, 2025 Provide services to customers on account for $48,200. May 20, 2025 Receive $10,000 fron customers for services provided in 2024. July 2 ; 2025 Write off the remaining amounts owed fron services provided in 2024. October 19,2025 Receive $38,5ea from custoners for services provided in 2025. december 31,2025 Estinate that 45% of accounts receivable at the end of the year will not be received. Required: 1. Record transactions for each date. 2. Post transactions to the following accounts: Cash, Accounts Recelvable, and Allowance for Uncollectible Accounts. 3. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025 . Complete this question by entering your answers in the tabs below. Record transactions for each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in thp first account field.) Journal entry worksheet Estimate that 45% of accounts receivable at the end of the year will not be received. Note: Enter debits before credits. \begin{tabular}{l|l|l} Required 1 Required 2 Required 3 & \end{tabular} Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncoliectible Accounts. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Accounts Recelvable } \\ \hline & & & \multicolumn{1}{|c|}{ Credit } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Allowance for Uncollectiblo Accounts \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Allowance for Uncollectiblo Accounts } \\ \hline Debit & & \multicolumn{2}{c|}{ Credit } \\ \hline & & & December 31, 2024 \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Journal entry worksheet Write off the remaining amounts owed from services provided in 2024. Note: Enter debits before credits. Journal entry worksheet 67 Provide services to customers on account for $33,200. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started