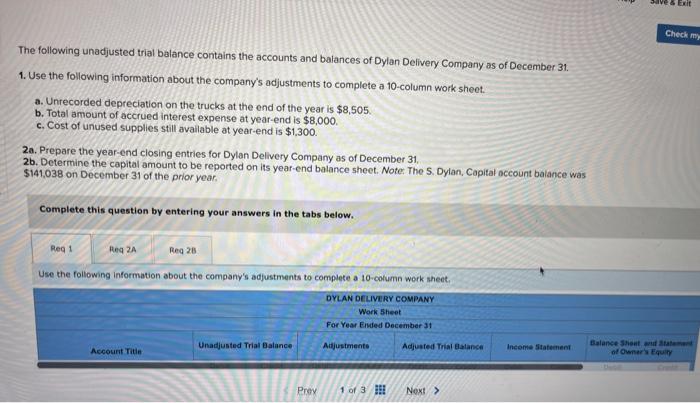

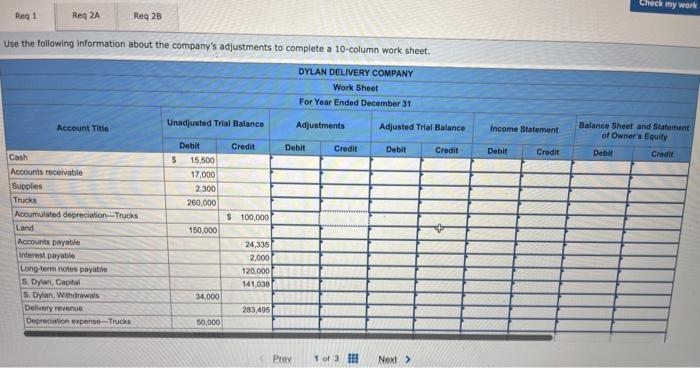

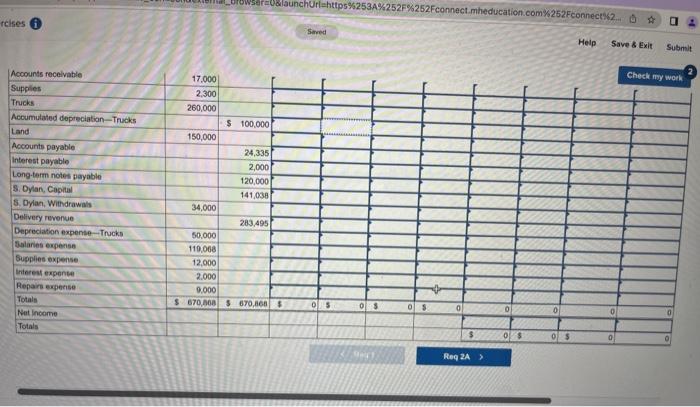

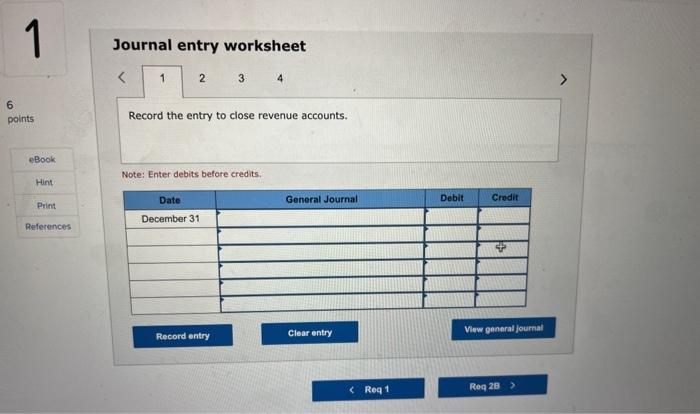

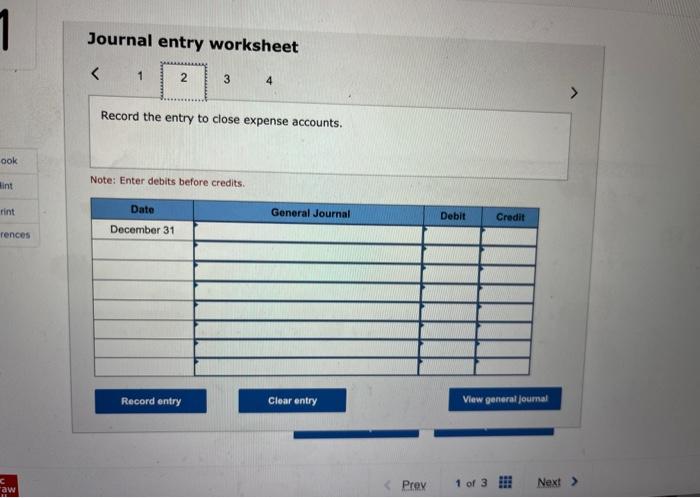

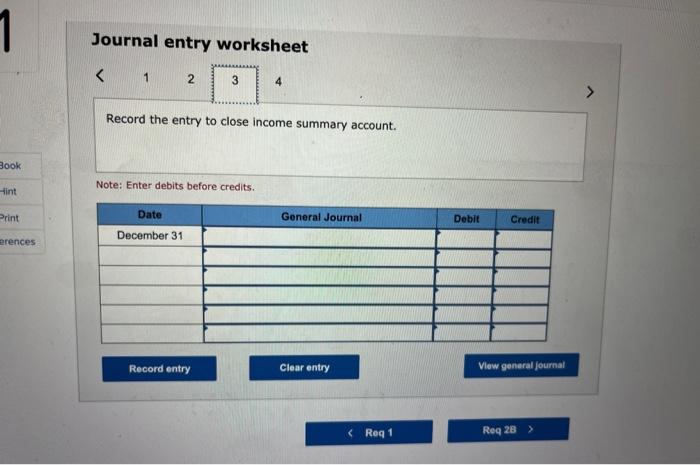

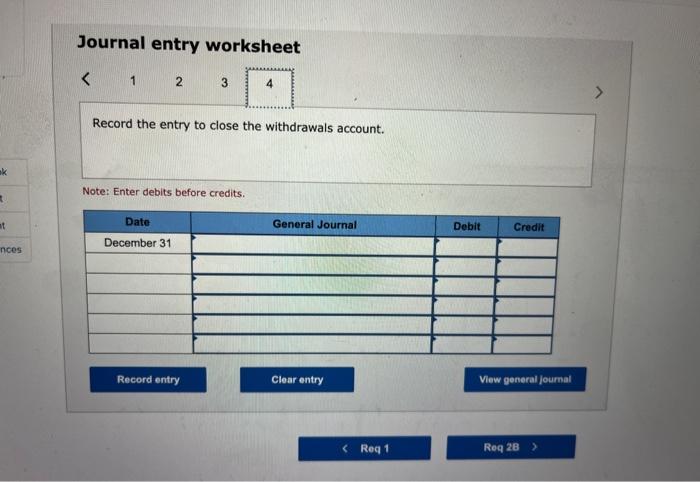

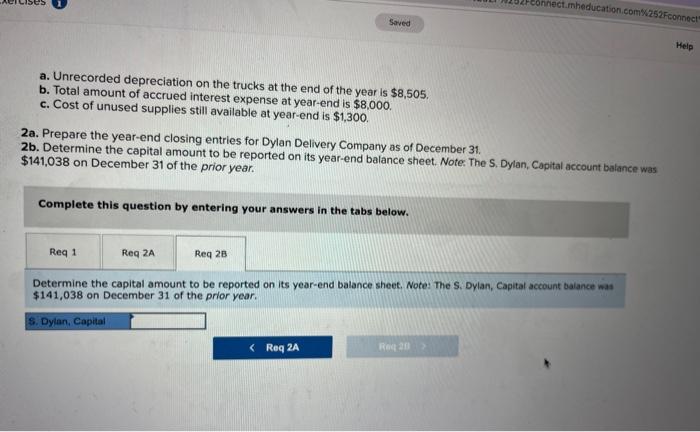

Journal entry worksheet Record the entry to close expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close income summary account. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the withdrawals account. Note: Enter debits before credits. The following unadjusted trial balance contains the accounts and balances of Dylan Defivery Company as of December 31 . 1. Use the following information about the company's adjustments to complete a 10-column work sheet. a. Unrecorded depreciation on the trucks at the end of the year is $8,505. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $1,300. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31 , 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $141,038 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Use the following information about the company's adjustments to complete a 10-column werk sheet. a. Unrecorded depreciation on the trucks at the end of the year is $8,505. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $1,300. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31 . 2b. Determine the capital amount to be reported on its year-end balance sheet. Note. The S. Dylan, Capital account balance was $141,038 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account baiance was $141,038 on December 31 of the prior year. Use the following information about the company's adjustments to complete a 10 -column work sheet. Journal entry worksheet 4 Record the entry to close revenue accounts. Note: Enter debits before credits. reises 0 Sined Help Save 8 Exit Submit Acoounts recelvable Supplies Trucks Acoumulated depreciation-Trucks Land Accounts payable Interest payable Long-term notes payable 5. Dylan, Caplas 5. Dyan, Withdrawals Delivery revenue Depreciation expense-Trucks Dalaries expense Supplies expense Interest expente Repairs experise Totals Net Inceme Totals 17,000 2,300 260,000 150,000 \$ 100,000 [ 24,335 2,000 120,000 141,038 34,000 283,495 50.000 110.068 12,000 2.000 0.000 0 Rega 2