journal goes all the way to 13

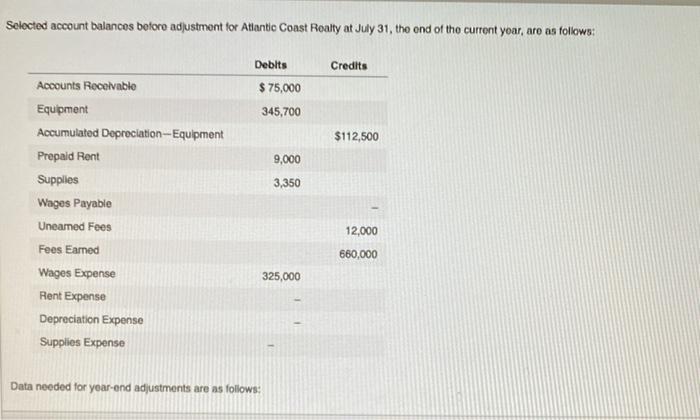

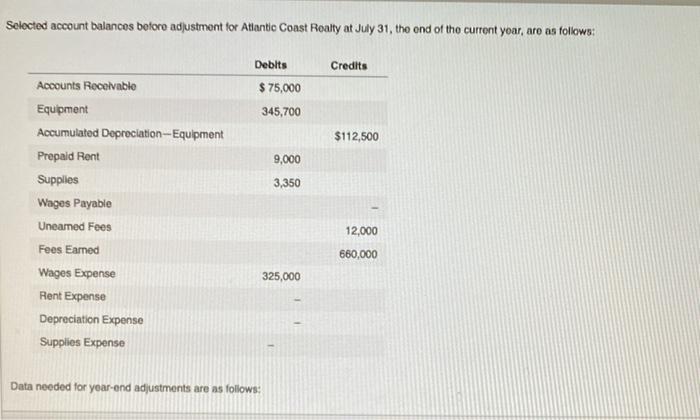

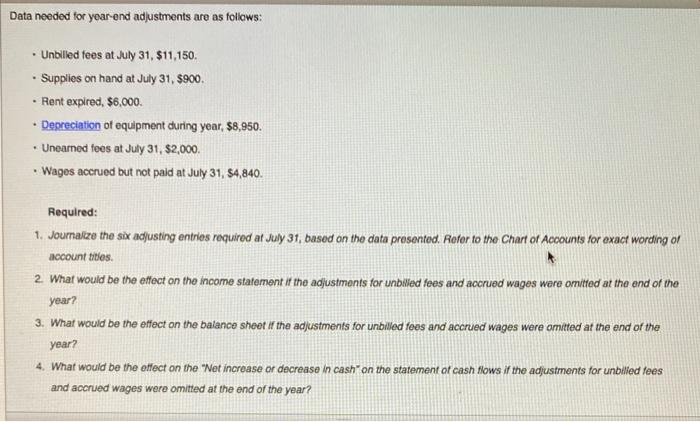

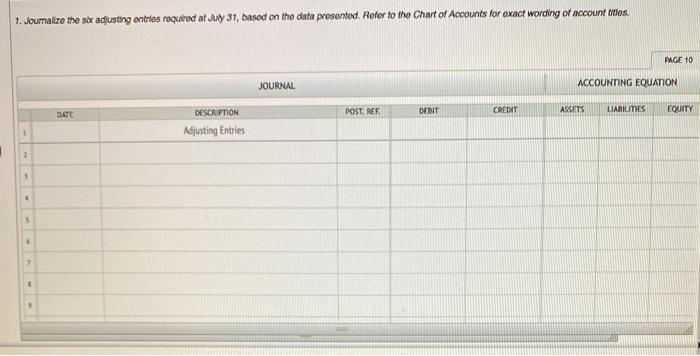

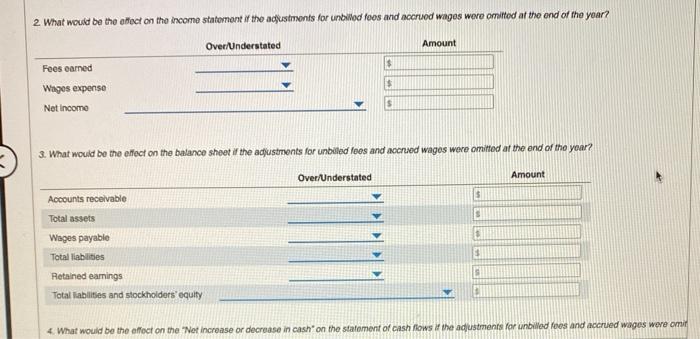

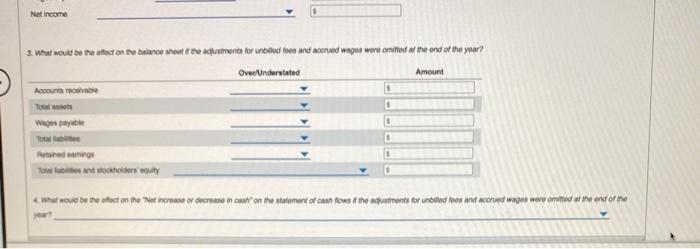

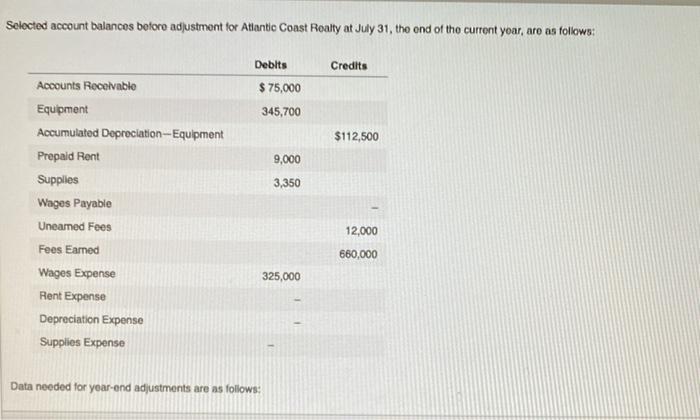

Selected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the curront yoar, are as follows: Credits Debits $ 75,000 345,700 $112,500 9,000 3,350 Accounts Receivable Equipment Accumulated Depreciation-Equipment Prepaid Rent Supplies Wages Payable Uneamed Fees Fees Eamed Wages Expense Rent Expense Depreciation Expense Supplies Expense 12,000 660,000 325,000 Data needed for year-end adjustments are as follows: Data needed for year-end adjustments are as follows: Unbilled tees at July 31, $11,150. Supplies on hand at July 31, $900. . Rent expired, $6,000 Depreciation of equipment during year, $8,950. Unearned fees at July 31, $2,000. Wages accrued but not paid at July 31, 54,840. Required: 1. Journalize the six adjusting entries required ar July 31, based on the data presented. Refer to the Chart of Accounts for exact wording of account titles. 2. What would be the effect on the income statement if the adjustments for unbilled foes and accrued wages were orrutted at the end of the year? 3. What would be the effect on the balance sheet in the adjustments for unbilled fees and accrued wages were omitted at the end of the year? 4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for unbilled fees and accrued wages were omitted at the end of the year? 1. Journalize the ser adjusting entries raquared at wy 31, based on the data presented. Hefer to the Chart of Accounts for exact wording of account titles PAGE 10 JOURNAL ACCOUNTING EQUATION POST REF DATE DEBIT CREDIT LIABILITIES ASSETS EQUITY DESCRIPTION Adjusting Entries 1 2 . . 5 . 1 1 2 What would be the effect on the income statement in the adjustments for unbilledloos and accrued wages were omitted at the end of the year? Over/Understated Amount $ Fees earned $ Wagos expenso Not Income S 3. What would be the effect on the balance sheet if the adjustments for unbiled loos and accrued wagos were omitted at the end of the year? Over/Understated Amount Accounts receivable S Total assets Wages payable Total liabilities S Retained earnings Total liabilities and stockholders' equity 4. What would be the effect on the "Not increase or decrease in cash on the statement of cash flows the adjustments for unbilled foes and accrued wages were omit Net Income What would be the afect on the balance sheets for unbited toes and scored Wages were omved at the end of the year? Over/Understated Amount Accounts receivable . Putrage To dohodou What would be the fact on the increase order in on the statement of cash fows the trustments for united for and coed wages were omiled at the end of the