Answered step by step

Verified Expert Solution

Question

1 Approved Answer

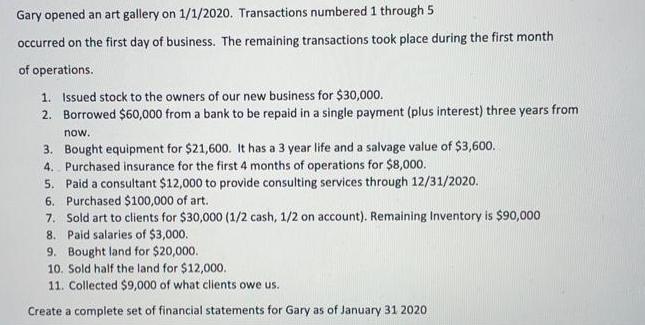

Gary opened an art gallery on 1/1/2020. Transactions numbered 1 through 5 occurred on the first day of business. The remaining transactions took place

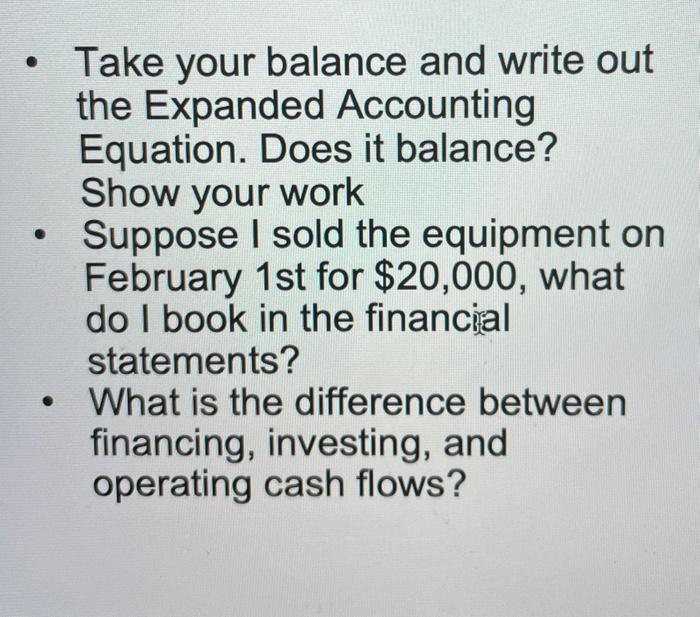

Gary opened an art gallery on 1/1/2020. Transactions numbered 1 through 5 occurred on the first day of business. The remaining transactions took place during the first month of operations. 1. Issued stock to the owners of our new business for $30,000. 2. Borrowed $60,000 from a bank to be repaid in a single payment (plus interest) three years from now. 3. Bought equipment for $21,600. It has a 3 year life and a salvage value of $3,600. 4. Purchased insurance for the first 4 months of operations for $8,000. 5. Paid a consultant $12,000 to provide consulting services through 12/31/2020. 6. Purchased $100,000 of art. 7. Sold art to clients for $30,000 (1/2 cash, 1/2 on account). Remaining Inventory is $90,000 8. Paid salaries of $3,000. 9. Bought land for $20,000. 10. Sold half the land for $12,000. 11. Collected $9,000 of what clients owe us. Create a complete set of financial statements for Gary as of January 31 2020 Take your balance and write out the Expanded Accounting Equation. Does it balance? Show your work Suppose I sold the equipment on February 1st for $20,000, what do I book in the financial statements? What is the difference between financing, investing, and operating cash flows?

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Garys Gallery Journal Enteries Trial Balance Trans Particulars Debit in Credit in For the Month endi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started