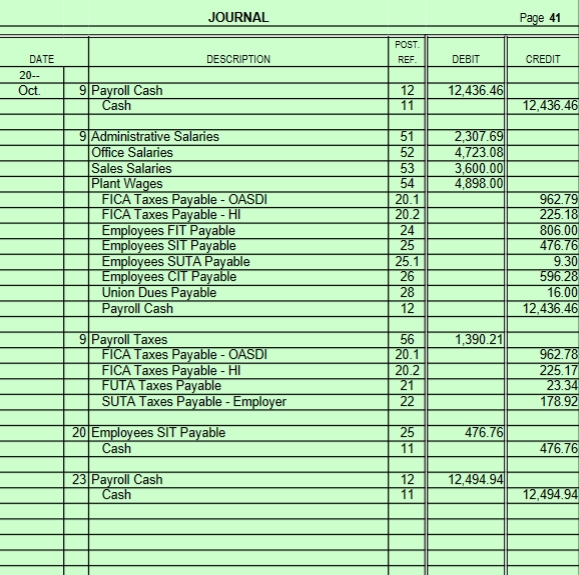

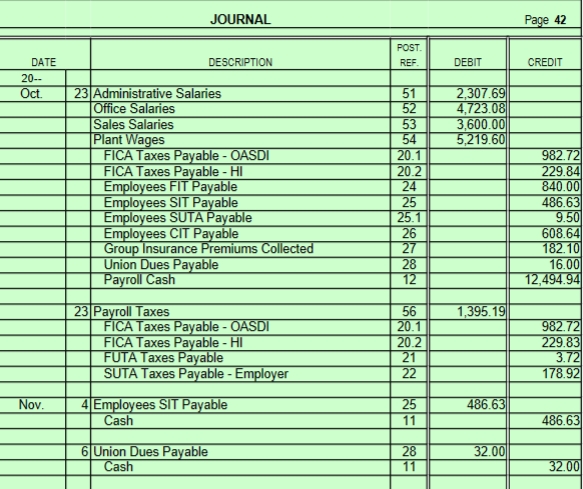

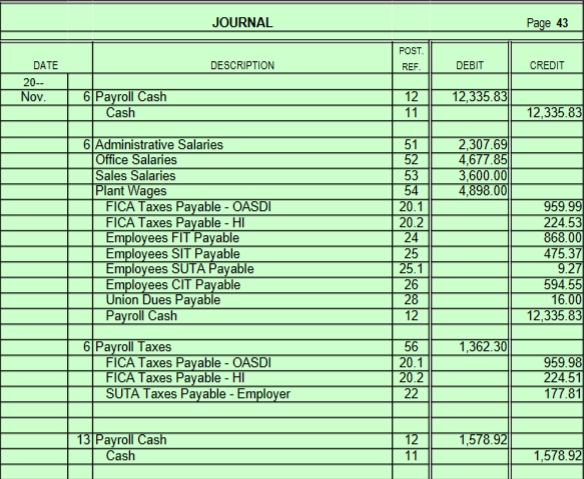

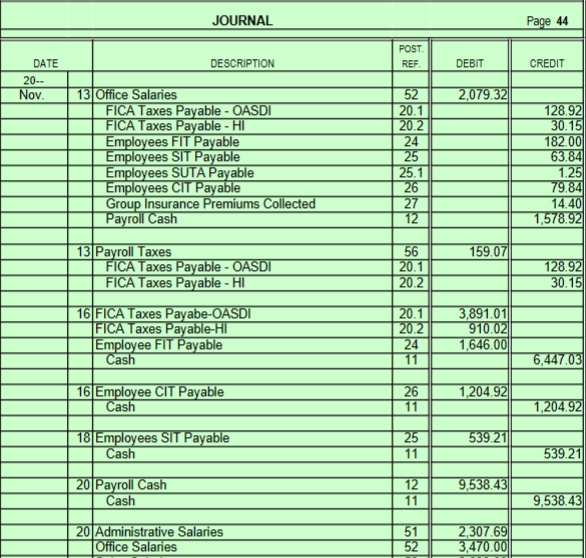

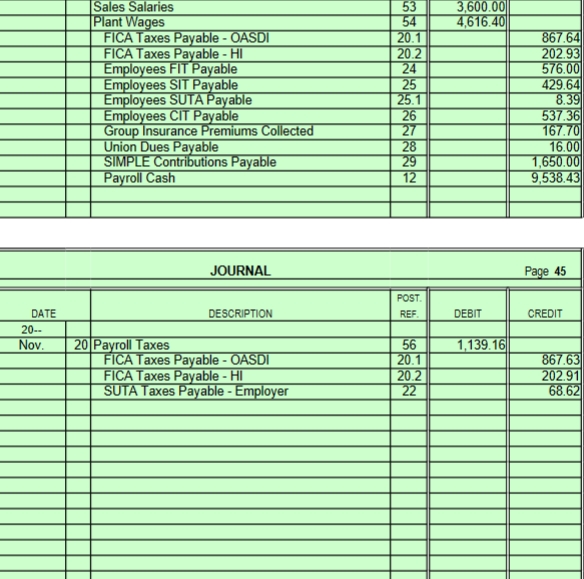

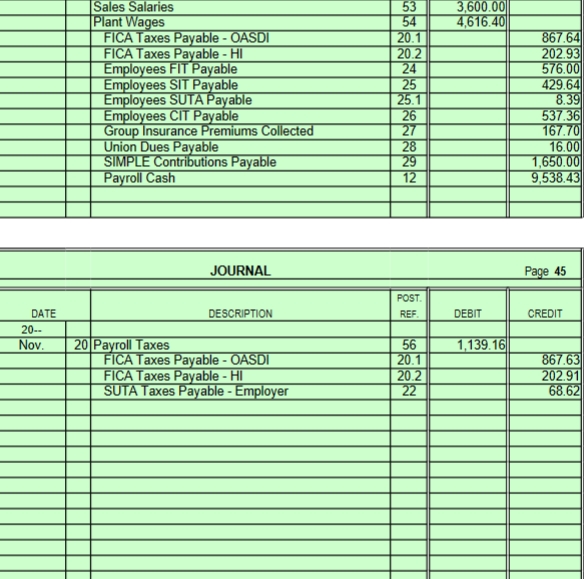

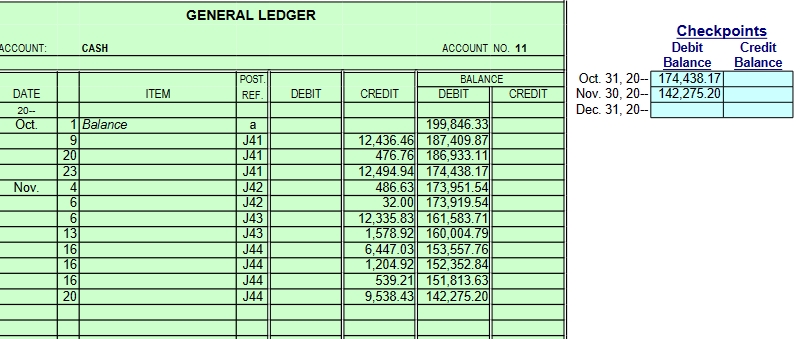

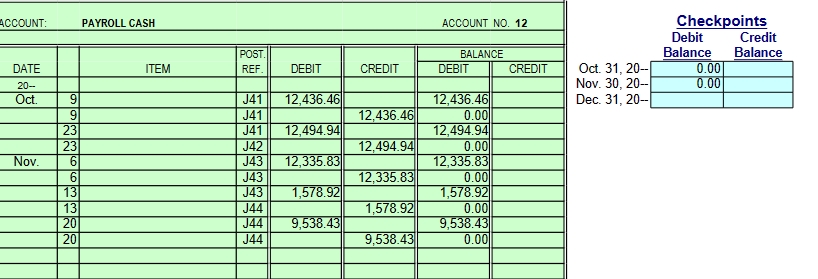

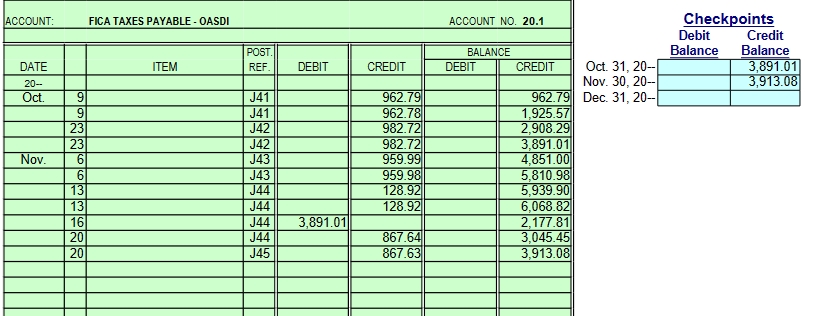

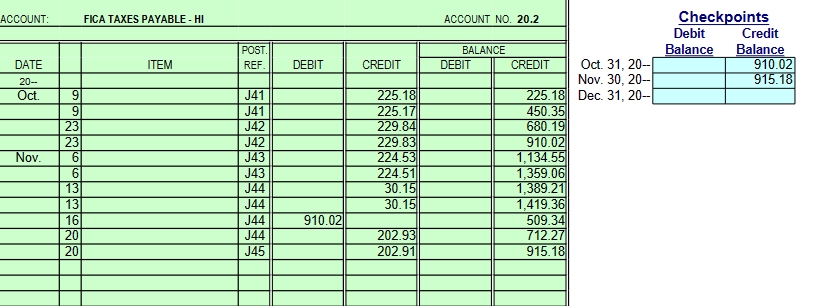

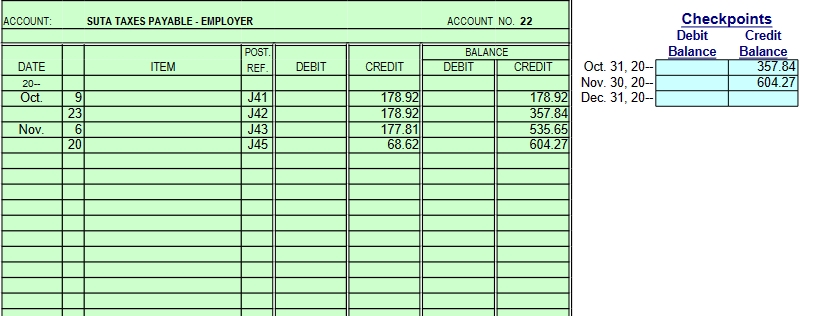

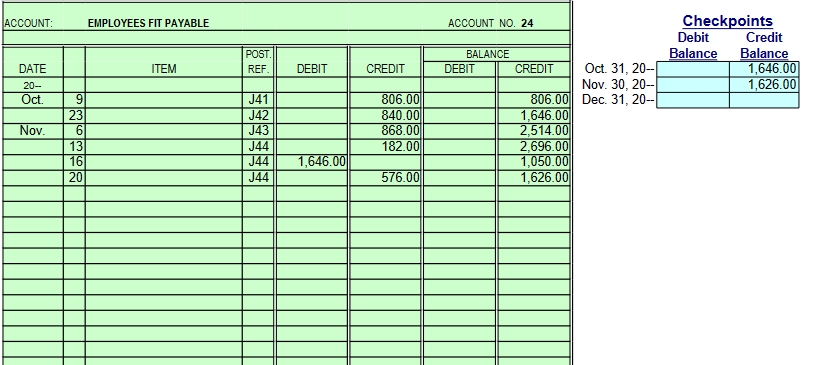

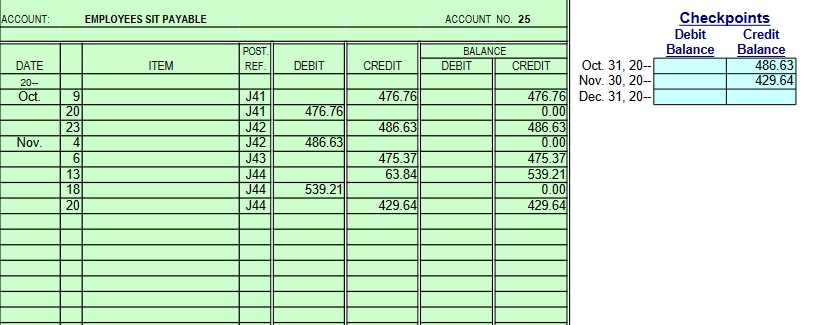

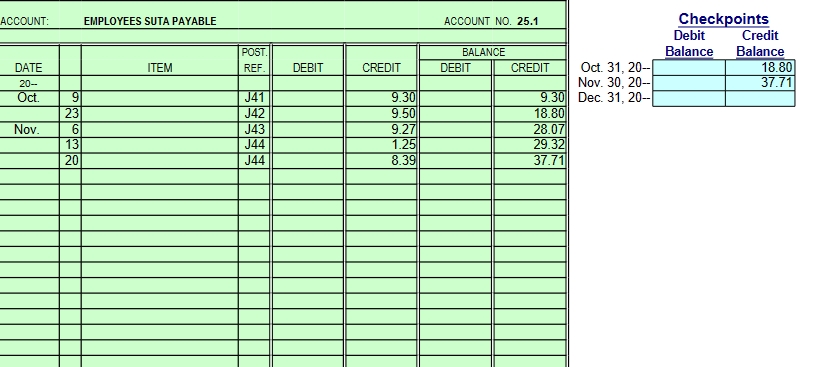

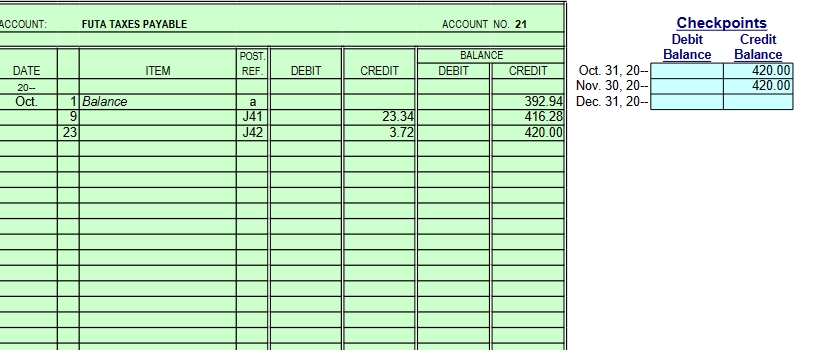

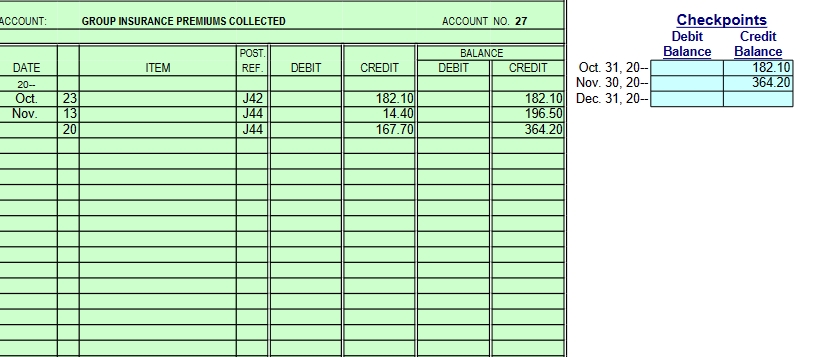

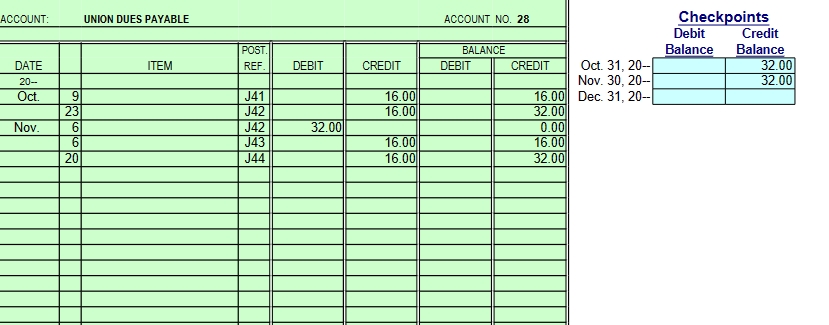

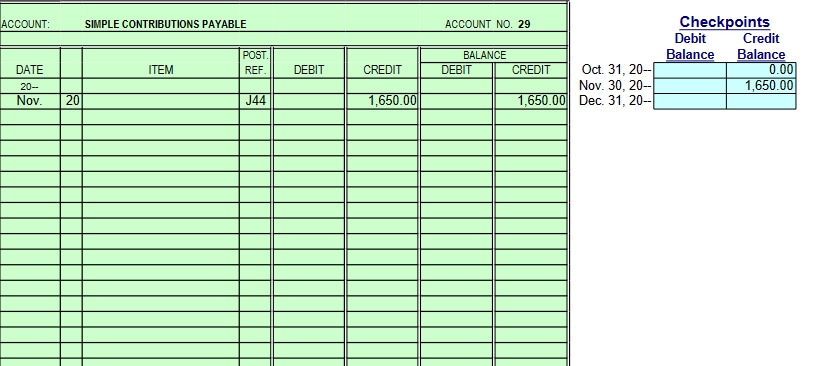

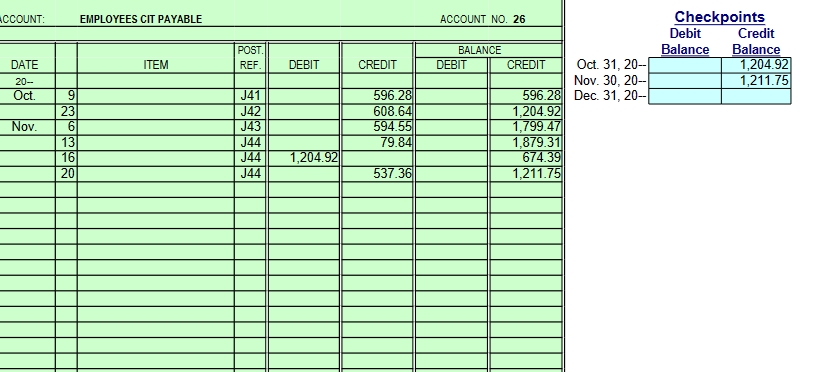

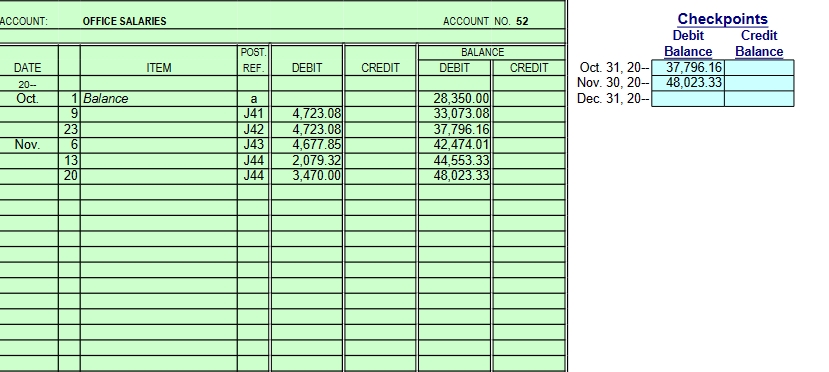

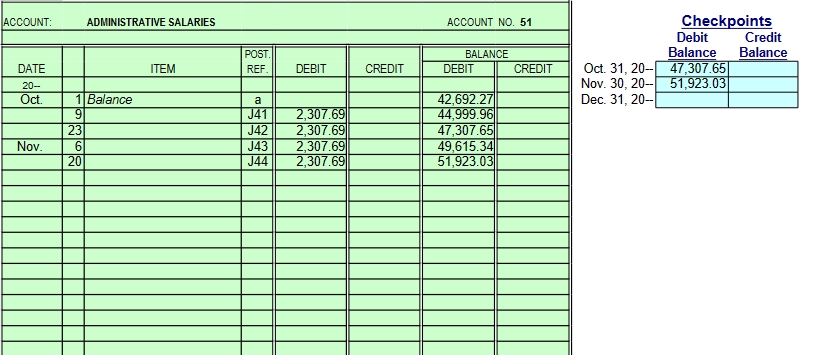

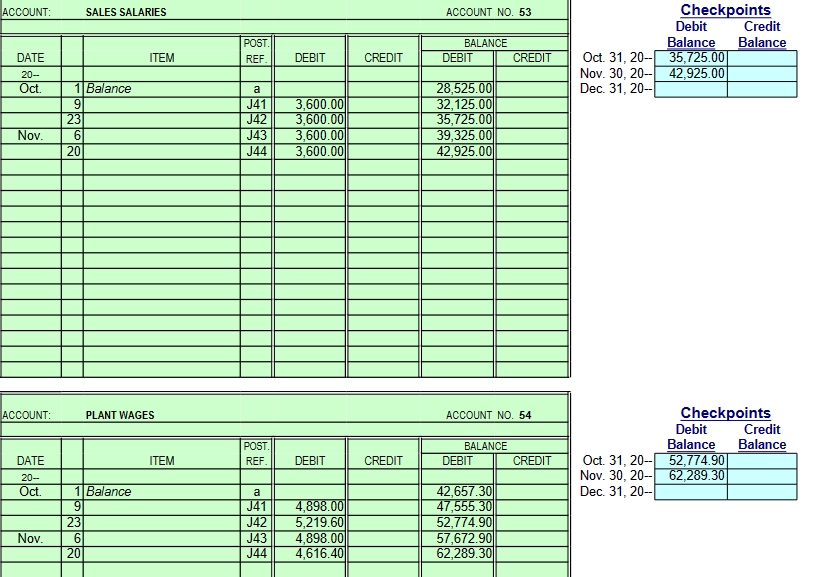

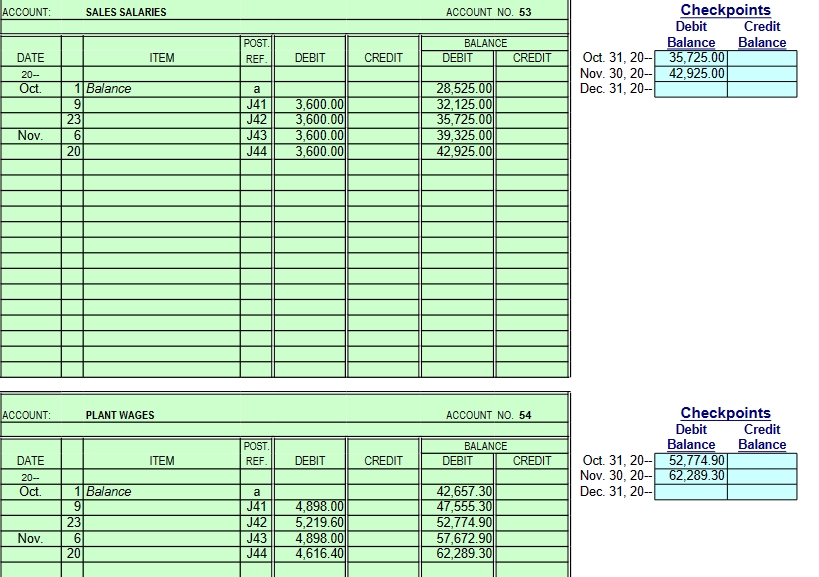

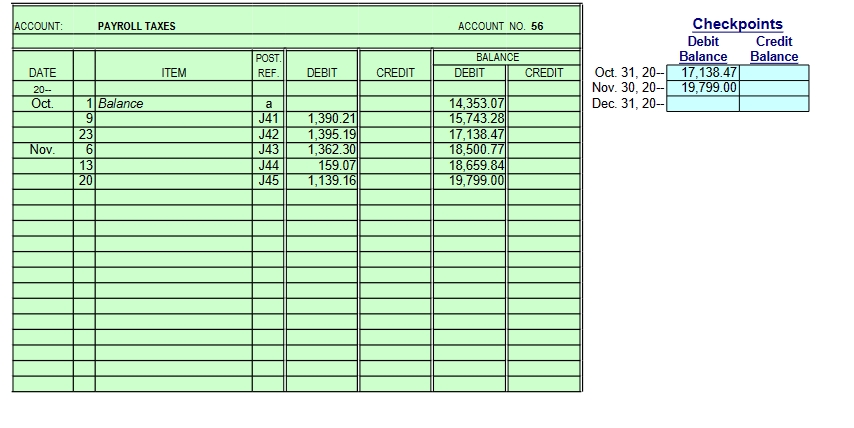

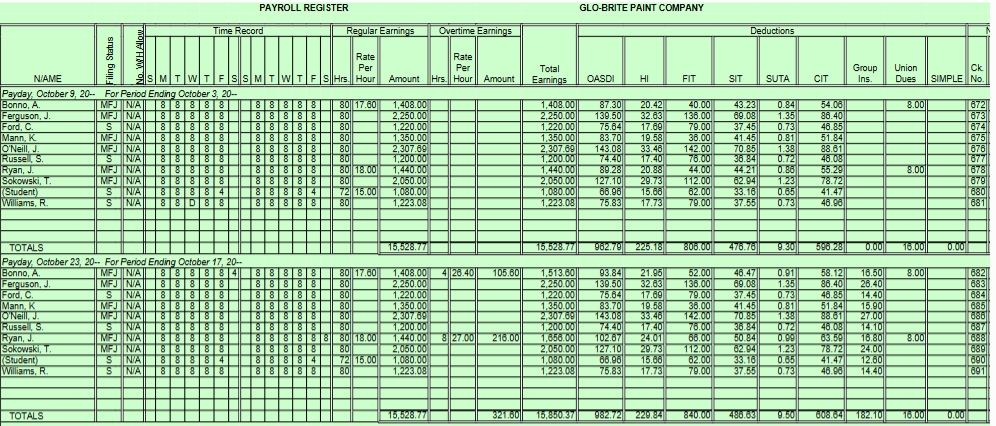

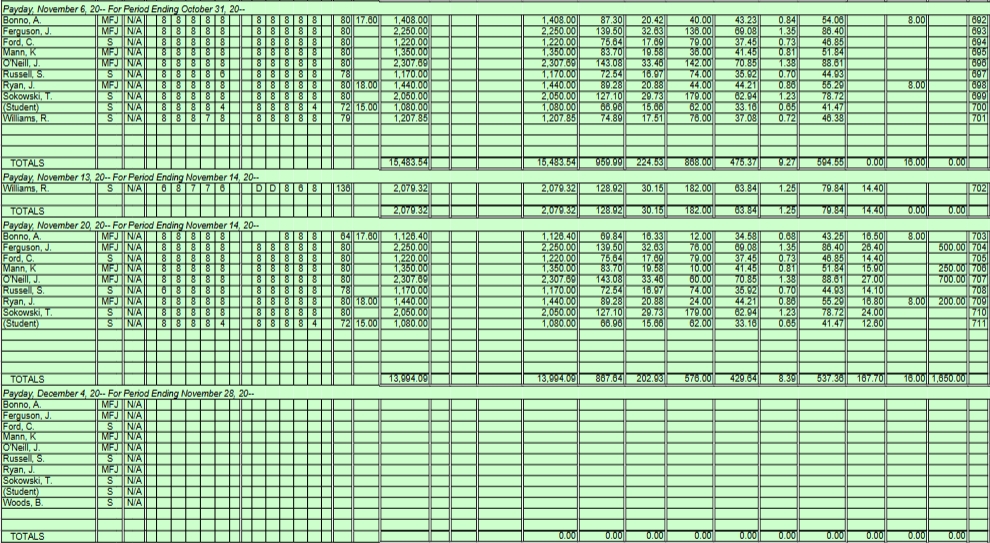

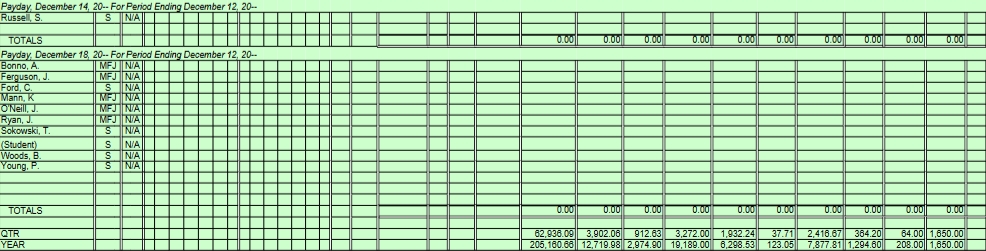

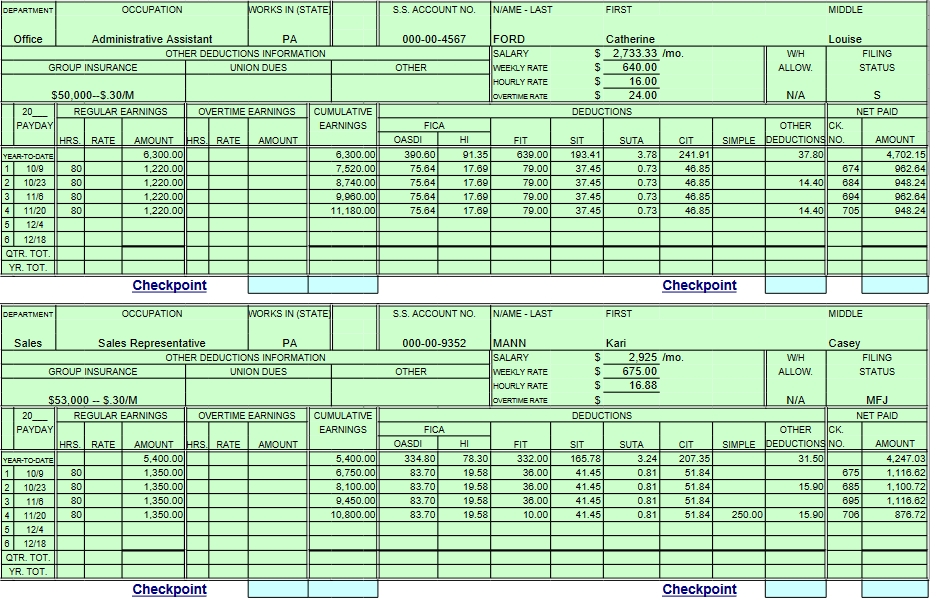

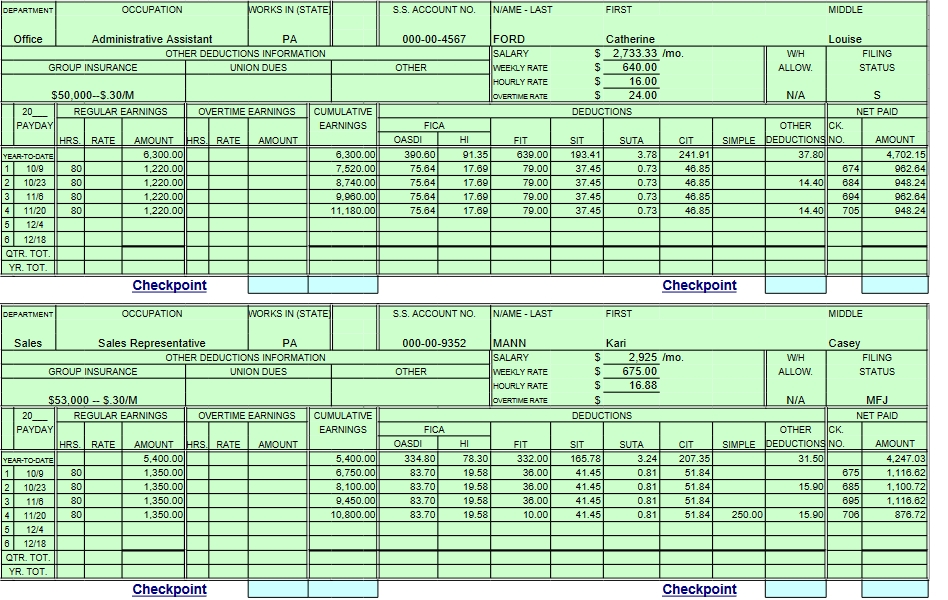

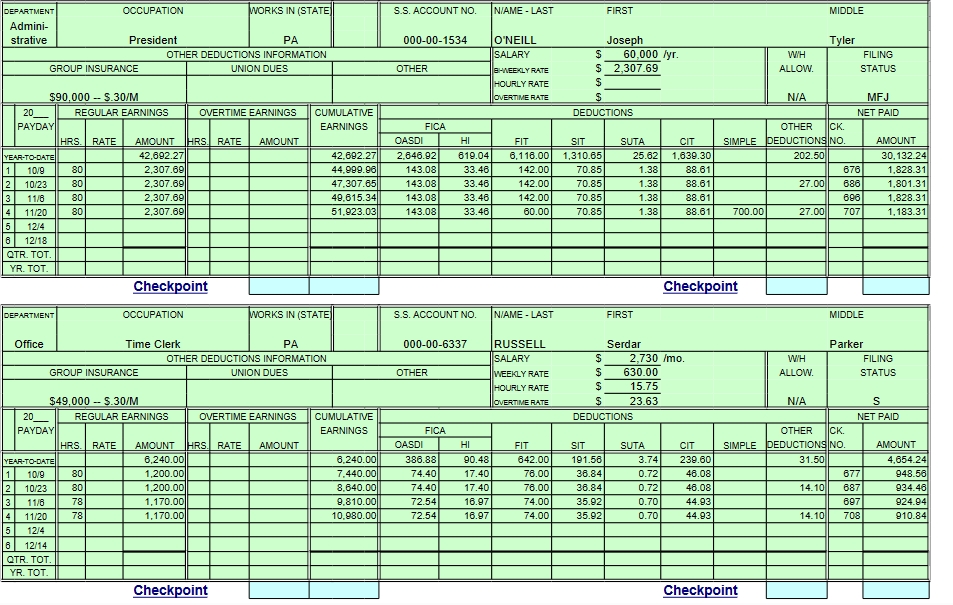

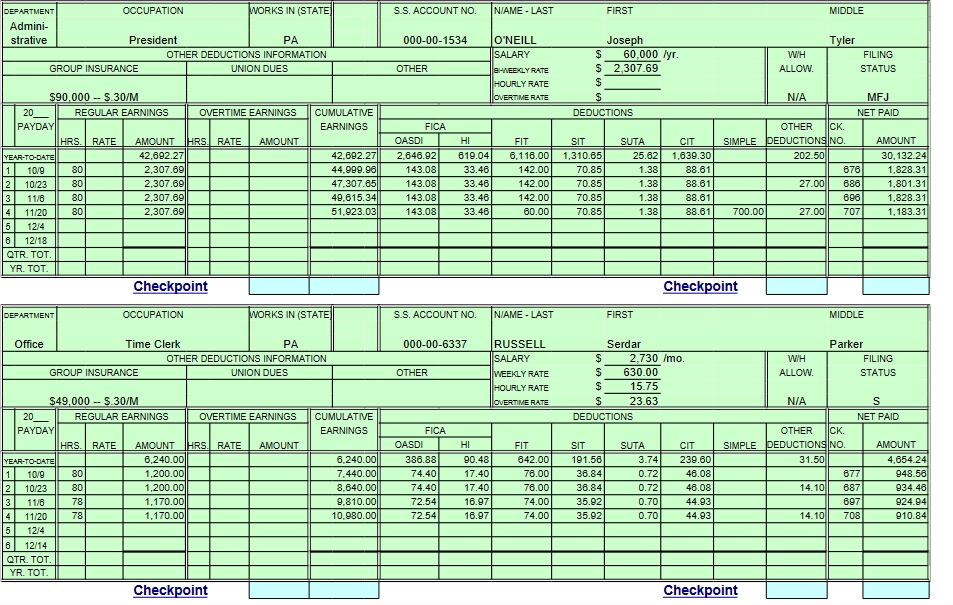

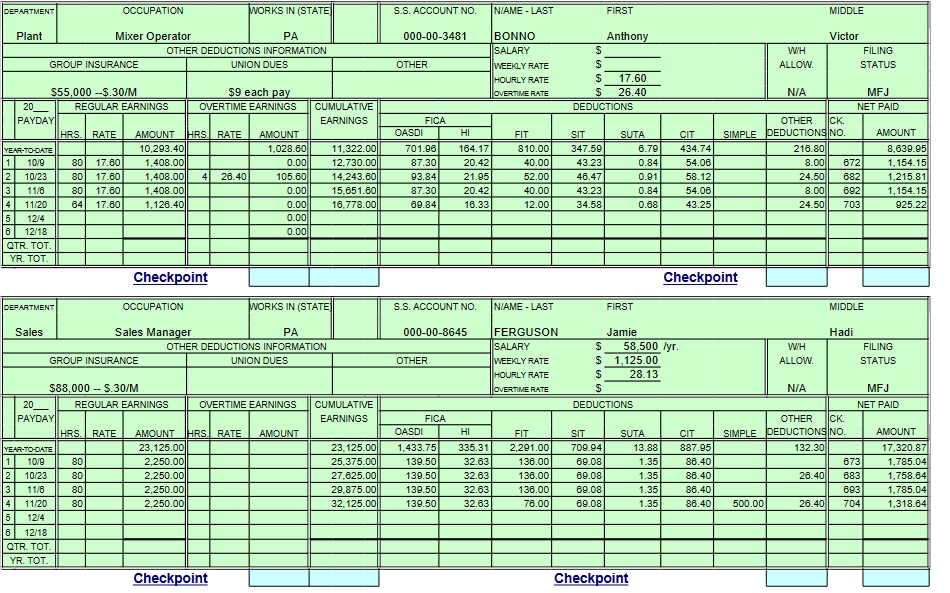

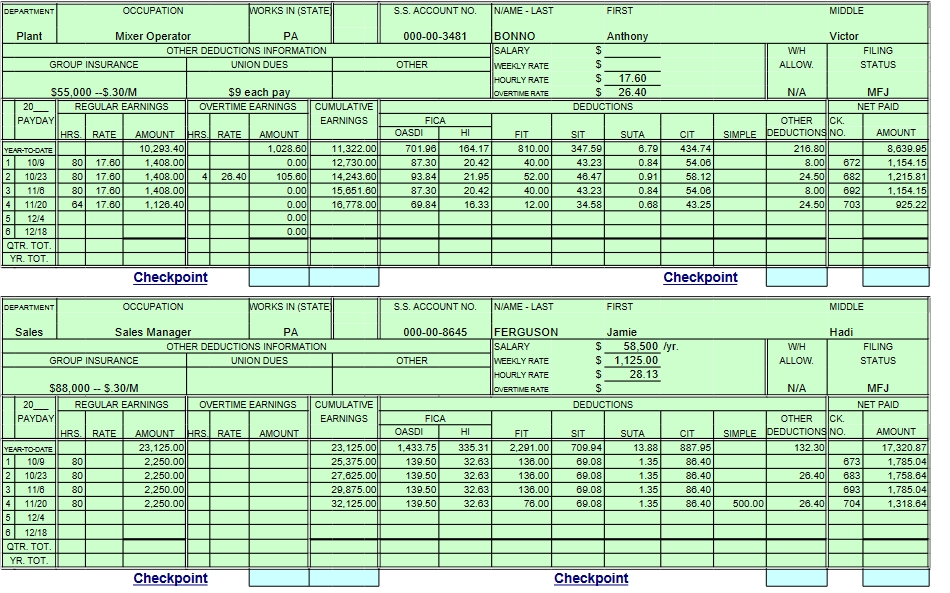

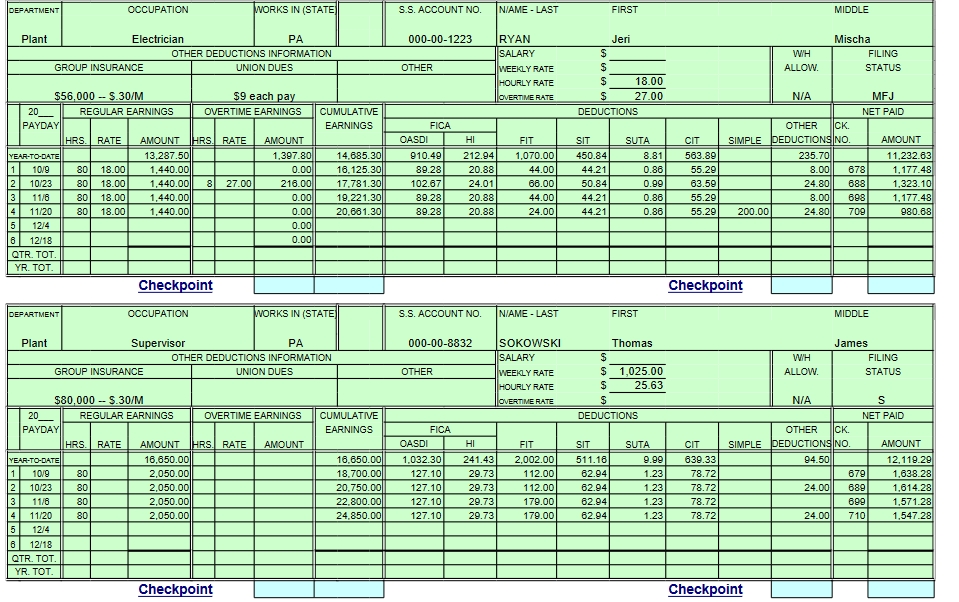

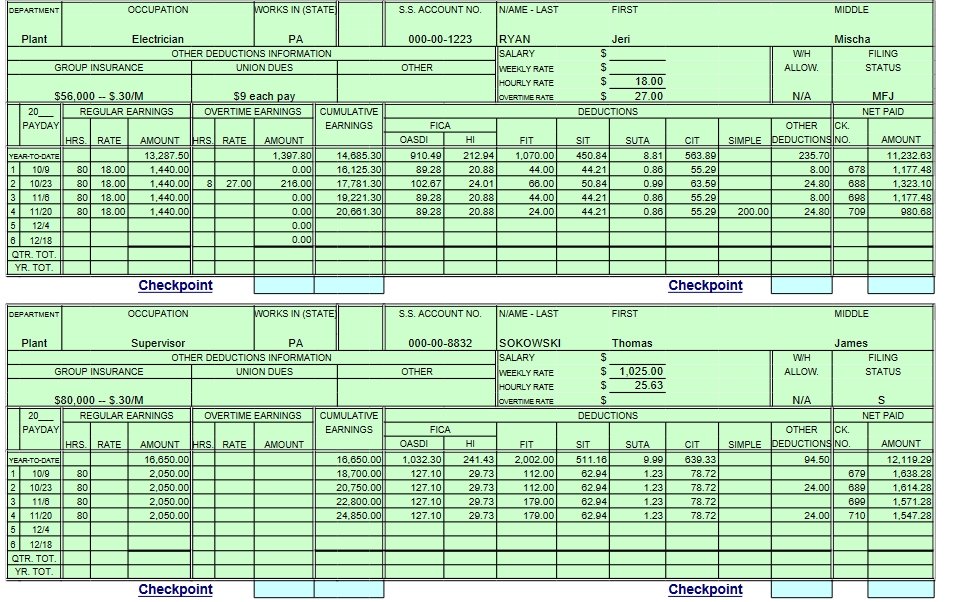

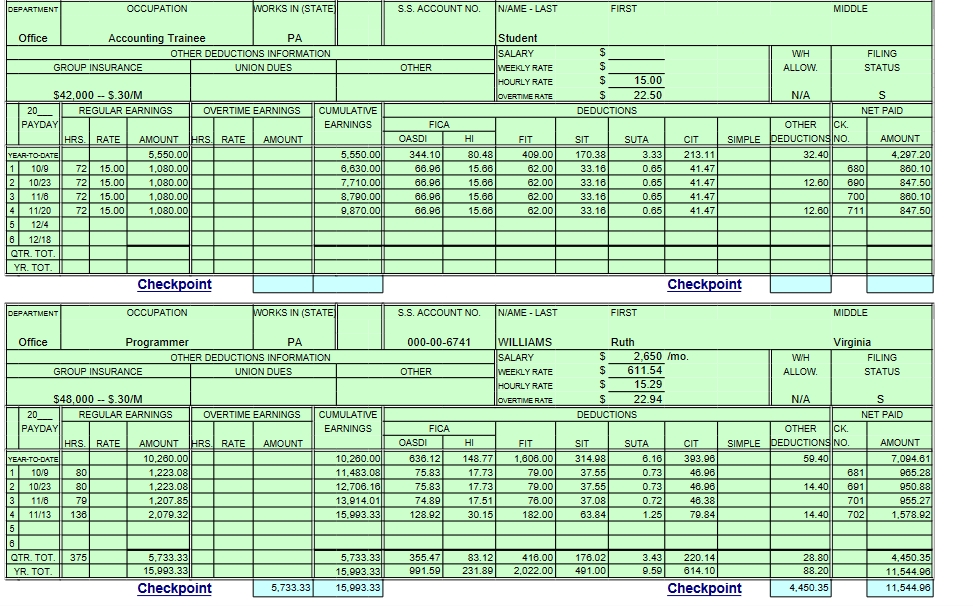

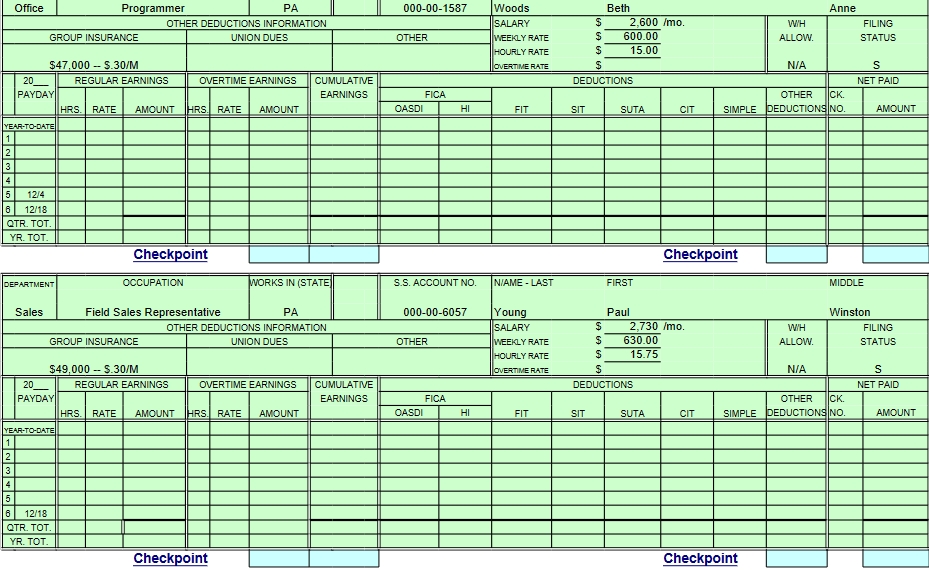

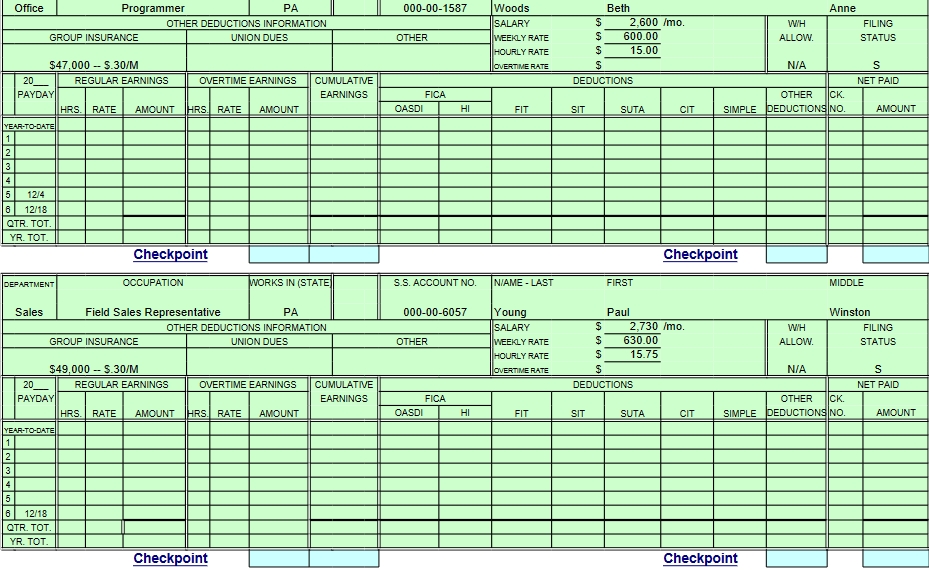

JOURNAL Page 41 POST DATE DESCRIPTION REF DEBIT CREDIT 20-- Oct. 9 Payroll Cash 12 12 436.46 Cash 11 12,436.46 9 Administrative Salaries 51 2,307.69 Office Salaries 52 4,723.08 Sales Salaries 53 3,600.00 Plant Wages 54 4,898.00 FICA Taxes Payable - OASDI 20.1 962.79 FICA Taxes Payable - HI 20.2 225.18 Employees FIT Payable 24 806.00 Employees SIT Payable 25 476.76 Employees SUTA Payable 25.1 9.30 Employees CIT Payable 26 596.28 Union Dues Payable 28 16.00 Payroll Cash 12 12,436.4 9 Payroll Taxes 56 1,390.21 FICA Taxes Payable - OASDI 20.1 962.78 FICA Taxes Payable - HI 20.2 225.17 FUTA Taxes Payable 21 23.34 SUTA Taxes Payable - Employer 22 178.92 20 Employees SIT Payable 25 476.76 Cash 11 476.76 23 Payroll Cash 12 12 494.94 Cash 12,494.94JOURNAL Page 42 POST. DATE DESCRIPTION REF DEBIT CREDIT 20-- Oct. 23 Administrative Salaries 51 2,307.69 Office Salaries 52 4,723.08 Sales Salaries 53 3,600.00 Plant Wages 54 5,219.60 FICA Taxes Payable - OASDI 20.1 982.72 FICA Taxes Payable - HI 20.2 229.84 Employees FIT Payable 24 840.00 Employees SIT Payable 25 486.63 Employees SUTA Payable 25.1 9.50 Employees CIT Payable 26 608.64 Group Insurance Premiums Collected 27 182. 10 Union Dues Payable 28 16.00 Payroll Cash 12 12,494.94 23 Payroll Taxes 56 1,395.19 FICA Taxes Payable - OASDI 20.1 982.72 FICA Taxes Payable - HI 20.2 229.83 FUTA Taxes Payable 21 3.72 SUTA Taxes Payable - Employer 22 178.92 Nov. 4 Employees SIT Payable 25 486.63 Cash 11 486.63 6 Union Dues Payable 28 32.00 Cash 11 32.00JOURNAL Page 43 POST. DATE DESCRIPTION REF DEBIT CREDIT 20-- Nov. 6 Payroll Cash 12 12,335.83 Cash 11 12,335.83 6 Administrative Salaries 51 2,307.69 Office Salaries 52 4,677.85 Sales Salaries 53 3,600.00 Plant Wages 54 4.898.00 FICA Taxes Payable - OASDI 20.1 959.99 FICA Taxes Payable - HI 20.2 224.53 Employees FIT Payable 24 868.00 Employees SIT Payable 25 475.37 Employees SUTA Payable 25.1 9.27 Employees CIT Payable 26 594.55 Union Dues Payable 28 16.00 Payroll Cash 12 12,335.83 6 Payroll Taxes 56 1,362.30 FICA Taxes Payable - OASDI 20.1 959.98 FICA Taxes Payable - HI 20.2 224.51 SUTA Taxes Payable - Employer 22 177.81 13 Payroll Cash 12 1,578.92 Cash 11 1,578.92JOURNAL Page 44 POST DATE DESCRIPTION REF DEBIT CREDIT 20-- Nov. 13 Office Salaries 52 2,079.32 FICA Taxes Payable - OASDI 20.1 128.92 FICA Taxes Payable - HI 20.2 30.15 Employees FIT Payable 24 182.00 Employees SIT Payable 25 63.84 Employees SUTA Payable 25.1 1.25 Employees CIT Payable 26 79.84 Group Insurance Premiums Collected 27 14.40 Payroll Cash 12 1,578.92 13 Payroll Taxes 56 159.07 FICA Taxes Payable - OASDI 20.1 128.92 FICA Taxes Payable - HI 20.2 30.15 16 FICA Taxes Payabe-OASDI 20.1 3,891.01 FICA Taxes Payable-HI 20.2 910.02 Employee FIT Payable 24 1,646.00 Cash 11 6,447.03 16 Employee CIT Payable 26 1,204.92 Cash 11 1,204.92 18 Employees SIT Payable 25 539.21 Cash 11 539.21 20 Payroll Cash 12 9,538.43 Cash 11 9,538.43 20 Administrative Salaries 51 2,307.69 Office Salaries 52 3,470.00Sales Salaries 53 3,600.00 Plant Wages 54 4.616.40 FICA Taxes Payable - OASDI 20.1 867.64 FICA Taxes Payable - HI 20.2 202.93 Employees FIT Payable 24 576.00 Employees SIT Payable 25 429.64 Employees SUTA Payable 25.1 8.39 Employees CIT Payable 26 537.36 Group Insurance Premiums Collected 27 167.70 Union Dues Payable 28 16.00 SIMPLE Contributions Payable 29 1,650.00 Payroll Cash 12 9.538.43 JOURNAL Page 45 POST. DATE DESCRIPTION REE DEBIT CREDIT 20- Nov. 20 Payroll Taxes 56 1,139.16 FICA Taxes Payable - OASDI 20.1 867.63 FICA Taxes Payable - HI 20.2 202.91 SUTA Taxes Payable - Employer 22 68.62Sales Salaries 53 3,600.00 Plant Wages 54 4.616.40 FICA Taxes Payable - OASDI 20.1 867.64 FICA Taxes Payable - HI 20.2 202.93 Employees FIT Payable 24 576.00 Employees SIT Payable 25 429.64 Employees SUTA Payable 25.1 8.39 Employees CIT Payable 26 537.36 Group Insurance Premiums Collected 27 167.70 Union Dues Payable 28 16.00 SIMPLE Contributions Payable 29 1,650.00 Payroll Cash 12 9.538.43 JOURNAL Page 45 POST. DATE DESCRIPTION REE DEBIT CREDIT 20- Nov. 20 Payroll Taxes 56 1,139.16 FICA Taxes Payable - OASDI 20.1 867.63 FICA Taxes Payable - HI 20.2 202.91 SUTA Taxes Payable - Employer 22 68.62GENERAL LEDGER Checkpoints ACCOUNT: CASH ACCOUNT NO. 11 Debit Credit Balance Balance POST. BALANCE Oct. 31, 20- 174,438.17 DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Nov. 30, 20-- 142,275.20 20-- Dec. 31, 20-- Oct. 1 Balance a 199,846.33 9 J41 12,436.46 187,409.87 20 J41 476.76 186,933.11 23 J41 12.494.94 174 438.17 Nov. 4 J42 486.63 173,951.54 6 J42 32.00 173,919.54 6 J43 12,335.83 161,583.71 13 J43 1,578.92 160,004.79 16 J44 6,447.03 153,557.76 16 J44 1,204.92 152,352.84 16 J44 539.21 151,813.63 20 J44 9,538.43 142,275.20ACCOUNT: PAYROLL CASH ACCOUNT NO. 12 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 0.00 20-- Nov. 30, 20- 0.00 Oct. LO J41 12,436.46 12,436.46 Dec. 31, 20- J41 12,436.46 0.00 23 J41 12,494.94 12,494.94 23 J42 12,494.94 0.00 Nov. 6 J43 12,335.83 12,335.83 6 J43 12,335.83 0.00 13 J43 1,578.92 1,578.92 13 J44 1,578.92 0.00 20 J44 9,538.43 9,538.43 20 J44 9,538.43 0.00ACCOUNT: FICA TAXES PAYABLE - OASDI ACCOUNT NO. 20.1 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 3,891.01 20- Nov. 30, 20-- 3,913.08 Oct. 9 J41 962.79 962.79 Dec. 31, 20- 9 J41 962.78 1,925.57 23 J42 982.72 2,908.29 23 J42 982.72 3,891.01 Nov. 6 J43 959.99 4,851.00 6 J43 959.98 5,810.98 13 J44 128.92 5,939.90 13 J44 128.92 6,068.82 16 J44 3,891.01 2,177.81 20 J44 867.64 3,045.45 20 J45 867.63 3,913.08ACCOUNT: FICA TAXES PAYABLE - HI ACCOUNT NO. 20.2 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 910.02 20- Nov. 30, 20-- 915.18 Oct. 9 J41 225.18 225.18 Dec. 31, 20- 9 J41 225.17 450.35 23 J42 229.84 680.19 23 J42 229.83 910.02 Nov. J43 224.53 1,134.55 6 J43 224.51 1,359.06 13 J44 30.15 1,389.21 13 J44 30.15 1,419.36 16 J44 910.02 509.34 20 J44 202.93 712.27 20 J45 202.91 915.18ACCOUNT: SUTA TAXES PAYABLE - EMPLOYER ACCOUNT NO. 22 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 357.84 20- Nov. 30, 20-- 604.27 Oct. 9 J41 178.92 178.92 Dec. 31, 20- 23 J42 178.92 357.84 Nov. 6 J43 177.81 535.65 20 J45 68.62 604.27ACCOUNT: EMPLOYEES FIT PAYABLE ACCOUNT NO. 24 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 1,646.00 20- Nov. 30, 20-- 1,626.00 Oct. 9 J41 806.00 806.00 Dec. 31, 20-- 23 J42 840.00 1,646.00 Nov. 6 J43 868.00 2,514.00 13 J44 182.00 2,696.00 16 J44 1,646.00 1,050.00 20 J44 576.00 1,626.00ACCOUNT: EMPLOYEES SIT PAYABLE ACCOUNT NO. 25 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 486.63 20-- Nov. 30, 20-- 429.64 Oct 9 J41 476.76 476.76 Dec. 31, 20-- 20 J41 476.76 0.00 23 J42 486.63 486.63 Nov. 4 J42 486.63 0.00 6 J43 475.37 475.37 13 J44 63.84 539.21 18 J44 539.21 0.00 20 J44 429.64 429.64ACCOUNT: EMPLOYEES SUTA PAYABLE ACCOUNT NO. 25.1 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 18.80 20- Nov. 30, 20-- 37.71 Oct. 9 J41 9.30 9.30 Dec. 31, 20- 23 J42 9.50 18.80 Nov. 6 J43 9.27 28.07 13 J44 1.25 29.32 20 J44 8.39 37.71ACCOUNT: FUTA TAXES PAYABLE ACCOUNT NO. 21 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 420.00 20- Nov. 30, 20- 420.00 Oct. 1 Balance a 392.94 Dec. 31, 20- 9 J41 23.34 416.28 23 J42 3.72 420.00ACCOUNT: GROUP INSURANCE PREMIUMS COLLECTED ACCOUNT NO. 27 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 182.10 20- Nov. 30, 20-- 364.20 Oct. 23 J42 182.10 182.10 Dec. 31, 20- Nov. 13 J44 14.40 196.50 20 J44 167.70 364.20ACCOUNT: UNION DUES PAYABLE ACCOUNT NO. 28 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 32.00 20- Nov. 30, 20-- 32.00 Oct. 9 J41 16.00 16.00 Dec. 31, 20- 23 J42 16.00 32.00 Nov. 6 J42 32.00 0.00 6 J43 16.00 16.00 20 J44 16.00 32.00ACCOUNT: SIMPLE CONTRIBUTIONS PAYABLE ACCOUNT NO. 29 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 0.00 20- Nov. 30, 20-- 1,650.00 Nov. 20 J44 1,650.00 1,650.00 Dec. 31, 20-ACCOUNT: EMPLOYEES CIT PAYABLE ACCOUNT NO. 26 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 1,204.92 20- Nov. 30, 20-- 1,211.75 Oct. 9 J41 596.28 596.28 Dec. 31, 20- 23 J42 608.64 1,204.92 Nov. 6 J43 594.55 1,799.47 13 J44 79.84 1,879.31 16 J44 1,204.92 674.39 20 J44 537.36 1,211.75ACCOUNT: OFFICE SALARIES ACCOUNT NO. 52 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20- 37,796.16 20- Nov. 30, 20-- 48,023.33 Oct. 1 Balance a 28,350.00 Dec. 31, 20- 9 J41 4, 723.08 33,073.08 23 J42 4,723.08 37,796.16 Nov. 6 J43 4,677.85 42,474.01 13 J44 2,079.32 44 553.33 20 J44 3,470.00 48,023.33\fACCOUNT: SALES SALARIES ACCOUNT NO. 53 Checkpoints Debit Credit POST BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 35,725.00 20- Nov. 30, 20- 42,925.00 Oct 1 Balance a 28,525.00 Dec. 31, 20- 9 J41 3,600.00 32, 125.00 23 J42 3,600.00 35,725.00 Nov. 6 J43 3,600.00 39,325.00 20 J44 3,600.00 42,925.00 ACCOUNT: PLANT WAGES ACCOUNT NO. 54 Checkpoints Debit Credit POST BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 52,774.90 20- Nov. 30, 20-- 62,289.30 Oct 1 Balance a 42,657.30 Dec. 31, 20- 9 J41 4,898.00 47,555.30 23 J42 5,219.60 52,774.90 Nov. 6 J43 4,898.00 57,672.90 20 J44 4,616.40 62,289.30ACCOUNT: SALES SALARIES ACCOUNT NO. 53 Checkpoints Debit Credit POST BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 35,725.00 20- Nov. 30, 20- 42,925.00 Oct 1 Balance a 28,525.00 Dec. 31, 20- 9 J41 3,600.00 32, 125.00 23 J42 3,600.00 35,725.00 Nov. 6 J43 3,600.00 39,325.00 20 J44 3,600.00 42,925.00 ACCOUNT: PLANT WAGES ACCOUNT NO. 54 Checkpoints Debit Credit POST BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 52,774.90 20- Nov. 30, 20-- 62,289.30 Oct 1 Balance a 42,657.30 Dec. 31, 20- 9 J41 4,898.00 47,555.30 23 J42 5,219.60 52,774.90 Nov. 6 J43 4,898.00 57,672.90 20 J44 4,616.40 62,289.30ACCOUNT: PAYROLL TAXES ACCOUNT NO. 56 Checkpoints Debit Credit POST. BALANCE Balance Balance DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Oct. 31, 20-- 17,138.47 20- Nov. 30, 20- 19,799.00 Oct. 1 Balance e 14,353.07 Dec. 31, 20- 9 J41 1,390.21 15,743.28 23 J42 1,395.19 17,138.47 Nov. 6 J43 1,362.30 18,500.77 13 J44 159.07 18,659.84 20 J45 1,139.16 19,799.00PAYROLL REGISTER GLO-BRITE PAINT COMPANY Time Record Regular Earnings Overtime Earnings Deductions NO. WITH Alow Filing Status Rate Rate Per NAME Pe SM T WT F S S M T W T F S Hrs. Total Hour Amount Hrs Hour Amount Group DASDI Union Ck Earnings HI FIT SIT Payday, October 9, 20-- For Period Ending October 3, 20- SUTA CIT Ins. Dues SIMPLE No Bonno, A MFJ NA| 8 8 8 8 8 8 8 8 8 8 1 80 17.80 Ferguson, MEJ NA 1,408.00 8 8 8 8 8 1,408.00 8 8 8 8 8 87.30 20.42 40.00 80 43.23 0.84 54.08 Ford, C. S NA 8 8 8 8 8 2.250.00 8 8 8 8 8 2.250.00 8.00 8721 80 139.50 32.83 136.00 89.08 1.35 86.40 873 Mann, K. MFJ NA 1,220.00 8 8 8 8 8 8 8 8 8 8 1,220.00 75.64 80 17.89 1,350.00 79.00 37.45 0.73 46.85 1,350.00 83.70 19.58 874 O'Neill, J. MFJ NA 8 8 8 8 8 36.00 41.45 Russell, S 8 8 8 8 8 0.81 51.84 S NA 8 8 8 8 8 2,307.89 8 8 8 8 8 801 2.307.89 143.08 33.46 875 1,200.00 142.00 1,200.00 70.85 1.38 88.61 Ryan, J. MFJ NA 17.40 676 8 8 8 8 8 Sokowski, T. 8 8 8 8 8 74.40 80 18.00 1,440.00 76.00 36.84 0.72 46.08 MFJ NA 8 8 8 8 8 38 8 8 8 1.440.00 89.28 20.83 80 44.00 677 44.21 0.88 55.29 8.00 Student 2.050.00 S NA 8 8 8 8 4 8 8 8 8 4 2.050.00 127.10 878 29.73 112.00 82.041 1.23 879 Williams, R S 72 15.00 1,080.00 78.72 NA 8 8 D 8 8 8 8 8 8 8 1,080.00 66.96 80 15.86 62.00 1,223.08 33.18 0.85 41.47 1,223.08 75.83 880 17.73 79.00 37.55 0.73 46.98 881 TOTALS 15.528.77 15,528.77 962.79 225.18 806.00 Payday, October 23, 20-- For Period Ending October 17, 20- 476.76 9.30 0.00 16.00 0.00 Bonno, A MFJ NA |8 8 8 8 8 4 8 8 8 8 8 80 17.80 Ferguson, MFJ NA 1,408.00 8 8 8 8 8 4 28.40 105.60 8 8 8 8 8 1.513.80] 93.841 21.95 52.00 46.47 0.91 58.12 16.50 8.00 682 Ford, C. 80 S NA 2.250.00 8 8 8 8 8 8 8 8 8 8 2.250.00 139.50 80 32.83 1,220.00 136.00 89.08 1.35 86.40 26.40 683 Mann, K MFJ NA O'Neil, J. 8 8 8 8 8 1,220.00 80 75.64 17.89 79.00 37.45 0.73 46.85 14.40 884 MFJ NA 8 8 8 8 8 8 8 8 8 8 1,350.00 8 8 8 8 8 801 1,350.00 83.70 19.58 36.00 S NA 8 8 8 8 8 2.307.89 41.45 Russell, S. 38 8 8 8 2.307.68 0.81 51.84 143.08 33.46 15.90 885 142.00 70.85 1.38 86.81 27.00 686 Ryan, J. MFJ NA 1.200.00 8 8 8 8 8 1.200.00 8 8 8 8 8 8 80 18.00 74.40 17.40 17440.00 8 27.00 76.00 36.84 0.72 Sokowski, T. MFJ NIA 8 8 8 8 8 218.00 46.08 1.858.00 14.10 8 8 8 8 8 102.87 80 24.01 68.00 2.050,00 50.84 0.89 83.58 16.80 8.00 838 (Student S INA 8 8 8 8 4 8 8 8 8 4 2.050.00 127.10 29.73 12.00 82.04 1.23 78.72 24.00 889 Williams, R 72 15.00 NIA 1.080.00 8 8 8 8 8 8 8 8 8 8 1.080.00 80 68.961 15.86 62.00 1.223.08 33.181 0.85 41.47 1.223.08 12.60 75.83 17.73 79.00 890 37.55 0.73 46.08 14.40 891 TOTALS 15.528.77 321.60 15.850.37 982.72 220.84 840.00 486.63 9.50 808.84 182.10 18.00 0.00Payday, November 6, 20-- For Period Ending October 31, 20- Bonno, A Ferguson, J MFJ NA |8 8 8 8 8 8 8 8 8 8 80 17.80 MFJ NA 8 8 8 8 8 1,408.00 Ford, C. 8 8 8 8 8 80 1,408.00 87.30 20.42 40,00 43.23 0.84 S NA 2.250.00 54.08 8.00 8 8 8 8 8 2.250.00 139.50 32.83 136,00 892 Mann. K 89.08 1.35 MFJ NA 8 8 8 8 8 86.40 8 838 8 80 1 220.00 893 O'Neil, J. MFJ NA 8 8 8 8 8 80 8 8 8 8 8 1,350.00 1,220.00 75.64 17,89 79,00 8 8 8 8 8 801 1,350.00 37.45 0.73 83.70 46.85 2.307.89 19.58 36.00 41.451 Russell, S 0.81 51.841 S NA 8 8 8 86 095 Ryan, J. 8 8 8 8 8 781 143.08 MFJ NA 8 8 8 8 8 1.170.00 2.307.80 33. 46 142.00 70.85 1.170.00 1.38 85.81 8 8 8 8 8 80 18.00 1,440.00 72.54 18.97 74.00 35.021 Sokowski, T. 0.70 44.03 S NAA 8 8 8 8 8 897 Student 8 8 8 8 8 801 1.440.00 80.281 20.88 44,00 44.21 0.80 55.20 8.00 S NA 8 8 8 8 4 2.050.00 898 Williams, R 8 8 8 8 4 2.050.00 127.10 NA 8 8 8 7 72 15.00 1080.00 20.73 179.00 82.04 1,080.00 1.231 78.72 8 8 8 8 8 1.207.85 15.80 02.00 1.207.85 33. 18 0.851 74.89 41.47 17.51 70.00 37.08 0.72 700 40.38 701 TOTALS 15,483.54 15.483.54 Payday, November 13, 20-- For Period Ending November 14, 20.. 050.09 224.60 808.00 476.37 10.00 0.00 Williams, R S NA 6 8 7 7 8 0 0 8 6 8 130 2.070.32 128.92 30. 16 182.00 U3.84 TOTALS 1.25 70.84 14.40 70 2.070.32 Payday, November 20, 20-- For Period Ending November 14, 20.. 2.070.32 128.021 30. 15 182.00 03.84 1.251 70.84 14.40 0.00 Bonno, A 0.00 MJ NA 8 8 8 8 8 Ferguson, 8 8 8 64 17.40 MJ NA 8 8 8 8 8 1,120.40 Ford, C. 8 8 8 8 8 S NA 80 1. 120.40 60.84 2.260.00 10.33 12.00 34.58 8 8 8 8 8 8 8 8 8 8 80 2.250.00 43.25 130.60 10.60 8.00 1220.00 32.03 70.00 703 Mann, K 1,220.00 1.35 MFJ NA 80.40 8 8 8 8 8 75.04 20.40 8 8 8 8 8 80 1,350.00 17.80 70.00 600.00 704 O'Neill, J. MFJ NA 8 8 8 8 8 8 8 8 8 8 801 1,350.00 37.45] 83.70 0.73 46.85 10.58 14.40 10.00 41.451 0.81 51.84 705 Russell, S S NA 2,307.80 2,307.80 15.90 68 8 8 8 8 8 8 8 8 781 1,170.00 143.08 33.40 50.00 1.170.00 70.85 250.00 708 1.38 Ryan, J. 72.541 38.81 MEJ NA 27.00 8 8 8 8 8 8 8 8 8 8 16.97 700.00 707 S NA 8 8 8 8 8 80 18.00 1,440.00 74.00 Sokowski, T 8 8 8 8 8 80 1.440.00 35.02 0.70 74.03 80.281 14. 10 2,060.00 20.88 24.00 44.21 35.201 708 Student 16.80 NA 8 8 8 8 4 8.00 200.00 709 8 8 8 8 4 72 15.00 1,080.00 2.050.80 127.10 20.73 170.00 1,080.00 62.04 66.96 1.23 15.86 78.72 24.00 62.00 33.18 0.65 710 41.47 12.60 711 TOTALS 13,094.08 Payday, December 4, 20-- For Period Ending November 28, 20.. 13,:4.08 867.64 202.89 676.00 420.64 8.38 537.38 167.70 16.00 1,850.00 Bonno, A MFJ NA Ferguson, J MFJ NA Ford, C. S NA Mann, K MFJ NIA O'Neil, J. MFJ NA Russell, S S NA Ryan, J. MEJ NA Sokowski, T. S NA (Student) INA Woods, B NA TOTALS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00\fDEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Administrative Assistant PA 000-00-4567 FORD Catherine Louise OTHER DEDUCTIONS INFORMATION SALARY $ 2,733.33 /mo. WH FILING OUP INSURANCE UNION DU OTHER WEEKLY RATE 640.00 ALLOW. STATUS HOURLY RATE 16.00 $50,000--5.30/M OVERTIME RATE 24.00 N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 6,300.00 6.300.00 390.60 91.35 839.00 193.41 3.78 241.91 37.80 1,702.15 1 10/9 BO 1,220.00 7.520.00 75.64 17.69 79.00 37.45 0.73 48.85 374 962.84 10/23 80 1,220.00 8.740.00 75.64 17.69 79.00 37.45 0.73 46.85 14.40 684 948.24 11/6 80 1,220.00 9.980.00 75.64 17.69 79.00 37.45 0.73 46.85 694 962.64 11/20 BO ,220.00 11.180.00 75.64 17.69 79.00 37.45 0.73 46.85 14.40 705 948.24 12/4 6 12/18 OTR. TOT YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Sales Representative PA 000-00-9352 MANN Kari Casey OTHER DEDUCTIONS INFORMATION SALARY 2,925 /mo. VWH FILING GROUP INSURANCE UNION DU OTHER WEEKLY RATE 675.00 ALLOW. STATUS HOURLY RATE 16.88 $53,000 - 5.30/M OVERTIME RATE N/A MFJ 20_ REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD H FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 5,400.00 5.400.00 334.80 78.30 332.00 165.7 3.24 207.35 31.50 4,247.03 1 10/9 BO 1.350.00 8.750.00 83.70 9.58 36.00 41.45 0.81 51.84 375 1, 116.62 10/23 80 1,350.00 8. 100.00 83.70 19.58 36.00 41.45 0.8 51.84 15.90 385 1, 100.72 11/6 80 1,350.00 9.450.00 83.70 19.58 36.00 41.45 0.81 51.84 695 1, 116.62 11/20 30 ,350.00 10.800.00 83.70 19.58 10.00 41.45 0.81 51.84 250.00 15.90 706 876.72 12/4 12/18 QTR. TOT. YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Administrative Assistant PA 000-00-4567 FORD Catherine Louise OTHER DEDUCTIONS INFORMATION SALARY $ 2,733.33 /mo. WH FILING OUP INSURANCE UNION DU OTHER WEEKLY RATE 640.00 ALLOW. STATUS HOURLY RATE 16.00 $50,000--5.30/M OVERTIME RATE 24.00 N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 6,300.00 6.300.00 390.60 91.35 839.00 193.41 3.78 241.91 37.80 1,702.15 1 10/9 BO 1,220.00 7.520.00 75.64 17.69 79.00 37.45 0.73 48.85 374 962.84 10/23 80 1,220.00 8.740.00 75.64 17.69 79.00 37.45 0.73 46.85 14.40 684 948.24 11/6 80 1,220.00 9.980.00 75.64 17.69 79.00 37.45 0.73 46.85 694 962.64 11/20 BO ,220.00 11.180.00 75.64 17.69 79.00 37.45 0.73 46.85 14.40 705 948.24 12/4 6 12/18 OTR. TOT YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Sales Representative PA 000-00-9352 MANN Kari Casey OTHER DEDUCTIONS INFORMATION SALARY 2,925 /mo. VWH FILING GROUP INSURANCE UNION DU OTHER WEEKLY RATE 675.00 ALLOW. STATUS HOURLY RATE 16.88 $53,000 - 5.30/M OVERTIME RATE N/A MFJ 20_ REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD H FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 5,400.00 5.400.00 334.80 78.30 332.00 165.7 3.24 207.35 31.50 4,247.03 1 10/9 BO 1.350.00 8.750.00 83.70 9.58 36.00 41.45 0.81 51.84 375 1, 116.62 10/23 80 1,350.00 8. 100.00 83.70 19.58 36.00 41.45 0.8 51.84 15.90 385 1, 100.72 11/6 80 1,350.00 9.450.00 83.70 19.58 36.00 41.45 0.81 51.84 695 1, 116.62 11/20 30 ,350.00 10.800.00 83.70 19.58 10.00 41.45 0.81 51.84 250.00 15.90 706 876.72 12/4 12/18 QTR. TOT. YR. TOT. Checkpoint Checkpoint|DEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Admini- strative President PA 000-00-1534 O'NEILL Joseph Tyler OTHER DEDUCTIONS INFORMATION SALARY 60,000 /yr. VWH FILING GROUP INSURANCE UNION DUES OTHER EHWEEKLY RATE 2,307.69 ALLOW. STATUS HOURLY RATE $90,000 - 5.30/M OVERTIME RATE N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 42,692.27 42.602.27 2.846.02 619.04 6,116.00 1,310.65 25.62 1,639.30 202.50 30,132.24 1 10/9 80 2,307.69 44,909.96 143.08 33.46 142.00 70.85 1.38 88.61 676 1,828.31 10/23 80 2,307.69 47.307.65 143.08 33.46 142.00 70.85 1.38 88.61 27.00 386 1,801.31 1 1/6 80 2,307.69 40.615.34 143.08 33.46 142.00 70.85 1.38 88.61 896 1,828.31 11/20 2.307.69 51.923.03 143.08 33.46 30.00 70.85 1.38 88.61 700.00 27.00 707 1,183.31 12/4 6 12/18 QTR. TOT. YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE] S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Time Clerk PA 100-00-6337 RUSSELL Serdar Parker OTHER DEDUCTIONS INFORMATION SALARY 2,730 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 630.00 ALLOW. STATUS HOURLY RATE 15.75 $49,000 - 5.30/M OVERTIME RATE 23.63 N/A 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HR'S RATE AMOUNT IRS. RATE AMOUNT DASO HI FIT SIT SUTA CIT SIMPLE |DEDUCTIONS NO AMOUNT YEAR-TO-DATE 6,240.00 6.240.00 386.88 30.4 842.00 191.56 3.74 239.60 31.50 4,654.24 1 10/9 80 1,200.00 7.440.00 74.40 17.40 76.00 36.84 0.72 46.08 677 948.56 2 10/23 80 1,200.00 8.640.00 74.40 17.40 76.00 36.84 0.72 46.08 14.10 687 934.46 1 1/6 78 1.170.00 8.810.00 72.54 16.97 74.00 35.92 0.70 44.93 697 924.94 11/20 78 1,170.00 10.980.00 72.54 16.97 74.00 35.92 0.70 44.93 14.10 708 @10.84 5 12/4 12/14 QTR. TOT YR. TOT. Checkpoint Checkpoint|DEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Admini- strative President PA 000-00-1534 O'NEILL Joseph Tyler OTHER DEDUCTIONS INFORMATION SALARY 60,000 /yr. VWH FILING GROUP INSURANCE UNION DUES OTHER EHWEEKLY RATE 2,307.69 ALLOW. STATUS HOURLY RATE $90,000 - 5.30/M OVERTIME RATE N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 42,692.27 42.602.27 2.846.02 619.04 6,116.00 1,310.65 25.62 1,639.30 202.50 30,132.24 1 10/9 80 2,307.69 44,909.96 143.08 33.46 142.00 70.85 1.38 88.61 676 1,828.31 10/23 80 2,307.69 47.307.65 143.08 33.46 142.00 70.85 1.38 88.61 27.00 386 1,801.31 1 1/6 80 2,307.69 40.615.34 143.08 33.46 142.00 70.85 1.38 88.61 896 1,828.31 11/20 2.307.69 51.923.03 143.08 33.46 30.00 70.85 1.38 88.61 700.00 27.00 707 1,183.31 12/4 6 12/18 QTR. TOT. YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE] S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Time Clerk PA 100-00-6337 RUSSELL Serdar Parker OTHER DEDUCTIONS INFORMATION SALARY 2,730 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 630.00 ALLOW. STATUS HOURLY RATE 15.75 $49,000 - 5.30/M OVERTIME RATE 23.63 N/A 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HR'S RATE AMOUNT IRS. RATE AMOUNT DASO HI FIT SIT SUTA CIT SIMPLE |DEDUCTIONS NO AMOUNT YEAR-TO-DATE 6,240.00 6.240.00 386.88 30.4 842.00 191.56 3.74 239.60 31.50 4,654.24 1 10/9 80 1,200.00 7.440.00 74.40 17.40 76.00 36.84 0.72 46.08 677 948.56 2 10/23 80 1,200.00 8.640.00 74.40 17.40 76.00 36.84 0.72 46.08 14.10 687 934.46 1 1/6 78 1.170.00 8.810.00 72.54 16.97 74.00 35.92 0.70 44.93 697 924.94 11/20 78 1,170.00 10.980.00 72.54 16.97 74.00 35.92 0.70 44.93 14.10 708 @10.84 5 12/4 12/14 QTR. TOT YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Mixer Operator PA 000-00-3481 BONNO Anthony Victor OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 17.60 555,000 --$.30/M $9 each pay OVERTIME RATE 26.40 N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 10,293.40 1,028.60 11.322.00 701.96 164.17 810.00 347.58 8.79 434.74 216.80 8.630.95 1 10/9 80 17.80 1,408.00 0.00 12.730.00 87.30 20.42 40.00 43.23 0.84 54.06 8.00 372 1, 154.15 2 10/23 80 17.80 1,408.00 4 26.40 105.80 14.243.80 83.84 21.95 52.00 46.47 0.91 58.12 24.50 682 1,215.81 1 1/6 80 17.80 1,408.00 0.00 15.651.60 87.30 20.42 40.0 43.23 0.84 54.06 8.00 392 1. 154.15 11/20 64 17.80 1.126.40 0.0 16.778.00 69.84 16.33 12.00 34.58 0.68 43.25 24.50 703 925.22 5 12/4 0.00 6 12/18 0.00 QTR. TOT. YR. TOT. Checkpoint Checkpoint |DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Sales Manager PA 000-00-8645 FERGUSON Jamie Hadi OTHER DEDUCTIONS INFORMATION SALARY 58,500 /yr. VWH FILING GROUP INSURANCE ION DUES OTHER WEEKLY RATE 1,125.00 ALLOW. STATUS HOURLY RATE 28.13 $88,000 - 5.30/M OVERTIME RATE N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT IRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 23,125.00 23.125.00 1.433.75 335.31 2,291.00 709.94 13.88 887.95 132.30 17.320.87 1 10/9 80 2,250.00 25.375.00 139.50 32.63 136.00 69.08 1.35 86.40 673 1,785.04 12 10/23 80 2,250.00 27.625.00 139.50 32.63 136.00 69.08 1.35 86.40 28.40 683 1,758.64 3 1 1/6 80 2,250.00 20.875.00 139.50 32.63 136.00 69.08 1.35 86.40 393 1,785.04 4 11/20 2,250.00 32. 125.00 139.50 32.63 78.00 89.08 1.35 86.40 500.00 26.40 704 1,318.64 5 12/4 6 12/18 QTR. TOT. YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE) S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Mixer Operator PA 000-00-3481 BONNO Anthony Victor OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 17.60 555,000 --$.30/M $9 each pay OVERTIME RATE 26.40 N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 10,293.40 1,028.60 11.322.00 701.96 164.17 810.00 347.58 8.79 434.74 216.80 8.630.95 1 10/9 80 17.80 1,408.00 0.00 12.730.00 87.30 20.42 40.00 43.23 0.84 54.06 8.00 372 1, 154.15 2 10/23 80 17.80 1,408.00 4 26.40 105.80 14.243.80 83.84 21.95 52.00 46.47 0.91 58.12 24.50 682 1,215.81 1 1/6 80 17.80 1,408.00 0.00 15.651.60 87.30 20.42 40.0 43.23 0.84 54.06 8.00 392 1. 154.15 11/20 64 17.80 1.126.40 0.0 16.778.00 69.84 16.33 12.00 34.58 0.68 43.25 24.50 703 925.22 5 12/4 0.00 6 12/18 0.00 QTR. TOT. YR. TOT. Checkpoint Checkpoint |DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Sales Manager PA 000-00-8645 FERGUSON Jamie Hadi OTHER DEDUCTIONS INFORMATION SALARY 58,500 /yr. VWH FILING GROUP INSURANCE ION DUES OTHER WEEKLY RATE 1,125.00 ALLOW. STATUS HOURLY RATE 28.13 $88,000 - 5.30/M OVERTIME RATE N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT IRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 23,125.00 23.125.00 1.433.75 335.31 2,291.00 709.94 13.88 887.95 132.30 17.320.87 1 10/9 80 2,250.00 25.375.00 139.50 32.63 136.00 69.08 1.35 86.40 673 1,785.04 12 10/23 80 2,250.00 27.625.00 139.50 32.63 136.00 69.08 1.35 86.40 28.40 683 1,758.64 3 1 1/6 80 2,250.00 20.875.00 139.50 32.63 136.00 69.08 1.35 86.40 393 1,785.04 4 11/20 2,250.00 32. 125.00 139.50 32.63 78.00 89.08 1.35 86.40 500.00 26.40 704 1,318.64 5 12/4 6 12/18 QTR. TOT. YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Electrician PA 000-00-1223 RYAN Jeri Mischa OTHER DEDUCTIONS INFORMATION SALARY WWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 18.00 $56,000 - 5.30/M $9 each pay OVERTIME RATE 27.00 N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS.| RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 13.287.50 1,397.80 14.685.30 910.49 212.94 1,070.0 450.84 8.81 563.89 235.70 11,232.83 10/9 BO 18.0 1,440.00 0.00 16.125.30 89.28 20.88 44.00 44.21 0.86 55.29 8.00 378 1, 177.48 10/23 80 18.00 1.440.00 27.00 216.00 17.781.30 102.67 24.01 68.0 50.84 0.89 63.59 24.80 688 1.323.10 1 1/6 BO 18.00 1,440.00 D.00 19.221.30 89.28 20.88 44.00 44.21 0.86 55.29 8.00 698 1, 177.48 11/20 BO 18.00 1,440.00 0.00 20.681.30 89.28 20.88 24.00 44.21 0.86 55.29 200.00 24.80 709 980.68 12/4 0.00 6 12/18 0.00 QTR. TOT. YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Supervisor PA 100-00-8832 SOKOWSKI Thomas James OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 1,025.00 ALLOW. STATUS HOURLY RATE 25.63 $80,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 16,650.00 16.650.00 1.032.30 241.43 2,002.00 511.18 9.89 839.33 94.50 12. 119.20 1 10/9 80 2,050.00 18.700.00 127.10 29.73 112.00 62.94 1.23 78.72 879 1.638.28 10/23 80 2.050.00 20.750.00 127.10 29.73 112.00 62.94 1.23 78.72 24.00 689 1.614.28 1 1/6 80 2,050.00 22.800.00 127.10 29.73 179.00 62.94 1.23 78.72 699 1.571.28 11/20 80 2,050.00 24.850.00 127.10 29.73 179.00 62.94 1.23 78.72 24.00 710 1,547.28 12/4 12/18 QTR. TOT. YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Electrician PA 000-00-1223 RYAN Jeri Mischa OTHER DEDUCTIONS INFORMATION SALARY WWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 18.00 $56,000 - 5.30/M $9 each pay OVERTIME RATE 27.00 N/A MFJ 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS.| RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 13.287.50 1,397.80 14.685.30 910.49 212.94 1,070.0 450.84 8.81 563.89 235.70 11,232.83 10/9 BO 18.0 1,440.00 0.00 16.125.30 89.28 20.88 44.00 44.21 0.86 55.29 8.00 378 1, 177.48 10/23 80 18.00 1.440.00 27.00 216.00 17.781.30 102.67 24.01 68.0 50.84 0.89 63.59 24.80 688 1.323.10 1 1/6 BO 18.00 1,440.00 D.00 19.221.30 89.28 20.88 44.00 44.21 0.86 55.29 8.00 698 1, 177.48 11/20 BO 18.00 1,440.00 0.00 20.681.30 89.28 20.88 24.00 44.21 0.86 55.29 200.00 24.80 709 980.68 12/4 0.00 6 12/18 0.00 QTR. TOT. YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Plant Supervisor PA 100-00-8832 SOKOWSKI Thomas James OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 1,025.00 ALLOW. STATUS HOURLY RATE 25.63 $80,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 16,650.00 16.650.00 1.032.30 241.43 2,002.00 511.18 9.89 839.33 94.50 12. 119.20 1 10/9 80 2,050.00 18.700.00 127.10 29.73 112.00 62.94 1.23 78.72 879 1.638.28 10/23 80 2.050.00 20.750.00 127.10 29.73 112.00 62.94 1.23 78.72 24.00 689 1.614.28 1 1/6 80 2,050.00 22.800.00 127.10 29.73 179.00 62.94 1.23 78.72 699 1.571.28 11/20 80 2,050.00 24.850.00 127.10 29.73 179.00 62.94 1.23 78.72 24.00 710 1,547.28 12/4 12/18 QTR. TOT. YR. TOT. Checkpoint CheckpointDEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Accounting Trainee PA Student OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 15.00 $42.000 - 5.30/M OVERTIME RATE 22.50 N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 5,550.00 5.550.00 344.10 80.48 409.00 170.38 3.33 213.11 32.40 1.297.20 1 10/9 72 15.00 1,080.00 6,630.00 36.96 15.66 62.00 33.16 0.6 41.47 680 860.10 2 10/23 72 15.00 1,080.00 7.710.00 66.96 15.6 62.00 33.16 0.65 41.47 12.60 690 847.50 13 11/8 72 15.00 1,080.00 8.790.00 56.86 15.66 62.00 33.16 0.65 41.47 700 860.10 4 11/20 72 15.00 1,080.00 8.870.00 86.96 15.66 62.00 33.18 0.65 41.47 12.60 711 847.50 5 12/4 6 12/18 QTR. TOT YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Programmer PA 000-00-6741 WILLIAMS Ruth Virginia OTHER DEDUCTIONS INFORMATION SALARY 2,650 /mo. WH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 611.54 ALLOW. STATUS HOURLY RATE 15.29 $48,000 - 5.30/M OVERTIME RATE 22.94 VIA S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 0,260.00 10.260.00 336.12 148.77 1,606.00 314.98 3.16 393.96 50.40 7.094.61 1 10/9 BO 1.223.08 11.483.08 75.83 17.73 79.00 37.55 0.73 46.96 681 965.28 21 10/2 80 1,223.08 12.706.16 75.83 17.73 79.00 37.55 0.73 46.96 14.40 691 950.88 3 11/6 79 1207.85 13,914.01 74.89 17.51 76.00 37.08 0.72 46.38 701 955.27 4 11/13 138 2,079.32 15.903.33 128.02 30.15 182.00 83.84 1.25 79.84 14.40 702 1,578.92 5 QTR. TOT. 375 5.733.33 5.733.33 355.47 B3.12 416.00 176.02 3.43 220.14 28.80 1.450.35 YR. TOT. 15,093.33 15.903.33 901.59 231.89 2,022.00 491.00 9.59 814.10 88.20 1.544.96 Checkpoint 5,733.33 15,903.33 Checkpoint 4,450.35 11,544.96DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Accounting Trainee PA Student OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE 15.00 $42.000 - 5.30/M OVERTIME RATE 22.50 N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 5,550.00 5.550.00 344.10 80.48 409.00 170.38 3.33 213.11 32.40 1.297.20 1 10/9 72 15.00 1,080.00 6,630.00 36.96 15.66 62.00 33.16 0.6 41.47 680 860.10 2 10/23 72 15.00 1,080.00 7.710.00 66.96 15.6 62.00 33.16 0.65 41.47 12.60 690 847.50 13 11/8 72 15.00 1,080.00 8.790.00 56.86 15.66 62.00 33.16 0.65 41.47 700 860.10 4 11/20 72 15.00 1,080.00 8.870.00 86.96 15.66 62.00 33.18 0.65 41.47 12.60 711 847.50 5 12/4 6 12/18 QTR. TOT YR. TOT. Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Office Programmer PA 000-00-6741 WILLIAMS Ruth Virginia OTHER DEDUCTIONS INFORMATION SALARY 2,650 /mo. WH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 611.54 ALLOW. STATUS HOURLY RATE 15.29 $48,000 - 5.30/M OVERTIME RATE 22.94 VIA S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO AMOUNT YEAR-TO-DATE 0,260.00 10.260.00 336.12 148.77 1,606.00 314.98 3.16 393.96 50.40 7.094.61 1 10/9 BO 1.223.08 11.483.08 75.83 17.73 79.00 37.55 0.73 46.96 681 965.28 21 10/2 80 1,223.08 12.706.16 75.83 17.73 79.00 37.55 0.73 46.96 14.40 691 950.88 3 11/6 79 1207.85 13,914.01 74.89 17.51 76.00 37.08 0.72 46.38 701 955.27 4 11/13 138 2,079.32 15.903.33 128.02 30.15 182.00 83.84 1.25 79.84 14.40 702 1,578.92 5 QTR. TOT. 375 5.733.33 5.733.33 355.47 B3.12 416.00 176.02 3.43 220.14 28.80 1.450.35 YR. TOT. 15,093.33 15.903.33 901.59 231.89 2,022.00 491.00 9.59 814.10 88.20 1.544.96 Checkpoint 5,733.33 15,903.33 Checkpoint 4,450.35 11,544.96Office Programmer PA 000-00-1587 Woods Beth Anne OTHER DEDUCTIONS INFORMATION SALARY 2,600 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 600.00 ALLOW STATUS HOURLY RATE 15.00 $47,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 2 3 12/4 12/18 QTR. TOT. YR. TOT Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE 5.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Field Sales Representative PA 100-00-6057 Young Paul Winston OTHER DEDUCTIONS INFORMATION SALARY 2,730 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 630.00 ALLOW. STATUS HOURLY RATE 15.75 $49,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 6 12/18 QTR. TOT. YR. TOT Checkpoint CheckpointOffice Programmer PA 000-00-1587 Woods Beth Anne OTHER DEDUCTIONS INFORMATION SALARY 2,600 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 600.00 ALLOW STATUS HOURLY RATE 15.00 $47,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 2 3 12/4 12/18 QTR. TOT. YR. TOT Checkpoint Checkpoint DEPARTMENT OCCUPATION WORKS IN (STATE 5.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE Sales Field Sales Representative PA 100-00-6057 Young Paul Winston OTHER DEDUCTIONS INFORMATION SALARY 2,730 /mo. VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE 630.00 ALLOW. STATUS HOURLY RATE 15.75 $49,000 - 5.30/M OVERTIME RATE N/A S 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASDI HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 6 12/18 QTR. TOT. YR. TOT Checkpoint CheckpointOTHER DEDUCTIONS INFORMATION SALARY WWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE OVERTIME RATE 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 12 3 16 QTR. TOT. YR. TOT. DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE OVERTIME RATE 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 2 3 QTR. TOT. YR. TOT.OTHER DEDUCTIONS INFORMATION SALARY WWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE OVERTIME RATE 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS RATE AMOUNT HRS. RATE AMOUNT DASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 12 3 16 QTR. TOT. YR. TOT. DEPARTMENT OCCUPATION WORKS IN (STATE S.S. ACCOUNT NO. NAME - LAST FIRST MIDDLE OTHER DEDUCTIONS INFORMATION SALARY VWH FILING GROUP INSURANCE UNION DUES OTHER WEEKLY RATE ALLOW. STATUS HOURLY RATE OVERTIME RATE 20 REGULAR EARNINGS OVERTIME EARNINGS CUMULATIVE DEDUCTIONS NET PAID PAYDAY EARNINGS FICA OTHER CK. HRS. RATE AMOUNT HRS. RATE AMOUNT OASD HI FIT SIT SUTA CIT SIMPLE DEDUCTIONS NO. AMOUNT YEAR-TO-DATE 1 2 3 QTR. TOT. YR. TOT