Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journalise the transactions The following are transactions for JJ's Company for the current year: Jan. 10. Purchased merchandise on account from Jane Co., $240,000, terms

journalise the transactions

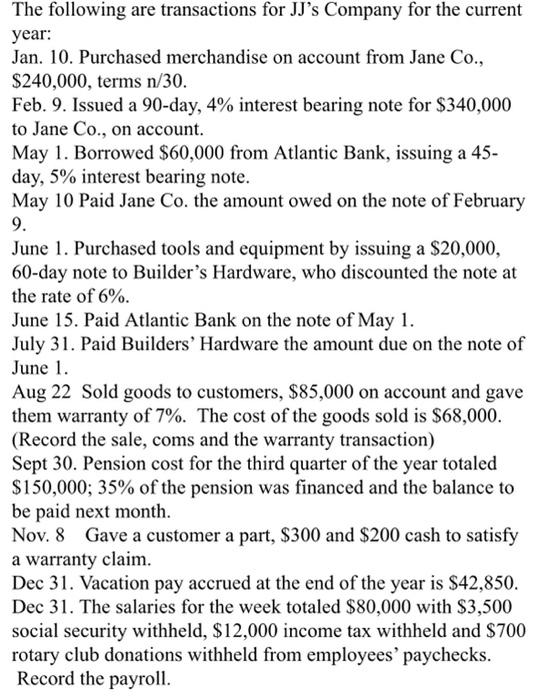

The following are transactions for JJ's Company for the current year: Jan. 10. Purchased merchandise on account from Jane Co., $240,000, terms n/30. Feb. 9. Issued a 90-day, 4% interest bearing note for $340,000 to Jane Co., on account. May 1. Borrowed $60,000 from Atlantic Bank, issuing a 45- day, 5% interest bearing note. May 10 Paid Jane Co. the amount owed on the note of February 9. June 1. Purchased tools and equipment by issuing a $20,000, 60-day note to Builder's Hardware, who discounted the note at the rate of 6%. June 15. Paid Atlantic Bank on the note of May 1. July 31. Paid Builders' Hardware the amount due on the note of June 1. Aug 22 Sold goods to customers, $85,000 on account and gave them warranty of 7%. The cost of the goods sold is $68,000. (Record the sale, coms and the warranty transaction) Sept 30. Pension cost for the third quarter of the year totaled $150,000; 35% of the pension was financed and the balance to be paid next month. Nov. 8 Gave a customer a part, $300 and $200 cash to satisfy a warranty claim. Dec 31. Vacation pay accrued at the end of the year is $42,850. Dec 31. The salaries for the week totaled $80,000 with $3,500 social security withheld, $12,000 income tax withheld and $700 rotary club donations withheld from employees' paychecks. Record the payroll Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started