Question

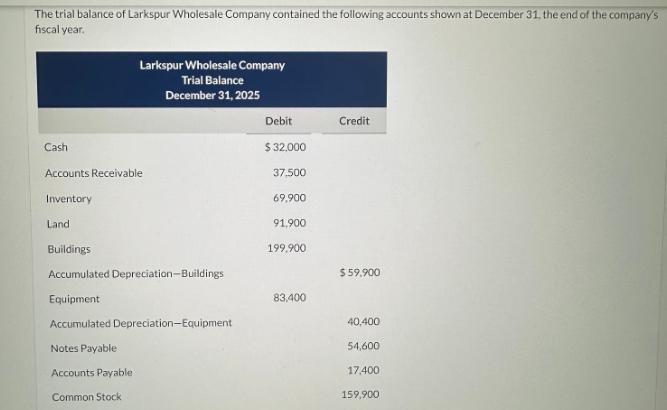

Journalize adjusting entries? The trial balance of Larkspur Wholesale Company contained the following accounts shown at December 31, the end of the company's fiscal year.

Journalize adjusting entries?

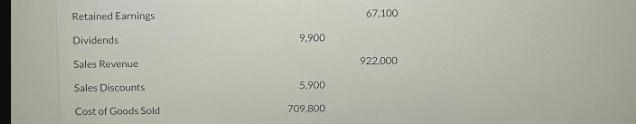

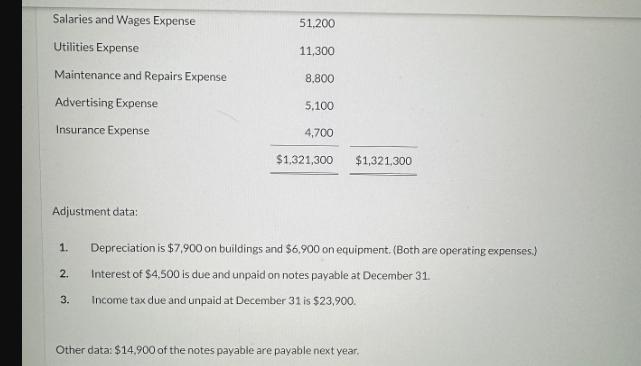

The trial balance of Larkspur Wholesale Company contained the following accounts shown at December 31, the end of the company's fiscal year. Cash Accounts Receivable Inventory Land Larkspur Wholesale Company Trial Balance December 31, 2025 Buildings Accumulated Depreciation Buildings Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Common Stock Debit $ 32,000 37,500 69,900 91,900 199.900 83,400 Credit $59,900 40,400 54,600 17,400 159,900

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries needed to properly adjust and close the accounts 1 Record depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

6th edition

1118096894, 978-1-11921511, 978-1118096895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App