Question

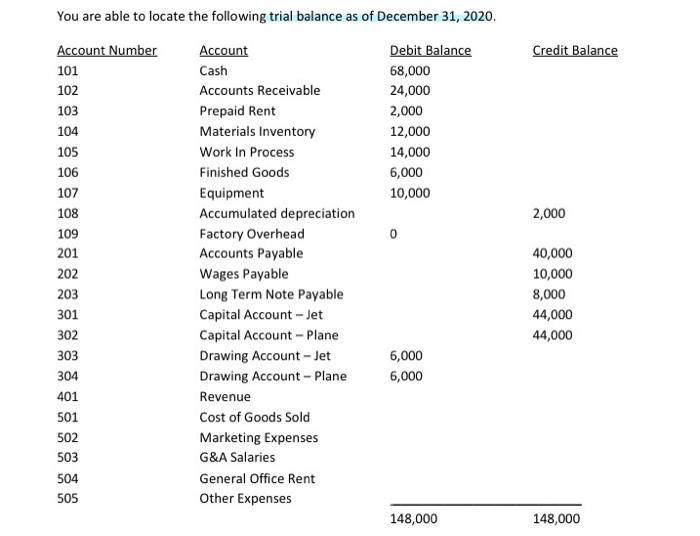

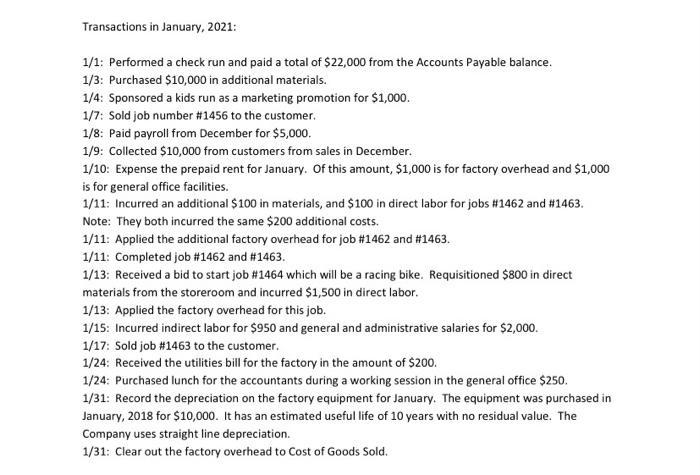

Journalize all the transactions for the month of January. You are able to locate the following trial balance as of December 31, 2020. Account Number

You are able to locate the following trial balance as of December 31, 2020. Account Number Account Debit Balance 101 Cash 68,000 102 Accounts Receivable 24,000 103 Prepaid Rent 2,000 104 Materials Inventory 12,000 105 Work In Process 14,000 106 Finished Goods 6,000 107 Equipment 10,000 108 Accumulated depreciation 109 Factory Overhead 201 Accounts Payable 202 Wages Payable 203 Long Term Note Payable Capital Account - Jet 301 302 Capital Account - Plane 303 Drawing Account - Jet 6,000 304 Drawing Account - Plane 6,000 401 Revenue 501 Cost of Goods Sold 502 Marketing Expenses 503 G&A Salaries 504 General Office Rent 505 Other Expenses 148,000 Credit Balance 2,000 40,000 10,000 8,000 44,000 44,000 148,000

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl warren, James Reeve, Jonathen Duchac, Sheila Elworthy,

Volume 1, 2nd canadian Edition

176509739, 978-0176509736, 978-0176509743

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App