journalize and post the adjusting entries for the month of january.

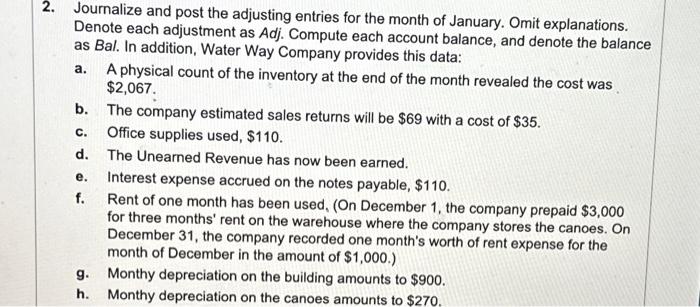

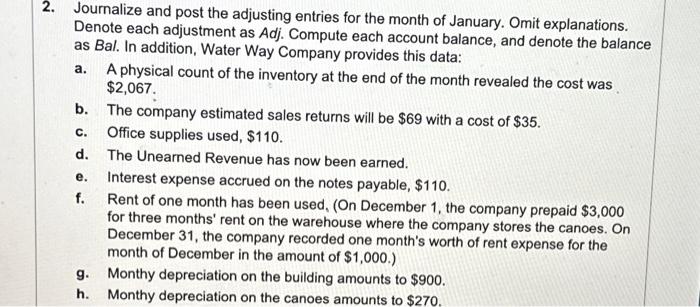

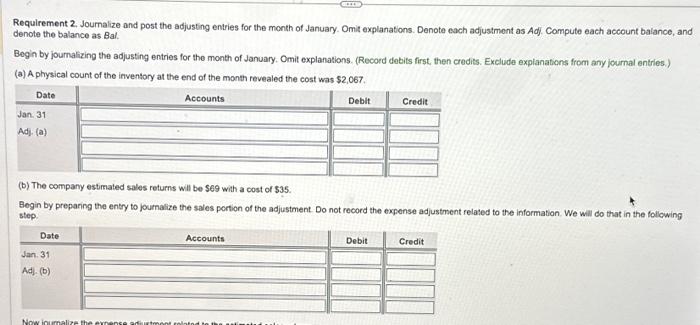

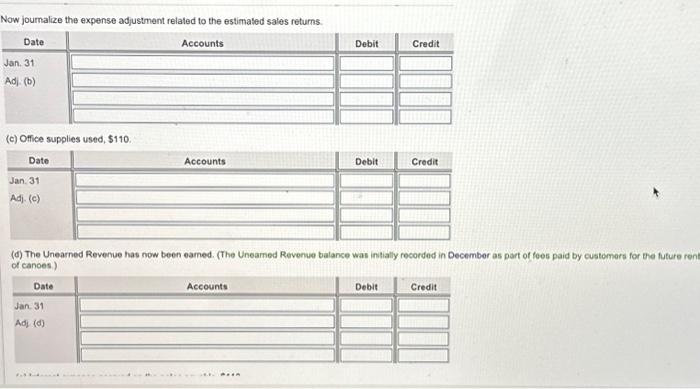

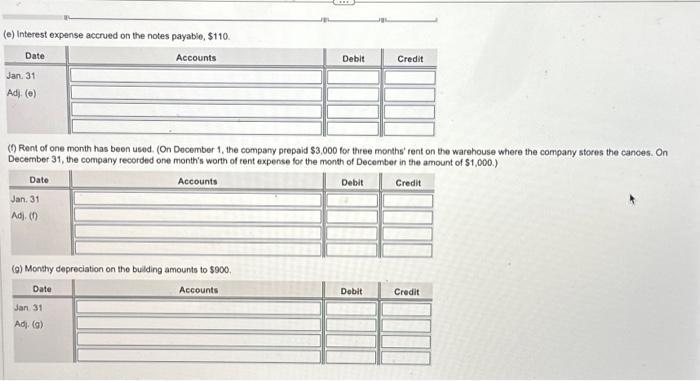

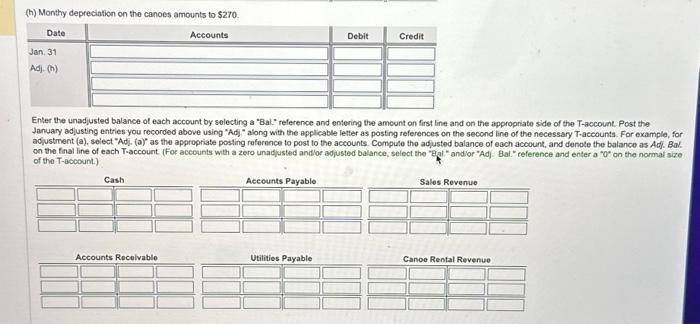

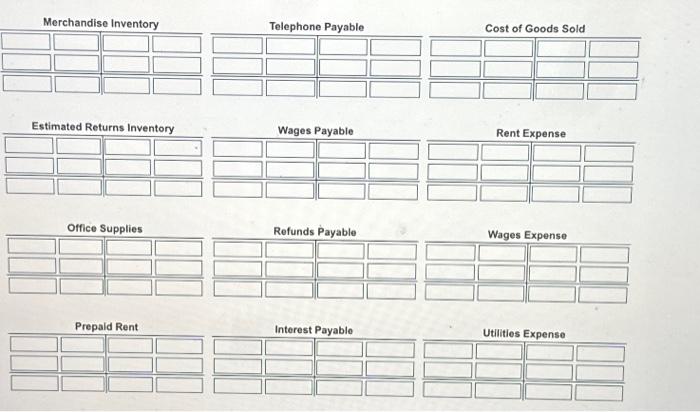

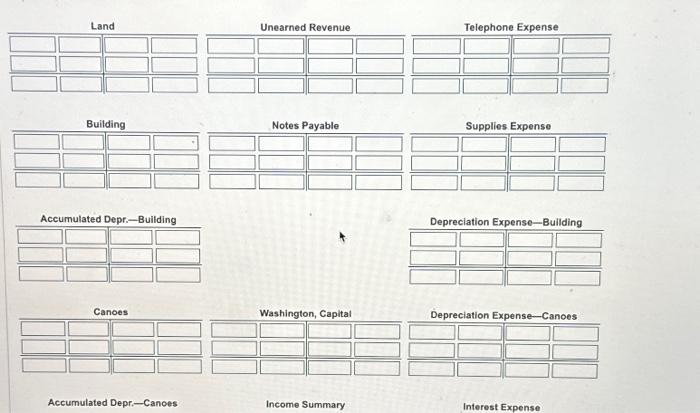

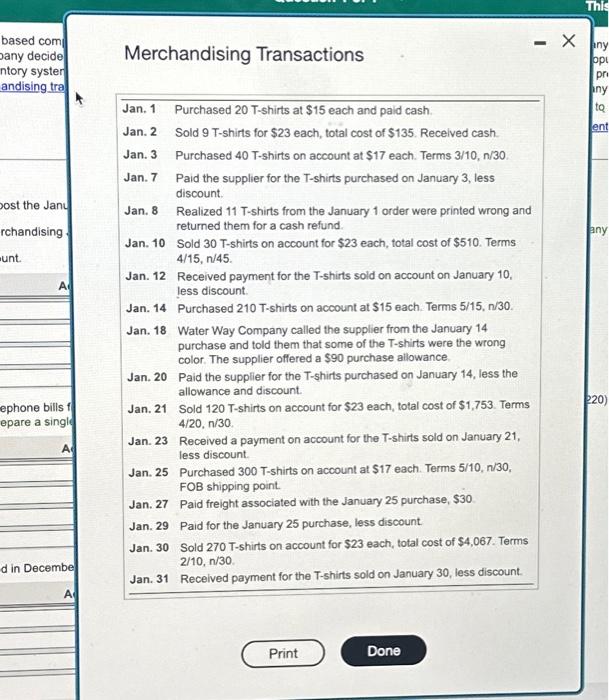

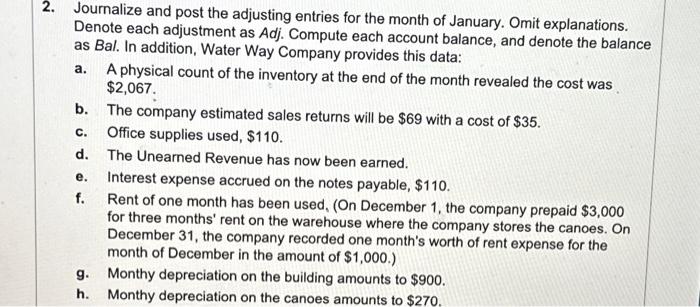

2. Journalize and post the adjusting entries for the month of January. Omit explanations. Denote each adjustment as Adj. Compute each account balance, and denote the balance as Bal. In addition, Water Way Company provides this data: a. A physical count of the inventory at the end of the month revealed the cost was $2,067. b. The company estimated sales returns will be $69 with a cost of $35. c. Office supplies used, $110. d. The Unearned Revenue has now been earned. e. Interest expense accrued on the notes payable, $110. f. Rent of one month has been used, (On December 1, the company prepaid $3,000 for three months' rent on the warehouse where the company stores the canoes. On December 31, the company recorded one month's worth of rent expense for the month of December in the amount of $1,000.) g. Monthy depreciation on the building amounts to $900. h. Monthy depreciation on the canoes amounts to $270. (e) Interest expense accrued on the notes payablo, \$110. (1) Rent of one month has been used. (On Docember 1, the Decernber 31, the company recorded one month's worth of (9) Monthy depreciation on the bulding amounts to $900. Merchandising Transactions Requirement 2. Journalize and post the adjusting entries for the month of January. Omit explanations. Denote each adjustment as Adj. Compute each account balance, and denote the balance as Bal. Begin by journalizing the adjusting entries for the month of January. Omit explanations. (Record debits first, then credits. Exclude explanations from any journal entries.) (a) A physical count of the inventory at the end of the month revealed the cost was $2,067. (b) The company estrinated sales returns will be $69 with a cost of $3.5. Begin by preparing the entry to journalize the sales portion of the adjustment. Do not record the expense adjustment related to the information. We will do that in the following. step. Now journalize the expense adjustment related to the estimated sales returns. Jar Ad (c) Office supplies used, $110. (h) Monthy depreciation on the canoes amounts to $270. Enter the unadjusted balance of each account by selecting a "Bal." reference and entering the amount on first line and on the appropriate side of the T-account. Post the January adjusting entries you recorded above using "Adj-" along with the applicable letter as posting references on the second line of the necessary T-accounts. For example, for adjustrnent (a), select "Adj. (a)" as the appropriate posting reference to post to the accounts. Compule the adfusted balance of each account, and denote the balance as Adj. Bav. on the final line of each T-account. (For accounts with a zero unadjusted andior adjusted balance, select the "Egl." andior "Adj). Bal." reference and enter a "O" on the normal size of the T-account.) Prepaid Rent Interest Payable Utilities Expense Unearned Revenue Building Accumulated Depr.-Building Canoes Notes Payable Telephone Expense Supplies Expense Depreciation Expenso-Bullding Washington, Capital Income Summary Interest Expense