Answered step by step

Verified Expert Solution

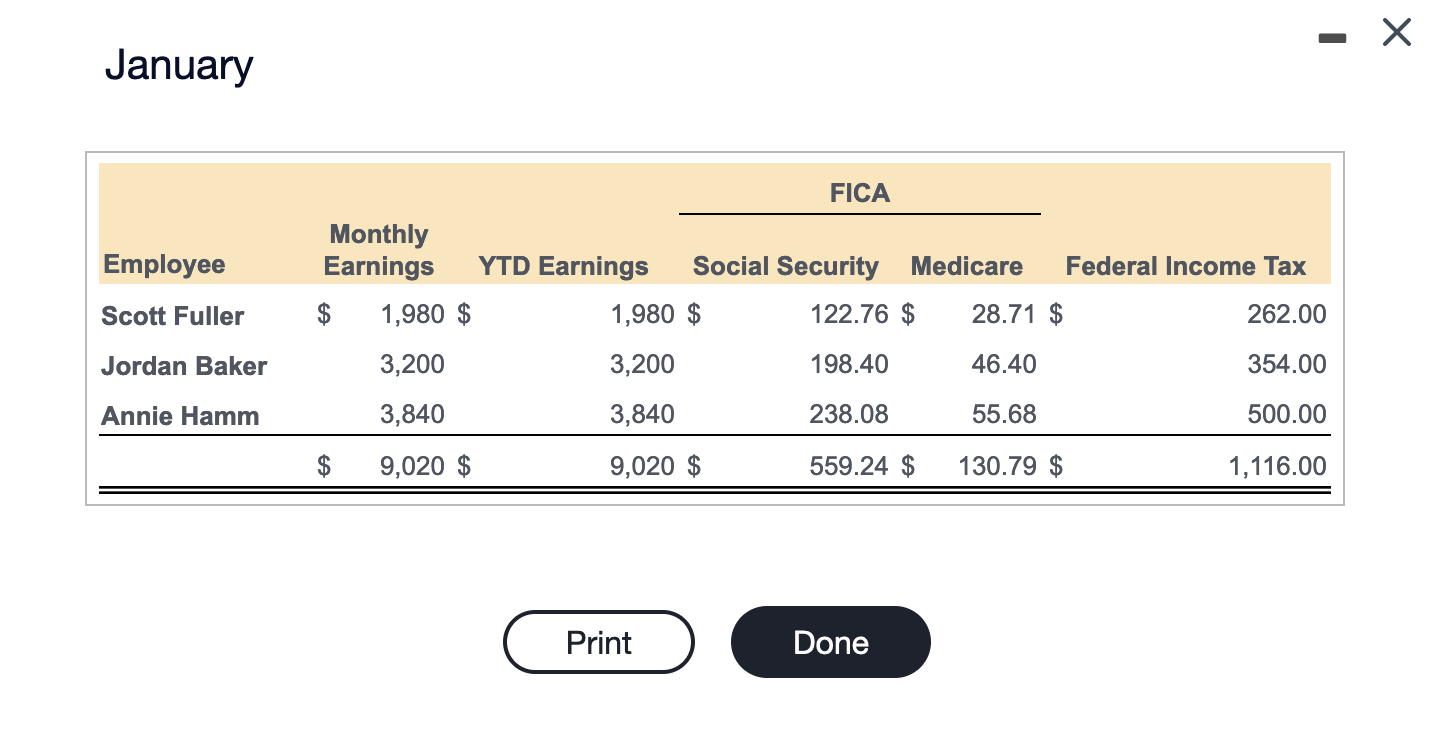

Question

1 Approved Answer

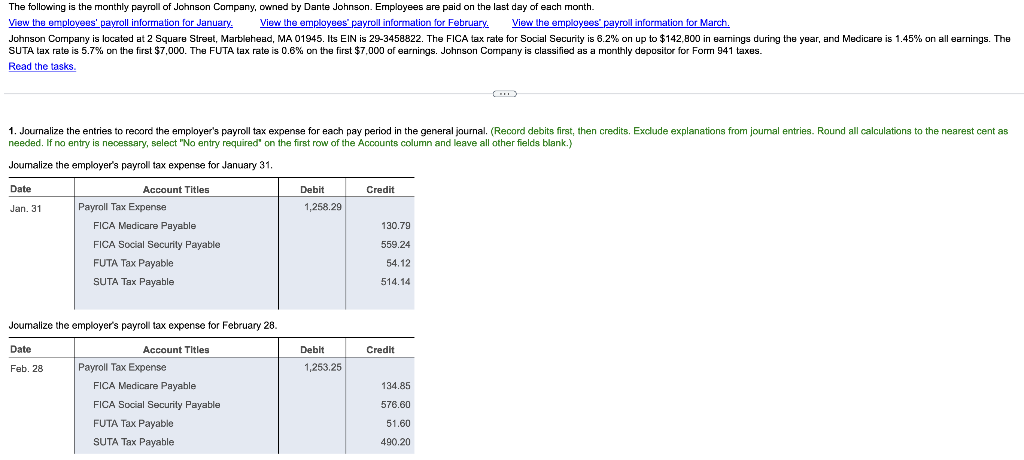

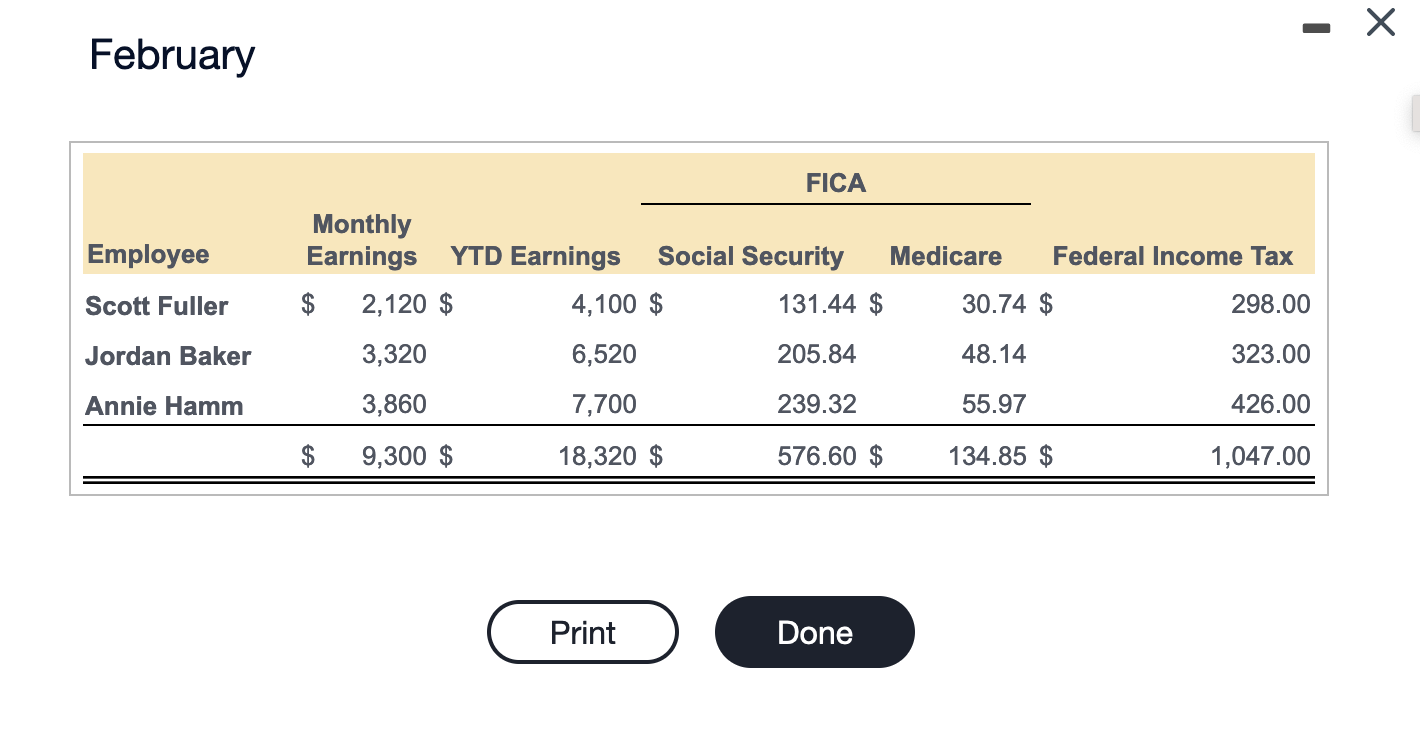

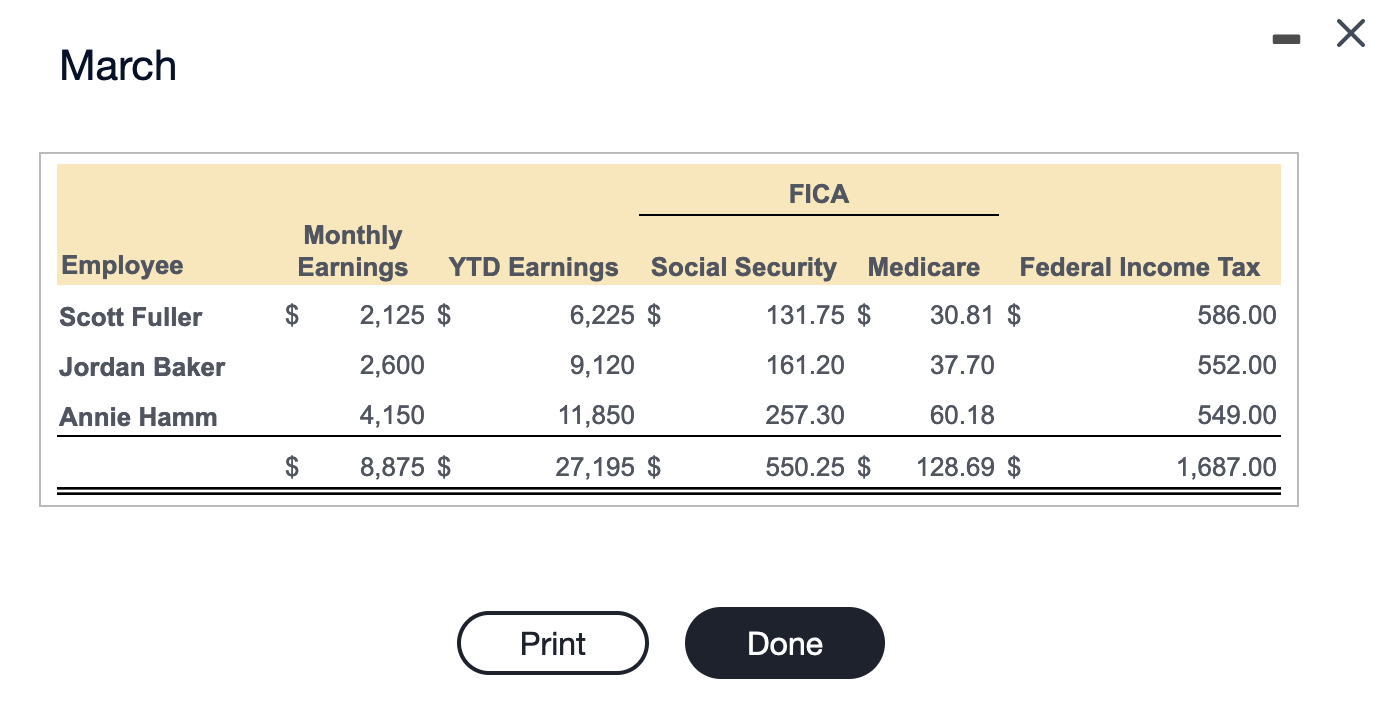

Journalize entries for the payment of each tax liability in the general journal. (Record debits first, then credits. Exclude explanations from journal entries. Round all

Journalize entries for the payment of each tax liability in the general journal. (Record debits first, then credits. Exclude explanations from journal entries. Round all calculations to the nearest cent as needed. If no entry is necessary, select "No entry required" on the first row of the Accounts column and leave all other fields blank.)

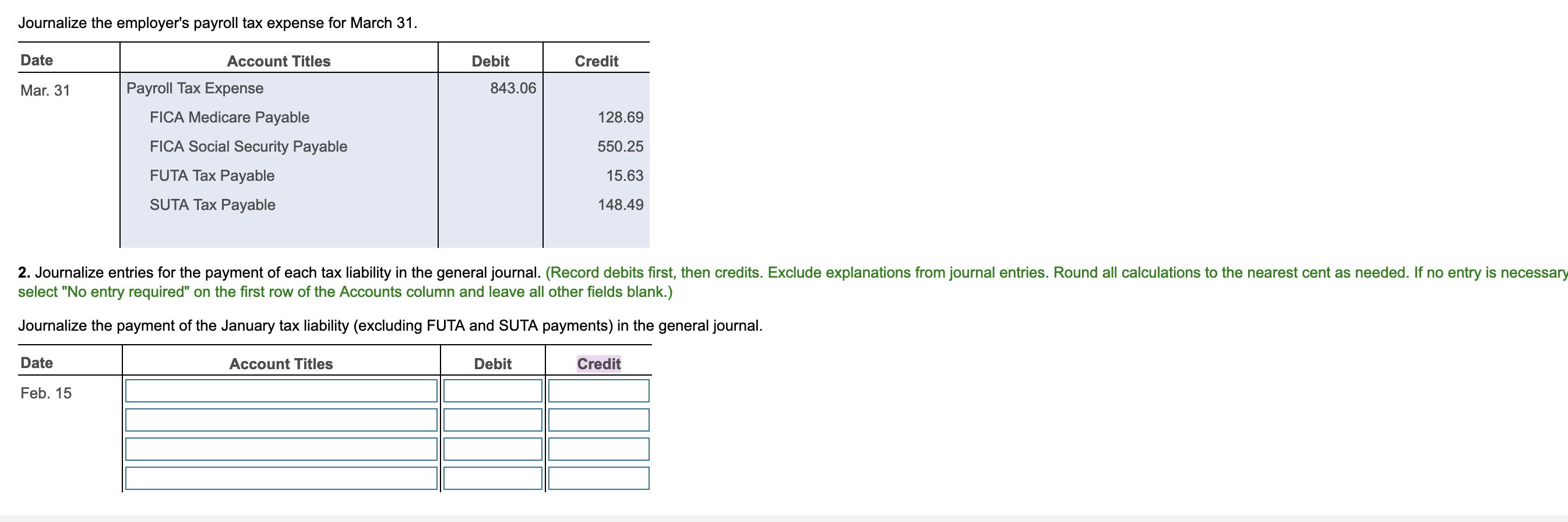

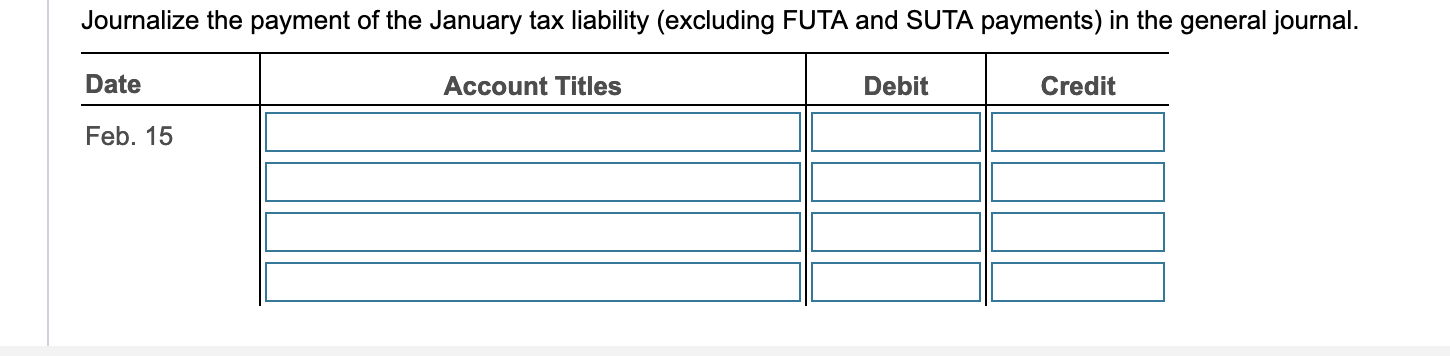

Journalize the payment of the January tax liability (excluding FUTA and SUTA payments) in the general journal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started