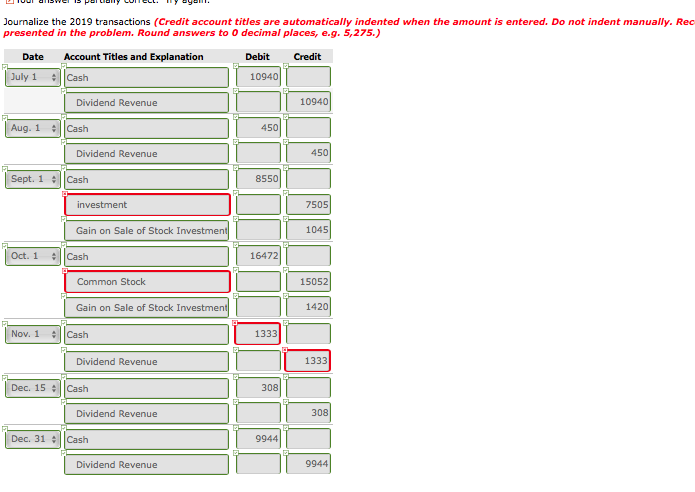

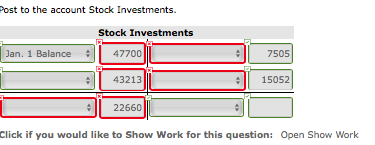

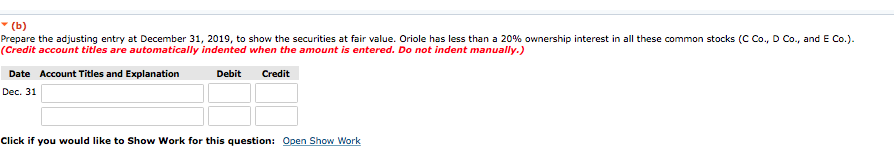

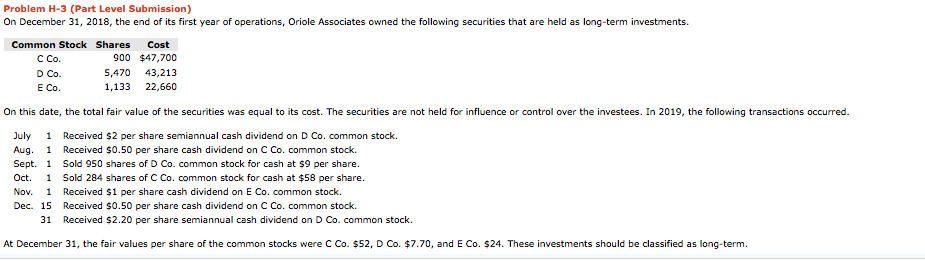

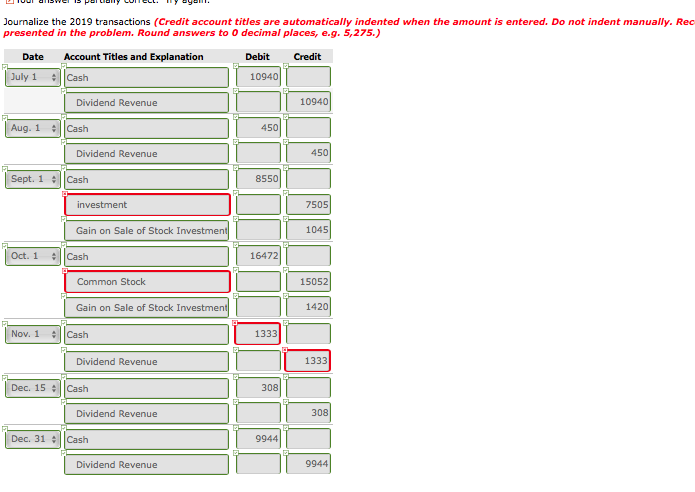

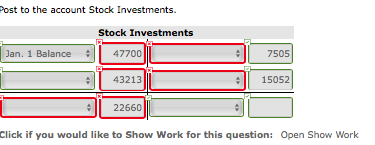

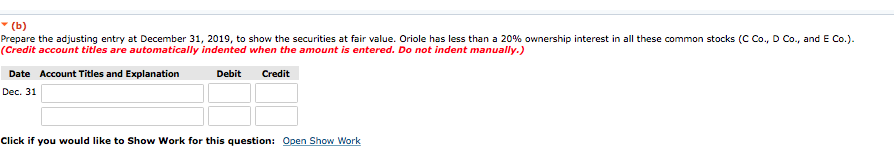

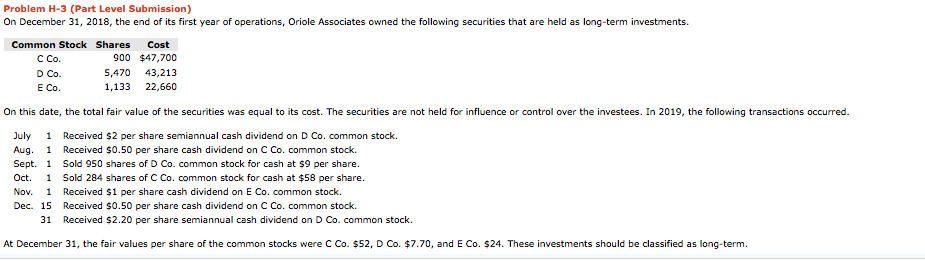

Journalize the 2019 transactions (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Rec presented in the problem. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Date Debit Credit Cash July 1 10940 10940 Dividend Revenue Cash Aug. 1 450 450 Dividend Revenue Sept. 1 Cash 8550 investment 7505 Gain on Sale of Stock Investment 1045 Cash Oct. 1 16472 Common Stock 15052 Gain on Sale of Stock Investment 1420 Cash Nov. 1 1333 1333 Dividend Revenue Dec. 15 lCash 308 308 Dividend Revenue Dec. 31 Cash 9944 9944 Dividend Revenue Post to the account Stock Investments Stock Investments Jan. 1 Balance 47700 7505 43213 15052 22660 Click if you would like to Show Work for this question: Open Show Work (b) Prepare the adjusting entry at December 31, 2019, to show the securities at fair value. Oriole has less than a 20 % ownership interest in all these common stocks (C Co., D Co., and E Co.). (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Click if you would like to Show Work for this question: Open Show Work Problem H-3 (Part Level Submission) On December 31, 2018, the end of its first year of operations, Oriole Associates owned the following securities that are held as long-term investments Cost Common Stock Shares C Co. 900 $47,700 43,213 5,470 D Co. E Co 1,133 22,660 On this date, the total fair value of the securities was equal to its cost. The securities are not held for influence or control over the investees. In 2019, the following transactions occurred. July 1 Received $2 per share semiannual cash dividend on D Co. common stock. Aug 1 Received $0.50 per share cash dividend on C Co. common stock. Sept. 1 Sold 950 shares of D Co. common stock for cash at $9 per share. Oct 1 Sold 284 shares of C Co. common stock for cash at $58 per share. Nov 1 Received $1 per share cash dividend on E Co. common stock. Dec. 15 Received $0.50 per share cash dividend on C Co. common stock. Received $2.20 per share semiannual cash dividend on D Co. common stock. 31 At December 31, the fair values per share of the common stocks were C Co. $52, D Co. $7.70, and E Co. $24. These investments should be classified as long-term