Question

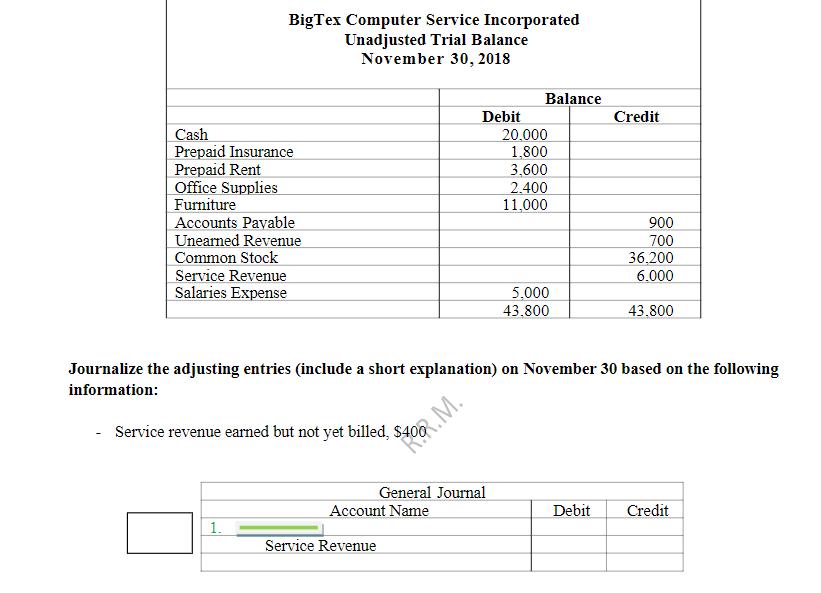

Journalize the adjusting entries BigTex Computer Service Incorporated Unadjusted Trial Balance November 30, 2018 Cash Prepaid Insurance Prepaid Rent Office Supplies Furniture Accounts Payable Unearned

Journalize the adjusting entries

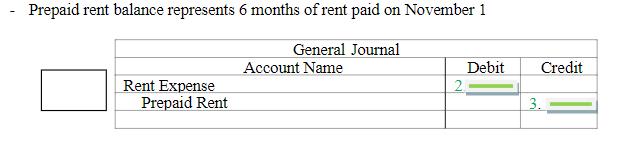

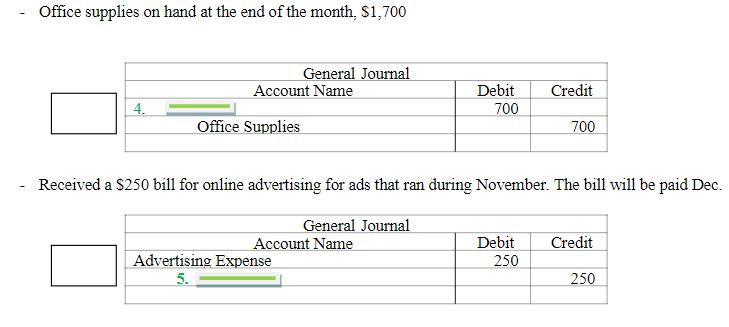

BigTex Computer Service Incorporated Unadjusted Trial Balance November 30, 2018 Cash Prepaid Insurance Prepaid Rent Office Supplies Furniture Accounts Payable Unearned Revenue Common Stock Service Revenue Salaries Expense 1. Debit Account Name Service Revenue General Journal Balance 20.000 1,800 3.600 2.400 11,000 5.000 43.800 Credit Journalize the adjusting entries (include a short explanation) on November 30 based on the following information: - Service revenue earned but not yet billed, $400,. M. 900 700 36,200 6.000 43.800 Debit Credit

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial And Managerial Accounting The Financial Chapters

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

6th Edition

978-0134486840, 134486838, 134486854, 134486846, 9780134486833, 978-0134486857

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App