Answered step by step

Verified Expert Solution

Question

1 Approved Answer

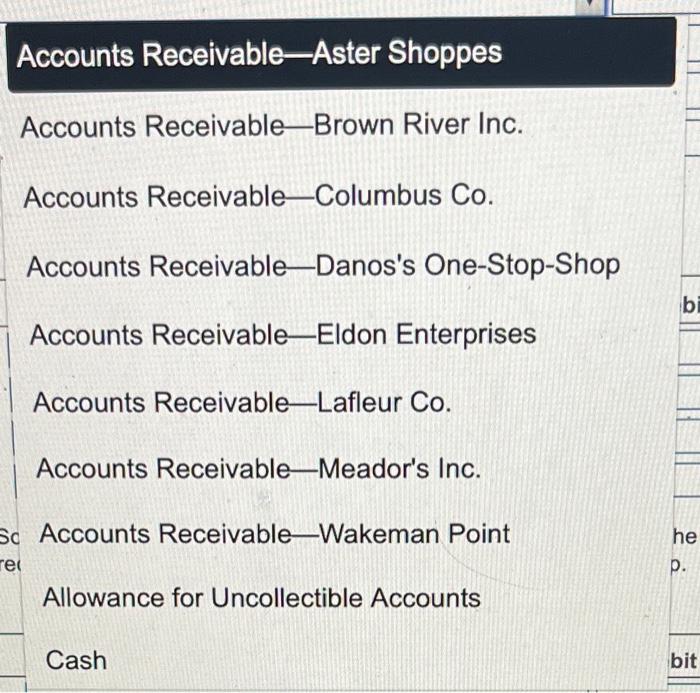

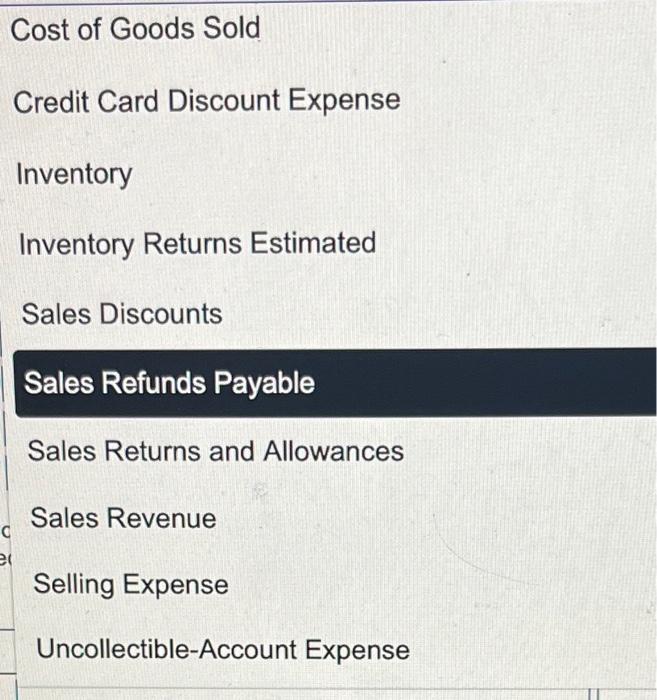

Journalize the entries and then calculate the net realizable value of accounts receivable as of Nov. 30. there are selections of the accounts in the

Journalize the entries and then calculate the net realizable value of accounts receivable as of Nov. 30. there are selections of the accounts in the screenshots.

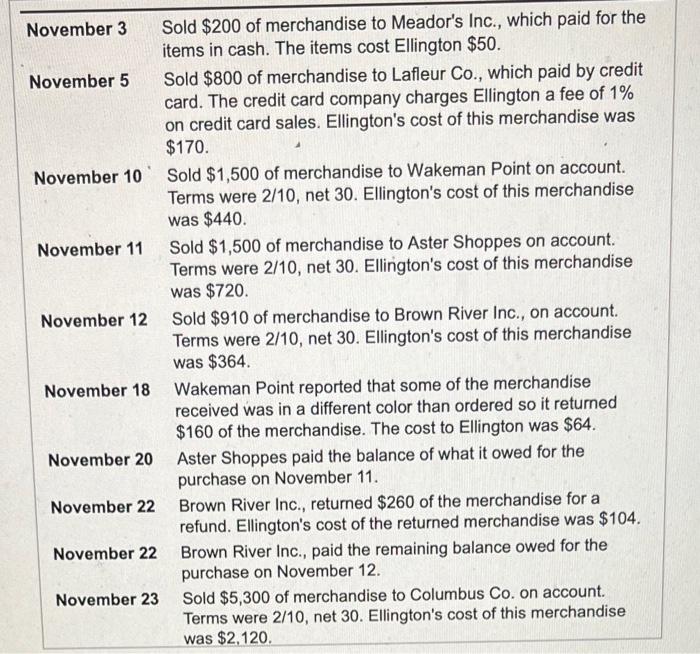

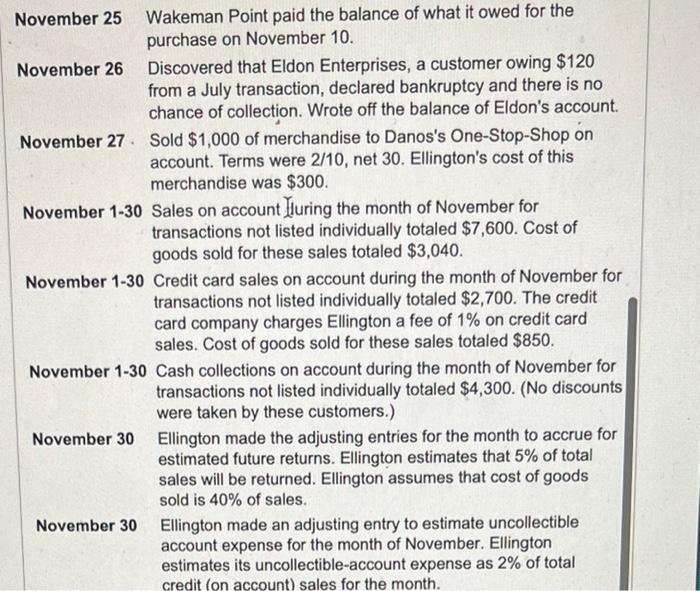

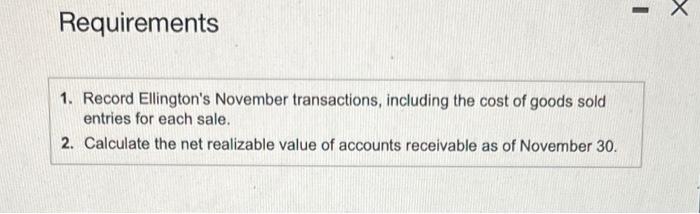

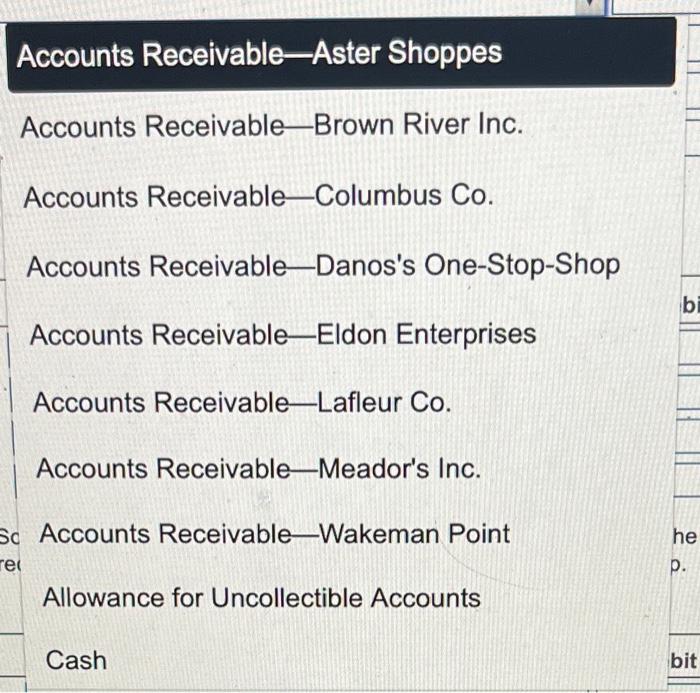

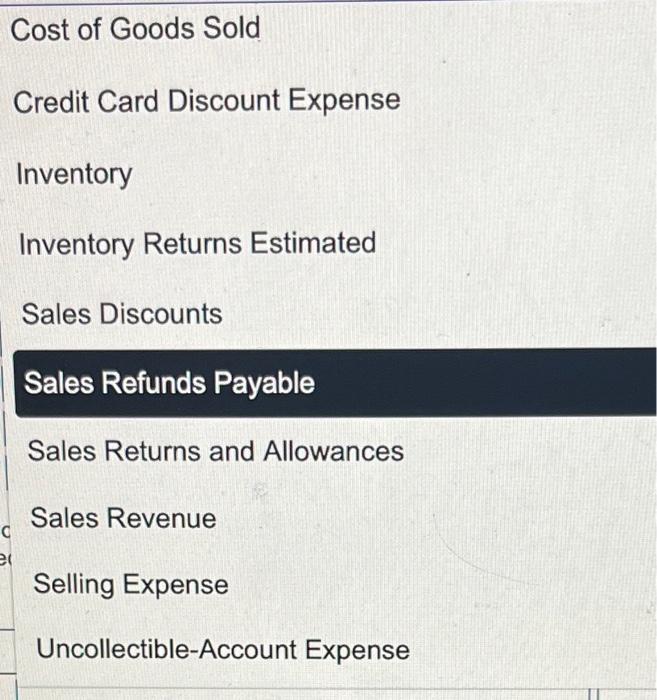

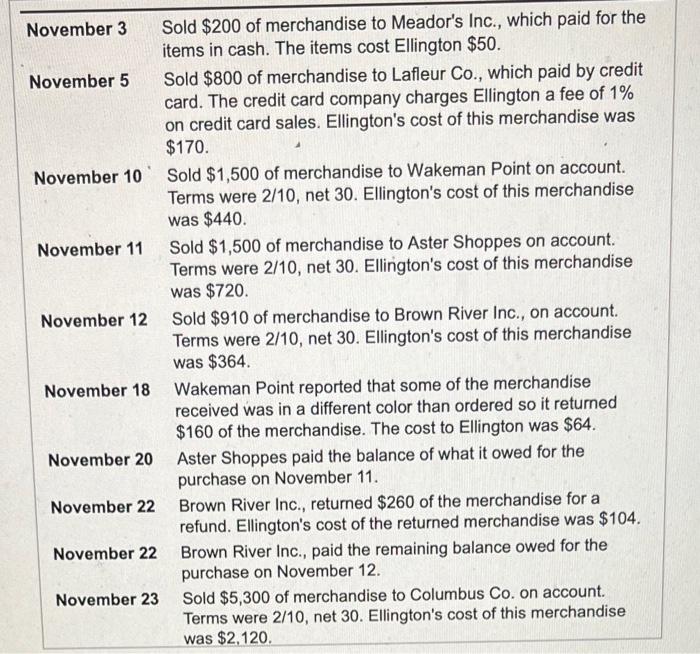

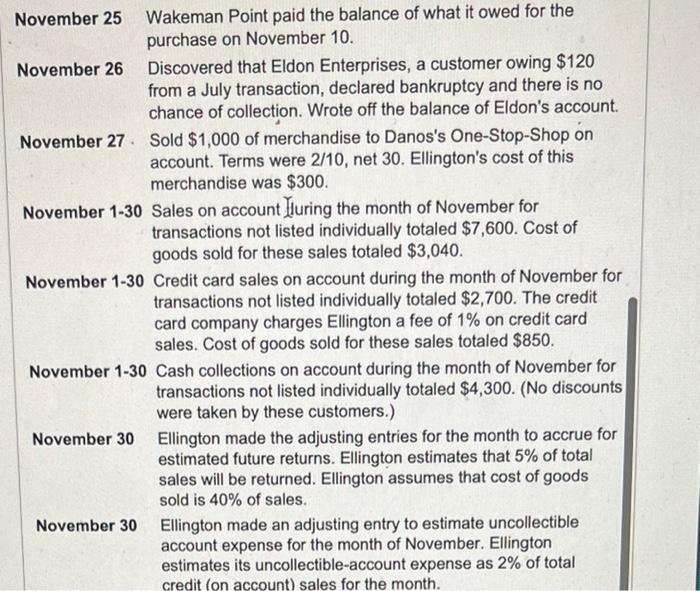

November 25 Wakeman Point paid the balance of what it owed for the purchase on November 10. November 26 Discovered that Eldon Enterprises, a customer owing $120 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Eldon's account. November 27 . Sold $1,000 of merchandise to Danos's One-Stop-Shop on account. Terms were 2/10, net 30 . Ellington's cost of this merchandise was $300. November 1-30 Sales on account Tluring the month of November for transactions not listed individually totaled $7,600. Cost of goods sold for these sales totaled $3,040. November 1-30 Credit card sales on account during the month of November for transactions not listed individually totaled $2,700. The credit card company charges Ellington a fee of 1% on credit card sales. Cost of goods sold for these sales totaled $850. November 1-30 Cash collections on account during the month of November for transactions not listed individually totaled $4,300. (No discounts were taken by these customers.) November 30 Ellington made the adjusting entries for the month to accrue for estimated future returns. Ellington estimates that 5% of total sales will be returned. Ellington assumes that cost of goods sold is 40% of sales. November 30 Ellington made an adjusting entry to estimate uncollectible account expense for the month of November. Ellington estimates its uncollectible-account expense as 2% of total credit (on account) sales for the month. Requirements 1. Record Ellington's November transactions, including the cost of goods sold entries for each sale. 2. Calculate the net realizable value of accounts receivable as of November 30 . Accounts Receivable-Brown River Inc. Accounts Receivable-Columbus Co. Accounts Receivable-Danos's One-Stop-Shop Accounts Receivable-Eldon Enterprises Accounts Receivable-Lafleur Co. Accounts Receivable-Meador's Inc. Accounts Receivable-Wakeman Point Allowance for Uncollectible Accounts Cash Cost of Goods Sold Credit Card Discount Expense Inventory Inventory Returns Estimated Sales Discounts Sales Refunds Payable Sales Returns and Allowances Sales Revenue Selling Expense Uncollectible-Account Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started