Answered step by step

Verified Expert Solution

Question

1 Approved Answer

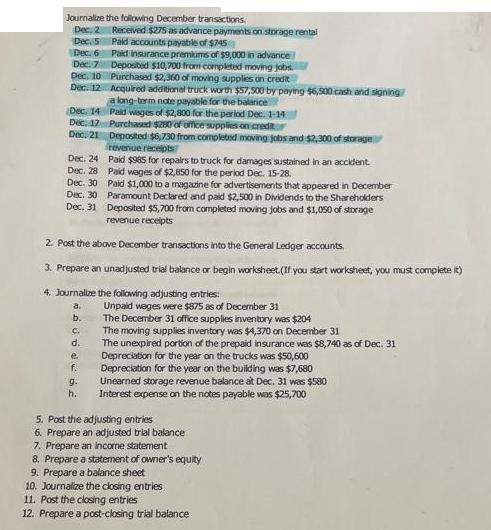

Journalize the following December transactions. Dec. 2 Dec. 5 Dec. 6 Dec. 7 Dec. 10 Dec. 12 Dec. 14 Dec. 17 Dec. 21 Dec.

Journalize the following December transactions. Dec. 2 Dec. 5 Dec. 6 Dec. 7 Dec. 10 Dec. 12 Dec. 14 Dec. 17 Dec. 21 Dec. 24 Dec. 28 Dec. 30 Dec. 30 Dec. 31 C. d. e f. Received $275 as advance payments on storage rental Pald accounts payable of $745 Paid insurance premiums of $9,000 in advance Deposited $10,700 from completed moving jobs. Purchased $2,360 of moving supplies on credit Acquired additional truck worth $57,500 by paying $6,500 cash and signing/ a long-term note payable for the balance 2. Post the above December transactions into the General Ledger accounts. 3. Prepare an unadjusted trial balance or begin worksheet (If you start worksheet, you must complete it) 4. Journalize the following adjusting entries: a. b. g. h. Paid wages of $2,800 for the period Dec. 1-14 Purchased $280 of office supplies on credit Deposited $6,730 from completed moving jobs and $2,300 of storage revenue receipts Paid $985 for repairs to truck for damages sustained in an accident. Paid wages of $2,850 for the period Dec. 15-28. Paid $1,000 to a magazine for advertisements that appeared in December Paramount Declared and paid $2,500 in Dividends to the Shareholders Deposited $5,700 from completed moving jobs and $1,050 of storage revenue receipts Unpaid wages were $875 as of December 31 The December 31 office supplies inventory was $204 The moving supplies inventory was $4,370 on December 31 The unexpired portion of the prepaid insurance was $8,740 as of Dec. 31 Depreciation for the year on the trucks was $50,600 Depreciation for the year on the building was $7,680 Unearned storage revenue balance at Dec. 31 was $580 Interest expense on the notes payable was $25,700 5. Post the adjusting entries 6. Prepare an adjusted trial balance 7. Prepare an income statement 8. Prepare a statement of owner's equity 9. Prepare a balance sheet 10. Journalize the closing entries 11. Post the closing entries 12. Prepare a post-closing trial balance

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets break down the transactions and steps Journal Entries for December Transactions Dec 2 Received 275 as advance payments on storage rental Debit Cash 275 Credit Unearned Revenue 275 Dec 5 Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started