Answered step by step

Verified Expert Solution

Question

1 Approved Answer

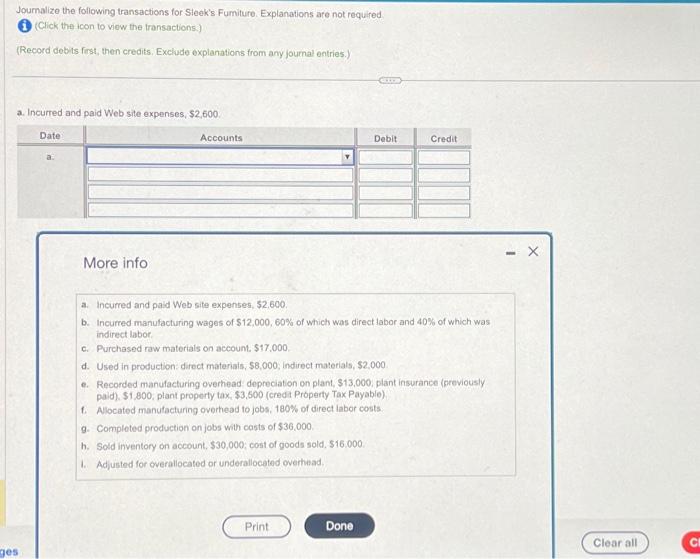

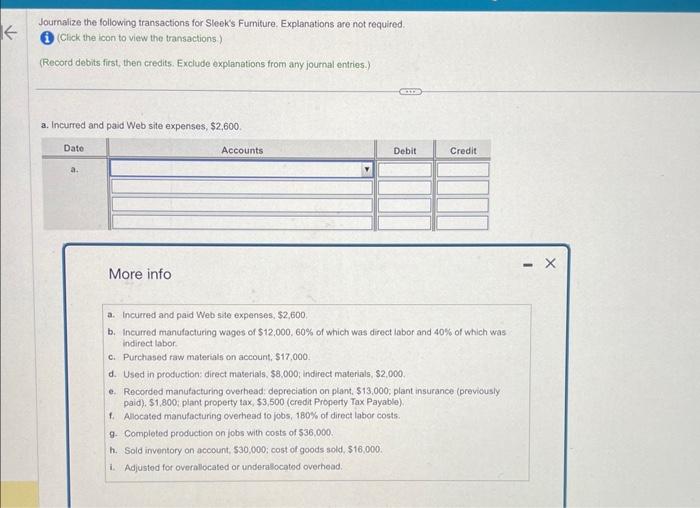

Journalize the following transactions for Sleek's Furniture. Explanations are not required. (Click the icon to view the transactions.) (Record debits first, then credits. Exclude explanations

Journalize the following transactions for Sleek's Furniture. Explanations are not required. (Click the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from any journal entries.) a. Incurred and paid Web site expenses, $2,600. ges Date a. More info Accounts g. Completed production on jobs with costs of $36,000. h. Sold inventory on account, $30,000; cost of goods sold, $16,000. 1. Adjusted for overallocated or underallocated overhead. COD a. Incurred and paid Web site expenses, $2,600. b. Incurred manufacturing wages of $12,000, 60% of which was direct labor and 40% of which was indirect labor. c. Purchased raw materials on account, $17,000. Print Debit d. Used in production: direct materials, $8,000; indirect materials, $2,000. e. Recorded manufacturing overhead: depreciation on plant, $13,000; plant insurance (previously paid), $1,800; plant property tax, $3,500 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 180% of direct labor costs. Done Credit X Clear all CI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started