journalize the journal, Bank Reconillation and Balance Sheet given by the photos listed

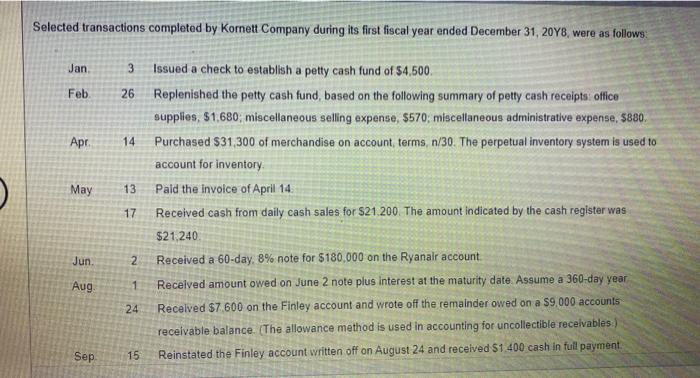

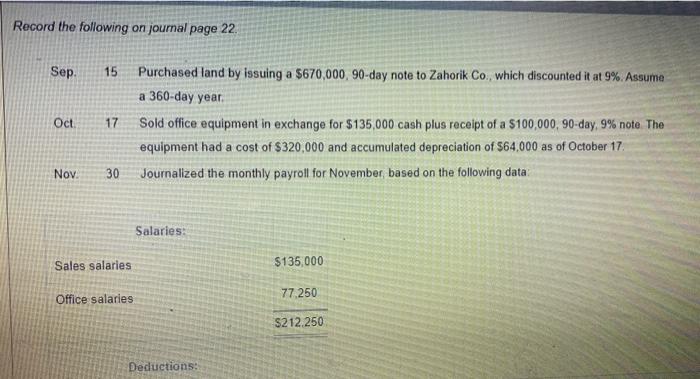

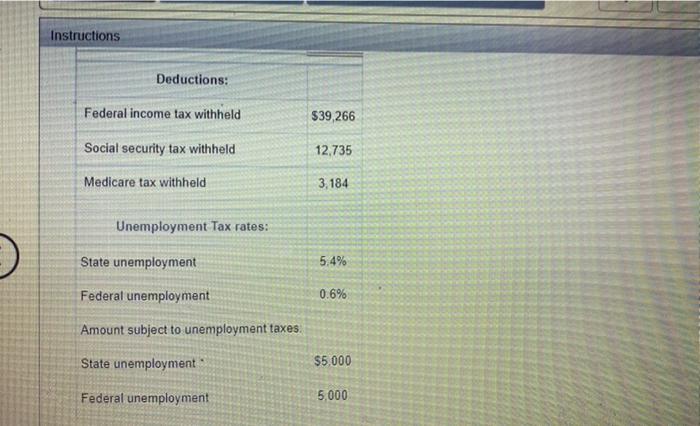

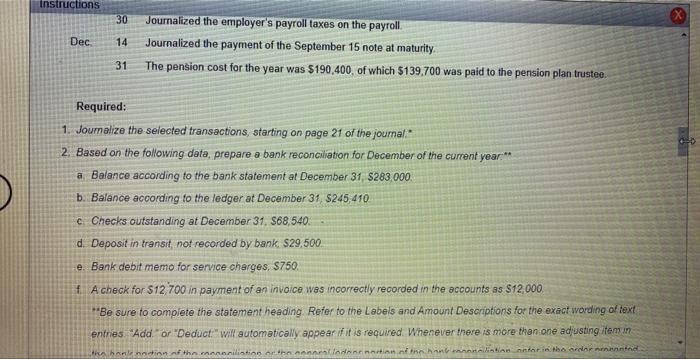

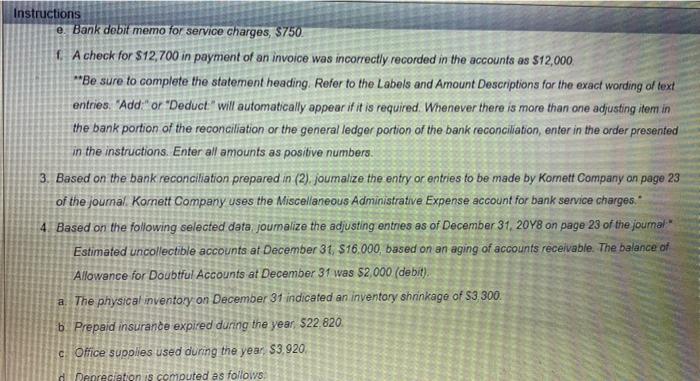

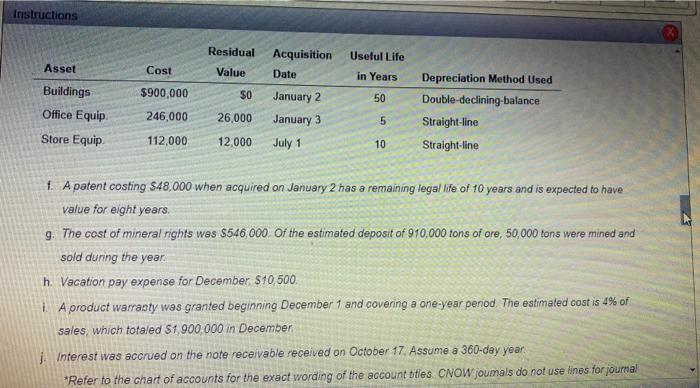

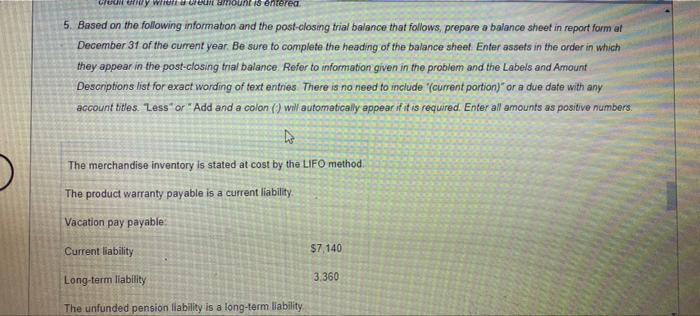

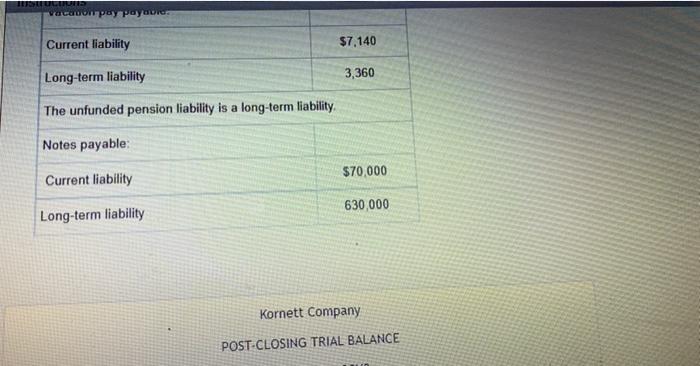

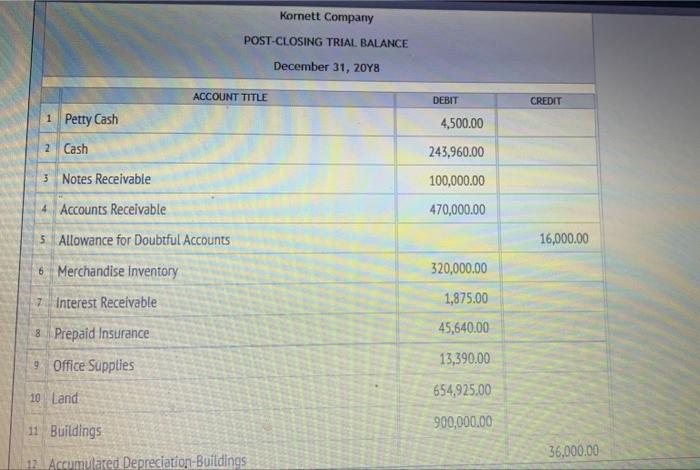

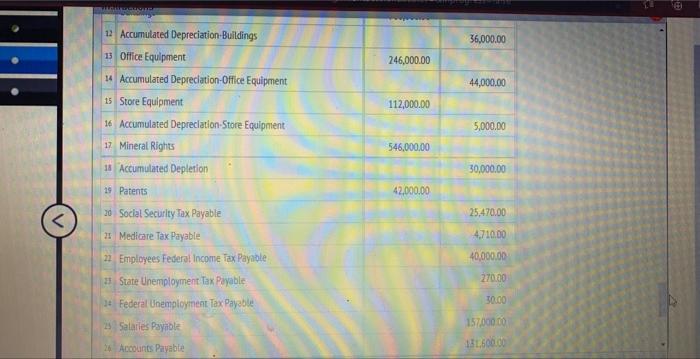

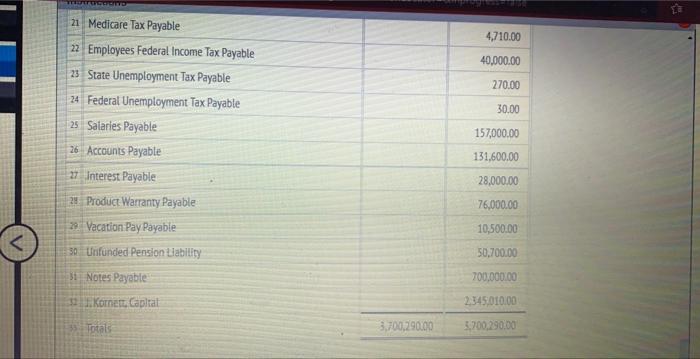

Selected transactions completed by Kornett Company during its first fiscal year ended December 31,20 Y 8 , were as follows: Jan. 3 Issued a check to establish a petty cash fund of $4,500. Feb. 26 Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, \$1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Apr. 14 Purchased $31,300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory. May 13 Paid the invoice of April 14. 17 Received cash from daily cash sales for $21.200. The amount indicated by the cash register was $21,240. Jun. 2 Received a 60 -day, 8% note for $180,000 on the Ryanair account. Aug. 1 Recelved amount owed on June 2 note plus interest at the maturity date. Assume a 360 -day year 24 Recelved $7.600 on the Finley account and wrote off the remainder owed on a $9.000 accounts: recelvable balance. (The allowance method is used in accounting for uncollectible receivables: Sep. 15 Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Record the following on journal page 22 . Sep. 15 Purchased land by issuing a $670,000,90-day note to Zahorik C0, which discounted it at 9%. Assume a 360-day year. Oct. 17 Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000,90-day, 9% note. The equipment had a cost of $320,000 and accumulated depreciation of $64,000 as of October 17 . Nov. 30 Journalized the monthly payroll for November, based on the following data: Salaries: Instructions \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Deductions: } \\ \hline Federal income tax withheld & $39,266 \\ \hline Social security tax withheld & 12,735 \\ \hline Medicare tax withheld & 3,184 \\ \hline \end{tabular} Unemployment Tax rates: \begin{tabular}{l|l} State unemployment & 5.4% \\ Federal unemployment & 0.6% \end{tabular} Amount subject to unemployment taxes. State unemployment : $5.000 Federal unemployment 5,000 30 Journalized the employer's payroll taxes on the payroll. Dec. 14 Journalized the payment of the September 15 note at maturity. 31 The pension cost for the year was $190,400. of which $139,700 was paid to the pension plan trustee. Required: 1. Joumalize the selected transactions, starting on page 21 of the joumal: 2. Based on the following data, prepare a bank reconciliation for December of the current year." a. Balance according to the bank statement at December 31,$283,000. b. Balance according to the ledger at December 31,$245,410 c. Checks outstanding at December 31,$68,540. d. Deposit in transit, not recorded by bank, $29,500 e. Bank debit memo for senvice charges, $750. f. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. "Be sure to complete the statement heading Refer to the Labels and Amount Descriptions for the exact warding of fext entres "Add." or "Deduct:" Will automatically appear if it is required. Whenever there is more then one adjusting item in e. Bank debit memo for service charges, $750 f. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounfs as $12,000 "Be sure to complete the statement heading. Refer to the Labels and Amount Descriptions for the exact wording of text entries. "Add:" or "Deduct" "Will automatically appear if it is required. Whenever there is more than one adjusting item in the bank portion of the reconciliation or the general ledger portion of the bank reconciliation, enter in the order presented in the instructions. Enter all amounts as positive numbers. 3. Based on the bank reconciliation prepared in (2). joumalize the entry or entries to be made by Komett Company an page 23 of the joumal. Kornett Company uses the Miscellaneous Administrative Expense account for bank senvice charges." 4. Based on the following selected data joumalize the adjusting entries as of December 31,20 Y 8 on page 23 of the joumal " Estimated uncollectible accounts at December 31,$16,000, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was $2,000 (debit). a. The physical inventoy on December 31 indicated an inventory shninkage of $3,300. b Prepaid insurance expired during the year, $22,820. c. Ofice sypolies used during the year, \$3,920. f. A patent costing $48,000 when acquired on January 2 has a remaining legal life of 10 years and is expected to have value for eight years. 9. The cost of mineral rights was $546,000. Of the estimated deposit of 910,000 tons of ore, 50,000 tons were mined and sold during the year. h. Vacation pay expense for December, $10,500 1. A product warranty was granted beginning December 1 and covering a one-year period. The estimated cost is 4% of sales, which totaled $1,900,000 in December. j. Interest was accrued on the note receivable received on October 17 . Assume a 360-day year. "Refer to the chart of accounts for the exact wording of the account tifes. CNOW joumals do not use lines for journal 5. Based on the following information and the post-closing trial balance that follows, prepare a balance sheet in report form at December 31 of the current year. Be sure to complete the heading of the balance sheet. Enter assets in the arder in which they appear in the post-closing trial balance. Refer to information given in the probiem and the Labels and Amount Descriptions list for exact wording of text entries. There is no need to include "(current portion)" or a due date with any account tites. Less" or " Add and a colon (?) Will automatically appear if it is required. Enter all amounts as positive numbers. \begin{tabular}{|l|l|} \hline Current liability & $7,140 \\ \hline Long-term liability & 3,360 \\ \hline \end{tabular} The unfunded pension liability is a long-term liability. Notes payable: Current liability Long-term liability 630,000 Kornett Company POST.CLOSING TRIAL BALANCE \begin{tabular}{|l} \hline \end{tabular} 9 Office Supplies 10 Land 654,925,00 11 Buildings 900,000.00 12 Accumulared Depreciation-Buildings 36,000.00 12 Accumulated Depreciation-Buildings 13 Ofilice Equipment- 14 Accumulated Depreciation-Office Equipment 15 Store Equipment 16 Accumulated Depreclation-Store Equipnient 17. Mineral Rights is Accumulated Depletion 19 Patents 20 Sociat Security Tax Payable is Mediore Tax Payable a Employees Federol income Tax Payatole if State Unemployment Tax Pyable 14 Federal Unemploymeat Tax Payable 23) Salarles Payiole 25.470.004.710.0040,000.00270.0030.00 26. Accounts Payabte 21 Medicare Tax Payable 22 Employees Federal Income Tax Payable 23 State Unemployment Tax Payable 24 Federal Unemployment Tax Payable 25 Saiaries Payable 26 Accounts Payable 4,710.00 40,000.00 270.00 30,00 157,000.00 131,600.00 28,000.00 76,000.00 29. Vacation Pay Payable Selected transactions completed by Kornett Company during its first fiscal year ended December 31,20 Y 8 , were as follows: Jan. 3 Issued a check to establish a petty cash fund of $4,500. Feb. 26 Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, \$1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Apr. 14 Purchased $31,300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory. May 13 Paid the invoice of April 14. 17 Received cash from daily cash sales for $21.200. The amount indicated by the cash register was $21,240. Jun. 2 Received a 60 -day, 8% note for $180,000 on the Ryanair account. Aug. 1 Recelved amount owed on June 2 note plus interest at the maturity date. Assume a 360 -day year 24 Recelved $7.600 on the Finley account and wrote off the remainder owed on a $9.000 accounts: recelvable balance. (The allowance method is used in accounting for uncollectible receivables: Sep. 15 Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Record the following on journal page 22 . Sep. 15 Purchased land by issuing a $670,000,90-day note to Zahorik C0, which discounted it at 9%. Assume a 360-day year. Oct. 17 Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000,90-day, 9% note. The equipment had a cost of $320,000 and accumulated depreciation of $64,000 as of October 17 . Nov. 30 Journalized the monthly payroll for November, based on the following data: Salaries: Instructions \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Deductions: } \\ \hline Federal income tax withheld & $39,266 \\ \hline Social security tax withheld & 12,735 \\ \hline Medicare tax withheld & 3,184 \\ \hline \end{tabular} Unemployment Tax rates: \begin{tabular}{l|l} State unemployment & 5.4% \\ Federal unemployment & 0.6% \end{tabular} Amount subject to unemployment taxes. State unemployment : $5.000 Federal unemployment 5,000 30 Journalized the employer's payroll taxes on the payroll. Dec. 14 Journalized the payment of the September 15 note at maturity. 31 The pension cost for the year was $190,400. of which $139,700 was paid to the pension plan trustee. Required: 1. Joumalize the selected transactions, starting on page 21 of the joumal: 2. Based on the following data, prepare a bank reconciliation for December of the current year." a. Balance according to the bank statement at December 31,$283,000. b. Balance according to the ledger at December 31,$245,410 c. Checks outstanding at December 31,$68,540. d. Deposit in transit, not recorded by bank, $29,500 e. Bank debit memo for senvice charges, $750. f. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. "Be sure to complete the statement heading Refer to the Labels and Amount Descriptions for the exact warding of fext entres "Add." or "Deduct:" Will automatically appear if it is required. Whenever there is more then one adjusting item in e. Bank debit memo for service charges, $750 f. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounfs as $12,000 "Be sure to complete the statement heading. Refer to the Labels and Amount Descriptions for the exact wording of text entries. "Add:" or "Deduct" "Will automatically appear if it is required. Whenever there is more than one adjusting item in the bank portion of the reconciliation or the general ledger portion of the bank reconciliation, enter in the order presented in the instructions. Enter all amounts as positive numbers. 3. Based on the bank reconciliation prepared in (2). joumalize the entry or entries to be made by Komett Company an page 23 of the joumal. Kornett Company uses the Miscellaneous Administrative Expense account for bank senvice charges." 4. Based on the following selected data joumalize the adjusting entries as of December 31,20 Y 8 on page 23 of the joumal " Estimated uncollectible accounts at December 31,$16,000, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was $2,000 (debit). a. The physical inventoy on December 31 indicated an inventory shninkage of $3,300. b Prepaid insurance expired during the year, $22,820. c. Ofice sypolies used during the year, \$3,920. f. A patent costing $48,000 when acquired on January 2 has a remaining legal life of 10 years and is expected to have value for eight years. 9. The cost of mineral rights was $546,000. Of the estimated deposit of 910,000 tons of ore, 50,000 tons were mined and sold during the year. h. Vacation pay expense for December, $10,500 1. A product warranty was granted beginning December 1 and covering a one-year period. The estimated cost is 4% of sales, which totaled $1,900,000 in December. j. Interest was accrued on the note receivable received on October 17 . Assume a 360-day year. "Refer to the chart of accounts for the exact wording of the account tifes. CNOW joumals do not use lines for journal 5. Based on the following information and the post-closing trial balance that follows, prepare a balance sheet in report form at December 31 of the current year. Be sure to complete the heading of the balance sheet. Enter assets in the arder in which they appear in the post-closing trial balance. Refer to information given in the probiem and the Labels and Amount Descriptions list for exact wording of text entries. There is no need to include "(current portion)" or a due date with any account tites. Less" or " Add and a colon (?) Will automatically appear if it is required. Enter all amounts as positive numbers. \begin{tabular}{|l|l|} \hline Current liability & $7,140 \\ \hline Long-term liability & 3,360 \\ \hline \end{tabular} The unfunded pension liability is a long-term liability. Notes payable: Current liability Long-term liability 630,000 Kornett Company POST.CLOSING TRIAL BALANCE \begin{tabular}{|l} \hline \end{tabular} 9 Office Supplies 10 Land 654,925,00 11 Buildings 900,000.00 12 Accumulared Depreciation-Buildings 36,000.00 12 Accumulated Depreciation-Buildings 13 Ofilice Equipment- 14 Accumulated Depreciation-Office Equipment 15 Store Equipment 16 Accumulated Depreclation-Store Equipnient 17. Mineral Rights is Accumulated Depletion 19 Patents 20 Sociat Security Tax Payable is Mediore Tax Payable a Employees Federol income Tax Payatole if State Unemployment Tax Pyable 14 Federal Unemploymeat Tax Payable 23) Salarles Payiole 25.470.004.710.0040,000.00270.0030.00 26. Accounts Payabte 21 Medicare Tax Payable 22 Employees Federal Income Tax Payable 23 State Unemployment Tax Payable 24 Federal Unemployment Tax Payable 25 Saiaries Payable 26 Accounts Payable 4,710.00 40,000.00 270.00 30,00 157,000.00 131,600.00 28,000.00 76,000.00 29. Vacation Pay Payable