Answered step by step

Verified Expert Solution

Question

1 Approved Answer

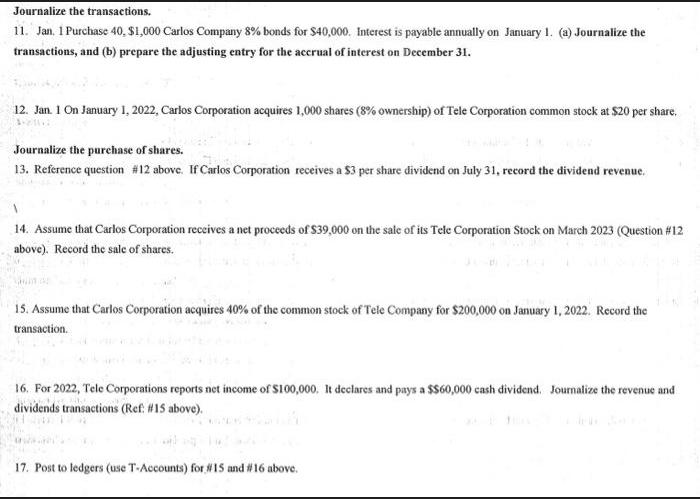

Journalize the transactions. 11. Jan. 1Purchase 40, $1,000 Carlos Company 8% bonds for $40,000. Interest is payable annually on January 1. (a) Journalize the

Journalize the transactions. 11. Jan. 1Purchase 40, $1,000 Carlos Company 8% bonds for $40,000. Interest is payable annually on January 1. (a) Journalize the transactions, and (b) prepare the adjusting entry for the accrual of interest on December 31. 12. Jan. 1 On January 1, 2022, Carlos Corporation acquires 1,000 shares (8% ownership) of Tele Corporation common stock at $20 per share. Journalize the purchase of shares. 13. Reference question #12 above. If Carlos Corporation receives a $3 per share dividend on July 31, record the dividend revenue. 14. Assume that Carlos Corporation receives a net proceeds of $39,000 on the sale of its Tele Corporation Stock on March 2023 (Question # 12 above). Record the sale of shares. Stuin of 15. Assume that Carlos Corporation acquires 40% of the common stock of Tele Company for $200,000 on January 1, 2022. Record the transaction. 16. For 2022, Tele Corporations reports net income of $100,000. It declares and pays a $$60,000 cash dividend. Journalize the revenue and dividends transactions (Ref: #15 above). 17. Post to ledgers (use T-Accounts) for #15 and #16 above.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings for each question 11 a Carlos Company purchased 40 bonds with a par value of 1000 each for a total of 40000 To record ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started