Answered step by step

Verified Expert Solution

Question

1 Approved Answer

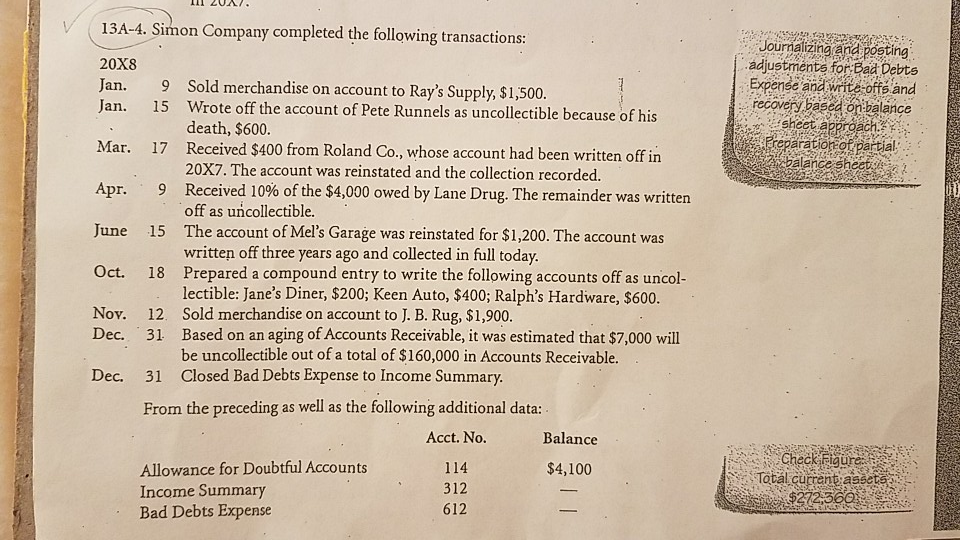

journalize the transactions using 2 methods 1. direct write off 2. the allowances for doubtful accounts 111 2017. 13A-4. Simon Company completed the following transactions:

journalize the transactions using 2 methods 1. direct write off 2. the allowances for doubtful accounts

111 2017. 13A-4. Simon Company completed the following transactions: Journalizing and posting adjustments for:Bad Debts Expense and write-offs and Pecovery based on balance 20X8 Jan. 9 Sold merchandise on account to Ray's Supply, $1,500. Jan. 15 Wrote off the account of Pete Runnels as uncollectible because of his death, $600. Mar. 17 Received $400 from Roland Co., whose account had been written off in 20X7. The account was reinstated and the collection recorded. Apr.. 9 Received 10% of the $4,000 owed by Lane Drug. The remainder was written off as uncollectible. June 15 The account of Mel's Garage was reinstated for $1,200. The account was written off three years ago and collected in full today. Oct. 18 Prepared a compound entry to write the following accounts off as uncol- lectible: Jane's Diner, $200; Keen Auto, $400; Ralph's Hardware, $600. Nov. 12. Sold merchandise on account to J. B. Rug, $1,900. Dec. 31. Based on an aging of Accounts Receivable, it was estimated that $7,000 will be uncollectible out of a total of $160,000 in Accounts Receivable. Dec. 31 Closed Bad Debts Expense to Income Summary. From the preceding as well as the following additional data: Acct. No. Balance Allowance for Doubtful Accounts 114 $4,100 Income Summary 312 Bad Debts Expense 612 Check Figure Total current assets $272,360

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started