Answered step by step

Verified Expert Solution

Question

1 Approved Answer

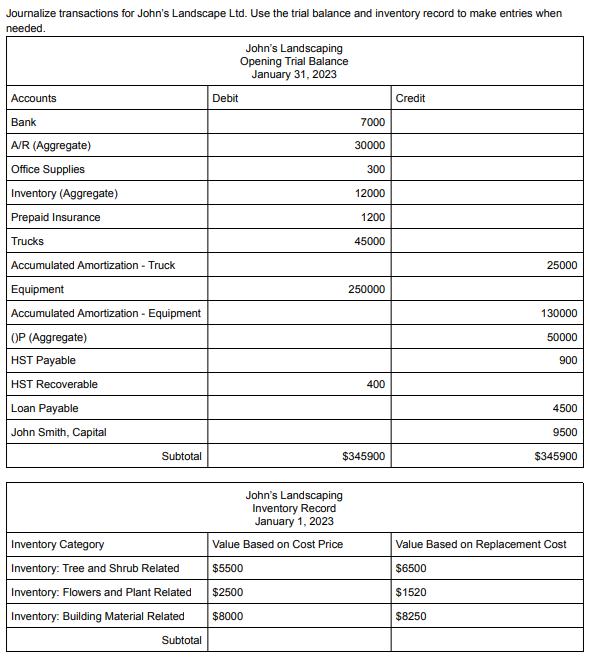

Journalize transactions for John's Landscape Ltd. Use the trial balance and inventory record to make entries when needed. Accounts Bank A/R (Aggregate) Office Supplies

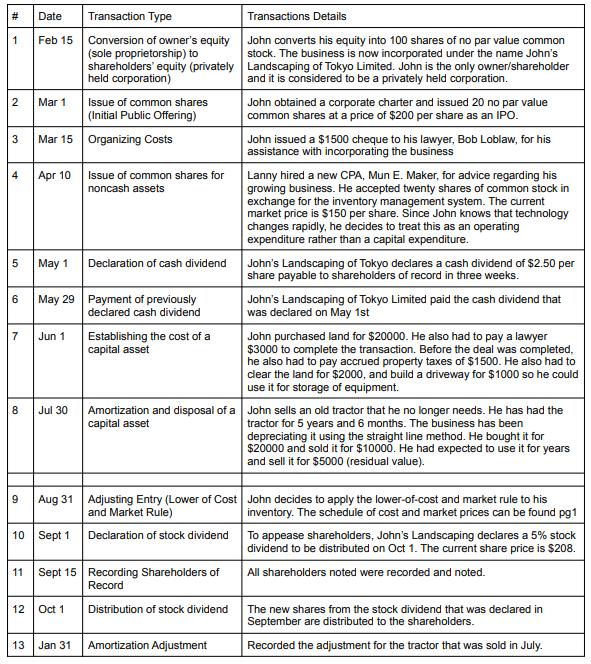

Journalize transactions for John's Landscape Ltd. Use the trial balance and inventory record to make entries when needed. Accounts Bank A/R (Aggregate) Office Supplies Inventory (Aggregate) Prepaid Insurance Trucks Accumulated Amortization - Truck Equipment Accumulated Amortization - Equipment (P (Aggregate) HST Payable HST Recoverable Loan Payable John Smith, Capital Subtotal Inventory Category Inventory: Tree and Shrub Related Inventory: Flowers and Plant Related Inventory: Building Material Related Subtotal Debit John's Landscaping Opening Trial Balance January 31, 2023 7000 30000 300 John's Landscaping Inventory Record January 1, 2023 Value Based on Cost Price $5500 $2500 $8000 12000 1200 45000 250000 400 $345900 Credit 25000 130000 50000 900 4500 9500 $345900 Value Based on Replacement Cost $6500 $1520 $8250 # 1 Feb 15 2 Mar 1 4 3 Mar 15 Organizing Costs 5 6 Date Transaction Type 7 8 9 Apr 10 May 1 Jun 1 Jul 30 Conversion of owner's equity (sole proprietorship) to shareholders' equity (privately held corporation) Issue of common shares (Initial Public Offering) May 29 Payment of previously declared cash dividend Establishing the cost of a capital asset 10 Sept 1 Issue of common shares for noncash assets 12 Oct 1 Declaration of cash dividend 11 Sept 15 Recording Shareholders of Record Distribution of stock dividend Transactions Details John converts his equity into 100 shares of no par value common stock. The business is now incorporated under the name John's Landscaping of Tokyo Limited. John is the only owner/shareholder and it is considered to be a privately held corporation. John obtained a corporate charter and issued 20 no par value common shares at a price of $200 per share as an IPO. 13 Jan 31 Amortization Adjustment John issued a $1500 cheque to his lawyer, Bob Loblaw, for his assistance with incorporating the business Lanny hired a new CPA, Mun E. Maker, for advice regarding his growing business. He accepted twenty shares of common stock in exchange for the inventory management system. The current market price is $150 per share. Since John knows that technology changes rapidly, he decides to treat this as an operating expenditure rather than a capital expenditure. John's Landscaping of Tokyo declares a cash dividend of $2.50 per share payable to shareholders of record in three weeks. John's Landscaping of Tokyo Limited paid the cash dividend that was declared on May 1st Amortization and disposal of a John sells an old tractor that he no longer needs. He has had the capital asset tractor for 5 years and 6 months. The business has been and Market Rule) Aug 31 Adjusting Entry (Lower of Cost John decides to apply the lower-of-cost and market rule to his inventory. The schedule of cost and market prices can be found pg1 To appease shareholders, John's Landscaping declares a 5% stock dividend to be distributed on Oct 1. The current share price is $208. All shareholders noted were recorded and noted. Declaration of stock dividend John purchased land for $20000. He also had to pay a lawyer $3000 to complete the transaction. Before the deal was completed, he also had to pay accrued property taxes of $1500. He also had to clear the land for $2000, and build a driveway for $1000 so he could use it for storage of equipment. depreciating it using the straight line method. He bought it for $20000 and sold it for $10000. He had expected to use it for years and sell it for $5000 (residual value). The new shares from the stock dividend that was declared in September are distributed to the shareholders. Recorded the adjustment for the tractor that was sold in July.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Lets journalize the transactions for Johns Landscaping Ltd 1 Feb 15 Conversion of owners equity sole proprietorship to shareholders equity privately h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started