Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journalizing and posting adjustment for bad debts expense and write-offs and recovery based on balance sheet approach; preparing partial balance sheet Questions, Classroom Demonstration Exercises,

journalizing and posting adjustment for bad debts expense and write-offs and recovery based on balance sheet

approach; preparing partial balance sheet

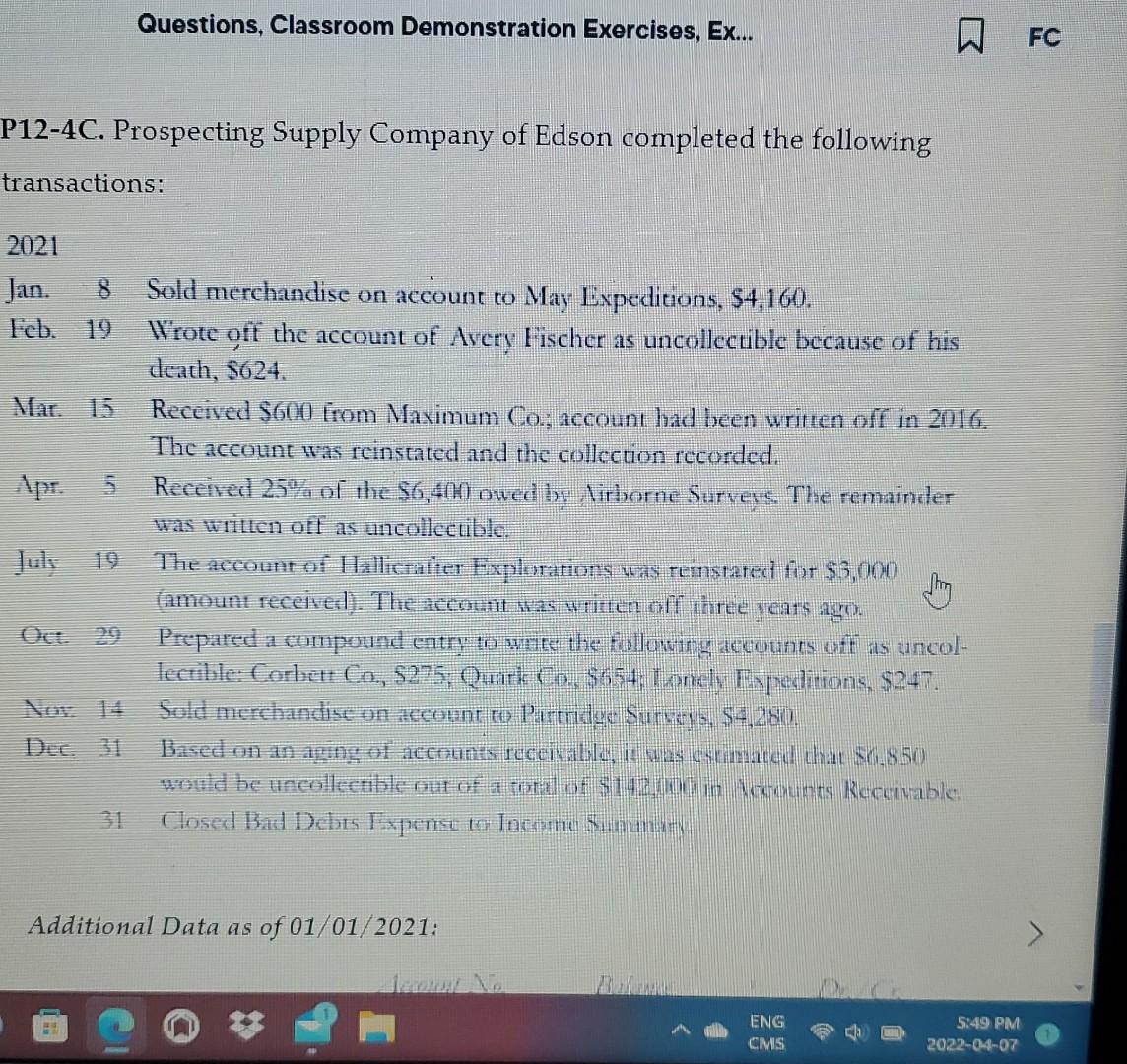

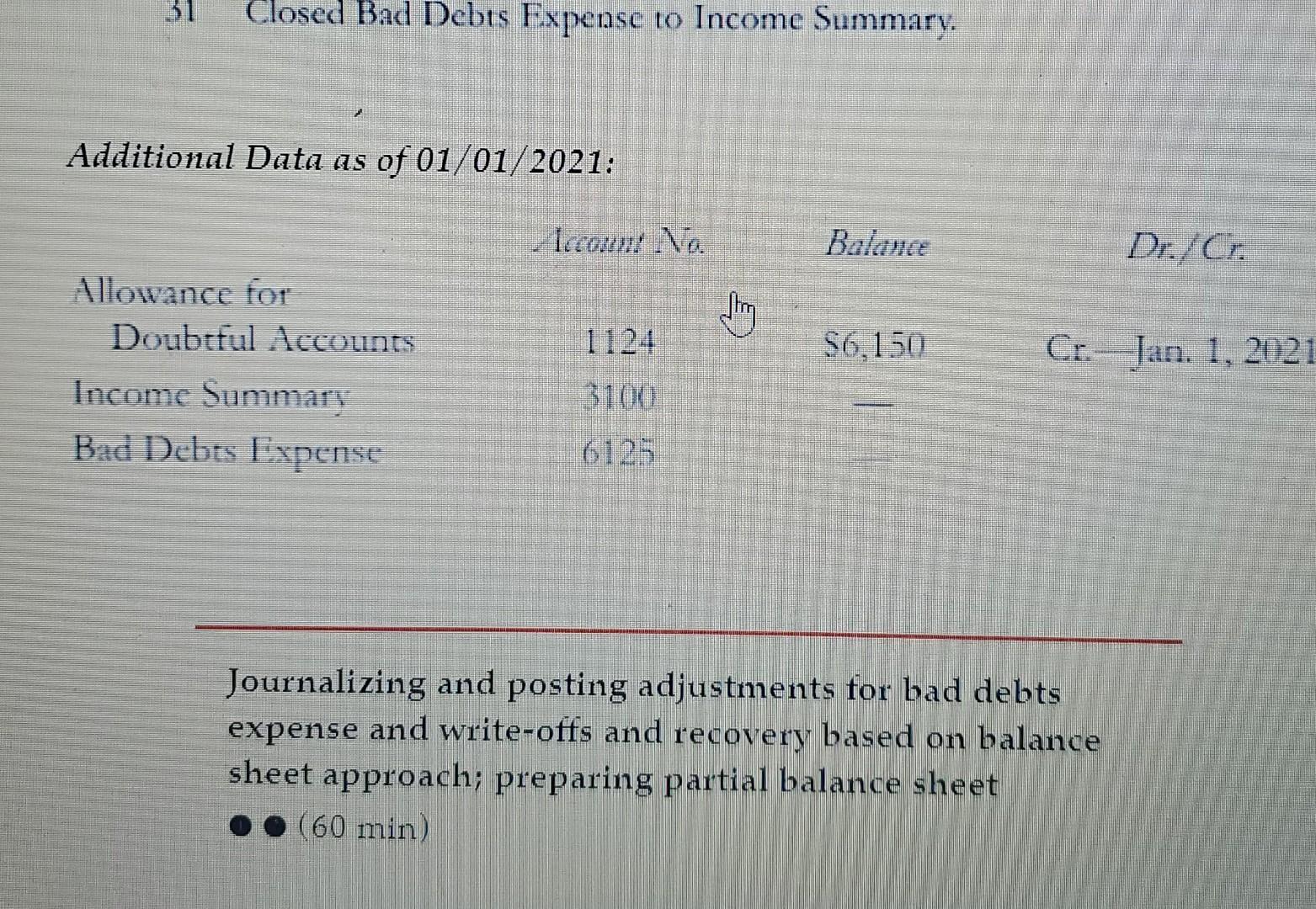

Questions, Classroom Demonstration Exercises, Ex... N FC P12-4C. Prospecting Supply Company of Edson completed the following transactions: 2021 Jan. 8 Feb. 19 Sold merchandise on account to May Expeditions, 54,160. Wrote off the account of Avery Fischer as uncollectible because of his death, $624. Received $600 from Maximum Co: account had been written off in 2016. The account was rcinstated and the collection recorded. Received 25% of the $6,400 owed by Virborne Surveys. The remainder was written ofl as uncollccuble. The account of Hallicrafter Explorations was ruinstared for $3,000 amouni receivel. The account was written off three years ago. Prepared a compound entry to wote the following accounts off as uncol- lectible: Corbet Co., $275, Quur Co. 5654: Lonely Expeditions, $247. Sold merchandise on account to Partridge Surveys, S4,280. Based on an aging of accounts receivable, it was sumated that sc_850 would be urcolectible culoa tu SIZELS Receivable Closed Bad Debis Expense to lacomo Sumuman Additional Data as of 01/01/2021: ENG CMS 5:49 PM 2022-04-07 Closed Bad Debts Expense to Income Summary. Additional Data as of 01/01/2021: Iccordi va Balance Dr./Cr thing $6.150 Allowance for Doubtful Accounts Income Summary Bad Debts Expense Cr- Jan. 1, 2021 6125 Journalizing and posting adjustments for bad debts expense and write-offs and recovery based on balance sheet approach; preparing partial balance sheet (60 min)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started