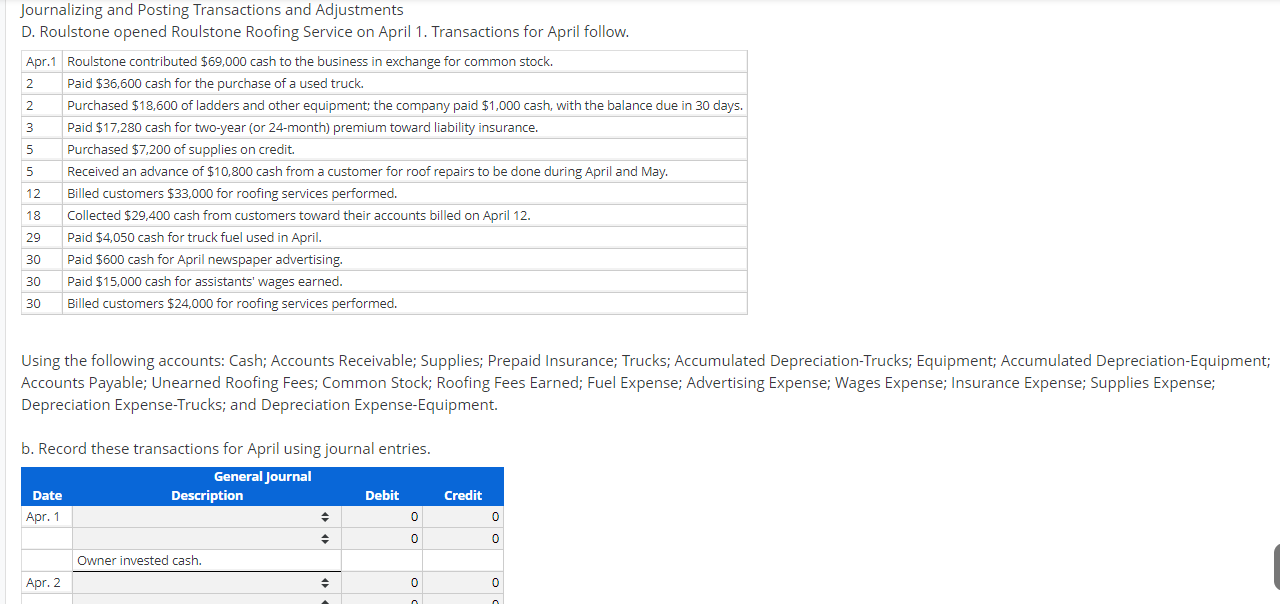

Journalizing and Posting Transactions and Adjustments D. Roulstone opened Roulstone Roofing Service on April 1. Transactions for April follow.

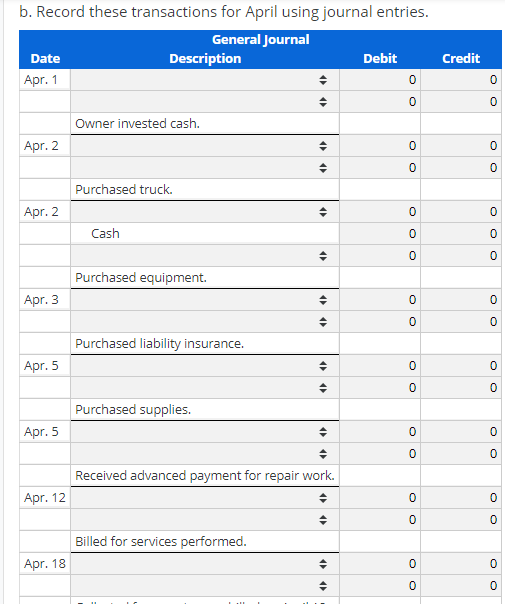

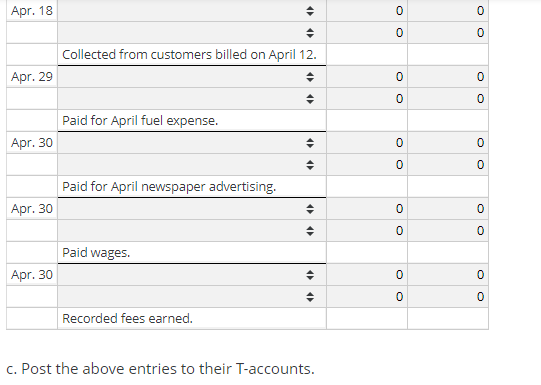

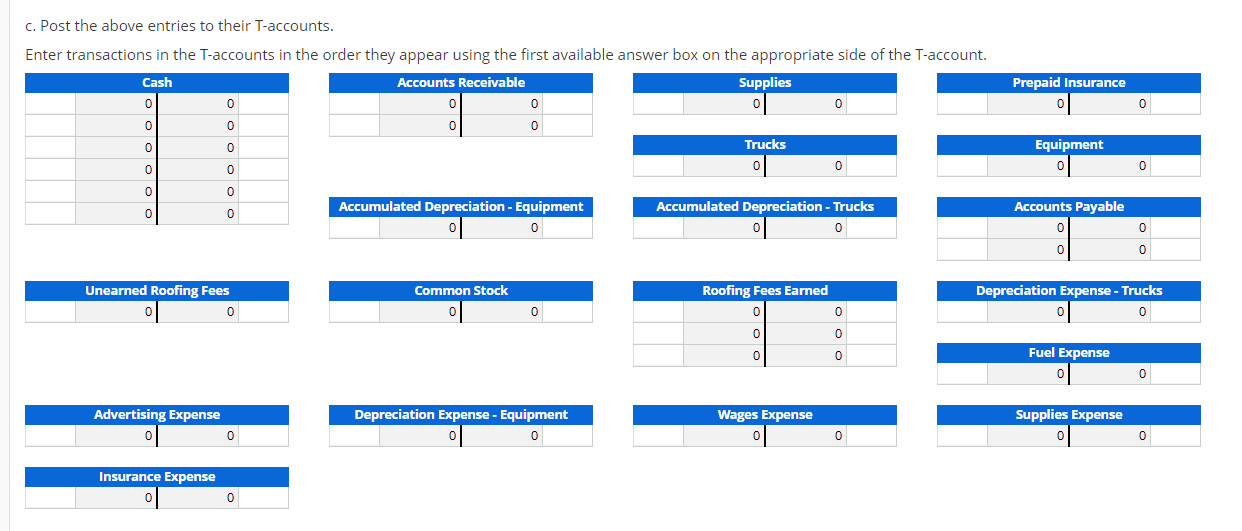

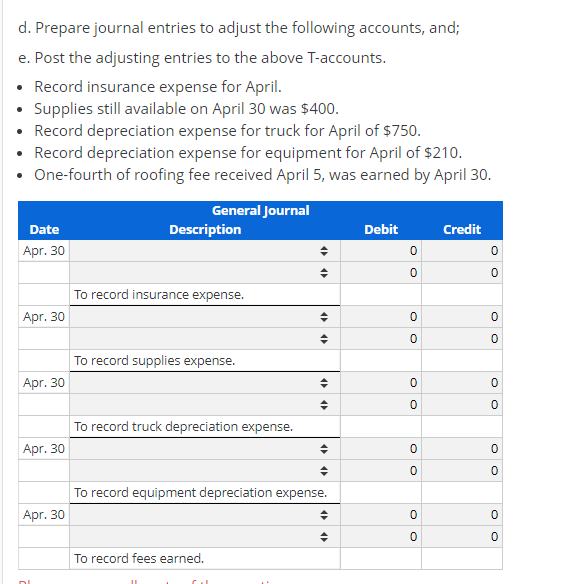

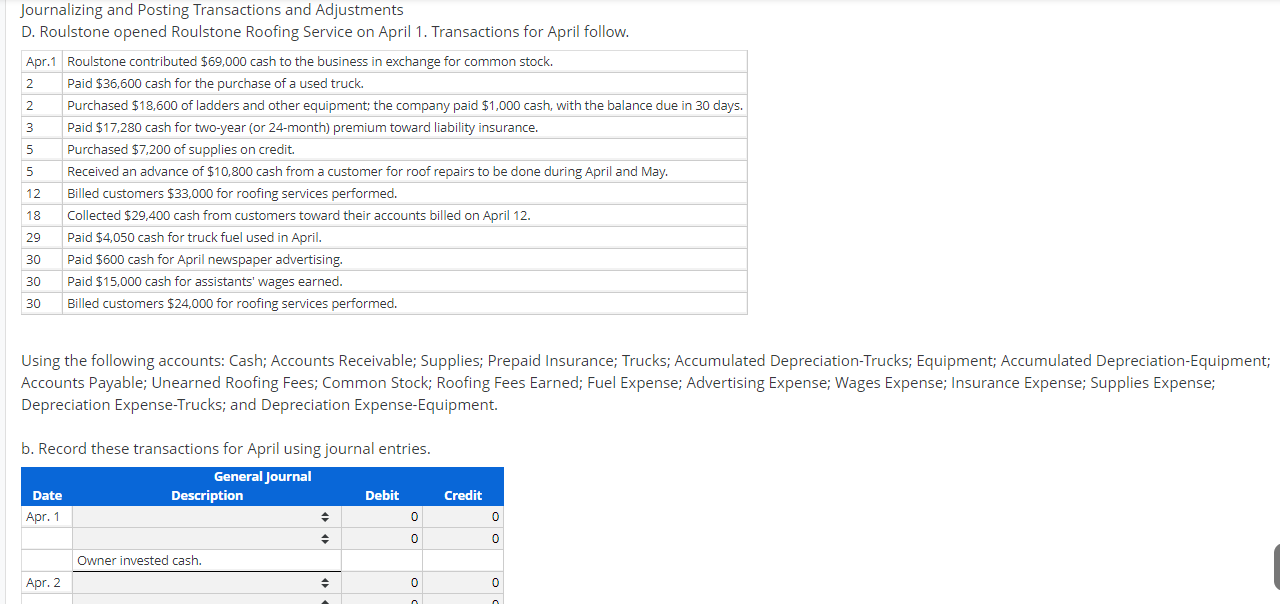

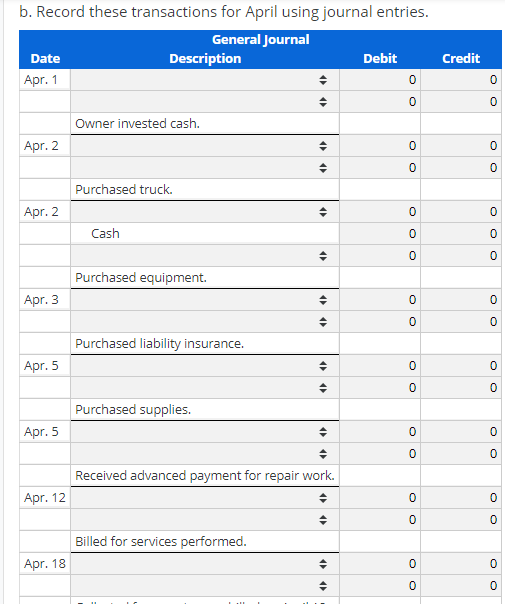

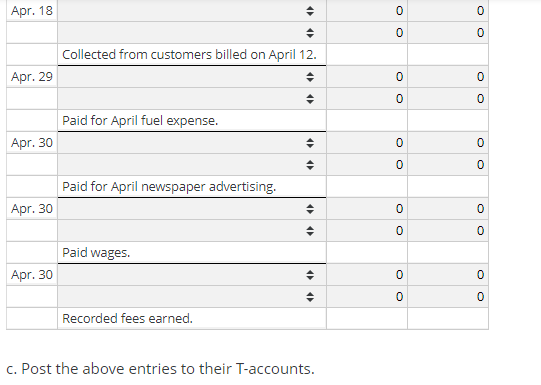

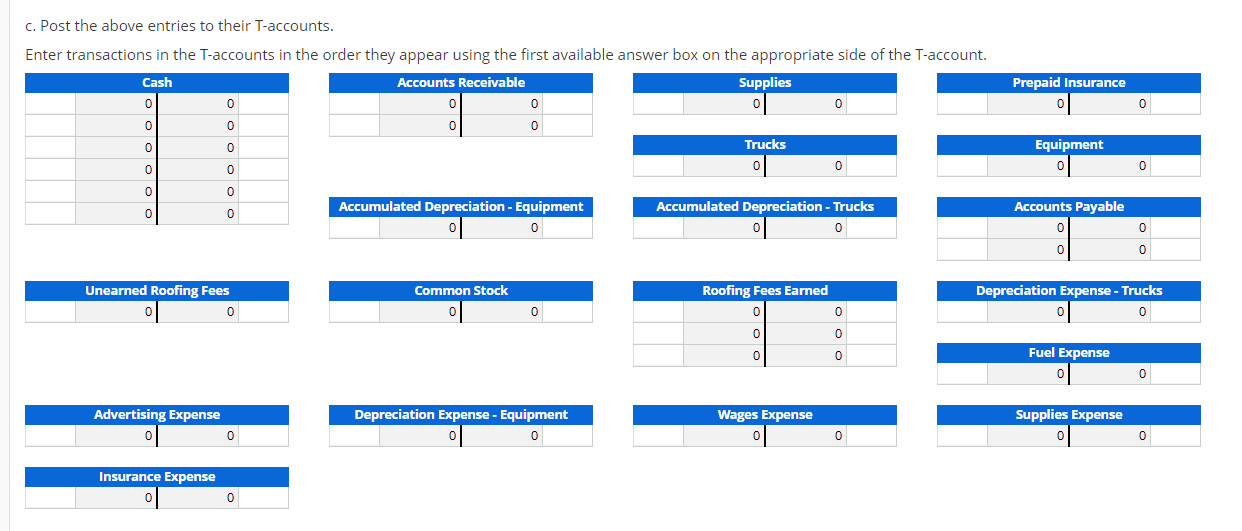

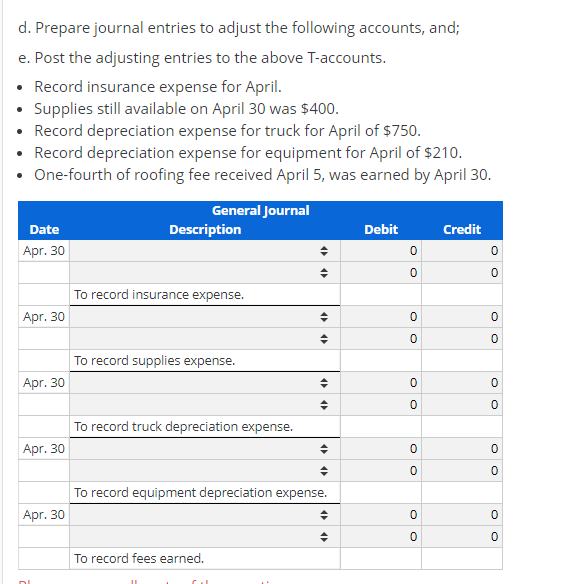

Journalizing and Posting Transactions and Adjustments D. Roulstone opened Roulstone Roofing Service on April 1. Transactions for April follow. Roulstone contributed $69,000 cash to the business in exchange for common stock. Apr.1 Paid $36,600 cash for the purchase of a used truck. 2 Purchased $18,600 of ladders and other equipment: the company paid $1,000 cash, with the balance due in 30 days. 2 Paid $17,280 cash for two-year (or 24-month) premium toward liability insurance. 3 Purchased $7,200 of supplies on credit. Received an advance of $10,800 cash from a customer for roof repairs to be done during April and May. Billed customers $33,000 for roofing services performed. 12 Collected $29,400 cash from customers toward their accounts billed on April 12. 18 Paid $4,050 cash for truck fuel used in April. Paid $600 cash for April newspaper advertising. 29 3 Paid $15,000 cash for assistants' wages earned. 30 Billed customers $24,000 for roofing services performed. 30 Using the following accounts: Cash; Accounts Receivable; Supplies; Prepaid Insurance; Trucks; Accumulated Depreciation-Trucks; Equipment; Accumulated Depreciation-Equipment; Accounts Payable; Unearned Roofing Fees; Common Stock; Roofing Fees Earned; Fuel Expense; Advertising Expense; Wages Expense; Insurance Expense; Supplies Expense; Depreciation Expense-Trucks; and Depreciation Expense-Equipment. b. Record these transactions for April using journal entries. General Journal Description Debit Credit Date Apr. 1 0 0 0 0 Owner invested cash. Apr. 2 0 b. Record these transactions for April using journal entries. General Journal Description Debit Credit Date Apr. 1 0 0 0 0 Owner invested cash. Apr. 2 C 0 0 0 Purchased truck. Apr. 2 0 0 Cash 0 0 0 0 Purchased equipment. Apr. 3 0 0 0 0 Purchased liability insurance. Apr. 5 0 C 0 0 Purchased supplies. Apr. 5 0 0 0 0 Received advanced payment for repair work Apr. 12 0 0 0 0 Billed for services performed. Apr. 18 0 C 0 0 1 c. Post the above entries to their T-accounts. Enter transactions in the T-accounts in the order they appear using the first available answer box on the appropriate side of the T-account. Cash Supplies Prepaid Insurance Accounts Receivable 0 0 0 0 0 0 Trucks Equipment 0 0 0 0 0 0 Accumulated Depreciation- Equipment Accumulated Depreciation - Trucks Accounts Payable 0 o 0 0 0 Unearned Roofing Fees Common Stock Roofing Fees Earned Depreciation Expense- Trucks 0 0 0 0 0 Fuel Expense 0 0 0 Advertising Expense Depreciation Expense- Equipment Supplies Expense Wages Expense 0 0 0 0 0 Insurance Expense 0 d. Prepare journal entries to adjust the following accounts, and; e. Post the adjusting entries to the above T-accounts. Record insurance expense for April. Supplies still available on Record depreciation expense for truck for April of $750. Record depreciation expense for equipment for April of $210. One-fourth of roofing fee received April 5, was earned by April 30. April 30 was $400. General Journal Debit Description Credit Date Apr. 30 0 0 0 C To record insurance expense. Apr. 30 0 0 0 0 To record supplies expense. Apr. 30 0 0 0 0 To record truck depreciation expense. Apr. 30 0 0 0 C To record equipment depreciation expense. Apr. 30 0 0 0 0 To record fees earned. C C C O 1