Question

Journalizing cash payments and recording petty cash; posting to the general ledger. The cash payments of European Gift Shop, a retail business, for September are

Journalizing cash payments and recording petty cash; posting to the general ledger.

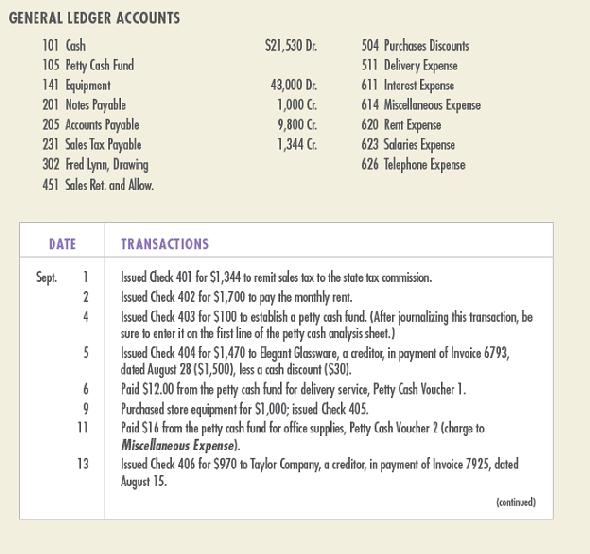

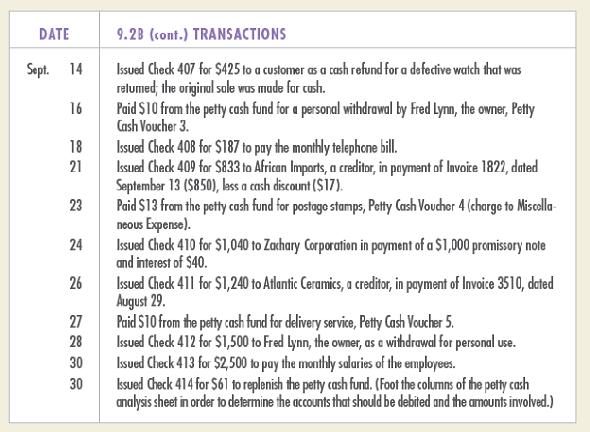

The cash payments of European Gift Shop, a retail business, for September are listed on the next page. The general ledger accounts used to record these transactions appear below.

INSTRUCTIONS

1. Open the general ledger accounts and enter the balances as of September 1, 2016.

2. Record all payments by check in a cash payments journal. Use 12 as the page number.

3. Record all payments from the petty cash fund on a petty cash analysis sheet with special columns for Delivery Expense and Miscellaneous Expense. Use 12 as the sheet number.

4. Post the individual entries from the Other Accounts Debit section of the cash payments journal to the proper general ledger accounts.

5. Total, prove, and rule the petty cash analysis sheet as of September 30, then record the replenishment of the fund and the final balance on the sheet.

6. Total, prove, and rule the cash payments journal as of September 30.

7. Post the column totals from the cash payments journal to the proper general ledger accounts.

Analyze: What was the number of total debits to general ledger liability accounts during the month of September?

GENERAL LEDGER ACCOUNTS 101 Cash 105 Petty Cash Fund 141 Equipmont 201 Notes Payable 205 Accounts Payable 231 Sales Tax Payable 302 Fred Lynn, Drawing 504 Purchases Discounts 511 Delivery Expense 611 Interest Exponse 614 Miscellaneous Expense 620 Rent Expense 623 Salaries Expense 626 Telephone Expense S21,530 D:. 43,000 D:. 1,000 C:. 9,800 C:. 1,344 C: 451 Sales Ret. and Allow. DATE TRANSACTIONS Issued Check 401 for S1,344 to remit sales tax to the state tax commission. Issued Check 402 for $1,700 to pay the mornhly rent. Issued Check 403 for $100 b establish a pety cash fund. (After journalizing this trarsaction, be sure to enter it en the fist line of the pety cash analysis sheet.) Sept. 1 2 Issued Check 404 for S1,470 to Blegunt Glassware, a cedito, in payment of Invaice 6793, dated August 28 ($1,500), less a cash discount (S30). Paid S12.00 from the petty cash fund for delivery service, Petty Cash Voucher 1. Purchased store equipment for S1,000; isued Check 405. 5 Paid S16 fram the petty cnsh fund for office supplies, Petty Cash Voucher 2 (charge to Miscellane ous Expense). Issued Check 405 for $970 b Taylor Compary, a creditor, in payment of Invoice 7925, deted August 15. 11 13 (continsed)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The total amount of the debits to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started