Answered step by step

Verified Expert Solution

Question

1 Approved Answer

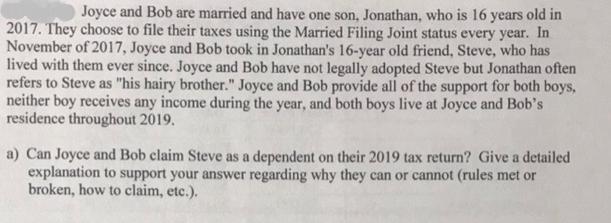

Joyce and Bob are married and have one son, Jonathan, who is 16 years old in 2017. They choose to file their taxes using

Joyce and Bob are married and have one son, Jonathan, who is 16 years old in 2017. They choose to file their taxes using the Married Filing Joint status every year. In November of 2017, Joyce and Bob took in Jonathan's 16-year old friend, Steve, who has lived with them ever since. Joyce and Bob have not legally adopted Steve but Jonathan often refers to Steve as "his hairy brother." Joyce and Bob provide all of the support for both boys, neither boy receives any income during the year, and both boys live at Joyce and Bob's residence throughout 2019. a) Can Joyce and Bob claim Steve as a dependent on their 2019 tax return? Give a detailed explanation to support your answer regarding why they can or cannot (rules met or broken, how to claim, etc.).

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer They Cannot clalm Steve as a dependent on thelr 2021 tax return b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started