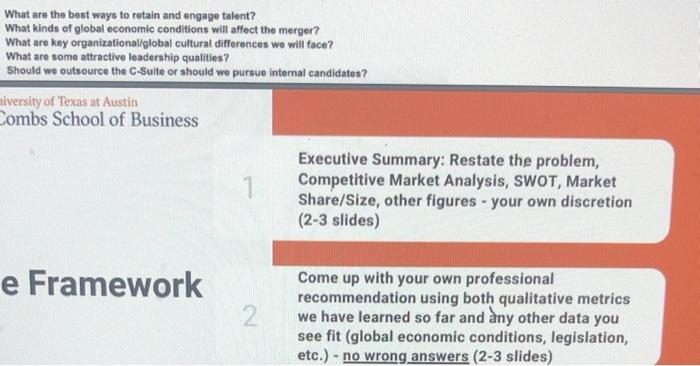

J.P Morgan and Goldman Sachs, two prominent investment management firms based in the United States, both have key financial holdings in the APAC (Asia-Pacific) shipping industry. The ASEAN Synergy Group is a shipping database management firm that is backed by J.P Morgan and primarily serves customers in Southeast Asia, providing insurance, information technology, and accounting for large-scale shipping companies. Their past fiscal year's income statement featured revenues of $550M USD and is headquartered in Singapore. 70% of employees are based out of Singapore, with regional offices in Bangkok, Jakarta, and Kuala Lumpur. Their clients are solely limited to Southeast Asia and have a total of 85,000 employees JK Transnational is another shipping database management firm that is backed by Goldman Sachs and serves customers primarily in South Korea and Japan. JK Transnational provides services ranging from crew management, information technology, revenue management, and transportation/logistics forecasting. Their past fiscal year's income statement featured revenues of $125M USD and is headquartered in Tokyo, Japan. 50% of employees are located in Japan and 50% are located in Seoul, South Korea. Their clients are solely limited to Japan and Korea and have a total of 45,000 employees. J.P Morgan and Goldman Sachs have approached you, a human capital management consulting firm, with an opportunity: they seek to merge these two companies into one conglomerate shipping database management firm that encompasses both Southeast and East Asia customer segments. J.P Morgan and Goldman Sachs are confident they can create a highly-efficient/profitable merger on their own, however, they are unsure about what the cultural alignment and system integration process will look like and have tasked you with providing them with a presentational overview of what metrics they should look out for such as... What are the best ways to retain and engage talent? What kinds of global economic conditions will alfect the merger? What are key organizationaliglobal cultural differences we will face? What are some attractive leadership qualities? Should wo outsource the C-Sulte or should we pursue internal candidates? iversity of Texas at Austin Combs School of Business Executive Summary: Restate the problem, Competitive Market Analysis, SWOT, Market Share/Size, other figures - your own discretion (2-3 slides) Come up with your own professional recommendation using both qualitative metrics we have learned so far and any other data you see fit (global economic conditions, legislation, etc.) - no wrong answers (2-3 slides) J.P Morgan and Goldman Sachs, two prominent investment management firms based in the United States, both have key financial holdings in the APAC (Asia-Pacific) shipping industry. The ASEAN Synergy Group is a shipping database management firm that is backed by J.P Morgan and primarily serves customers in Southeast Asia, providing insurance, information technology, and accounting for large-scale shipping companies. Their past fiscal year's income statement featured revenues of $550M USD and is headquartered in Singapore. 70% of employees are based out of Singapore, with regional offices in Bangkok, Jakarta, and Kuala Lumpur. Their clients are solely limited to Southeast Asia and have a total of 85,000 employees JK Transnational is another shipping database management firm that is backed by Goldman Sachs and serves customers primarily in South Korea and Japan. JK Transnational provides services ranging from crew management, information technology, revenue management, and transportation/logistics forecasting. Their past fiscal year's income statement featured revenues of $125M USD and is headquartered in Tokyo, Japan. 50% of employees are located in Japan and 50% are located in Seoul, South Korea. Their clients are solely limited to Japan and Korea and have a total of 45,000 employees. J.P Morgan and Goldman Sachs have approached you, a human capital management consulting firm, with an opportunity: they seek to merge these two companies into one conglomerate shipping database management firm that encompasses both Southeast and East Asia customer segments. J.P Morgan and Goldman Sachs are confident they can create a highly-efficient/profitable merger on their own, however, they are unsure about what the cultural alignment and system integration process will look like and have tasked you with providing them with a presentational overview of what metrics they should look out for such as... What are the best ways to retain and engage talent? What kinds of global economic conditions will alfect the merger? What are key organizationaliglobal cultural differences we will face? What are some attractive leadership qualities? Should wo outsource the C-Sulte or should we pursue internal candidates? iversity of Texas at Austin Combs School of Business Executive Summary: Restate the problem, Competitive Market Analysis, SWOT, Market Share/Size, other figures - your own discretion (2-3 slides) Come up with your own professional recommendation using both qualitative metrics we have learned so far and any other data you see fit (global economic conditions, legislation, etc.) - no wrong answers (2-3 slides)