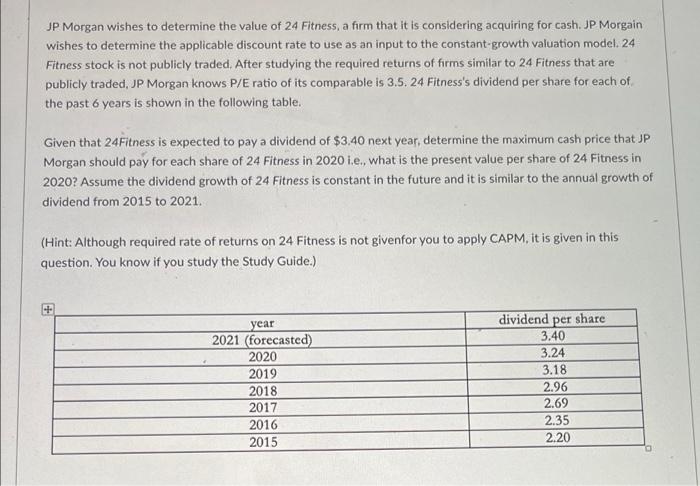

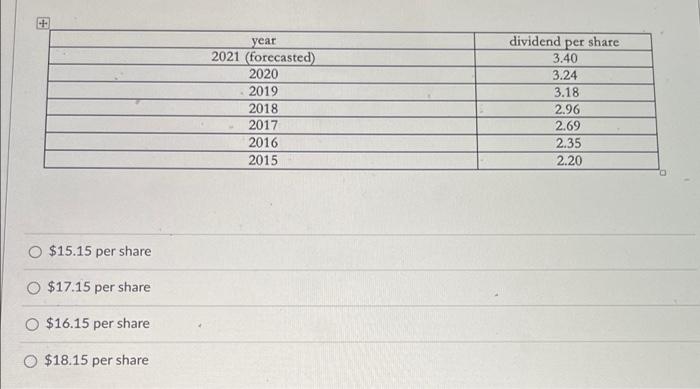

JP Morgan wishes to determine the value of 24 Fitness, a firm that it is considering acquiring for cash. JP Morgain wishes to determine the applicable discount rate to use as an input to the constant-growth valuation model. 24 Fitness stock is not publicly traded. After studying the required returns of forms similar to 24 Fitness that are publicly traded, JP Morgan knows P/E ratio of its comparable is 3.5. 24 Fitness's dividend per share for each of the past 6 years is shown in the following table. Given that 24Fitness is expected to pay a dividend of $3.40 next year, determine the maximum cash price that JP Morgan should pay for each share of 24 Fitness in 2020 i.e., what is the present value per share of 24 Fitness in 2020? Assume the dividend growth of 24 Fitness is constant in the future and it is similar to the annual growth of dividend from 2015 to 2021. (Hint: Although required rate of returns on 24 Fitness is not givenfor you to apply CAPM. it is given in this question. You know if you study the Study Guide.) year 2021 (forecasted) 2020 2019 2018 2017 2016 2015 dividend per share 3.40 3.24 3.18 2.96 2.69 2.35 2.20 year 2021 (forecasted) 2020 2019 2018 2017 2016 2015 dividend per share 3.40 3.24 3.18 2.96 2.69 2.35 2.20 O $15.15 per share $17.15 per share $16.15 per share $18.15 per share JP Morgan wishes to determine the value of 24 Fitness, a firm that it is considering acquiring for cash. JP Morgain wishes to determine the applicable discount rate to use as an input to the constant-growth valuation model. 24 Fitness stock is not publicly traded. After studying the required returns of forms similar to 24 Fitness that are publicly traded, JP Morgan knows P/E ratio of its comparable is 3.5. 24 Fitness's dividend per share for each of the past 6 years is shown in the following table. Given that 24Fitness is expected to pay a dividend of $3.40 next year, determine the maximum cash price that JP Morgan should pay for each share of 24 Fitness in 2020 i.e., what is the present value per share of 24 Fitness in 2020? Assume the dividend growth of 24 Fitness is constant in the future and it is similar to the annual growth of dividend from 2015 to 2021. (Hint: Although required rate of returns on 24 Fitness is not givenfor you to apply CAPM. it is given in this question. You know if you study the Study Guide.) year 2021 (forecasted) 2020 2019 2018 2017 2016 2015 dividend per share 3.40 3.24 3.18 2.96 2.69 2.35 2.20 year 2021 (forecasted) 2020 2019 2018 2017 2016 2015 dividend per share 3.40 3.24 3.18 2.96 2.69 2.35 2.20 O $15.15 per share $17.15 per share $16.15 per share $18.15 per share