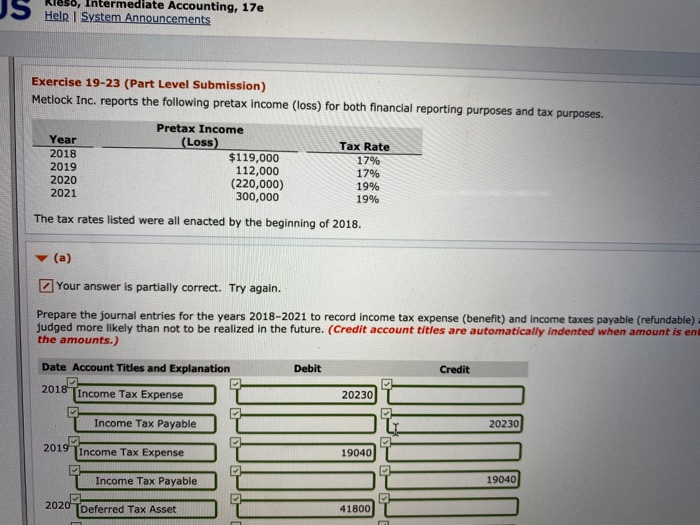

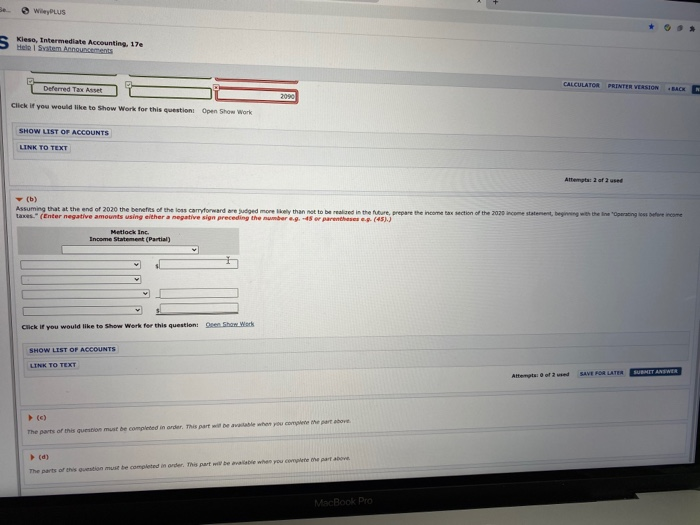

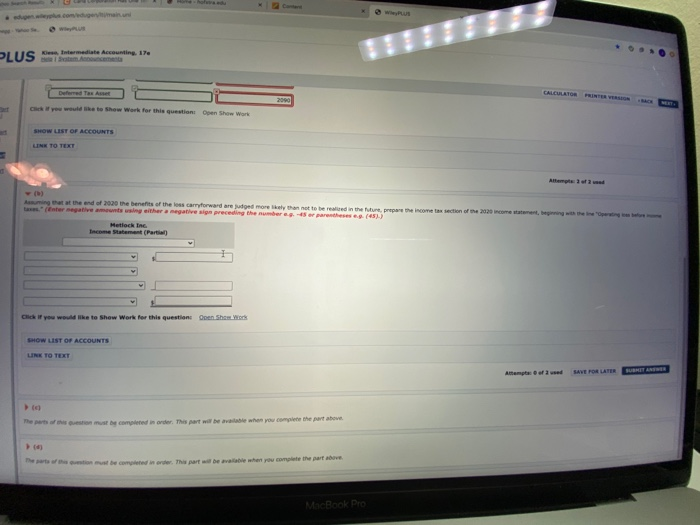

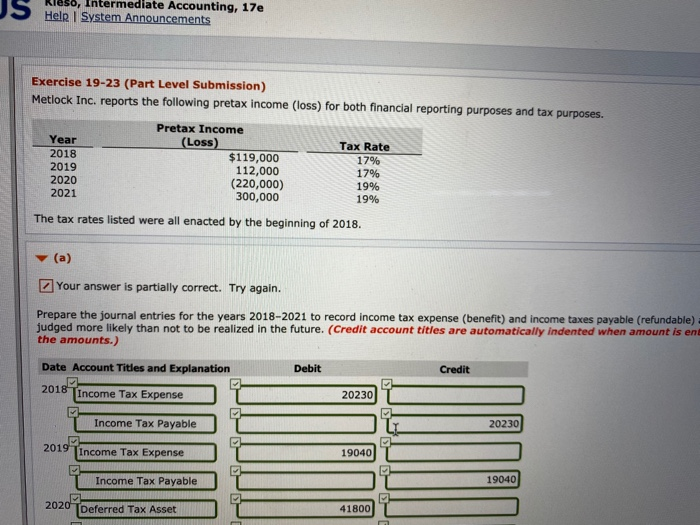

JS Kieso, Intermediate Accounting, 17e Help System Announcements Exercise 19-23 (Part Level Submission) Metlock Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year 2018 2019 2020 2021 Pretax Income (Loss) $119,000 112,000 (220,000) 300,000 Tax Rate 17% 17% 19% 19% The tax rates listed were all enacted by the beginning of 2018. (a) Your answer is partially correct. Try again. Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income taxes payable (refundable) judged more likely than not to be realized in the future. (Credit account titles are automatically indented when amount is en the amounts.) Date Account Titles and Explanation Debit Credit 2018 Income Tax Expense 20230 Income Tax Payable 20230 2019 Income Tax Expense 19040 Income Tax Payable 19040 M 2020 Deferred Tax Asset 41800 > WPLUS S klesa, Intermediate Accounting, 17e CALCULATOR PRINTER VERSION Deferred Tax Asset HAGE 2090 Click if you would like to show Work for this question Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Attempts: 2 of 2 used (b) Assuming that at the end of 2020 the benefits of the loss carryforward are judged more than not to be relied in there, prepare the income tax section of the 2020 income statement, be the line Operating to come taxes." (Enter negative amounts using either a negative sign preceding the numbers.g.-15 or parentheses - (45)) Metlack Inc. Income Statement (Partial) Click if you would like to show Werk for this questioni Open Show. Wach SHOW LIST OF ACCOUNTS LINK TO TEXT SAVLATEA SUBMIT ANSWER Attempt of (6) The parts of this question must be completed in order, this part be able to come the part above (d) The parts of this westion must be completed in order. This art will be avait whepou cometer av MacBook Pro PLUS Sambatan.com es Intermediate Accounting. 17 CALCULATOR 2000 Deferred Tax Asses you would like to show Work for this question Coen Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Ang at the end of 2020 the benefits of the loss carryforward are judged more than not to be reared in the future prepare the income tax section of the 2020 income statementet anter negative amounting ither a negative sige preceding the number -15 or parentheses ... (451) Metlocking Income Statement (Part Click if you would like to Show Work for this questions Open Show York SHOW LIST OF ACCOUNTS LINK TO TEXT SANE POR LATER estion completed in order the part will be when you complete the part above et must be completed in order. The part bewable when you complete part above MacBook Pro JS Kieso, Intermediate Accounting, 17e Help System Announcements Exercise 19-23 (Part Level Submission) Metlock Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year 2018 2019 2020 2021 Pretax Income (Loss) $119,000 112,000 (220,000) 300,000 Tax Rate 17% 17% 19% 19% The tax rates listed were all enacted by the beginning of 2018. (a) Your answer is partially correct. Try again. Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income taxes payable (refundable) judged more likely than not to be realized in the future. (Credit account titles are automatically indented when amount is en the amounts.) Date Account Titles and Explanation Debit Credit 2018 Income Tax Expense 20230 Income Tax Payable 20230 2019 Income Tax Expense 19040 Income Tax Payable 19040 M 2020 Deferred Tax Asset 41800 PLUS Sambatan.com es Intermediate Accounting. 17 CALCULATOR 2000 Deferred Tax Asses you would like to show Work for this question Coen Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Ang at the end of 2020 the benefits of the loss carryforward are judged more than not to be reared in the future prepare the income tax section of the 2020 income statementet anter negative amounting ither a negative sige preceding the number -15 or parentheses ... (451) Metlocking Income Statement (Part Click if you would like to Show Work for this questions Open Show York SHOW LIST OF ACCOUNTS LINK TO TEXT SANE POR LATER estion completed in order the part will be when you complete the part above et must be completed in order. The part bewable when you complete part above MacBook Pro JS Kieso, Intermediate Accounting, 17e Help System Announcements Exercise 19-23 (Part Level Submission) Metlock Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year 2018 2019 2020 2021 Pretax Income (Loss) $119,000 112,000 (220,000) 300,000 Tax Rate 17% 17% 19% 19% The tax rates listed were all enacted by the beginning of 2018. (a) Your answer is partially correct. Try again. Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income taxes payable (refundable) judged more likely than not to be realized in the future. (Credit account titles are automatically indented when amount is en the amounts.) Date Account Titles and Explanation Debit Credit 2018 Income Tax Expense 20230 Income Tax Payable 20230 2019 Income Tax Expense 19040 Income Tax Payable 19040 M 2020 Deferred Tax Asset 41800 > WPLUS S klesa, Intermediate Accounting, 17e CALCULATOR PRINTER VERSION Deferred Tax Asset HAGE 2090 Click if you would like to show Work for this question Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Attempts: 2 of 2 used (b) Assuming that at the end of 2020 the benefits of the loss carryforward are judged more than not to be relied in there, prepare the income tax section of the 2020 income statement, be the line Operating to come taxes." (Enter negative amounts using either a negative sign preceding the numbers.g.-15 or parentheses - (45)) Metlack Inc. Income Statement (Partial) Click if you would like to show Werk for this questioni Open Show. Wach SHOW LIST OF ACCOUNTS LINK TO TEXT SAVLATEA SUBMIT ANSWER Attempt of (6) The parts of this question must be completed in order, this part be able to come the part above (d) The parts of this westion must be completed in order. This art will be avait whepou cometer av MacBook Pro PLUS Sambatan.com es Intermediate Accounting. 17 CALCULATOR 2000 Deferred Tax Asses you would like to show Work for this question Coen Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Ang at the end of 2020 the benefits of the loss carryforward are judged more than not to be reared in the future prepare the income tax section of the 2020 income statementet anter negative amounting ither a negative sige preceding the number -15 or parentheses ... (451) Metlocking Income Statement (Part Click if you would like to Show Work for this questions Open Show York SHOW LIST OF ACCOUNTS LINK TO TEXT SANE POR LATER estion completed in order the part will be when you complete the part above et must be completed in order. The part bewable when you complete part above MacBook Pro JS Kieso, Intermediate Accounting, 17e Help System Announcements Exercise 19-23 (Part Level Submission) Metlock Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year 2018 2019 2020 2021 Pretax Income (Loss) $119,000 112,000 (220,000) 300,000 Tax Rate 17% 17% 19% 19% The tax rates listed were all enacted by the beginning of 2018. (a) Your answer is partially correct. Try again. Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income taxes payable (refundable) judged more likely than not to be realized in the future. (Credit account titles are automatically indented when amount is en the amounts.) Date Account Titles and Explanation Debit Credit 2018 Income Tax Expense 20230 Income Tax Payable 20230 2019 Income Tax Expense 19040 Income Tax Payable 19040 M 2020 Deferred Tax Asset 41800 PLUS Sambatan.com es Intermediate Accounting. 17 CALCULATOR 2000 Deferred Tax Asses you would like to show Work for this question Coen Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Ang at the end of 2020 the benefits of the loss carryforward are judged more than not to be reared in the future prepare the income tax section of the 2020 income statementet anter negative amounting ither a negative sige preceding the number -15 or parentheses ... (451) Metlocking Income Statement (Part Click if you would like to Show Work for this questions Open Show York SHOW LIST OF ACCOUNTS LINK TO TEXT SANE POR LATER estion completed in order the part will be when you complete the part above et must be completed in order. The part bewable when you complete part above MacBook Pro