Answered step by step

Verified Expert Solution

Question

1 Approved Answer

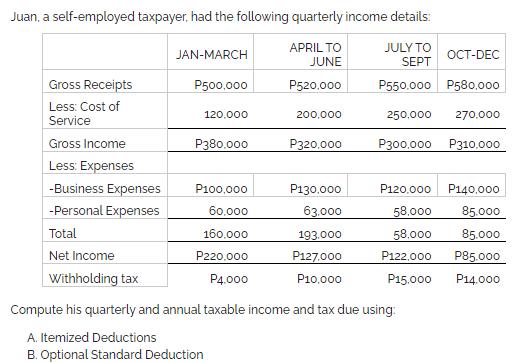

Juan, a self-employed taxpayer, had the following quarterly income details: JULY TO SEPT P550.000 P580,000 Gross Receipts Less: Cost of Service Gross Income Less:

Juan, a self-employed taxpayer, had the following quarterly income details: JULY TO SEPT P550.000 P580,000 Gross Receipts Less: Cost of Service Gross Income Less: Expenses -Business Expenses -Personal Expenses Total Net Income Withholding tax JAN-MARCH P500,000 120.000 P380.000 P100,000 60.000 160.000 P220.000 P4.000 APRIL TO JUNE P520.000 200,000 P320,000 P130.000 63,000 193.000 P127.000 P10,000 OCT-DEC 250,000 270.000 P300,000 P310,000 P120,000 P140,000 58,000 85.000 58,000 85.000 P122,000 P85.000 P15,000 P14.000 Compute his quarterly and annual taxable income and tax due using: A. Itemized Deductions B. Optional Standard Deduction

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute Juans quarterly and annual taxable income and tax due using itemized deductions and the optional standard deduction we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started