Question

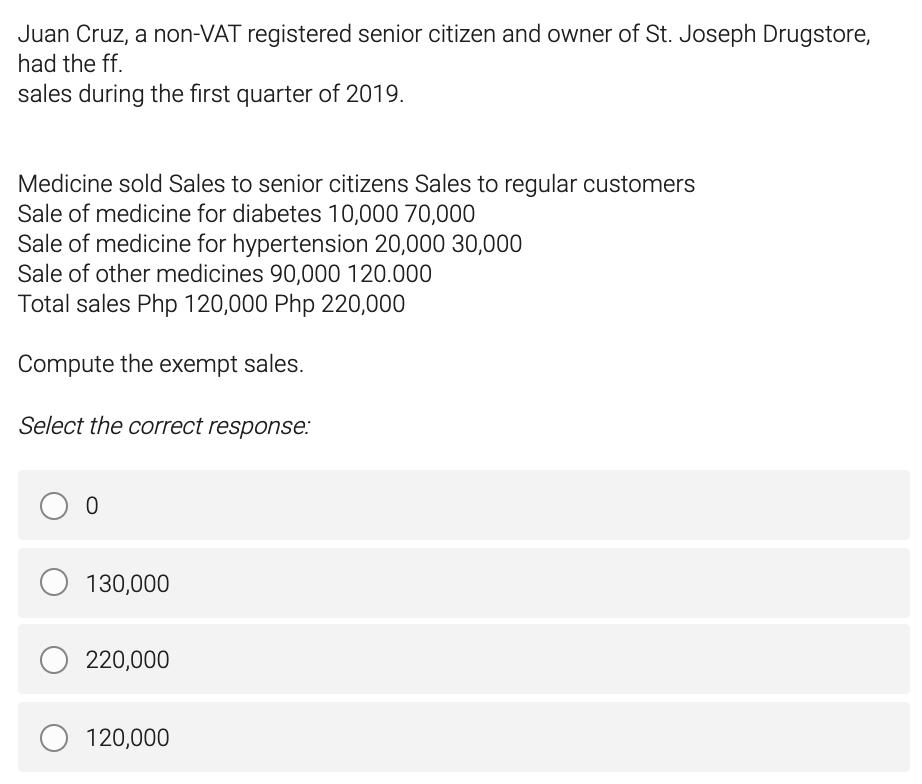

Juan Cruz, a non-VAT registered senior citizen and owner of St. Joseph Drugstore, had the ff. sales during the first quarter of 2019. Medicine

Juan Cruz, a non-VAT registered senior citizen and owner of St. Joseph Drugstore, had the ff. sales during the first quarter of 2019. Medicine sold Sales to senior citizens Sales to regular customers Sale of medicine for diabetes 10,000 70,000 Sale of medicine for hypertension 20,000 30,000 Sale of other medicines 90,000 120.000 Total sales Php 120,000 Php 220,000 Compute the exempt sales. Select the correct response: O 130,000 O 220,000 120,000

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Sol Calculation of Exempt sales Amount 2 Particulars Sale of medicine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial And Managerial Accounting The Financial Chapters

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

6th Edition

978-0134486840, 134486838, 134486854, 134486846, 9780134486833, 978-0134486857

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App