Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Juan Diego began the year with a tax basis in his partnership interest of $40,000. During the year, he was allocated $33,000 of partnership

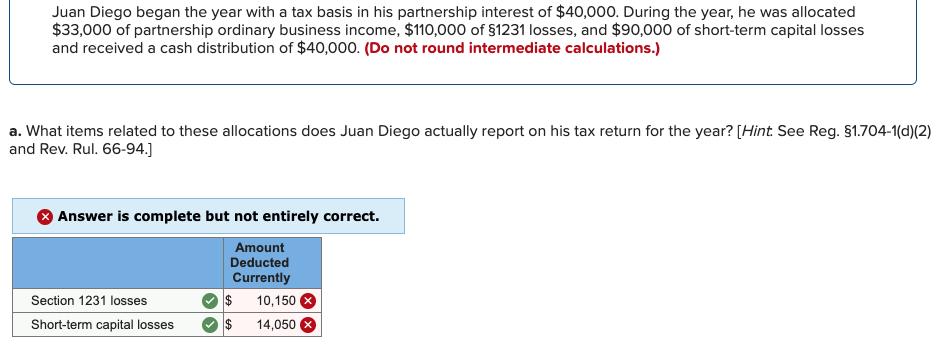

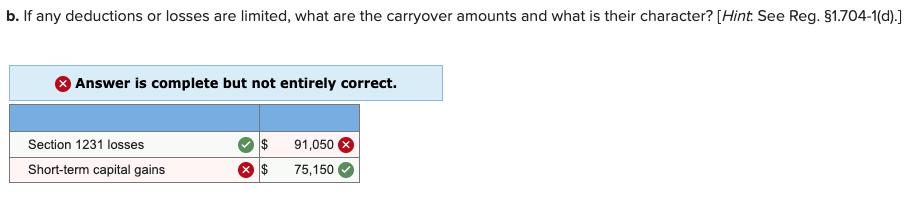

Juan Diego began the year with a tax basis in his partnership interest of $40,000. During the year, he was allocated $33,000 of partnership ordinary business income, $110,000 of $1231 losses, and $90,000 of short-term capital losses and received a cash distribution of $40,000. (Do not round intermediate calculations.) a. What items related to these allocations does Juan Diego actually report on his tax return for the year? [Hint See Reg. $1.704-1(d)(2) and Rev. Rul. 66-94.] Answer is complete but not entirely correct. Amount Deducted Currently Section 1231 losses $ 10,150 Short-term capital losses 14,050 b. If any deductions or losses are limited, what are the carryover amounts and what is their character? [Hint. See Reg. $1.704-1(d).] Answer is complete but not entirely correct. Section 1231 losses $ 91,050 Short-term capital gains $ 75,150

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Business income 33000 Cash distribution 40000 Total 330004000073000 1231 losses 11...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started