Answered step by step

Verified Expert Solution

Question

1 Approved Answer

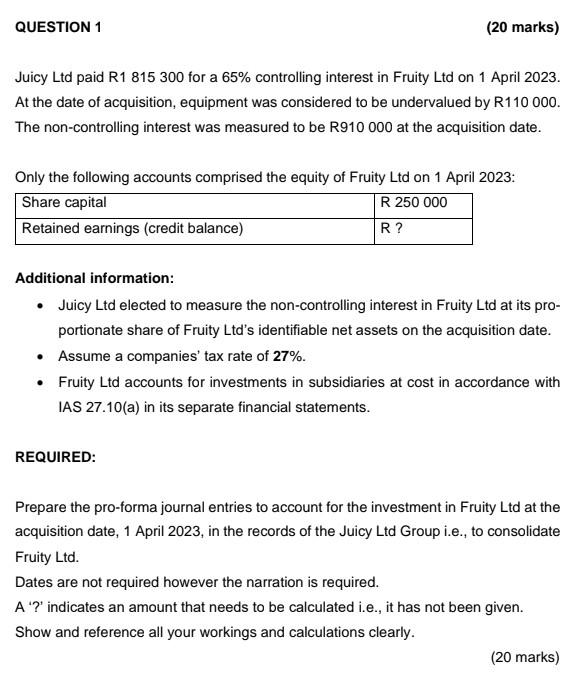

Juicy Ltd paid R1 815300 for a 65% controlling interest in Fruity Ltd on 1 April 2023. At the date of acquisition, equipment was considered

Juicy Ltd paid R1 815300 for a 65\% controlling interest in Fruity Ltd on 1 April 2023. At the date of acquisition, equipment was considered to be undervalued by R110 000 . The non-controlling interest was measured to be R910 000 at the acquisition date. Only the following accounts comprised the equity of Fruity Ltd on 1 April 2023: Additional information: - Juicy Ltd elected to measure the non-controlling interest in Fruity Ltd at its proportionate share of Fruity Ltd's identifiable net assets on the acquisition date. - Assume a companies' tax rate of 27%. - Fruity Ltd accounts for investments in subsidiaries at cost in accordance with IAS 27.10(a) in its separate financial statements. REQUIRED: Prepare the pro-forma journal entries to account for the investment in Fruity Ltd at the acquisition date, 1 April 2023, in the records of the Juicy Ltd Group i.e., to consolidate Fruity Ltd. Dates are not required however the narration is required. A '?' indicates an amount that needs to be calculated i.e., it has not been given. Show and reference all your workings and calculations clearly. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started