Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,000; accounts receivable, $20,800; supplies, $3,200; and office equipment,

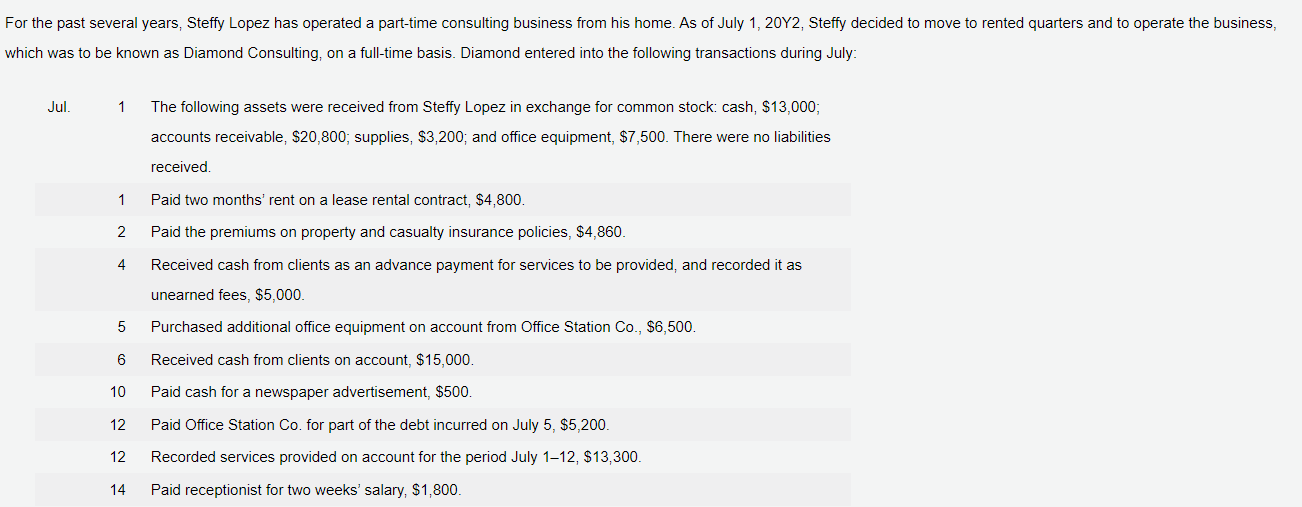

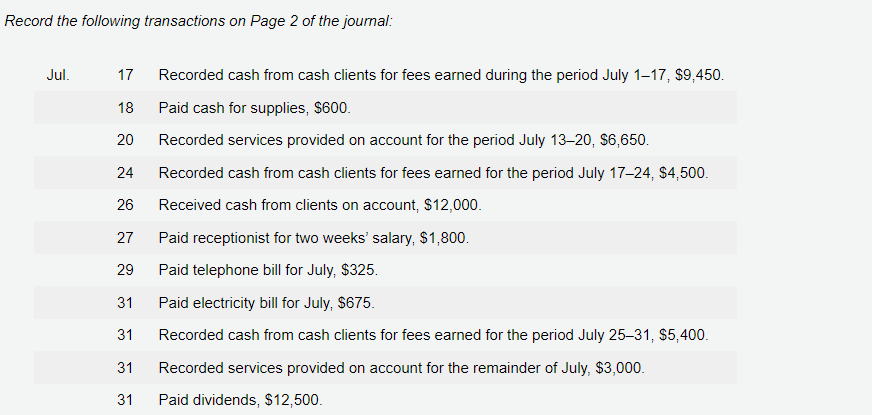

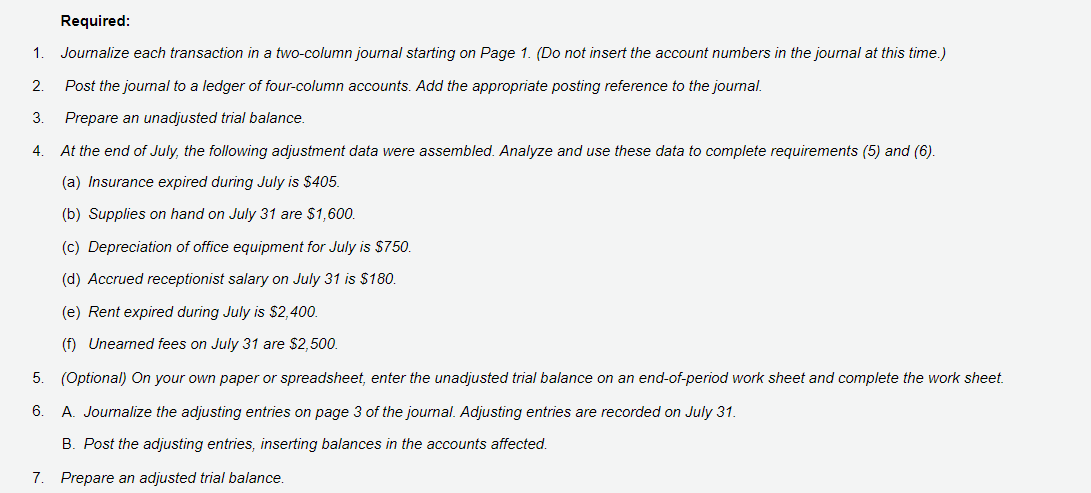

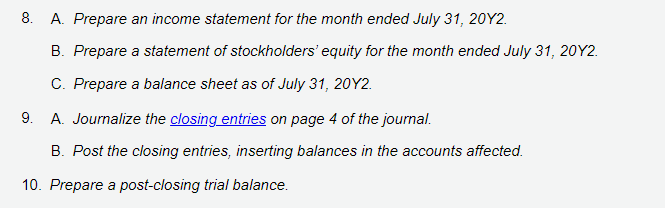

Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,000; accounts receivable, $20,800; supplies, $3,200; and office equipment, $7,500. There were no liabilities received. 1 Paid two months' rent on a lease rental contract, $4,800. 2 Paid the premiums on property and casualty insurance policies, $4,860. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,000. 5 Purchased additional office equipment on account from Office Station Co., $6,500. Received cash from clients on account, $15,000. 10 Paid cash for a newspaper advertisement, $500. 12 Paid Office Station Co. for part of the debt incurred on July 5,$5,200. 12 Recorded services provided on account for the period July 112,$13,300. 14 Paid receptionist for two weeks' salary, $1,800. Record the following transactions on Page 2 of the journal: Jul. 17 Recorded cash from cash clients for fees earned during the period July 117,$9,450. 18 Paid cash for supplies, $600. 20 Recorded services provided on account for the period July 1320,$6,650. 24 Recorded cash from cash clients for fees earned for the period July 1724,$4,500. 26 Received cash from clients on account, $12,000. 27 Paid receptionist for two weeks' salary, $1,800. 29 Paid telephone bill for July, $325. 31 Paid electricity bill for July, $675. 31 Recorded cash from cash clients for fees earned for the period July 2531,$5,400. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete requirements (5) and (6). (a) Insurance expired during July is $405. (b) Supplies on hand on July 31 are $1,600. (c) Depreciation of office equipment for July is $750. (d) Accrued receptionist salary on July 31 is $180. (e) Rent expired during July is $2,400. (f) Unearned fees on July 31 are $2,500. 5. (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an end-of-period work sheet and complete the work sheet. 6. A. Journalize the adjusting entries on page 3 of the journal. Adjusting entries are recorded on July 31 . B. Post the adjusting entries, inserting balances in the accounts affected. 7. Prepare an adjusted trial balance. 8. A. Prepare an income statement for the month ended July 31,20Y2. B. Prepare a statement of stockholders' equity for the month ended July 31,20 Y2. C. Prepare a balance sheet as of July 31,20Y2. 9. A. Journalize the closing entries on page 4 of the journal. B. Post the closing entries, inserting balances in the accounts affected. 10. Prepare a post-closing trial balance

Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, $13,000; accounts receivable, $20,800; supplies, $3,200; and office equipment, $7,500. There were no liabilities received. 1 Paid two months' rent on a lease rental contract, $4,800. 2 Paid the premiums on property and casualty insurance policies, $4,860. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,000. 5 Purchased additional office equipment on account from Office Station Co., $6,500. Received cash from clients on account, $15,000. 10 Paid cash for a newspaper advertisement, $500. 12 Paid Office Station Co. for part of the debt incurred on July 5,$5,200. 12 Recorded services provided on account for the period July 112,$13,300. 14 Paid receptionist for two weeks' salary, $1,800. Record the following transactions on Page 2 of the journal: Jul. 17 Recorded cash from cash clients for fees earned during the period July 117,$9,450. 18 Paid cash for supplies, $600. 20 Recorded services provided on account for the period July 1320,$6,650. 24 Recorded cash from cash clients for fees earned for the period July 1724,$4,500. 26 Received cash from clients on account, $12,000. 27 Paid receptionist for two weeks' salary, $1,800. 29 Paid telephone bill for July, $325. 31 Paid electricity bill for July, $675. 31 Recorded cash from cash clients for fees earned for the period July 2531,$5,400. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete requirements (5) and (6). (a) Insurance expired during July is $405. (b) Supplies on hand on July 31 are $1,600. (c) Depreciation of office equipment for July is $750. (d) Accrued receptionist salary on July 31 is $180. (e) Rent expired during July is $2,400. (f) Unearned fees on July 31 are $2,500. 5. (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an end-of-period work sheet and complete the work sheet. 6. A. Journalize the adjusting entries on page 3 of the journal. Adjusting entries are recorded on July 31 . B. Post the adjusting entries, inserting balances in the accounts affected. 7. Prepare an adjusted trial balance. 8. A. Prepare an income statement for the month ended July 31,20Y2. B. Prepare a statement of stockholders' equity for the month ended July 31,20 Y2. C. Prepare a balance sheet as of July 31,20Y2. 9. A. Journalize the closing entries on page 4 of the journal. B. Post the closing entries, inserting balances in the accounts affected. 10. Prepare a post-closing trial balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started