Question

Jul. 2: Purchased 2,800 shares of Beta, Inc. common stock at $15.00 per share. Postage People plans to sell the stock within three months, when

Jul. 2: Purchased

2,800 shares of

Beta, Inc. common stock at

$15.00 per share.

Postage People plans to sell the stock within three months, when the company will need the cash for normal operations.

Postage People does not have significant influence over

Beta.

| Date | Accounts | Debit | Credit | ||

| Jul. 2 | Equity Investments | 42,000 |

| ||

|

| Cash |

| 42,000 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3

Aug. 21: Received a cash dividend of

$0.40 per share on the

Beta stock investment.

| Date | Accounts | Debit | Credit | ||

| Aug. 21 | Cash | 1,120 |

| ||

|

| Dividend Revenue |

| 1,120 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 4

Sep. 16: Sold the

Beta stock for

$15.50 per share.

| Date | Accounts | Debit | Credit | ||

| Sep. 16 | Cash | 43,400 |

| ||

|

| Gain on Disposal |

| 1,400 | ||

|

|

|

| Equity Investments |

| 42,000 |

|

|

|

|

|

|

|

Part 5

Oct. 1: Purchased a

Ronco bond for

$28,000 at face value.

Postage People classifies the investment as trading and short-term.

| Date | Accounts | Debit | Credit | ||

| Oct. 1 | Trading Debt Investments | 28,000 |

| ||

|

| Cash |

| 28,000 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 6

Dec. 31: Received a

$160 interest payment from

Ronco.

| Date | Accounts and Explanation | Debit | Credit | ||

| Dec. 31 | Cash | 160 |

| ||

|

| Interest Revenue |

| 160 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 7

Dec. 31: Adjusted the

Ronco bond to its market value of

$30,000.

| Date | Accounts | Debit | Credit | ||

| Dec. 31 | Fair Value AdjustmentTrading | 2,000 |

| ||

|

| Unrealized Holding GainTrading |

| 2,000 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 8

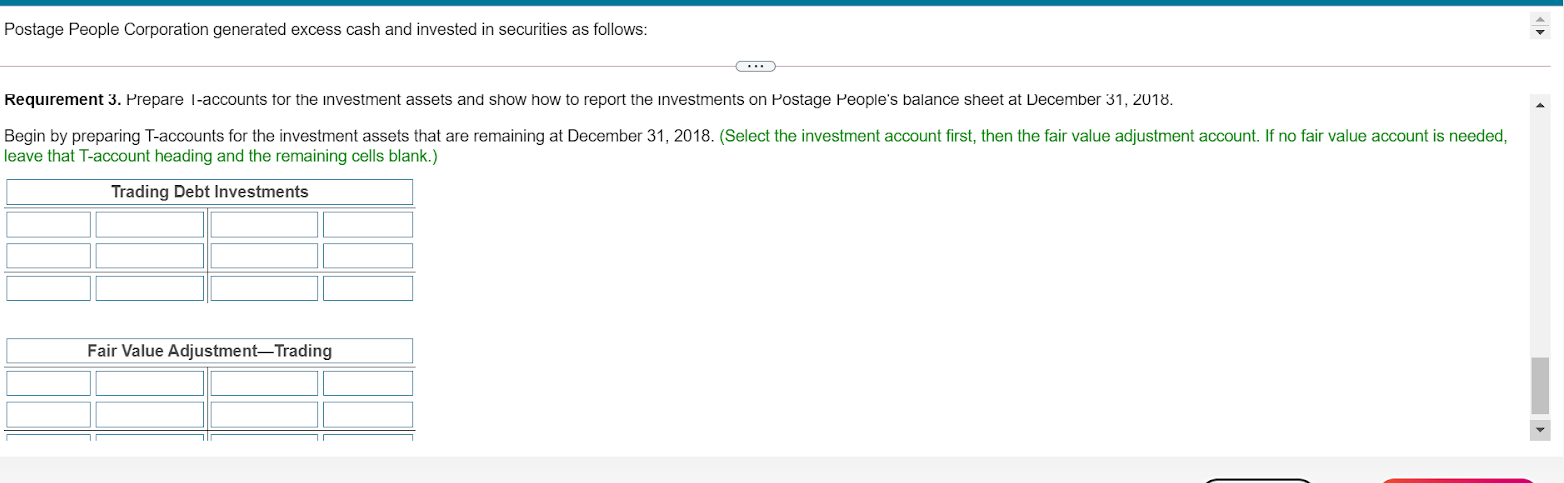

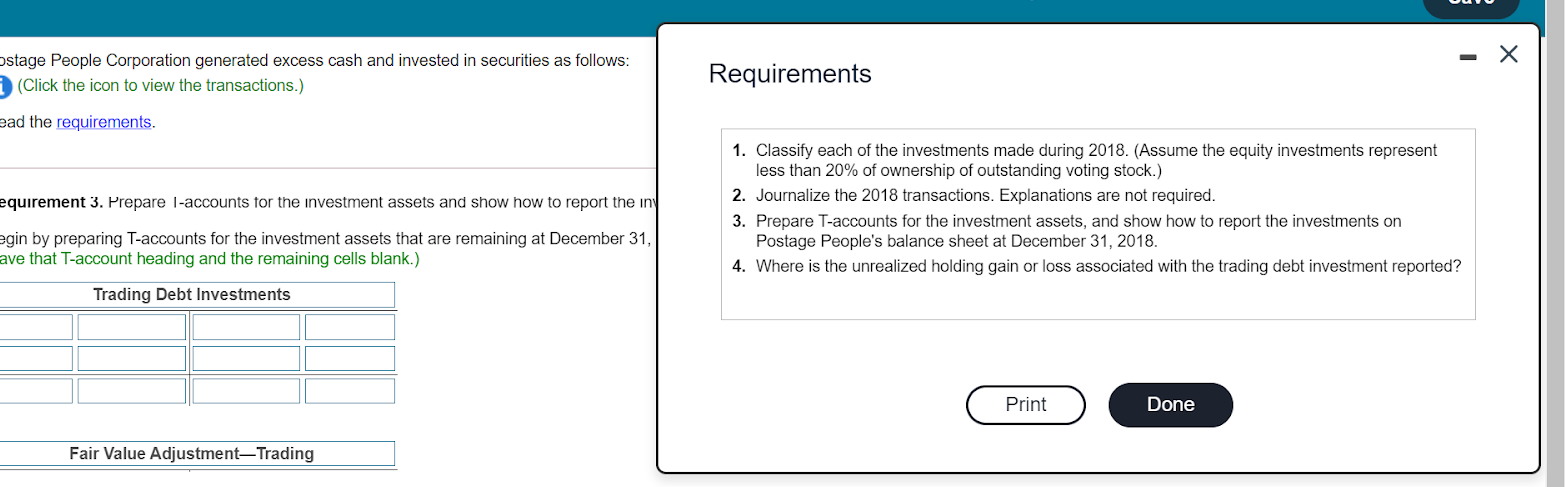

Requirement 3. Prepare T-accounts for the investment assets and show how to report the investments on

Postage People Corporation generated excess cash and invested in securities as follows: Requirement 3. Prepare l-accounts for the investment assets and show how to report the investments on Postage People's balance sheet at December 31, 2018. Begin by preparing T-accounts for the investment assets that are remaining at December 31, 2018. (Select the investment account first, then the fair value adjustment account. If no fair value account is needed, leave that T-account heading and the remaining cells blank.) Trading Debt Investments Fair Value AdjustmentTrading ostage People Corporation generated excess cash and invested in securities as follows: (Click the icon to view the transactions.) Requirements ead the requirements. equirement 3. Prepare l-accounts for the investment assets and show how to report the in 1. Classify each of the investments made during 2018. (Assume the equity investments represent less than 20% of ownership of outstanding voting stock.) 2. Journalize the 2018 transactions. Explanations are not required. 3. Prepare T-accounts for the investment assets, and show how to report the investments on Postage People's balance sheet at December 31, 2018. 4. Where is the unrealized holding gain or loss associated with the trading debt investment reported? egin by preparing T-accounts for the investment assets that are remaining at December 31, ave that T-account heading and the remaining cells blank.) Trading Debt Investments Print Done Fair Value AdjustmentTrading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started