Answered step by step

Verified Expert Solution

Question

1 Approved Answer

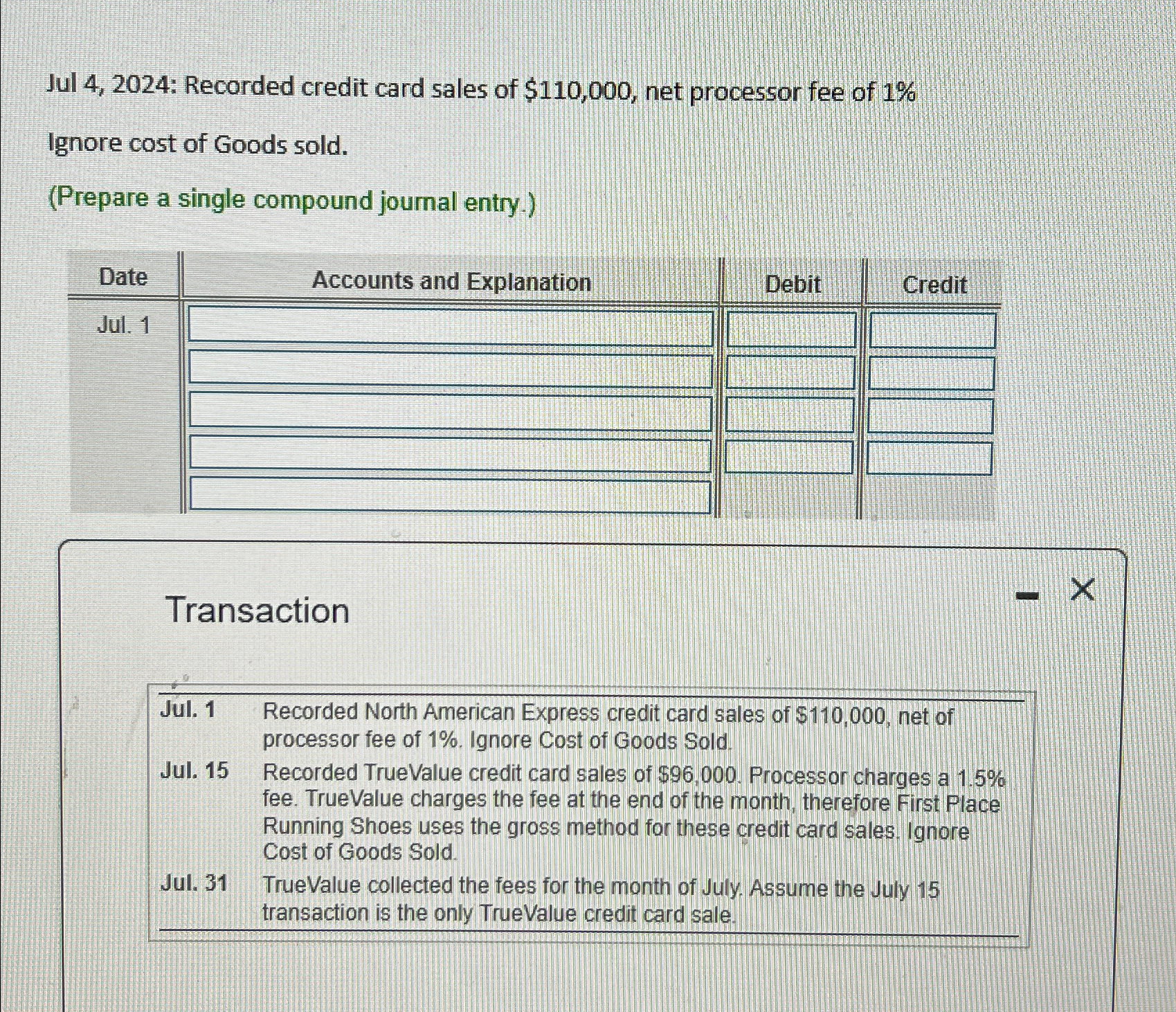

Jul 4, 2024: Recorded credit card sales of $110,000, net processor fee of 1% Ignore cost of Goods sold. (Prepare a single compound journal

Jul 4, 2024: Recorded credit card sales of $110,000, net processor fee of 1% Ignore cost of Goods sold. (Prepare a single compound journal entry.) Date Jul. 1 Accounts and Explanation Debit Credit Transaction Jul. 1 Jul. 15 Jul. 31 Recorded North American Express credit card sales of $110,000, net of processor fee of 1%. Ignore Cost of Goods Sold. Recorded TrueValue credit card sales of $96,000. Processor charges a 1.5% fee. TrueValue charges the fee at the end of the month, therefore First Place Running Shoes uses the gross method for these credit card sales. Ignore Cost of Goods Sold. TrueValue collected the fees for the month of July. Assume the July 15 transaction is the only TrueValue credit card sale. X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The compound journal entry for the given transactions would be Date Jul 1 Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started