Answered step by step

Verified Expert Solution

Question

1 Approved Answer

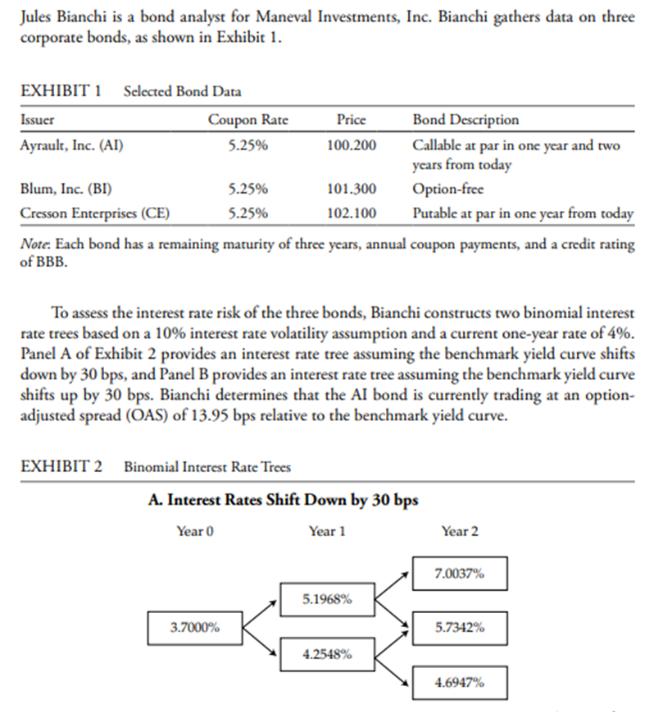

Jules Bianchi is a bond analyst for Maneval Investments, Inc. Bianchi gathers data on three corporate bonds, as shown in Exhibit 1. EXHIBIT 1

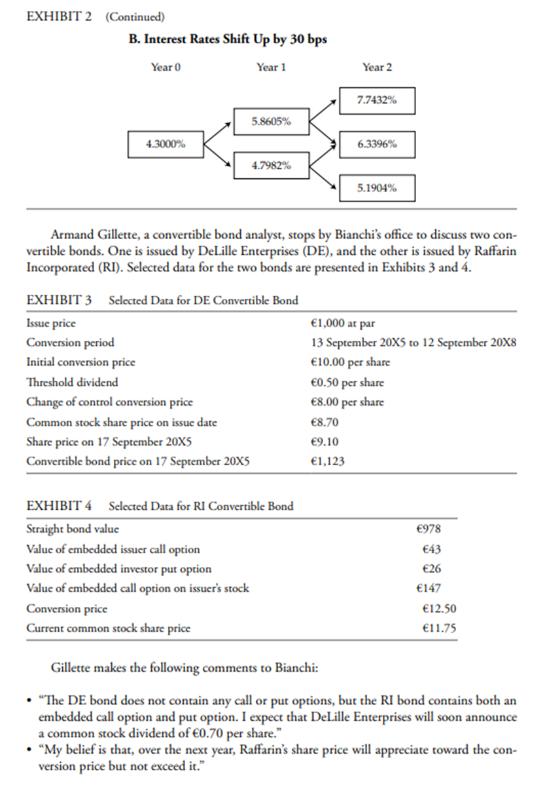

Jules Bianchi is a bond analyst for Maneval Investments, Inc. Bianchi gathers data on three corporate bonds, as shown in Exhibit 1. EXHIBIT 1 Selected Bond Data Issuer Ayrault, Inc. (AI) Blum, Inc. (BI) Cresson Enterprises (CE) Coupon Rate 5.25% 5.25% 5.25% Price 100.200 EXHIBIT 2 Binomial Interest Rate Trees 101.300 102.100 Note: Each bond has a remaining maturity of three years, annual coupon payments, and a credit rating of BBB. 3.7000% To assess the interest rate risk of the three bonds, Bianchi constructs two binomial interest rate trees based on a 10% interest rate volatility assumption and a current one-year rate of 4%. Panel A of Exhibit 2 provides an interest rate tree assuming the benchmark yield curve shifts down by 30 bps, and Panel B provides an interest rate tree assuming the benchmark yield curve shifts up by 30 bps. Bianchi determines that the AI bond is currently trading at an option- adjusted spread (OAS) of 13.95 bps relative to the benchmark yield curve. Bond Description Callable at par in one year and two years from today Option-free Putable at par in one year from today A. Interest Rates Shift Down by 30 bps Year 0 Year 1 5.1968% 4.2548% Year 2 7.0037% 5.7342% 4.6947%

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the effective duration for the AI bond we need to calculate the price change of the bond given the changes in the yield curve Fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started