Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julez has his specialist expertise in Information Technology and has emigrated from Germany with his wife Joelle. Joelle wants to take care of her

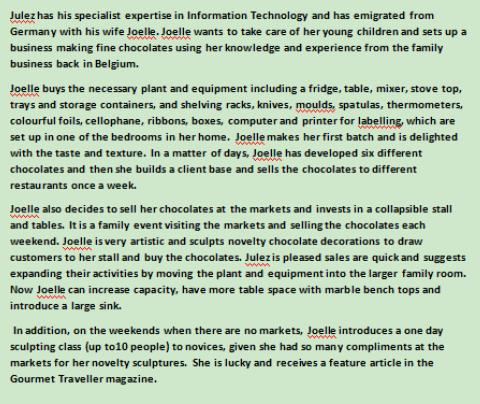

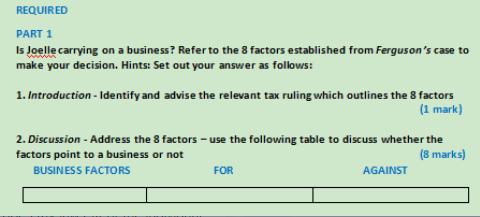

Julez has his specialist expertise in Information Technology and has emigrated from Germany with his wife Joelle. Joelle wants to take care of her young children and sets up a business making fine chocolates using her knowledge and experience from the family business back in Belgium. Joelle buys the necessary plant and equipment including a fridge, table, mixer, stove top, trays and storage containers, and shelving racks, knives, moulds, spatulas, thermometers, colourful foils, cellophane, ribbons, boxes, computer and printer for labelling, which are set up in one of the bedrooms in her home. Joelle makes her first batch and is delighted with the taste and texture. In a matter of days, Joelle has developed six different chocolates and then she builds a client base and sells the chocolates to different restaurants once a week. Joelle also decides to sell her chocolates at the markets and invests in a collapsible stall and tables. It is a family event visiting the markets and selling the chocolates each www weekend. Joelle is very artistic and sculpts novelty chocolate decorations to draw customers to her stall and buy the chocolates. Julez is pleased sales are quick and suggests expanding their activities by moving the plant and equipment into the larger family room. Now Joelle can increase capacity, have more table space with marble bench tops and introduce a large sink. In addition, on the weekends when there are no markets, Joelle introduces a one day sculpting class (up to 10 people) to novices, given she had so many compliments at the markets for her novelty sculptures. She is lucky and receives a feature article in the Gourmet Traveller magazine. REQUIRED PART 1 Is Joelle carrying on a business? Refer to the 8 factors established from Ferguson's case to make your decision. Hints: Set out your answer as follows: 1. Introduction -Identify and advise the relevant tax ruling which outlines the 8 factors (1 mark) 2. Discussion - Address the 8 factors - use the following table to discuss whether the factors point to a business or not (8 marks) BUSINESS FACTORS FOR AGAINST 3. Conclusion - Weigh up the factors, and decide on balance, whether Joelle is carrying on a business. (1 mark) PART 2 What 3 considerations do you see impact most when transitioning from a hobby to a business and why? (3 marks) PART 3 An SBE by definition is carrying on a business. Outline 2 SBE concessions stipulated in this course. (make sure you refer to the law and state what the concession provides) (2 marks)

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

PART 1 Introduction The relevant tax ruling outlining the 8 factors to determine whether an individual is carrying on a business is established in Taxation Ruling TR 9711 Discussion Addressing the 8 f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started