Answered step by step

Verified Expert Solution

Question

1 Approved Answer

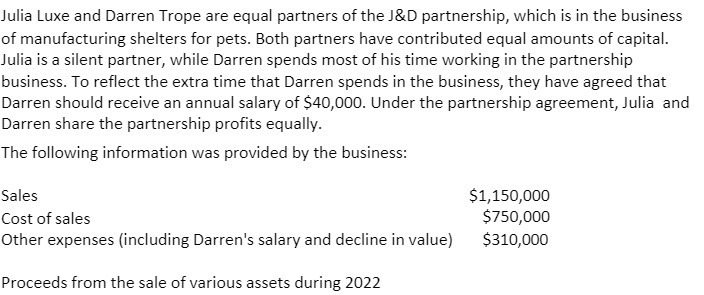

Julia Luxe and Darren Trope are equal partners of the J&D partnership, which is in the business of manufacturing shelters for pets. Both partners

Julia Luxe and Darren Trope are equal partners of the J&D partnership, which is in the business of manufacturing shelters for pets. Both partners have contributed equal amounts of capital. Julia is a silent partner, while Darren spends most of his time working in the partnership business. To reflect the extra time that Darren spends in the business, they have agreed that Darren should receive an annual salary of $40,000. Under the partnership agreement, Julia and Darren share the partnership profits equally. The following information was provided by the business: Sales Cost of sales Other expenses (including Darren's salary and decline in value) Proceeds from the sale of various assets during 2022 $1,150,000 $750,000 $310,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the profit for the JD partnership we need to subtract the cost of sales a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started