Julia Walters owns and operates one of the largest Mercedes-Benz auto dealerships in Washington, DC. In the past 36 months her sales of this

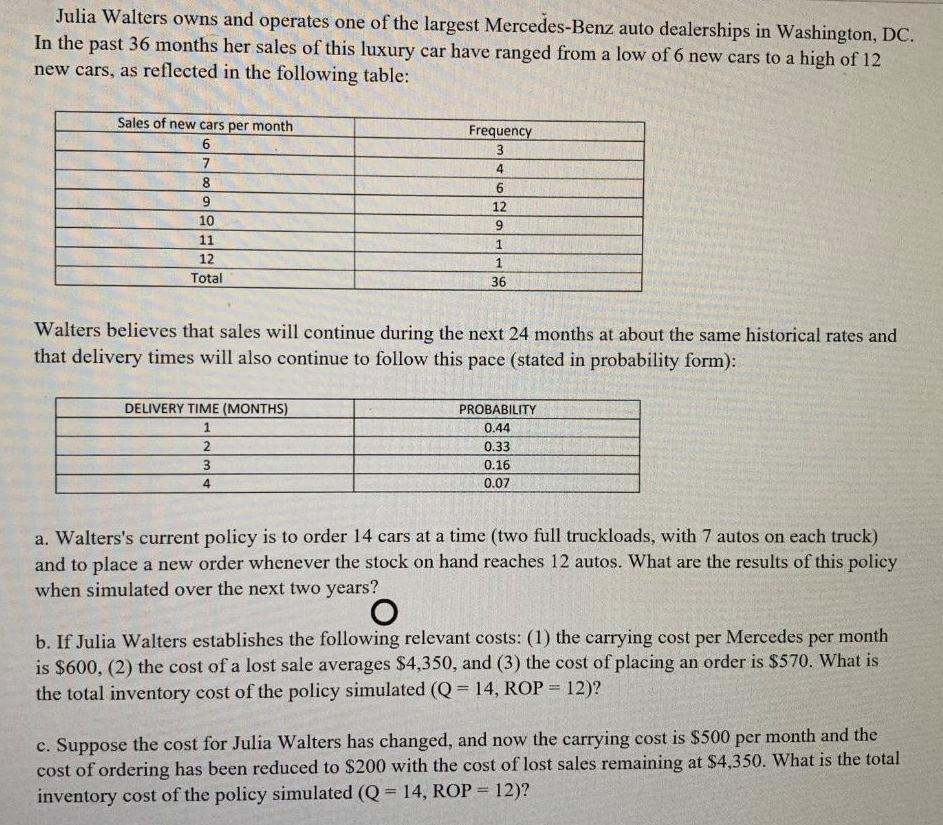

Julia Walters owns and operates one of the largest Mercedes-Benz auto dealerships in Washington, DC. In the past 36 months her sales of this luxury car have ranged from a low of 6 new cars to a high of 12 new cars, as reflected in the following table: Sales of new cars per month Frequency 6 3 7 4 8 6 9. 12 10 9. 11 12 Total 36 Walters believes that sales will continue during the next 24 months at about the same historical rates and that delivery times will also continue to follow this pace (stated in probability form): DELIVERY TIME (MONTHS) PROBABILITY 1 0.44 2 0.33 3 0.16 4 0.07 a. Walters's current policy is to order 14 cars at a time (two full truckloads, with 7 autos on each truck) and to place a new order whenever the stock on hand reaches 12 autos. What are the results of this policy when simulated over the next two years? b. If Julia Walters establishes the following relevant costs: (1) the carrying cost per Mercedes per month is $600, (2) the cost of a lost sale averages $4,350, and (3) the cost of placing an order is $570. What is the total inventory cost of the policy simulated (Q = 14, ROP = 12)? c. Suppose the cost for Julia Walters has changed, and now the carrying cost is $500 per month and the cost of ordering has been reduced to $200 with the cost of lost sales remaining at $4,350. What is the total inventory cost of the policy simulated (Q = 14, ROP = 12)?

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

B Dt Pg Theoretical ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards