Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julia will retire in 20 years. Currently, she works for an established firm and has a contract with fixed wages of $70,000 per year

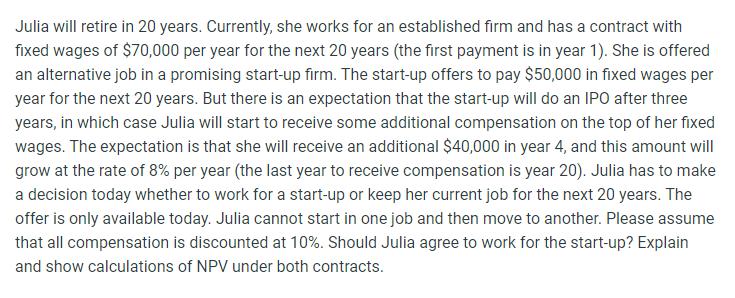

Julia will retire in 20 years. Currently, she works for an established firm and has a contract with fixed wages of $70,000 per year for the next 20 years (the first payment is in year 1). She is offered an alternative job in a promising start-up firm. The start-up offers to pay $50,000 in fixed wages per year for the next 20 years. But there is an expectation that the start-up will do an IPO after three years, in which case Julia will start to receive some additional compensation on the top of her fixed wages. The expectation is that she will receive an additional $40,000 in year 4, and this amount will grow at the rate of 8% per year (the last year to receive compensation is year 20). Julia has to make a decision today whether to work for a start-up or keep her current job for the next 20 years. The offer is only available today. Julia cannot start in one job and then move to another. Please assume that all compensation is discounted at 10%. Should Julia agree to work for the start-up? Explain and show calculations of NPV under both contracts.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To make a decision Julia needs to compare the net present value NPV of the two contracts The NPV is the sum of the present values of all cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started