Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julianna wants to save more and is thinking of consolidating her debts. Her Savings goals are: 1. To save at least $500/month towards RRSP

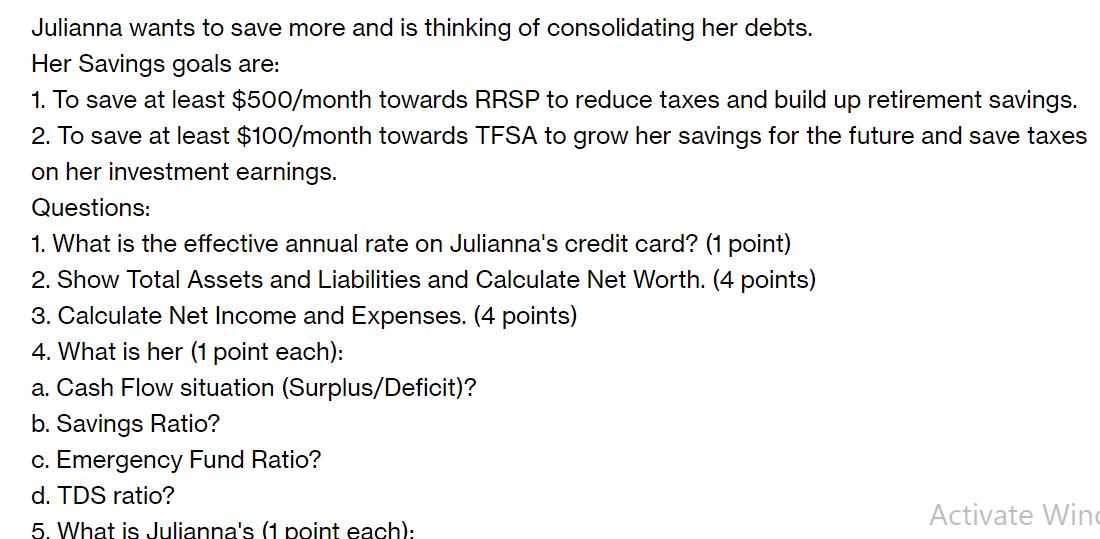

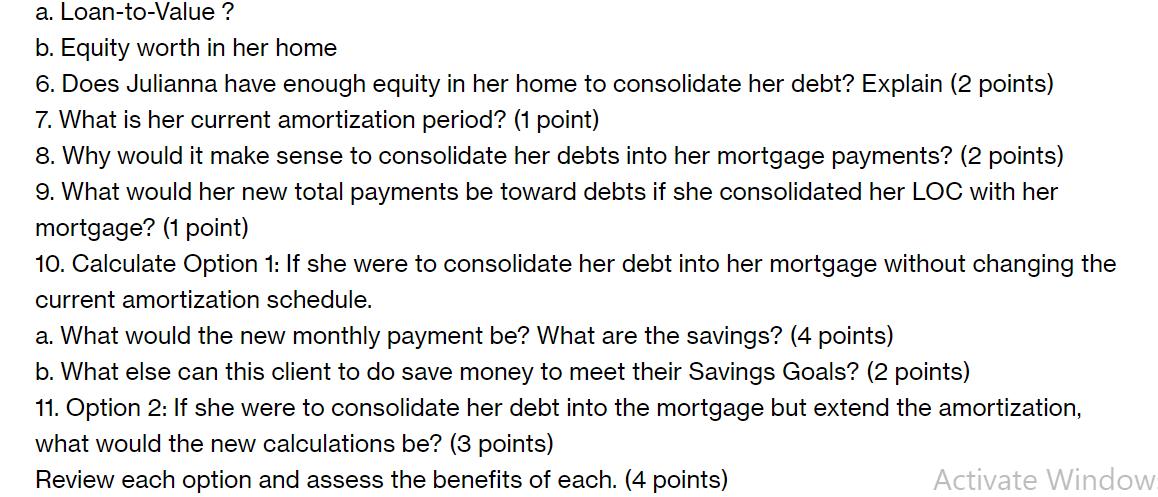

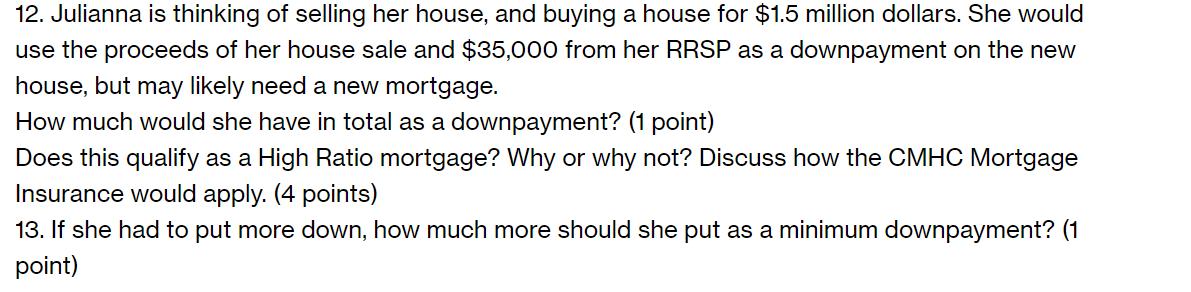

Julianna wants to save more and is thinking of consolidating her debts. Her Savings goals are: 1. To save at least $500/month towards RRSP to reduce taxes and build up retirement savings. 2. To save at least $100/month towards TFSA to grow her savings for the future and save taxes on her investment earnings. Questions: 1. What is the effective annual rate on Julianna's credit card? (1 point) 2. Show Total Assets and Liabilities and Calculate Net Worth. (4 points) 3. Calculate Net Income and Expenses. (4 points) 4. What is her (1 point each): a. Cash Flow situation (Surplus/Deficit)? b. Savings Ratio? c. Emergency Fund Ratio? d. TDS ratio? 5. What is Julianna's (1 point each): Activate Wing a. Loan-to-Value? b. Equity worth in her home 6. Does Julianna have enough equity in her home to consolidate her debt? Explain (2 points) 7. What is her current amortization period? (1 point) 8. Why would it make sense to consolidate her debts into her mortgage payments? (2 points) 9. What would her new total payments be toward debts if she consolidated her LOC with her mortgage? (1 point) 10. Calculate Option 1: If she were to consolidate her debt into her mortgage without changing the current amortization schedule. a. What would the new monthly payment be? What are the savings? (4 points) b. What else can this client to do save money to meet their Savings Goals? (2 points) 11. Option 2: If she were to consolidate her debt into the mortgage but extend the amortization, what would the new calculations be? (3 points) Review each option and assess the benefits of each. (4 points) Activate Window 12. Julianna is thinking of selling her house, and buying a house for $1.5 million dollars. She would use the proceeds of her house sale and $35,000 from her RRSP as a downpayment on the new house, but may likely need a new mortgage. How much would she have in total as a downpayment? (1 point) Does this qualify as a High Ratio mortgage? Why or why not? Discuss how the CMHC Mortgage Insurance would apply. (4 points) 13. If she had to put more down, how much more should she put as a minimum downpayment? (1 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started