Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julia's Jams & Jellies, Inc. reported the following January 2 0 1 9 transactions with respect to inventory item JJJMPSJ - 2 , a 2

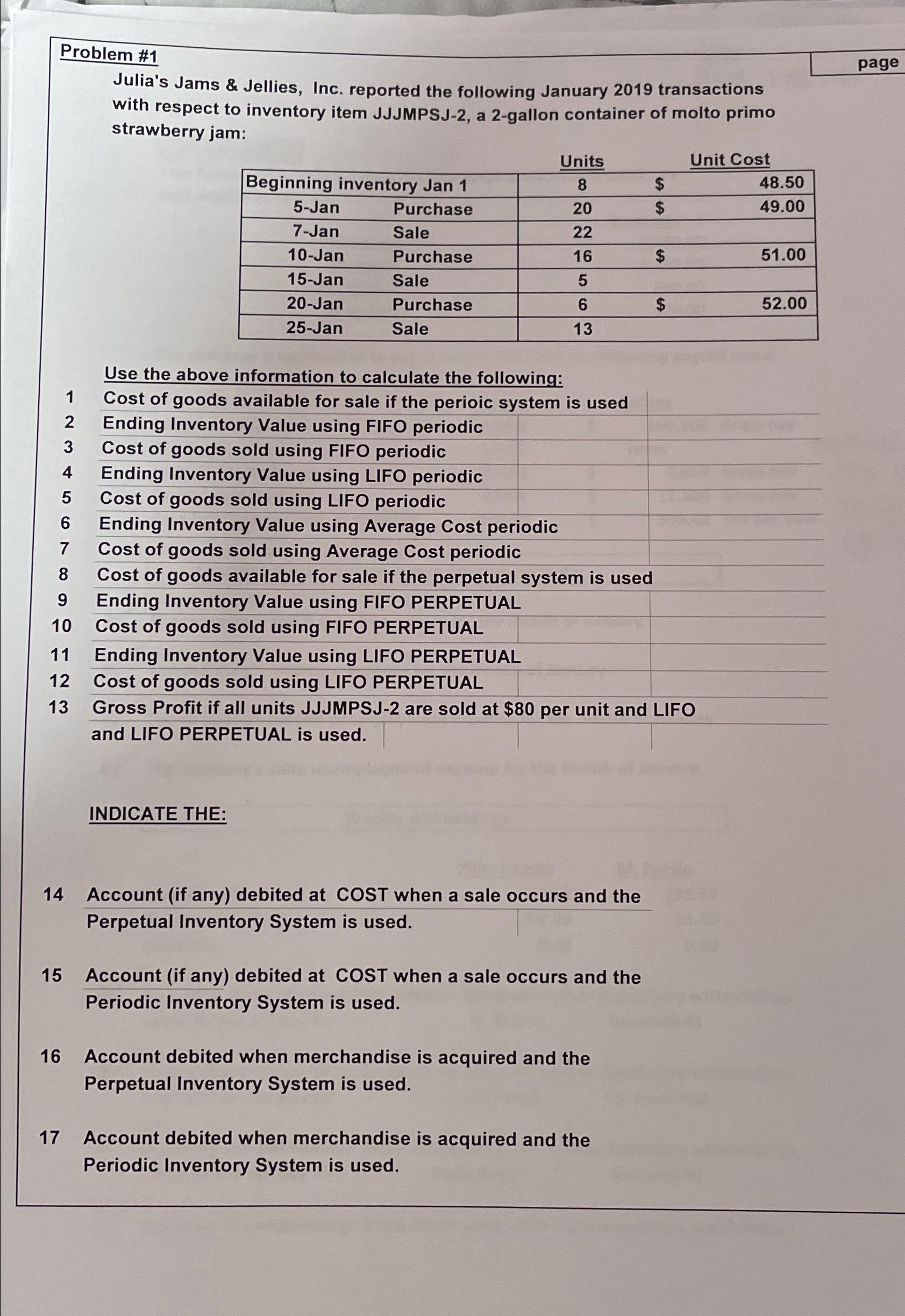

Julia's Jams & Jellies, Inc. reported the following January transactions with respect to inventory item JJJMPSJ a gallon container of molto primo strawberry jam:pageProblem Julia's with respect to strawberry jam:tableUnits,Unit CostBeginning inventory Jan $Jan,Purchase,$Jan,Sale,Jan,Purchase,$Jan,Sale,Jan,Purchase,$Jan,Sale,Use the above information to calculate the following:Cost of goods available for sale if the perioic system is usedEnding Inventory Value using FIFO periodicCost of goods sold using FIFO periodicEnding Inventory Value using LIFO periodicCost of goods sold using LIFO periodicEnding Inventory Value using Average Cost periodicCost of goods sold using Average Cost periodicCost of goods available for sale if the perpetual system is usedEnding Inventory Value using FIFO PERPETUALCost of goods sold using FIFO PERPETUALEnding Inventory Value using LIFO PERPETUALCost of goods sold using LIFO PERPETUALGross Profit if all units JJJMPSJ are sold at $ per unit and LIFOand LIFO PERPETUAL is used.INDICATE THE: Account if any debited at COST when a sale occurs and the Perpetual Inventory System is used. Account if any debited at COST when a sale occurs and the Periodic Inventory System is used. Account debited when merchandise is acquired and the Perpetual Inventory System is used. Account debited when merchandise is acquired and the Periodic Inventory System is used.

Problem #1 Julia's Jams & Jellies, Inc. reported the following January 2019 transactions with respect to inventory item JJJMPSJ-2, a 2-gallon container of molto primo strawberry jam: page Units Unit Cost Beginning inventory Jan 1 8 $ 48.50 5-Jan Purchase 20 $ 49.00 7-Jan Sale 22 10-Jan Purchase 16 $ 51.00 15-Jan Sale 5 20-Jan Purchase 6 $ 52.00 25-Jan Sale 13 Use the above information to calculate the following: 1 Cost of goods available for sale if the perioic system is used 2 Ending Inventory Value using FIFO periodic 3 Cost of goods sold using FIFO periodic 4 Ending Inventory Value using LIFO periodic 5 Cost of goods sold using LIFO periodic 6 Ending Inventory Value using Average Cost periodic 7 Cost of goods sold using Average Cost periodic 8 Cost of goods available for sale if the perpetual system is used 9 Ending Inventory Value using FIFO PERPETUAL 10 Cost of goods sold using FIFO PERPETUAL 11 Ending Inventory Value using LIFO PERPETUAL 12 13 Cost of goods sold using LIFO PERPETUAL Gross Profit if all units JJJMPSJ-2 are sold at $80 per unit and LIFO and LIFO PERPETUAL is used. INDICATE THE: 14 Account (if any) debited at COST when a sale occurs and the Perpetual Inventory System is used. 15 Account (if any) debited at COST when a sale occurs and the Periodic Inventory System is used. 16 Account debited when merchandise is acquired and the Perpetual Inventory System is used. 17 Account debited when merchandise is acquired and the Periodic Inventory System is used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainlylets analyze the provided data and calculate the required values step by step Inventory Data Date Transaction Units Unit Cost Jan 1 Beginning Inventory 8 4850 Jan 5 Purchase 20 4900 Jan 7 Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started