Question

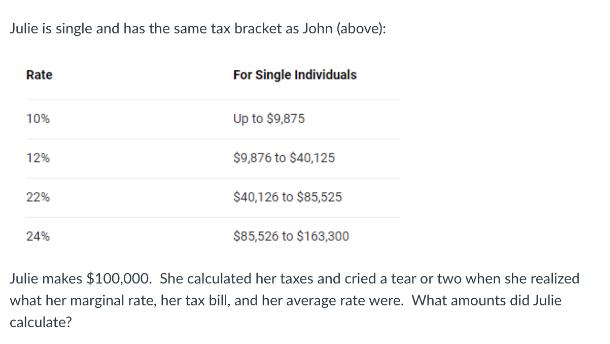

Julie is single and has the same tax bracket as John (above): Rate 10% 12% 22% 24% For Single Individuals Up to $9,875 $9,876

Julie is single and has the same tax bracket as John (above): Rate 10% 12% 22% 24% For Single Individuals Up to $9,875 $9,876 to $40,125 $40,126 to $85,525 $85,526 to $163,300 Julie makes $100,000. She calculated her taxes and cried a tear or two when she realized what her marginal rate, her tax bill, and her average rate were. What amounts did Julie calculate?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Julies taxes well need to determine the tax liability for each bracket and then sum the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

13th Edition

1265553602, 978-1265553609

Students also viewed these Marketing questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App