Julie is the insured on a $300,000 ordinary life insurance policy. Julie sells her life insurance policy to Ben for $20,000. Ben promptly named

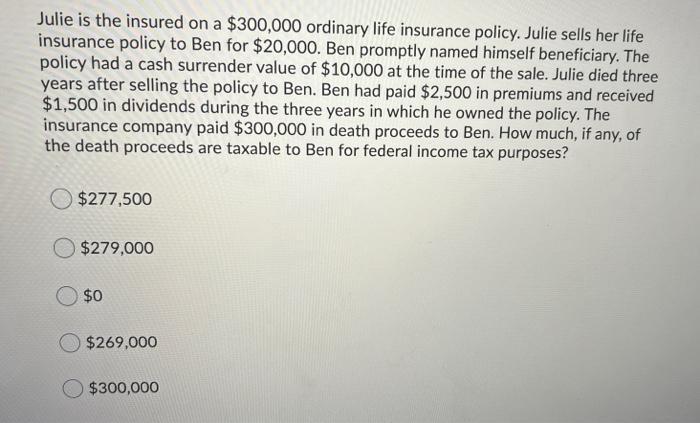

Julie is the insured on a $300,000 ordinary life insurance policy. Julie sells her life insurance policy to Ben for $20,000. Ben promptly named himself beneficiary. The policy had a cash surrender value of $10,000 at the time of the sale. Julie died three years after selling the policy to Ben. Ben had paid $2,500 in premiums and received $1,500 in dividends during the three years in which he owned the policy. The insurance company paid $300,000 in death proceeds to Ben. How much, if any, of the death proceeds are taxable to Ben for federal income tax purposes? $277,500 $279,000 $0 $269,000 $300,000

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

According to the income tax act the death benefit tha... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards