Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company. What

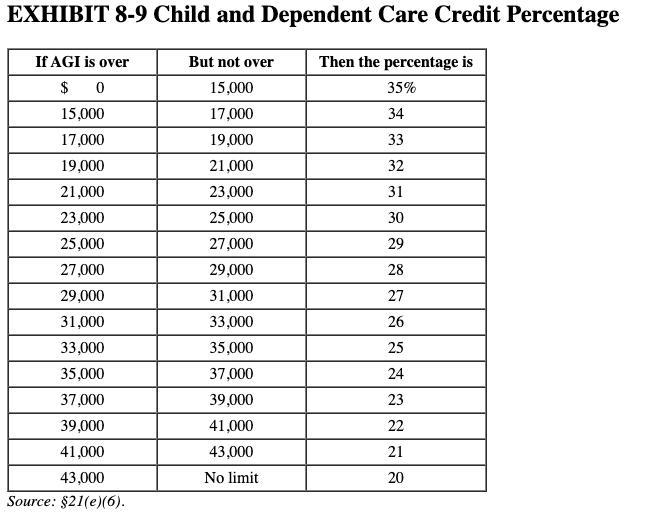

Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company. What amount of child and dependent care credit can Julie claim in each of the following alternative scenarios? Exhibit 8-9 a. Julie paid $2440 to the day care center and her AGI is $50,000 (all salary). Child and dependent care credit b. Julie paid $6,100 to the day care center and her AGI is $50,000 (all salary). Child and dependent care credit c. Julie paid $5,100 to the day care center and her AGI is $25,000 (all salary). Child and dependent care credit d. Julie paid $2,440 to the day care center and her AGI is $14,000 (all salary). Child and dependent care credit e. Julie paid $5,100 to the day care center and her AGI is $14,000 ($2,440 salary and $11,560 unearned income). Child and dependent care credit EXHIBIT 8-9 Child and Dependent Care Credit Percentage If AGI is over But not over Then the percentage is $ 0 15,000 35% 15,000 17,000 34 17,000 19,000 33 19,000 21,000 32 21,000 23,000 31 23,000 25,000 30 25,000 27,000 29 27,000 29,000 28 29,000 31,000 27 31,000 33,000 26 33,000 35,000 25 35,000 37,000 24 37,000 39,000 23 39,000 41,000 22 41,000 43,000 21 43,000 No limit 20 Source: $21(e)(6).

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The Maximum Dollar Limit for Claiming DependentChild care credit is 3000 for single child and 6000 f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started