Answered step by step

Verified Expert Solution

Question

1 Approved Answer

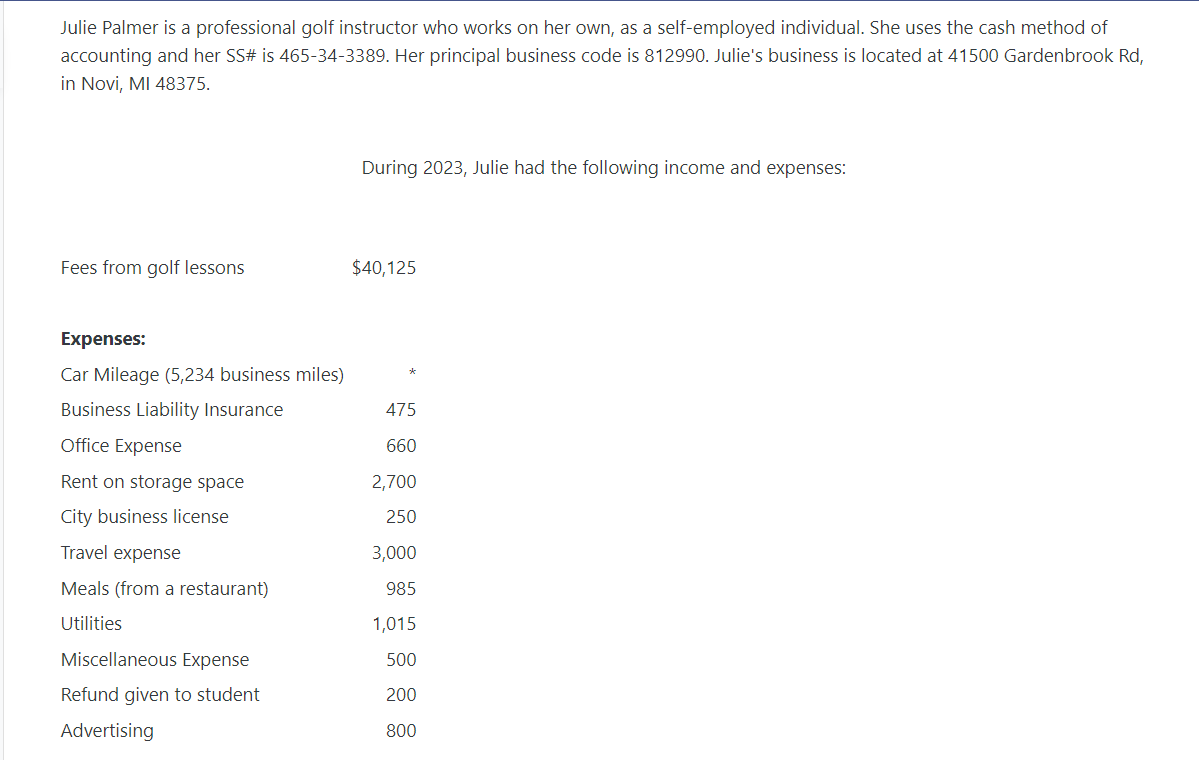

Julie Palmer is a professional golf instructor who works on her own, as a self-employed individual. She uses the cash method of accounting and

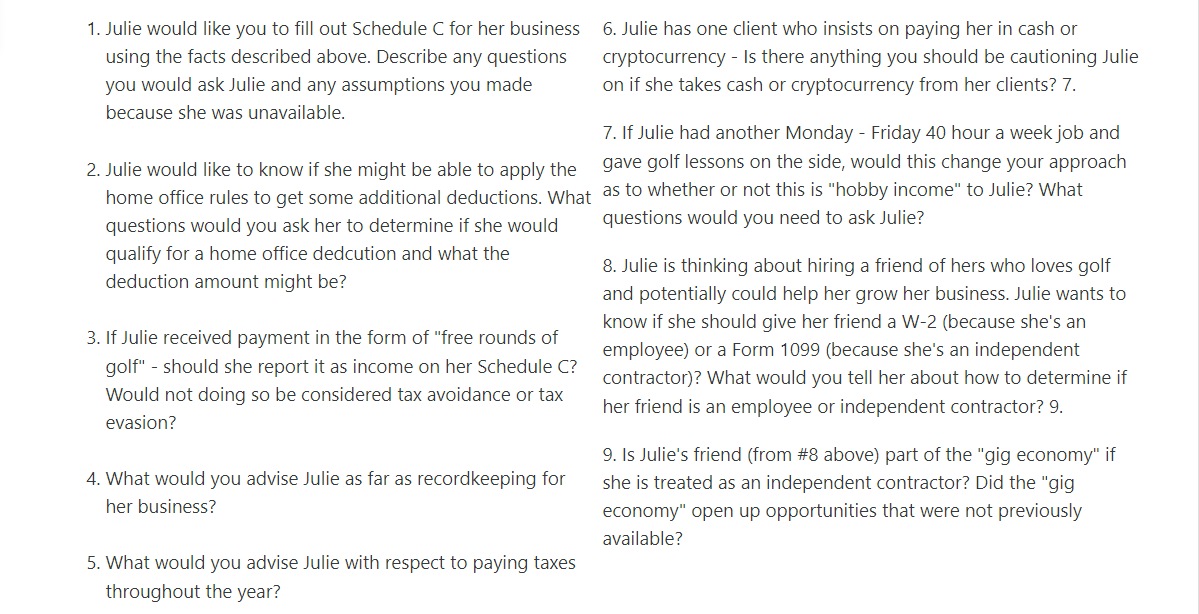

Julie Palmer is a professional golf instructor who works on her own, as a self-employed individual. She uses the cash method of accounting and her SS# is 465-34-3389. Her principal business code is 812990. Julie's business is located at 41500 Gardenbrook Rd, in Novi, MI 48375. During 2023, Julie had the following income and expenses: Fees from golf lessons $40,125 Expenses: Car Mileage (5,234 business miles) Business Liability Insurance 475 Office Expense 660 Rent on storage space 2,700 City business license 250 Travel expense 3,000 Meals (from a restaurant) 985 Utilities 1,015 Miscellaneous Expense 500 Refund given to student 200 Advertising 800 * Julie used the standard mileage rate in 2023. Julie is a good friend of yours who knows you have just learned about all sorts of interesting tax stuff. She would like your help with the following: 1. Julie would like you to fill out Schedule C for her business using the facts described above. Describe any questions you would ask Julie and any assumptions you made because she was unavailable. 2. Julie would like to know if she might be able to apply the home office rules to get some additional deductions. What questions would you ask her to determine if she would qualify for a home office dedcution and what the deduction amount might be? 3. If Julie received payment in the form of "free rounds of 6. Julie has one client who insists on paying her in cash or cryptocurrency - Is there anything you should be cautioning Julie on if she takes cash or cryptocurrency from her clients? 7. 7. If Julie had another Monday - Friday 40 hour a week job and gave golf lessons on the side, would this change your approach as to whether or not this is "hobby income" to Julie? What questions would you need to ask Julie? 8. Julie is thinking about hiring a friend of hers who loves golf and potentially could help her grow her business. Julie wants to know if she should give her friend a W-2 (because she's an employee) or a Form 1099 (because she's an independent golf" - should she report it as income on her Schedule C? contractor)? What would you tell her about how to determine if Would not doing so be considered tax avoidance or tax evasion? 4. What would you advise Julie as far as recordkeeping for her business? 5. What would you advise Julie with respect to paying taxes throughout the year? her friend is an employee or independent contractor? 9. 9. Is Julie's friend (from #8 above) part of the "gig economy" if she is treated as an independent contractor? Did the "gig economy" open up opportunities that were not previously available?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started